Commercial Loan Contract Template free printable template

Show details

This document outlines the terms and conditions of a loan agreement between a lender and a borrower, including loan amounts, interest rates, repayment terms, and default conditions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

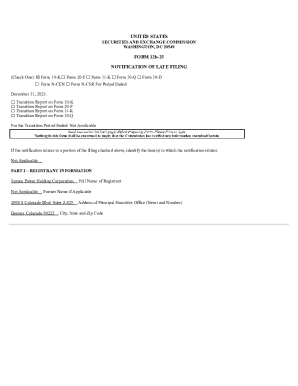

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Commercial Loan Contract Template

A Commercial Loan Contract Template is a legal document outlining the terms and conditions under which a borrower agrees to repay a loan provided by a lender for business purposes.

pdfFiller scores top ratings on review platforms

It has been a life-saver as I had some PDF I needed to edit badly. Thank you PDfiller!

I only had a chance to try it on one pdf so far, an dit was simple replacement of words.

ALWAYS BEEN ABLE TO FIND THE FORMS I NEED AND THE EASE OF USE TO GET THINGS DONE QUICKLY. EXCELLENT SERVICE!!!!!

Solid replacement for Adobe Acrobat - Hard to use with multiple linked google accounts on one computer.

I was able to fill in the form but found it difficult yo get the "fill-in" at the appropriate level on the form lines.

Just started working with the software and like it very much -

Who needs Commercial Loan Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Commercial Loan Contract Template on pdfFiller

This guide will help you understand how to fill out a Commercial Loan Contract Template form effectively, ensuring clarity and compliance throughout the document.

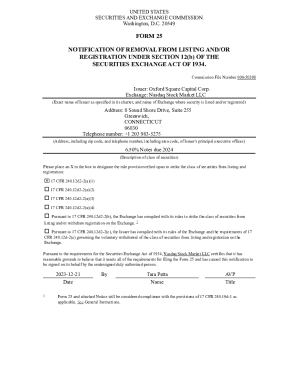

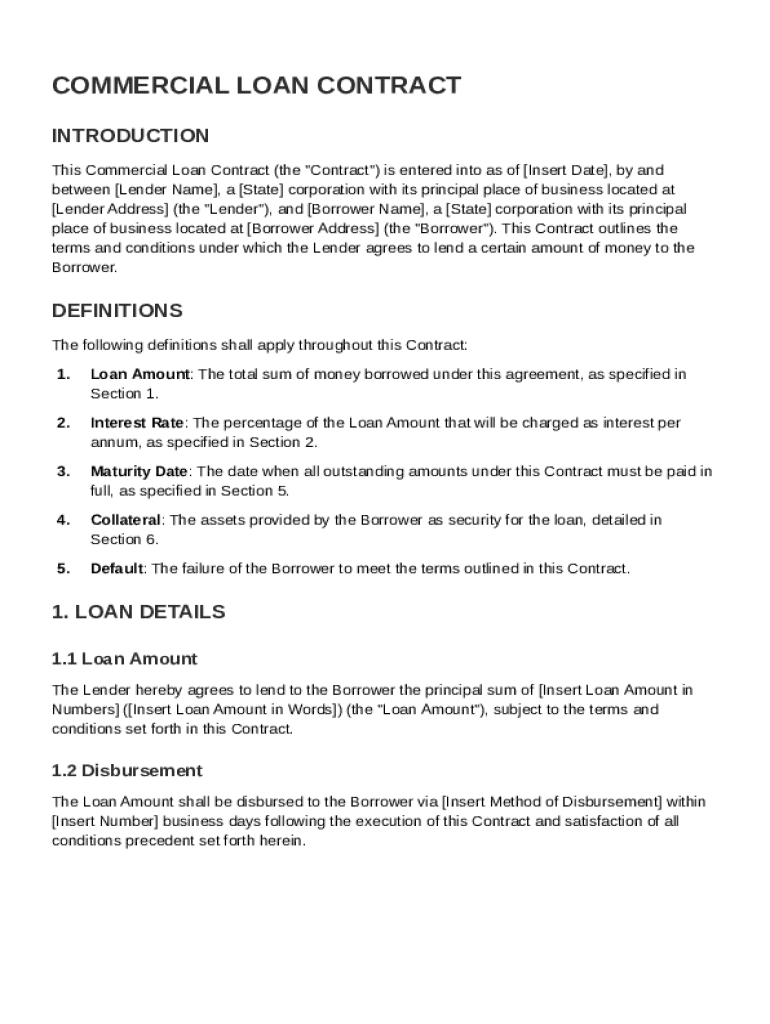

What is a commercial loan contract?

