Interest Exemption Contract Template free printable template

Show details

This document outlines the terms and conditions for an interest exemption on a loan between a lender and a borrower, specifying repayment details and other contractual obligations.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Interest Exemption Contract Template

An Interest Exemption Contract Template is a legal document that outlines the terms under which interest payments are exempted between parties.

pdfFiller scores top ratings on review platforms

have to get use to the signature , but it was a great tool

Very handy to have and can access from any computer!

Simple to use. Easy to complete forms and save, email or print.

Very helpful to have this capability and convenience.

Difficulty finding how to print, otherwise fine

Just learning the program. It would be nice to have a little lesson

Very user friendly for someone who is not very computer/technical competent.

Who needs Interest Exemption Contract Template?

Explore how professionals across industries use pdfFiller.

How to effectively fill out an interest exemption contract template form

Creating an interest exemption contract template form requires a thorough understanding of its structure and components. This guide provides a step-by-step approach to ensure you correctly complete the form, maintain compliance, and safeguard your interests.

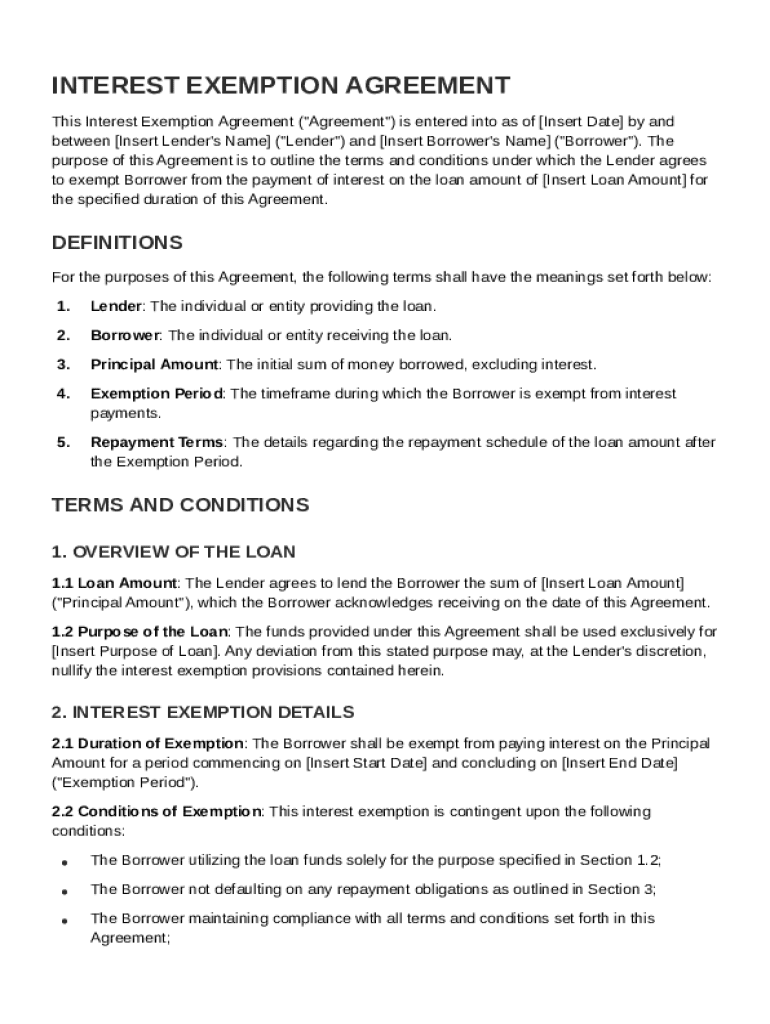

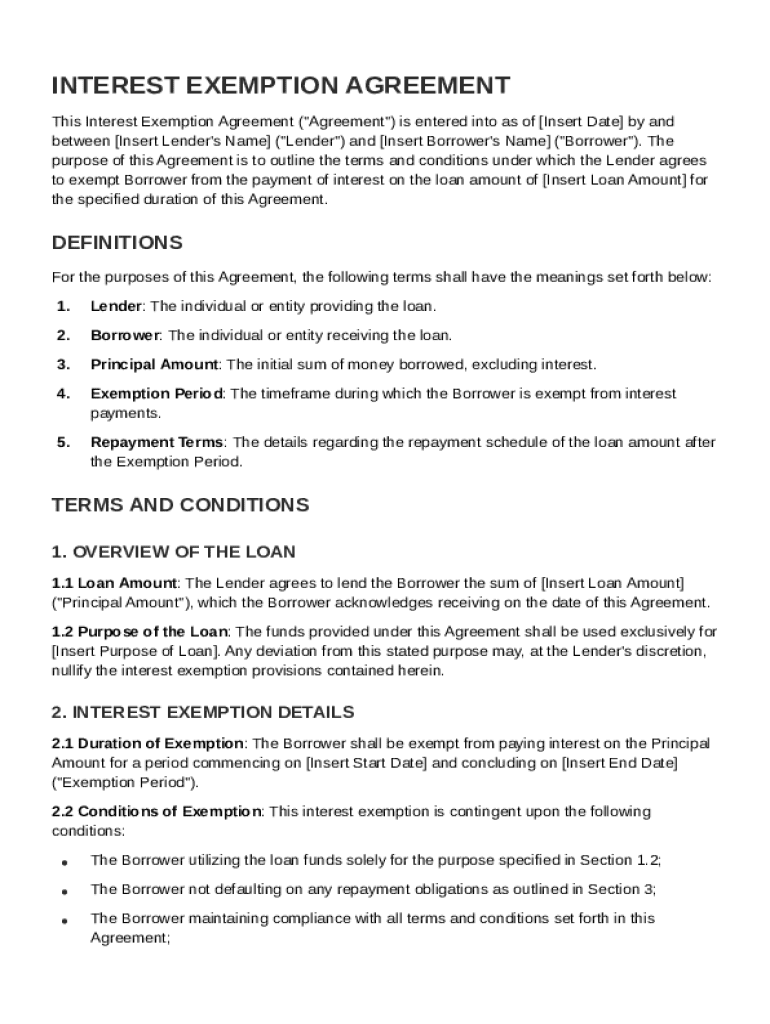

Understanding the interest exemption agreement

An interest exemption agreement is a financial document that allows borrowers to temporarily avoid paying interest on a specified loan amount. This agreement not only helps manage financial burdens but also promotes borrower-lender relationships by clarifying each party's responsibilities.

-

The lender provides the funds, while the borrower is responsible for repayment under the agreed terms. Understanding the roles of these parties is crucial for compliance and maintaining transparency.

-

Clearly articulated terms help avoid disputes and ensure both parties adhere to the agreement, fostering trust and efficiency in the process.

Essential definitions in the agreement

Clarifying key terms in the interest exemption agreement is essential for both borrowers and lenders to navigate their obligations. Below are critical definitions that should be understood prior to finalizing the agreement.

-

Qualified lenders provide the capital. It’s essential to identify the lender’s credentials before proceeding.

-

The borrower assumes responsibility for repayment. Awareness of their duties ensures compliance.

