Friend To Friend Loan Contract Template free printable template

Show details

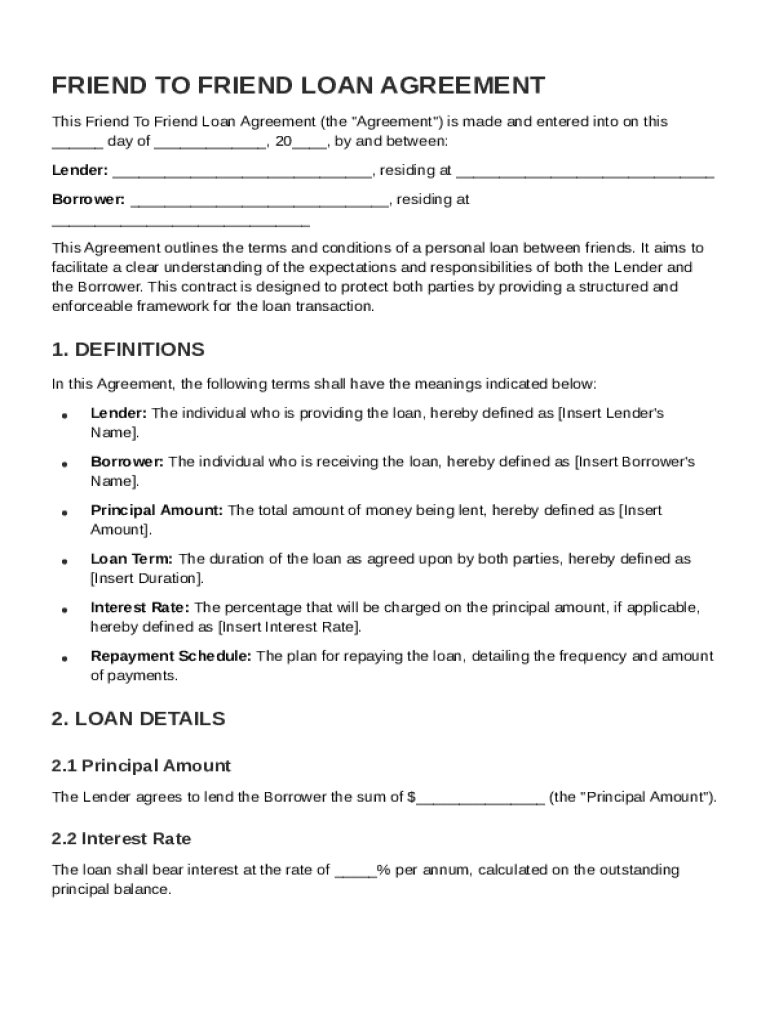

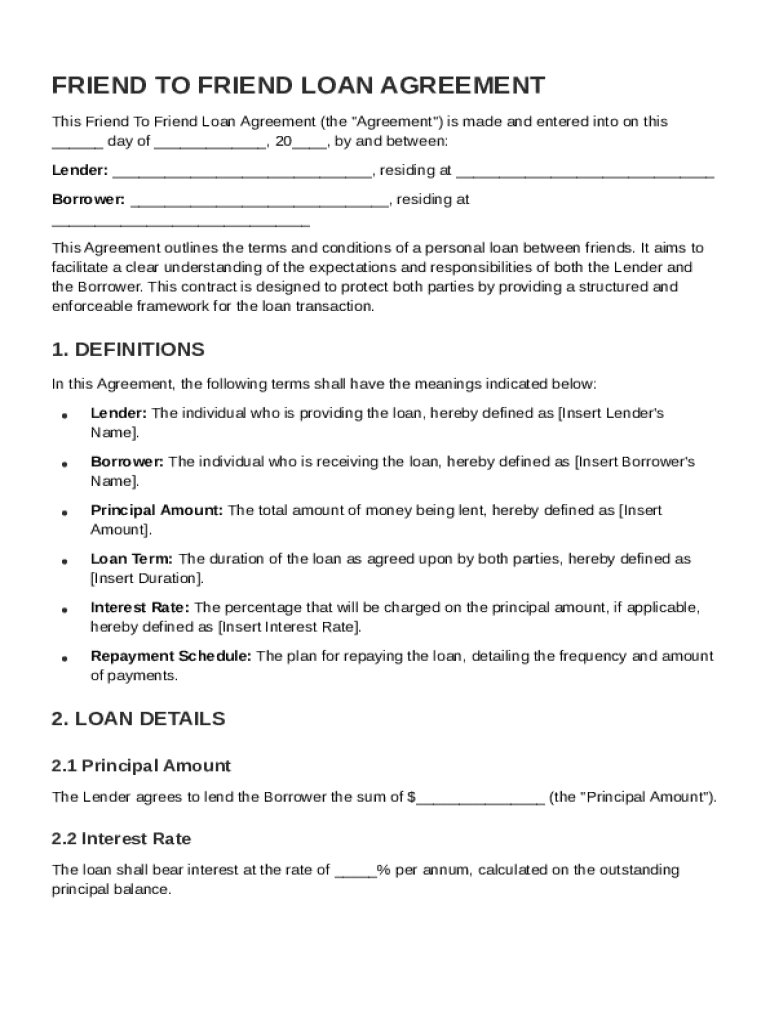

This document outlines the terms and conditions of a personal loan agreement between friends, detailing the responsibilities and expectations of both the lender and the borrower.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Friend To Friend Loan Contract Template

A Friend To Friend Loan Contract Template is a legal document outlining the terms and conditions of a loan between friends.

pdfFiller scores top ratings on review platforms

New Review 7.23

So far, it was very user friendly, I am old so I was not to sure, but I was able to create 3 menu weeks in a matter of minutes.

