Last updated on Feb 17, 2026

Credit Contract Template free printable template

Show details

This Credit Contract outlines the terms and conditions under which credit is extended from the Lender to the Borrower, ensuring clarity and providing a legal framework for the credit relationship.

We are not affiliated with any brand or entity on this form

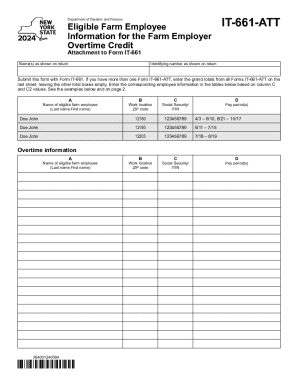

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

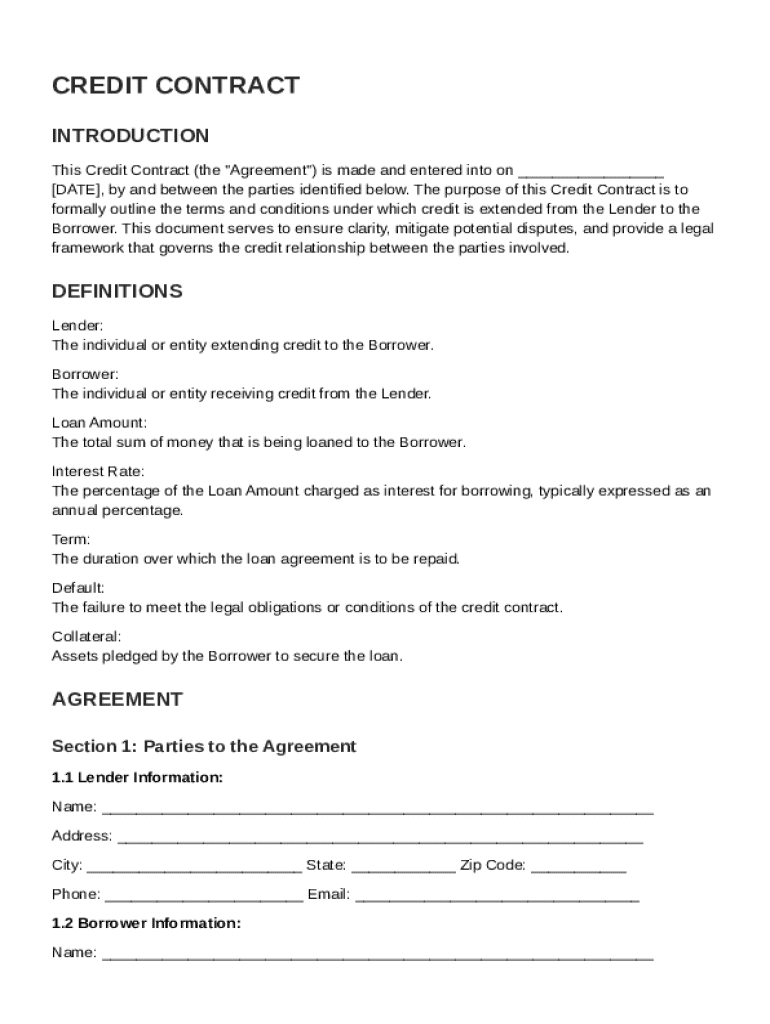

What is Credit Contract Template

A Credit Contract Template is a standardized document outlining the terms and conditions for borrowing money and the repayment of that loan.

pdfFiller scores top ratings on review platforms

Have been pleased with ability to complete forms and submit them.

so far so good, I thought the price was discounted, but I guess 120/year is the discount?

S far pretty good. Have not done a whole lot with it , but what I did use was very good

So far, it's been super easy to fill out W2Cs. No more handwriting and starting all over if a mistake is made =)

So far it has been great. I still have some to learn but so far my forms are coming out just right. Thank you

I am new to using. I like the features and I am interested in learning how to use the program more efficiently.

Who needs Credit Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Credit Contract Template Form

Filling out a Credit Contract Template form can seem complex, but it essentially involves entering personal and loan details accurately to create a legally binding agreement. In this guide, we’ll walk through each step of the process, ensuring you understand the key components, how to fill it out effectively, and what to consider post-completion.

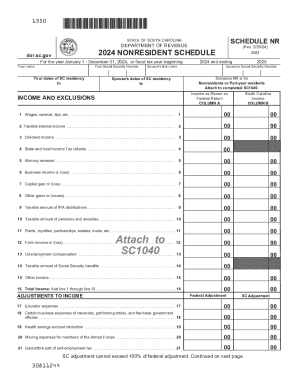

What is a credit contract?

