Home Loan Contract Template free printable template

Show details

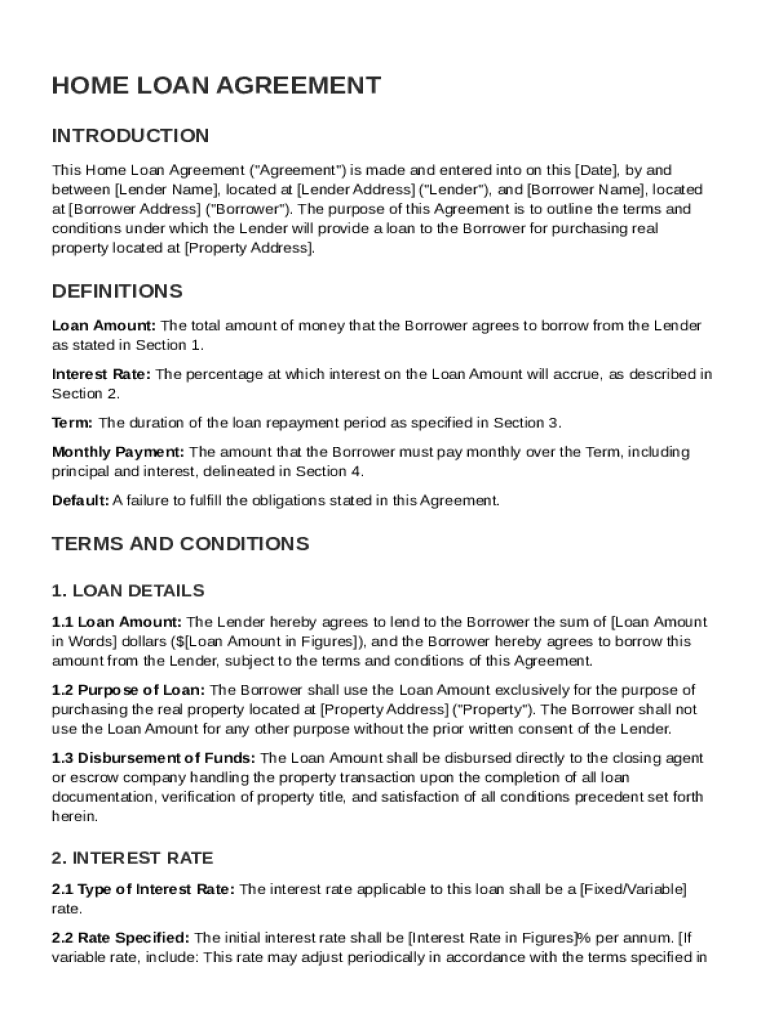

This document outlines the terms and conditions of a home loan agreement between a lender and a borrower for the purpose of purchasing real property.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Home Loan Contract Template

A Home Loan Contract Template is a standardized document outlining the terms, conditions, and obligations of a home loan agreement between a lender and a borrower.

pdfFiller scores top ratings on review platforms

EXCELLENT! MADE TAX FORMS SO MUCH EASIER

It has been a great tool to use for forms that are hard to access.

So far so good. I think it's a great product and I am starting to use it alot.

This is excellent software. Very impressed.

Great job. Easy. Flexible. Comprehensive

I LOVE IT I THINK THIS PROGRAM IS AWESOME

Who needs Home Loan Contract Template?

Explore how professionals across industries use pdfFiller.

How to navigate your Home Loan Contract Template

Filling out a Home Loan Contract Template involves several key components to ensure clarity and compliance. This guide will provide you with step-by-step instructions on how to complete your form accurately.

Understanding the Home Loan Contract Template

A Home Loan Contract Template is essential for facilitating agreements between lenders and borrowers. It serves as a foundational document that outlines the loan's terms, ensuring both parties understand their rights and obligations.

-

This template protects the interests of both lenders and borrowers by providing a legally binding agreement.

-

It typically includes sections for personal information, loan details, interest rates, and repayment terms.

-

Having a structured template encourages open communication regarding loan terms, minimizing the potential for disputes.

What are the key elements of the Home Loan Agreement?

The Home Loan Agreement encompasses several critical elements necessary for a comprehensive understanding of the loan.

