Interest Contract Template free printable template

Show details

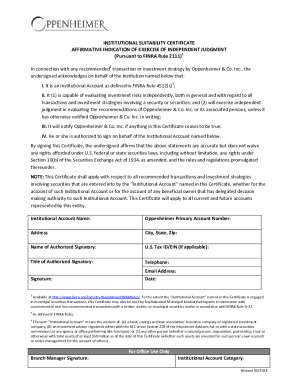

This document outlines the terms and conditions for interest or profit sharing between two parties involved in a specific investment or arrangement.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Interest Contract Template

An Interest Contract Template is a legal document outlining the terms and conditions under which one party pays interest to another on borrowed funds.

pdfFiller scores top ratings on review platforms

just starated using so far its been very productive

So glad I found you guys. You have made my life very easy filling out tax forms. THANKS :)

Saw it bought it used it could not be happie

This program makes working with forms so much easier, and they all look professional. Awesome.

Very handy and easy to use. Worth the subscription price.

Nice product. Annoying that you are asking me about what I think with only an hour on the software.

Who needs Interest Contract Template?

Explore how professionals across industries use pdfFiller.

Interest Contract Template Guide

How to fill out an interest contract template form

Filling out an Interest Contract Template form is straightforward if you follow structured steps. Begin by identifying all parties involved and clearly defining the terms of the agreement. Using a reliable template such as those found on pdfFiller can streamline this process.

Understanding the Interest Contract Agreement

An Interest Contract Agreement defines the terms under which interest is calculated and exchanged between parties. Such agreements are essential to ensure all parties have clarity regarding their obligations, which can prevent disputes in the future.

-

This is a formal document outlining how interest is computed and agreed upon by involved parties.

-

A clear contract minimizes misunderstandings, providing a solid reference for all parties.

-

Interest contracts are used in various financial engagements, from loans to investment partnerships.

Key components of the interest contract agreement

Understanding the key components of an Interest Contract Agreement is crucial for effective contract management. Each section of the contract holds significant value and must be crafted with care.

-

Clearly stating who the parties are ensures accountability and legal validity.

-

Indicates when the agreement begins and how long it remains valid.

-

Detailing how interest is calculated is critical to avoiding disputes.

-

Specifies what each party is expected to do under the agreement.

-

Outlines conditions under which the contract can be terminated.

Filling out your interest contract template

Completing your Interest Contract Template requires attention to detail. Follow a systematic approach to ensure accuracy and compliance.

-

Navigate the template, filling in each section according to your specific agreement.

-

Ensure that all parties’ details are correct to forestall legal complications.

-

Review the completed document collaboratively to ensure all parties are in agreement.

How to edit and customize your interest contract

The ability to edit and customize your Interest Contract Template enhances its relevance and adaptability. Platforms like pdfFiller simplify this process through intuitive editing tools.

-

Leverage collaborative features to engage all parties in the editing process.

-

Adapt your template to fit specific industry requirements or unique agreements.

-

Consult legal counsel to ensure that all changes align with applicable laws.

Signing and managing your interest contract

Once your Interest Contract is completed and edited, it must be signed according to legal standards. Familiarizing yourself with eSignature laws is necessary for valid documentation.

-

Know what constitutes a legally binding signature through various methods.

-

Use tracking tools to monitor all changes and ensure transparency in editing and signing.

-

Create and store version history for reference and audit purposes.

Real-world applications of interest contracts

Interest contracts have numerous applications in everyday financial dealings, from loans to complex investment partnerships.

-

Examine real-life scenarios to understand how interest contracts play a pivotal role.

-

Different industries may have unique demands when structuring interest agreements.

-

Analyze what makes certain agreements successful to inform future contracts.

Legal considerations and compliance

Adhering to legal standards is non-negotiable when drafting an Interest Contract. Understanding relevant laws can prevent legal repercussions.

-

Stay informed of federal and state requirements to ensure compliance.

-

Note state laws that may impact your agreement, particularly in multi-state transactions.

-

Regularly consult legal experts to adapt documents according to changing regulations.

Maximizing the benefits of your interest contract

To achieve the best outcomes with your Interest Contract, proactive strategies must be employed. Leveraging effective tools can significantly enhance your management process.

-

Focus on transparency and clarity to foster better agreements.

-

Each party should agree upon measurable conditions to gauge success.

-

Utilize pdfFiller’s capabilities for continuous management and revision of contracts.

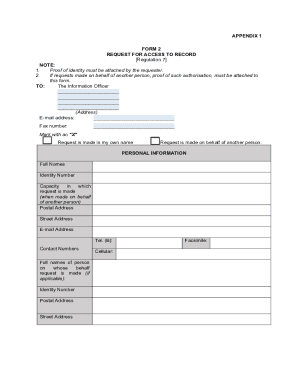

How to fill out the Interest Contract Template

-

1.Open the Interest Contract Template in pdfFiller.

-

2.Read the introductory section to understand the purpose of the document.

-

3.Begin filling out the 'Lender Details' section with the lender's name and contact information.

-

4.Enter the 'Borrower Details' by providing the borrower's name and contact information.

-

5.Specify the loan amount in the 'Principal' field.

-

6.Fill in the 'Interest Rate' section with the agreed-upon percentage.

-

7.Indicate the 'Loan Term' by defining the duration for which the loan will be active.

-

8.Provide details in the 'Repayment Schedule' to describe how and when payments will be made.

-

9.Review all entries for accuracy, ensuring all terms are clear and mutually acceptable.

-

10.Save the completed document and share it with all parties for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.