Home Buy Contract Template free printable template

Show details

This document establishes the terms and conditions under which the Buyer will purchase and the Seller will sell the property, outlining the rights and responsibilities of both parties in the transaction.

We are not affiliated with any brand or entity on this form

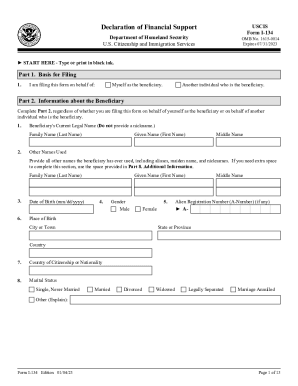

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

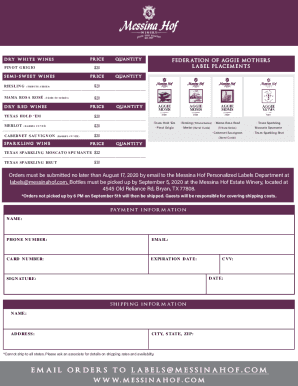

What is Home Buy Contract Template

A Home Buy Contract Template is a legal document outlining the terms and conditions under which a property is sold and purchased.

pdfFiller scores top ratings on review platforms

It has been great to digitally sign and fill out forms.

Very easy to find documents,good that there are no time limits on use.

Simple to use, professional in its appearance, thorough in its scope

has been a nice experience I didnt knew that I can have a full capability to edit and make fillable docs....

24/7 support and with team viewer on top of it i have a choice whether to learn myself or have them do it as i watch

Very easy to sign up. More importantly, easy to use. Source docs easy to upload. Screens and features facilitated doc completion. Able to point and click pdf conversions rapidly.

Who needs Home Buy Contract Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Home Buy Contract Template form

Filling out a Home Buy Contract Template form can seem daunting, but it’s essential for a smooth real estate transaction. This guide will walk you through the process, ensuring you understand each component and that both buyer and seller are protected.

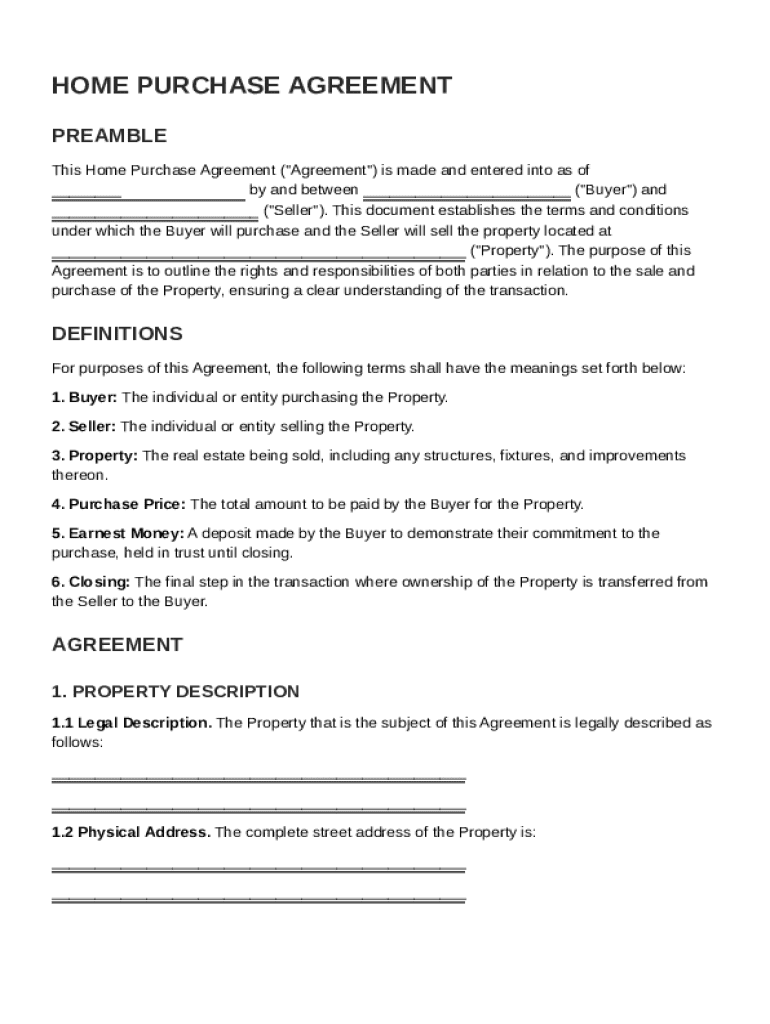

What is the home purchase contract?

