Insurance Contract Template free printable template

Show details

This document establishes the terms and conditions of the agreement between the Insurer and the Policyholder, outlining coverage, obligations, procedures for claims, and protecting the interests of

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Insurance Contract Template

An Insurance Contract Template is a customizable document outlining the terms and conditions of an insurance agreement between an insurer and the insured.

pdfFiller scores top ratings on review platforms

This great I now just scan the forms I need to fill out and use PDFfiller to fill them in. It is lot better then using my handwriting.

I wish to gain more experience before making a committment, but, thus far, I am finding the product useful.

Since writing the above, I have used the PDFfiller to complete a batch of same-format, but different forms, and found it convenient to be able to use the one basic form for each of my projects.

Wonderful we run a small business and I have everything I need at my fingertips! Thank you

very helpful less frustration to govt forms

It is awesome. Been able to save printing and scanning. time

Great, the interface could be better, more modern.

Who needs Insurance Contract Template?

Explore how professionals across industries use pdfFiller.

Insurance Contract Template Guide

How does an insurance contract work?

An insurance contract is a legally binding agreement between an insurer and a policyholder that outlines the terms of coverage in exchange for premium payments. Understanding these contracts is essential for financial security, as they protect against various risks. In this guide, we'll explore what an insurance contract entails, its key definitions, and how to fill out an insurance contract template form.

What are the key components of an insurance contract?

-

An insurance contract serves to transfer the risk from the policyholder to the insurer, ensuring financial support in unforeseen events.

-

These contracts are pivotal in providing peace of mind and financial stability, helping individuals and businesses manage unexpected losses.

-

The insurer provides coverage and pays claims, while the policyholder makes premium payments and adheres to the policy terms.

What are the key definitions in insurance contracts?

-

The policyholder has the responsibility to pay premiums and provide accurate information while having the right to claim benefits per the policy terms.

-

An insurer is a company that provides financial protection and is obliged to honor valid claims when covered events occur.

-

Coverage can vary from liability, health, homeowners, to travel insurance, each addressing specific risks.

-

Premiums are the payments made for the policy, while claims are the requests for payment made when a covered event occurs.

-

Exclusions detail what is not covered, and the policy period indicates the timeframe during which coverage is active.

Who are the parties involved in an insurance contract?

-

The insurer must provide clear terms, policy details, and their claims process to the policyholder.

-

The policyholder is required to share relevant personal and risk-related information to enable accurate premium assessment.

-

Providing complete and accurate information is critical as it impacts premium calculations and the validity of claims.

What coverage details should be included in an insurance contract?

-

Different policies cover various risks, so it's vital to select the type that meets your specific needs.

-

Each insurance type, from auto to life, has unique features. A policy number uniquely identifies your contract.

-

Per occurrence limits cap payouts for each event, while aggregate limits cap total payouts within a policy period.

-

Deductibles are out-of-pocket costs before insurers pay claims. Optional coverages allow for additional security and protection.

How are premium payments structured?

-

Premiums can be paid monthly, quarterly, or annually. Understanding the schedule helps manage budgeting.

-

Payments can be made via bank transfer, credit card, or online financial services, providing flexibility for policyholders.

-

Late payments often incur fees, so being aware of grace periods before cancellation ensures coverage is maintained.

-

Being familiar with local payment regulations is essential to avoid penalties and ensure the contract is upheld.

What are the obligations of parties in an insurance contract?

-

The insurer must provide coverage as agreed and handle claims fairly according to the policy terms.

-

Policyholders should be transparent and report changes that may affect coverage or risk.

-

Following the insurer's claims process promptly helps resolve any issues and get assistance when needed.

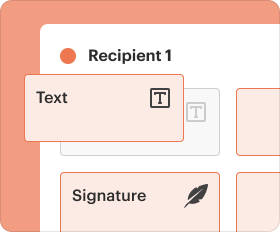

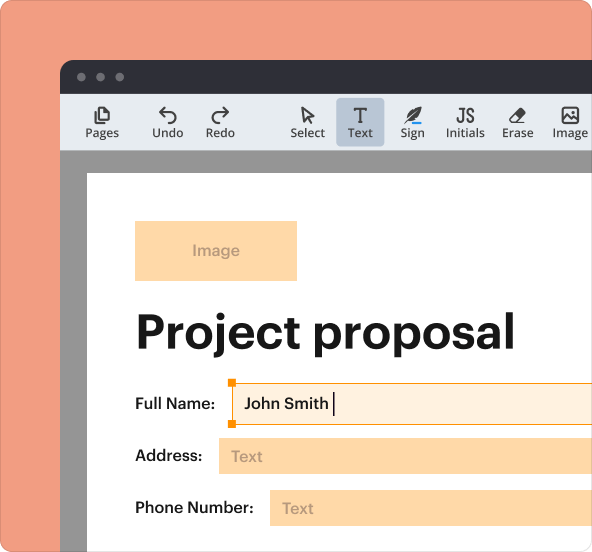

How to utilize pdfFiller for insurance contracts?

-

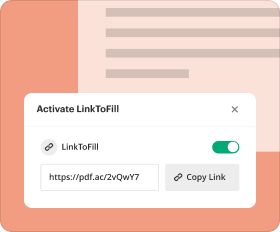

pdfFiller provides tools that simplify filling out insurance contract templates efficiently.

-

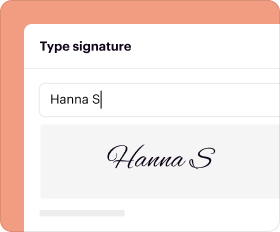

Users can easily make amendments or sign contracts digitally, ensuring compliance and time savings.

-

The platform allows real-time collaboration, making it easy for teams to work on contracts, even remotely.

What are the compliance and best practices in creating insurance contracts?

-

Always ensure your contracts adhere to evolving regulations in your region to avoid legal complications.

-

Common mistakes include vague terms or failing to disclose exclusions, which can lead to disputes.

-

By using pdfFiller, users can create compliant templates that are thorough and accurately address all necessary details.

How to fill out the Insurance Contract Template

-

1.Locate the Insurance Contract Template on pdfFiller.

-

2.Open the template and review the sections that need to be completed.

-

3.Begin with the policyholder's information including name, address, and contact details in the designated fields.

-

4.Input the insurer's details in the corresponding areas, ensuring accuracy for legal purposes.

-

5.Fill out the coverage details, specifying the type of insurance, limits, and deductibles.

-

6.Include any additional clauses or endorsements relevant to the specific policy being issued.

-

7.Review the payment terms and schedule; enter premium amounts and payment frequency.

-

8.Provide space for signatures of both parties, ensuring date fields are also included.

-

9.Double-check all information for accuracy and completeness before finalizing the document.

-

10.Save the completed template and share it with involved parties for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.