Financial Loan Contract Template free printable template

Show details

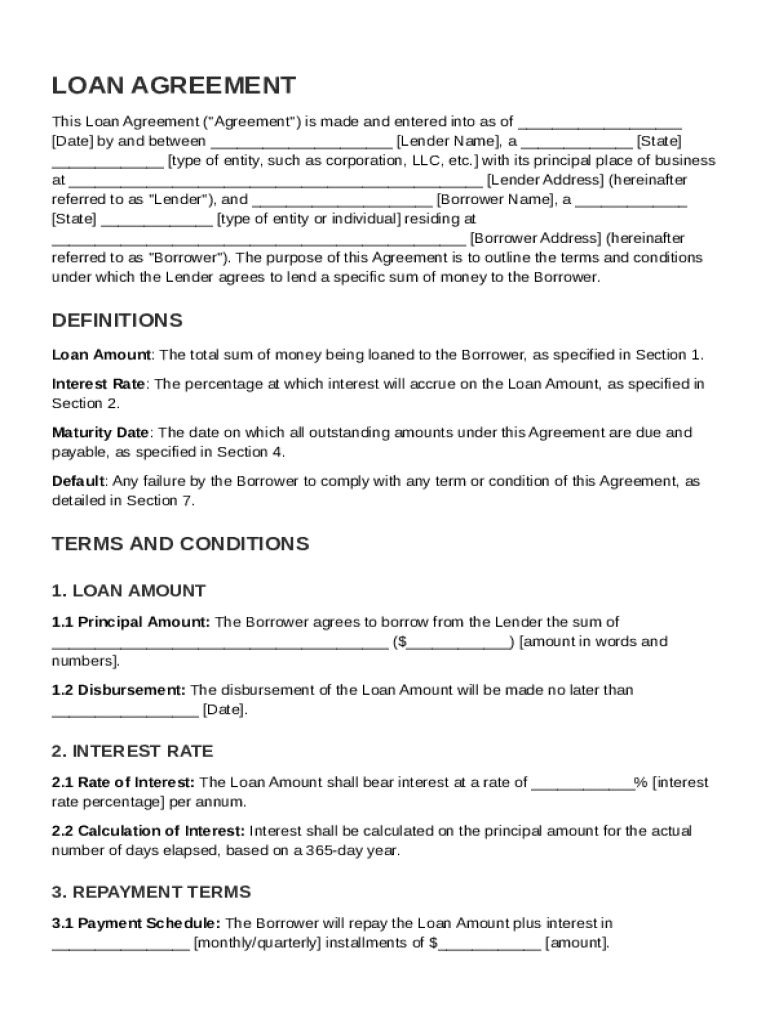

This document outlines the terms and conditions of a loan between a lender and a borrower, detailing the loan amount, interest rate, repayment terms, and other relevant provisions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Financial Loan Contract Template

A Financial Loan Contract Template is a formal document that outlines the terms and conditions governing a loan agreement between a lender and a borrower.

pdfFiller scores top ratings on review platforms

This program really provides me the opportunity to create the forms and fillable documents that can help speed up my report filling.

I enjoy the different ways to sign and initial different documents that otherwise could not be sent back electronically without several steps. I also have created templates and forms for consistent reports and forms I will be using to help speed up my entries. Thank you I do enjoy the program But I only know a little about it. I wish there was a little more user friendly tutorials.

The service was great and really…

The service was great and really useful! I've used it for the past year- I just didnt need it and couldn't afford it this year- the reason I'm giving 5 stars is because when I went to cancel it within a month of by mistake letting it renew- they (Jerome in the chatbox) were SOOOO AMAZING and helpful! With so many companies they completely dehumanize you and fight for ages when you try to cancel. It has given me immense respect for this company that they were kind and helpful!

Quick download, easy fillable PDF forms online

very practical online fillable forms but using the snail mail from the IRS, i was able to obtain the same forms via mail a week later. I like its free trial but only needed the 2022 W2 form and not the entire services

The Best PDF Field Configuration Sodftware

By Far, the easiest tool and best option to modify PDF and define all Filling fields, however you want. i have no complaints at all, only my gratitude.

Fantastic experience I have had with the program in this

excelent

Who needs Financial Loan Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to financial loan contract template

How do loan agreements work?

A loan agreement is a formal contract between a lender and a borrower outlining the terms of a loan. It sets clear expectations, responsibilities, and repercussions for non-compliance, ensuring both parties are protected under the law. Having a financial loan contract template simplifies this process, making it easier to navigate initial discussions and formalities.