A commercial loan contract is a legally binding agreement between a lender and a borrower for financing a business purpose. These contracts outline the loan's terms, including the amount borrowed, interest rates, and repayment schedules. It's essential for both parties to understand the purpose, which is to facilitate business expansion or operations.

Why are clear terms and conditions important?

Clear terms and conditions are vital in a commercial loan contract to prevent misunderstandings and disputes. These conditions not only guide the borrower on what is required but also protect the lender's interests by clearly outlining expectations. A well-defined agreement ensures a smoother relationship between lender and borrower.

How does a commercial loan differ from other loans?

Commercial loans are specifically designed for business purposes, unlike personal loans which cater to individual needs. They often have different terms, such as collateral requirements and interest rates, reflecting the higher risks associated with business financing.

What are the key components of a commercial loan contract?

-

Breaking down essential terms is crucial for clarity, ensuring that all parties understand their responsibilities.

-

Specifying loan amounts clearly helps prevent miscommunication and ensures that both parties agree on what is being borrowed.

-

Understanding the charges associated with the loan is vital for budgeting and financial planning.

-

This date indicates when the loan is due, providing a clear timeline for payment obligations.

-

Collateral serves as security for loans, minimizing the lender's risk in the event of default.

-

Clarifying what happens if terms aren't met is essential to understanding the consequences of non-compliance.

How do break down a loan agreement?

-

This is the date when the agreement becomes active and legally binding.

-

Clearly list the lender and borrower details to avoid confusion later.

-

State the loan amount both in numbers and words to eliminate ambiguity.

-

Outline the process and timeline for how the loan funds will be distributed.

-

Clarify how interest rates will be calculated to ensure transparency.

What are the payment terms and schedules?

-

Specify whether interest payments are made monthly or quarterly to aid in cash flow planning.

-

Amortization schedules break down payments over the loan's life, providing clear visibility into payment timelines.

-

Detail the repercussions of late or missed payments, which often include penalties or increased interest rates.

How do fill out a commercial loan contract template?

Filling out a Commercial Loan Contract Template can be straightforward with the right tools. On pdfFiller, users can leverage interactive tools and step-by-step instructions to ensure accuracy.

-

Utilize pdfFiller's features for an efficient form-filling experience.

-

Follow the provided guidelines to modify the template according to your specific needs.

-

Learn how to add digital signatures for easier collaboration and legal validation.

How do manage my commercial loan agreement?

-

Monitoring your payment progress helps maintain financial health and compliance.

-

Understanding your refinancing options can potentially reduce monthly payments or extend loan terms.

-

pdfFiller's platform enables seamless document management, promoting organization and efficiency.

What are common mistakes to avoid in a loan agreement?

-

Inattention to details can result in serious legal and financial consequences.

-

Ambiguity about loan figures can lead to disputes that complicate repayment.

-

Failure to adhere to legal obligations can invalidate your agreement and lead to penalties.

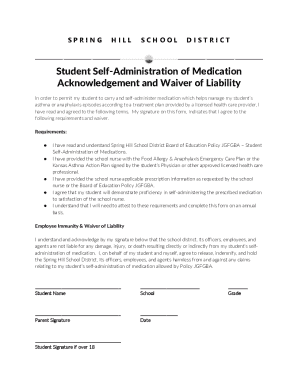

How to fill out the Commercial Loan Contract Template

-

1.Open the Commercial Loan Contract Template on pdfFiller.

-

2.Enter the date of the agreement at the top of the document.

-

3.Fill in the names and addresses of the borrower and lender in the designated fields.

-

4.Specify the loan amount in the relevant section, ensuring it's clearly stated.

-

5.Detail the interest rate and payment schedule, including the frequency of payments.

-

6.Outline any collateral associated with the loan within the respective section.

-

7.Include provisions for default and remedies, ensuring all potential scenarios are covered.

-

8.Review all entries for accuracy and completeness before finalizing.

-

9.Save the completed contract, then share or print as needed for signatures.

-

10.Ensure all parties involved sign the contract to make it legally binding.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.