The home purchase contract is a legally binding document that outlines the terms and conditions of a real estate transaction. It serves to protect both the buyer and seller, ensuring clear expectations throughout the buying process.

-

The contract specifies buyer and seller responsibilities, minimizing potential misunderstandings.

-

It includes critical components like price, payment structure, and closing date, maintaining clarity.

What are the key terms in a home purchase contract?

Understanding key terms is crucial for anyone involved in the transaction. Key definitions include:

-

The party purchasing the property, responsible for securing financing and fulfilling contract terms.

-

The owner of the property, who agrees to transfer ownership under specified conditions.

-

Includes both the legal description and physical address, ensuring there’s no ambiguity.

-

The agreed amount between buyer and seller, subject to negotiations and market conditions.

-

A good faith deposit made by the buyer to demonstrate seriousness; this goes towards the purchase price if the transaction proceeds.

-

The final step in the transaction where ownership is legally transferred, and payments are settled.

How to break down the home purchase agreement?

A home purchase agreement is multifaceted; understanding its detailed components can help in its accurate completion.

-

This section must accurately describe the property’s boundaries and any pertinent legal details.

-

Accurate address information is vital for legal clarity and to avoid confusion during the closing.

-

Reflect on factors like market conditions and property appraisal when agreeing on this amount.

-

Outlines how payments are made, including earnest money and various financing options available.

What are the steps to fill out the home purchase agreement?

Completing a home purchase agreement involves several steps to ensure accuracy and compliance.

-

Collect necessary information such as property details and personal identification.

-

Use a template to guide your entries, ensuring no fields are left blank.

-

Avoid errors like incorrect figures or inadequate legal descriptions, which could complicate the process.

-

Consider using pdfFiller’s interactive features for effortless editing and e-signing.

What financing options are available for home purchase?

Selecting the right financing method is critical; several options are available to buyers.

-

A popular option that typically requires a higher credit score and down payment.

-

These loans are government-backed and ideal for first-time buyers due to lower down payment requirements.

-

Available for veterans and active-duty service members, these loans often require no down payment.

-

Buying outright with cash can simplify the process and eliminate financing complications.

How to manage the home purchase process?

Navigating the home purchase process requires attention to detail and proactive management.

-

Understand your commitments when putting down earnest money, which assures the seller of your intent.

-

Be prepared for the detailed steps leading to closing, including necessary inspections and final negotiations.

-

Leverage pdfFiller’s platform for seamless document management, ensuring all forms are finalized timely.

How can pdfFiller assist with your home purchase agreement?

Using pdfFiller offers several advantages during the home purchase process, enhancing efficiency and organization.

-

Easily edit and eSign documents, streamlining the agreement process without the need for printing.

-

Follow tailored instructions for completing your home purchase agreement accurately.

-

Discover how other users successfully managed their transactions using pdfFiller, simplifying their purchasing journey.

How to fill out the Home Buy Contract Template

-

1.Open the Home Buy Contract Template on pdfFiller.

-

2.Review the template sections, including buyer and seller information, property details, and price.

-

3.Begin by filling in the buyer's name and address in the designated fields.

-

4.Enter the seller's name and address in the corresponding sections.

-

5.Specify the property details, including the full address, legal description, and any included fixtures.

-

6.Fill in the purchase price and any deposit amounts in the financial terms section.

-

7.Outline any contingencies, such as financing or inspection requirements, to protect both parties.

-

8.Include the closing date and any specifics regarding the transfer of ownership.

-

9.Review the filled document for accuracy and completeness before saving or printing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.