-

A loan agreement is a legally binding document that explains the terms and conditions of a loan, including repayment schedules and interest rates.

-

Loan agreements provide legal protection and clarity, safeguarding both parties’ interests and minimizing disputes.

What are the components of a financial loan contract?

A well-structured financial loan contract includes several critical components that ensure clarity and compliance. Each section includes essential details that must be clearly stated to avoid misunderstandings.

-

The contract must clearly state the names, addresses, and identifying information for both the lender and borrower.

-

It specifies the total money being lent and includes both written and numerical forms to avoid misinterpretation.

-

This part defines how interest will be calculated, whether it’s a fixed percentage or variable based on market rates.

-

The maturity date indicates when the loan must be fully repaid, essential for managing repayment expectations.

-

Clearly defining default conditions is crucial in determining what actions will be taken if repayments are late or missed.

How to fill out a loan agreement template?

Completing a loan agreement can be straightforward if each section is approached methodically. By following specific steps, users can ensure that no important detail is overlooked.

-

Systematically fill each section by referring to the agreement components, ensuring all necessary details are included.

-

Double-check for errors, especially in the identification details of both parties and numerical values.

-

Utilize pdfFiller's features to edit, fill, and sign the form easily, significantly simplifying the process.

What are the repayment terms and conditions?

The repayment section of a financial loan contract is vital, as it dictates how and when the borrower will repay the loan. Clear repayment terms prevent disputes and misunderstandings from arising.

-

The schedule outlines the payment frequency, such as monthly or quarterly, assisting borrowers in managing their finances effectively.

-

Specify potential penalties for delayed payments to emphasize the importance of timely repayment.

-

Include examples of how interest accumulates on the principal over time, which helps borrowers understand their obligations.

What legal considerations should be included in a loan agreement?

It is crucial to consider legal obligations when drafting loan agreements, as compliance ensures enforceability and avoids legal issues. Each region may have unique regulations governing loan agreements.

-

Research and comply with any local laws regarding loan agreements to ensure the contract is enforceable.

-

Clearly outline the legal actions that may occur should the borrower default, protecting the lender’s interests.

How can eSigning and document management enhance the process?

The digital signing process streamlines the completion of loan agreements, making it faster and more efficient. pdfFiller offers features that enhance collaboration and documentation management.

-

Step-by-step guidance is provided to help users understand the electronic signing process effectively.

-

pdfFiller allows multiple stakeholders to collaborate seamlessly during the review of documents.

-

pdfFiller ensures secure storage and retrieval options, enhancing organizational efficiency.

What is the difference between loan agreements and promissory notes?

Understanding the differences between loan agreements and promissory notes is essential to determine the appropriate document for various situations. Each has distinct legal implications that impact the lender's and borrower's responsibilities.

-

Loan agreements are more detailed contracts, while promissory notes are simpler, focusing primarily on the borrower's promise to pay.

-

Loan agreements are suitable for larger sums or detailed terms, whereas promissory notes may be adequate for smaller, informal loans.

How to fill out the Financial Loan Contract Template

-

1.Download the Financial Loan Contract Template from pdfFiller.

-

2.Open the document in the pdfFiller editor.

-

3.Begin by filling in the date at the top of the contract.

-

4.Enter the names and contact information of the lender and borrower in the designated fields.

-

5.Specify the loan amount and interest rate clearly in the appropriate sections.

-

6.Outline the repayment schedule, including due dates and payment methods.

-

7.Include any collateral information if applicable, detailing items held against the loan.

-

8.Review additional clauses, such as default provisions and fees, to ensure they meet both parties' agreement.

-

9.Once all fields are completed, review the document carefully for accuracy.

-

10.Sign the contract digitally within pdfFiller, ensuring both parties provide their signatures where required.

-

11.Save the finalized document and share it with all parties involved.

How to write a loan contract agreement?

What's in a Personal Loan Agreement? Identifications: The contract will need to list the names of all those involved and their addresses. Dates: There will need to be dates for when the contract goes into effect and any other important dates. Loan amount: This is the principal amount the borrower agrees to take out.

What is the difference between a promissory note and a loan?

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

What is the structure of a loan agreement?

Key sections include definitions, credit facilities, terms of borrowing, interest computations, security documentation, conditions precedent, representations and warranties, covenants, events of default, and agent provisions.

What is a contract of loan?

A loan agreement or loan contract is a written agreement that specifies all the details of a personal or business loan, including the amount of money or the assets being lent, the repayment terms, and what happens if the borrower defaults (is unable to pay according to the terms).

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.