A credit contract is a legal document that outlines the agreement between a lender and a borrower when borrowing money. Its main purpose is to stipulate the specific terms of the loan, including the amount borrowed, the interest rate, and the repayment schedule. Clarity in the terms and conditions is crucial to avoid disputes later.

-

Defines the obligations of both parties involved in the agreement.

-

Reduces misunderstandings and legal issues.

-

Stipulates the laws that govern these agreements, ensuring they are enforceable.

What are the key components of a credit contract?

Understanding the critical components of a credit contract is essential to ensuring that both lender and borrower are on the same page and protected legally. Key components include the definitions of essential terms as well as critical terms that could affect repayment.

Definitions of essential terms

-

The individual or institution providing the loan, along with their required information.

-

The individual taking the loan, who must provide identification and relevant profile details.

-

The total sum requested by the borrower, which is crucial for the terms.

-

The cost of borrowing expressed as a percentage, which can be fixed or variable.

-

The duration over which the loan must be repaid, clearly defined in the contract.

What are critical terms?

-

Default occurs when the borrower fails to make payments, potentially leading to penalties or repossession.

-

Collateral is an asset pledged by the borrower that can be seized if the borrower defaults.

How to fill out the Credit Contract Template?

Filling out your Credit Contract Template accurately is critical as it sets the groundwork for the entire loan agreement. The following steps will help guide you in correctly entering the required information.

Step-by-Step Guide to Inputting Information

-

Fill in the complete legal names and contact information, along with any other needed identification.

-

Clearly state the amount being borrowed and the applicable interest rate, which determines how much will be paid back.

-

Indicate how frequently payments will be made (weekly, monthly, etc.) and the total duration of repayment.

Helpful Tips for Effective Completion

-

Double-check details like loan amounts or contact information to prevent errors.

-

Make sure to gather all required documentation and information before starting.

-

Leverage digital tools to edit and ensure accuracy in your template filling.

What are repayment terms?

Effective management of repayment terms is essential for maintaining a healthy credit relationship. The clarity in payment structure helps both lenders and borrowers in planning financial responsibilities.

Establishing Payment Frequency

-

Choose a repayment frequency that aligns with your financial situation to avoid potential defaults.

-

Calculate a manageable payment size that includes both principal and interest, factoring in your overall budget.

Importance of First Payment Due Date

-

Set a first payment due date that allows ample time for the borrower to prepare financially.

-

Establish clear communication procedures for notifying both parties of upcoming due dates.

How to manage credit contracts post-completion?

Once you've filled out and signed your Credit Contract Template, managing it efficiently ensures all parties adhere to the terms. This includes proper storage, accessibility, and updating the contract as necessary.

Storing and Accessing Your Completed Credit Contract

-

Store your completed forms in the cloud for easy access and sharing with relevant parties.

-

Ensure you can view your contract from any device, allowing for seamless management.

Editing and Updating Your Contract After Creation

-

Use pdfFiller to edit the contract terms when necessary, ensuring that all changes are clearly documented.

-

Facilitate discussions and changes by sharing access with stakeholders who can contribute to the agreement.

What is legal compliance in credit contracts?

Understanding the legal framework surrounding credit contracts is crucial for ensuring valid agreements. Compliance helps to protect all parties and reduces the risk of legal disputes.

Governing Law and Jurisdiction

-

Clearly outline where legal matters concerning the contract will be addressed.

-

Ensure the contract meets all local legal standards to maintain enforceability.

Handling Disputes and Modifications

-

Outline the process for making amendments to the contract that maintain mutual agreement.

-

Establish how to handle disagreements or defaults, including mediation or legal action.

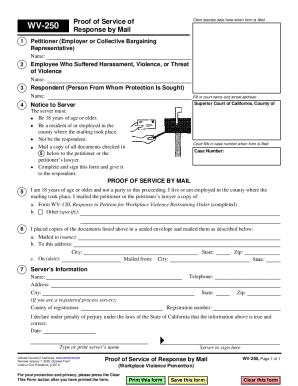

How to fill out the Credit Contract Template

-

1.Download the Credit Contract Template from pdfFiller.

-

2.Begin by entering your personal information in the designated fields, including your full name and address.

-

3.Fill in the lender's details, specifying their name and contact information.

-

4.Enter the loan amount you are requesting and the interest rate agreed upon.

-

5.Specify the repayment terms, including the payment schedule and duration of the loan.

-

6.Make sure to include any collateral details or security interests if applicable.

-

7.Review the conditions regarding default and any fees associated with the loan.

-

8.Sign and date the document in the provided areas to validate the contract.

-

9.Save the completed document in PDF format and consider printing a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.