-

This agreement clearly identifies the lender and the borrower, confirming who is involved in the transaction.

-

Details like the date, names, and addresses are crucial for legal verification and record-keeping.

-

The agreement specifies that it pertains to the provision of a loan for real property, outlining its intent.

What are core definitions within the agreement?

Several key terms within your loan agreement must be clearly defined to avoid confusion.

-

This indicates the total amount borrowed. It is essential to verify and understand your financial obligations.

-

The rate may either be fixed or variable, affecting your monthly payments and total interest paid over time.

-

This is the duration of the loan repayment period. Understanding the term is vital for planning your finances.

-

This includes your loan principal and accrued interest, and knowing its structure can aid budgeting.

-

This section outlines the consequences should the borrower fail to meet their obligations, emphasizing the importance of timely payments.

How are comprehensive loan details explained?

Accurate completion of loan details is crucial for a successful agreement.

-

Make sure to fill in the amount you wish to borrow accurately.

-

Clarify what the loan funds will be used for, as this can influence the terms.

-

Understanding the process and conditions under which funds will be released is vital for financial planning.

How can you navigate the interest rate section?

The interest rate section can significantly impact the cost of your loan, so it’s essential to understand it fully.

-

Understand how lenders assess your risk factor to determine your interest rate.

-

Choosing between fixed or variable rates can influence your payments over time; be aware of the benefits and drawbacks of each.

-

Consider how potential changes in interest rates may affect your total repayments throughout the loan term.

What interactive tools can help with your Home Loan Agreement?

Utilizing modern tools can streamline your Home Loan Contract Template experience.

-

Make use of pdfFiller's editing features to modify your contract template according to your needs.

-

Use the eSignature tool to finalize your agreement officially, ensuring a smooth transaction.

-

Engage with professionals during the agreement process using pdfFiller’s collaborative functionalities.

How can you manage your loan agreement efficiently?

Effective management of your loan agreement is essential for long-term success.

-

Use pdfFiller to store your contract in a secure cloud environment, allowing easy access whenever needed.

-

Whenever necessary, you can easily make changes to your agreement to reflect current needs.

-

Ensure you’re maintaining digital records according to legal standards, safeguarding your documents against loss.

What are common questions and troubleshooting tips?

It is important to address any issues that arise during the loan process promptly.

-

Take note of any discrepancies immediately and consult professionals to understand the rectification process.

-

Ensure open lines of communication with your lender to amend any unfavorable terms.

-

If issues persist, contact pdfFiller's support for expert assistance in managing your documents effectively.

What compliance considerations should you know?

Adhering to legal requirements is essential while drafting your Home Loan Contract Template.

-

Include all necessary clauses as dictated by local regulations to ensure compliance.

-

Be sure to disclose critical information to borrowers, as mandated by law.

-

Regularly review your document to ensure it satisfied all necessary regulations based on your location.

What further steps should you take after completing the Home Loan Agreement?

After signing your agreement, understanding subsequent steps is crucial for a smooth home-buying process.

-

Begin the process according to the terms of your agreement to access the funds.

-

Stay on top of tasks required to finalize your home purchase once the agreement is in place.

-

Keep an open dialogue with your lender about any changes or questions that arise after the agreement.

In conclusion, effectively using a Home Loan Contract Template allows both parties to engage in a legally binding, transparent manner. Leveraging tools like pdfFiller can simplify the editing, signing, and management of your Home Loan Agreement and enhance your overall borrowing experience.

How to fill out the Home Loan Contract Template

-

1.Open the Home Loan Contract Template in pdfFiller.

-

2.Review the provided fields to understand what information is required.

-

3.Begin by entering the borrower's name and contact information in the designated sections.

-

4.Fill in the lender's details, including the name of the financial institution and contact information.

-

5.Specify the loan amount, interest rate, and repayment terms in the corresponding fields.

-

6.Provide the property address and description that is being financed under the loan contract.

-

7.Indicate the loan purpose, such as purchasing a home or refinancing.

-

8.Review the terms and conditions of the contract, ensuring all necessary clauses are included.

-

9.Sign the document electronically where indicated, adding the date of signing.

-

10.Save or download the completed Home Loan Contract Template for your records or to share with involved parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.