House Financ Contract Template free printable template

Show details

This document serves as a formal agreement between the Lender and the Borrower for financing the purchase or refinance of a residential property, outlining terms and conditions to protect both parties\'

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is House Financ Contract Template

A House Financing Contract Template is a formal document outlining the terms and conditions of a financial agreement related to purchasing or refinancing a house.

pdfFiller scores top ratings on review platforms

GREAT SITE

GREAT SITE , LOVED IIT

Easy and reasonably priced!

Easy and reasonably priced!

GOOD

TRIED IT AND IT'S GOOG

I found that I no longer needed pdfFiller but the subscription was renewed. Upon advising prfFiller they promptly refunded the subscription. A good and honest company.

Useful service, allowed me to fill and sign a PDF online. And when I accidentally signed up for a subscription, they also processed a quick refund

I found that I no longer needed pdfFiller but the subscription was renewed. Upon advising prfFiller they promptly refunded the subscription. A good and honest company.

Who needs House Financ Contract Template?

Explore how professionals across industries use pdfFiller.

House Finance Contract Template on pdfFiller

Creating a House Finance Contract Template form can be straightforward if you understand its components and compliance requirements. This guide will provide you with a detailed roadmap on how to fill out the House Finance Contract Template form effectively, using tools available on pdfFiller.

Understanding house finance contracts

A House Finance Contract legally binds a lender and a borrower, outlining the terms of a property loan. It is essential for clarity in terms and conditions to avoid disputes and misunderstandings.

-

It defines the responsibilities of both parties in a financial agreement.

-

Clear terms reduce ambiguity and enhance mutual understanding.

-

They safeguard the rights and obligations of both lenders and borrowers.

What are the core components of the contract?

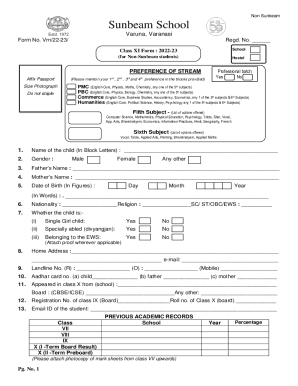

A comprehensive understanding of the core components of a House Finance Contract can mitigate risks and facilitate smooth transactions.

Definitions

-

The lender provides the loan. Examples include banks and credit unions.

-

The borrower must repay the loan, adhering to agreed-upon terms.

-

The contract specifies the property to be financed, including all relevant details.

-

It details the total principal amount borrowed, inclusive of any fees.

-

The rate impacts overall costs and can be fixed or variable.

-

The term outlines how long borrowers have to repay the loan.

-

Defaulting occurs when a borrower fails to meet terms, leading to financial penalties.

Parties to the agreement

-

Including full name, address, and contact details ensures easy communication.

-

It's crucial to gather comprehensive borrower details to avoid any miscommunication.

How to understand loan details breakdown?

A proper understanding of loan details is vital for financial planning and decision-making.

-

Know the borrowing total, including ancillary costs.

-

Consider the implications of choosing fixed or variable rates relative to your financial situation.

-

Assess how different loan terms affect monthly payments and total interest.

What are the payment terms clarification steps?

Clarifying payment terms is crucial to avoid unnecessary fees and maintain a good credit rating.

-

Create a schedule that aligns with your financial capabilities to ensure timely payments.

-

Use financial tools to estimate expected monthly payments accurately.

-

Be aware of how late payments can impact your overall loan costs.

-

Understanding grace periods can provide temporary relief without penalties.

-

Learn how paying off the loan early might incur fees.

How to navigate escrow and insurance requirements?

Understanding escrow and insurance requirements can streamline the financing process.

-

Escrow accounts are used to hold funds before both parties fulfill their obligations.

-

Common items include property taxes and insurance payments.

-

Main types include homeowner’s insurance, which protects against property loss.

-

The borrower must maintain adequate insurance coverage during the loan period.

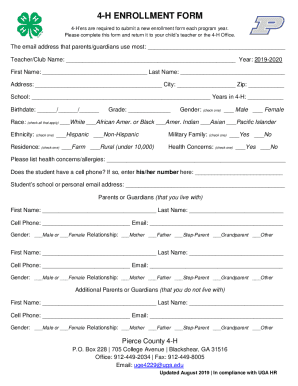

What are the steps to fill out the house finance contract?

Filling out the contract correctly avoids future legal disputes.

-

Compile all personal, financial, and property documents beforehand.

-

Utilize pdfFiller’s capabilities for an efficient, paperless process.

-

Familiarize yourself with local laws to ensure validity.

What are common mistakes to avoid?

Awareness of common pitfalls can save time and money.

-

Always review the terms thoroughly to avoid missing critical details.

-

Neglect can lead to severe financial penalties.

-

Skipping these parts can result in complications during the loan term.

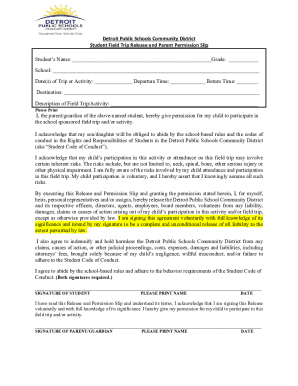

What conclusion and next steps should you consider?

Before finalizing the contract, ensure a complete review provides confidence in your agreement.

-

Verify that all information is accurate and complete.

-

Consult documents or legal experts if needed.

-

Leverage pdfFiller’s platform for future editing and signing needs.

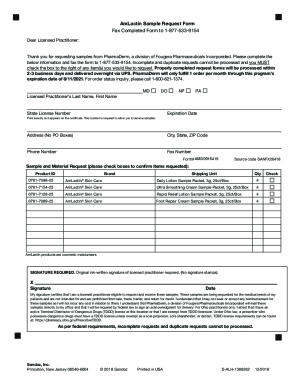

How to fill out the House Financ Contract Template

-

1.Open the House Financing Contract Template in pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the names and addresses of the buyer(s) and seller(s) in the designated fields.

-

4.Input the property details, including address and legal description.

-

5.Specify the loan amount and interest rate in the appropriate sections.

-

6.Outline the repayment terms, including payment frequency and due dates.

-

7.Add any contingencies or special conditions that apply to the financing agreement.

-

8.Review all entered information for accuracy and completeness.

-

9.Save the filled contract and share it with all involved parties for signatures.

-

10.Finalize the document by ensuring all parties receive a copy for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.