Last updated on Feb 17, 2026

Government Invoice Contract Template free printable template

Show details

This document standardizes the format for processing invoices related to services rendered or goods supplied to government entities, ensuring accountability and efficient payment processing.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Government Invoice Contract Template

A Government Invoice Contract Template is a standardized document used for billing government agencies for goods or services provided, ensuring compliance with government accounting standards.

pdfFiller scores top ratings on review platforms

Great product I have had no problem with the app so far.

Has made it easier to customize forms for our business.

well done thank you

good

Went very smoothly

I like it, it's easy and nice to use

Who needs Government Invoice Contract Template?

Explore how professionals across industries use pdfFiller.

Government Invoice Contract Template Guide

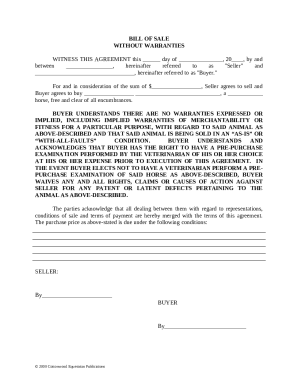

What is a government invoice contract template?

A government invoice contract template serves as a standardized document used in transactions between contractors and government entities. It ensures clarity and consistency in billing procedures, helping to minimize misunderstandings and facilitate prompt payment. By using this template, both parties can uphold accountability and transparency throughout the invoicing process.

Standardization in invoicing for government entities is crucial to maintain uniformity across various departments and contractors. This template aids in reducing the risk of errors, streamlining the billing process, and ensuring compliance with regulatory requirements.

What are the key definitions for clarity?

-

Individuals or businesses responsible for delivering goods or services to government agencies.

-

A formal document itemizing services rendered or goods provided, with detailed payment information required for government transactions.

-

Conditions specifying when and how payments will be made, including timelines and accepted methods.

-

A unique identifier assigned by a government agency that is used to facilitate tracking and payments.

-

The specific organization within the government responsible for overseeing and processing contracts.

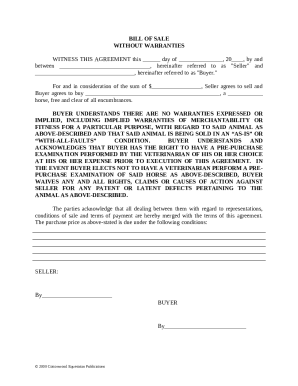

How to fill out the contractor information section?

Accurate contractor information is vital for ensuring seamless communication and payment processing. The required details include the business name, its legal designation, and a 'Doing Business As' (DBA) name if applicable. Along with this, an accurate business address and tax identification number are necessary to comply with tax regulations.

Verifying contact information is essential. Ensuring responsiveness can significantly affect the efficiency of communication with the government agency.

How to compile government information accurately?

Correctly identifying the relevant government agency, including the agency name and address, is crucial for processing invoices efficiently. Additionally, detailing the specific agency department can provide clarity and prevent delays.

Including the right contact person along with their accurate details is essential for establishing a reliable point of contact. This minimizes miscommunication and ensures prompt responses to any queries regarding the invoice.

What to include when detailing invoice elements?

-

Every invoice should have a unique number to prevent confusion and aid in tracking payments.

-

Including the date ensures timelines are clear, while referencing the PO number connects the invoice to the corresponding order.

-

Summarizing the provided goods or services helps verify what was delivered, alongside their quantities and pricing.

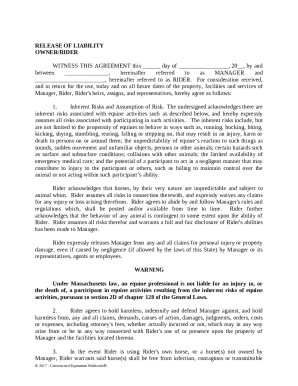

How to establish payment terms clearly?

Specifying a clear payment due date reinforces the urgency for payment processing on the part of the agency. Listing accepted payment methods enhances convenience for the agency, facilitating quicker transactions.

Furthermore, providing guidance about potential late payment implications can encourage prompt payment and enhance the contractor's cash flow management.

Why use pdfFiller for your government invoice contract template needs?

pdfFiller empowers users to effectively manage and edit their documents. Its robust editing tools simplify the document creation process, allowing for quick adjustments and updates to invoices.

Furthermore, utilizing pdfFiller’s eSignature features facilitates prompt approvals, streamlining the overall invoicing procedure. Collaborating in a cloud-based environment with teams is also simplified, promoting efficiency and better project management.

What are the compliance considerations for government invoices?

Understanding regional regulations regarding government billing is critical. Compliance helps avoid legal issues and ensures the contractor adheres to prevailing laws and standards.

Adopting best practices in line with fiscal responsibility not only assures good standing with government agencies but also enhances a contractor's reputation. Additionally, staying informed about compliance changes through regular updates is essential for long-term success.

How to fill out the Government Invoice Contract Template

-

1.Open the Government Invoice Contract Template on pdfFiller.

-

2.Begin by entering your business or organization name in the designated field at the top of the document.

-

3.Fill in the contact information, including address, email, and phone number, ensuring accuracy for potential follow-up.

-

4.Enter the invoice number, date of service, and the period during which services were rendered.

-

5.List the services or products provided, with corresponding descriptions and quantities.

-

6.Specify the agreed-upon rates for each item or service, and calculate the total cost, making sure to check for any applicable taxes or fees.

-

7.If applicable, include any terms and conditions related to payment and delivery details in the provided space.

-

8.Review the completed invoice for accuracy and completeness, ensuring all fields are filled correctly.

-

9.Finally, save the completed document and send it to the designated government agency via email or postal service as per their requirements.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.