This was the easiest software to use

This was the easiest software to use. Perfect!! Very impressed! A lot better than microsoft office

It was a little tricky but I eventually figured it out. Some boxes automatically checked both yes and no when trying to choose no.

FINE

So far so good for the immediate purposes of editing and signing

Very useful

Who needs Friend To Friend Loan Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Friend To Friend Loan Contract Template Form

What is a friend to friend loan agreement?

A friend to friend loan agreement is a formalized contract that outlines the terms and conditions of a loan between individuals who are friends. This structured agreement is crucial for ensuring clear communication and expectations regarding loan repayment and obligations. Many people wrongly assume that informal loans between friends do not require documentation, but having a contract is vital in preserving relationships and avoiding potential disputes.

What are the key components of a loan agreement?

-

The lender is the individual or entity providing the loan, responsible for detailing the terms and maintaining records.

-

The borrower is the individual receiving the loan and is obligated to repay under the agreed terms.

-

Determining the principal amount involves careful consideration of the borrower's needs and the lender's capacity.

-

The loan term specifies the duration over which the loan will be repaid, essential for setting repayment expectations.

-

Understanding the interest rate is critical, as it affects the total amount to be repaid and can vary widely.

-

This outlines the frequency of payments and amounts due, which helps both parties maintain accountability.

How do fill out the friend to friend loan agreement form?

Filling out the friend to friend loan agreement form can be straightforward if approached methodically. Start with the lender and borrower details, followed by specifying the loan amount and duration. Utilize interactive tools available on pdfFiller for easy editing and customization, ensuring you avoid common mistakes.

-

Begin by entering the names of the lender and borrower at the top of the form.

-

Clearly state the principal amount being borrowed, as well as any interest rate agreed upon.

-

Define the loan term, including the start and end date.

-

Detail the repayment schedule in full, including payment amounts.

What are the repayment terms and schedule?

A well-defined repayment schedule minimizes misunderstandings. Options for repayment can include monthly installments, one-time payments, or a flexible arrangement depending on mutual agreement. It is also vital to discuss consequences of non-repayment openly, preparing for any potential disputes.

-

Allowing customized repayment dates or amounts can ease financial pressure on the borrower.

-

Consider digital payments, checks, or cash for convenient transaction methods.

-

Discuss how to address any issues before they escalate into formal disputes.

What legal considerations should be taken into account?

Legal considerations are critical in personal loans. Understanding any regional laws affecting personal loans helps prevent legal issues down the road. It's advisable to regularly consult legal advice when setting up agreements, ensuring that both parties are protected and informed.

-

Familiarize yourself with any specific regulations in your area regarding personal loans and interest rates.

-

Keeping thorough records of all transactions and communications can serve as protection should legal disputes arise.

-

Don't hesitate to consult with a legal professional before finalizing any significant loans.

How can pdfFiller optimize document management?

pdfFiller offers a variety of features that simplify document tracking and collaboration. Its cloud storage provides easy access to important forms, and tools for customizing templates streamline the process. This makes pdfFiller an ideal solution for managing your friend to friend loan contract template form effectively.

-

Keep a log of changes and communication attached to your documents for better organization.

-

Always have access to your documents from any location, making it convenient for both parties.

-

Tailor your agreement to meet specific needs using pdfFiller’s user-friendly interface.

How to maintain healthy relationships through financial agreements?

Open communication is vital when discussing loan terms with friends. Strategies should include establishing trust and transparency early on in the conversation, to ensure both parties feel secure about their commitment. Handling conflicts amicably helps preserve relationships while addressing financial matters.

-

Transparent discussions around loan terms can prevent misunderstandings before they occur.

-

Encouraging honesty and openness fosters a healthy lending environment.

-

Immediate discussion of issues can prevent escalation and help maintain the friendship.

What are the conclusions on leveraging this template?

In conclusion, using a friend to friend loan contract template form is essential for ensuring both parties are secure in their arrangements. An emphasis on transparency reduces the risk of misunderstandings and allows for a healthier dynamic in lending relationships. By leveraging this template, both lender and borrower can safeguard their interests effectively.

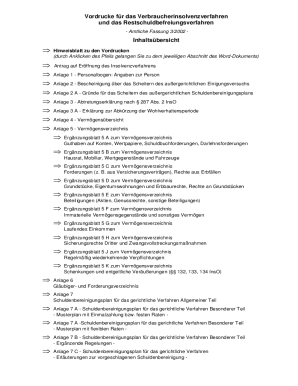

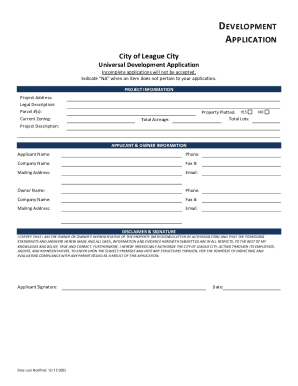

How to fill out the Friend To Friend Loan Contract Template

-

1.Download the Friend To Friend Loan Contract Template from pdfFiller.

-

2.Open the document in pdfFiller and review the pre-filled sections.

-

3.Enter the name of the lender and the borrower at the designated spaces.

-

4.Fill in the loan amount, specifying the currency.

-

5.Set the interest rate, if applicable, and include terms of repayment.

-

6.Indicate the loan duration and the repayment schedule.

-

7.Add any collateral or security agreements, if necessary.

-

8.Ensure all parties agree on the terms by reviewing the entire document.

-

9.Have both the lender and borrower sign the contract electronically.

-

10.Save the finalized document and distribute copies to all parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.