-

This term refers to the initial amount borrowed without interest. A clear understanding of this figure is crucial for repayment plans.

-

It defines the specific duration during which no interest is accrued. Clarity on the exemption period ensures lenders and borrowers are aligned.

-

This outlines how repayments will occur post-exemption. Explicit terms prevent confusion after the exemption period concludes.

How are terms and conditions outlined for loans?

The loan’s terms and conditions must be clearly defined to ensure both parties understand their rights and responsibilities. This overview encapsulates key aspects of the agreement, ensuring compliance and effective management.

-

The loan amount must be explicit, as it sets the foundation for all financial interactions. It specifies how much the borrower is permitted to borrow.

-

The intended use of the loan often dictates compliance requirements. Stating this clearly can protect both parties.

-

Any deviation without approval may lead to penalties or repayment demands, highlighting the need for adherence to stated uses.

Exemption details: duration and conditions

Understanding the exemption details is crucial. These elements detail the timeframe and stipulations for maintaining the exemption, providing clarity and protection for both borrower and lender.

-

It defines the period during which interest fees are waived. Both parties must agree upon this timeline to ensure transparency and compliance.

-

The borrower may have responsibilities to uphold during this period, such as maintaining communication with the lender regarding usage of funds.

-

Failure to adhere to the specified conditions can result in immediate ramifications, including termination of the exemption.

Navigating the creation of your interest exemption agreement

Creating your interest exemption agreement might seem daunting, but it can be streamlined by following straightforward steps. Utilizing proper tools enhances this process.

-

Correctly inputting details is essential for compliance. Start by clearly stating the lender, borrower, and principal amount.

-

pdfFiller offers a range of features that facilitate easy editing, signing, and sharing, making document creation efficient.

-

Familiarity with local laws prevents issues, while pdfFiller can help in validating these regulations before submission.

Finalizing your agreement: best practices

Finalizing your interest exemption contract requires careful review and consideration. Following best practices ensures the document is completed accurately and professionally.

-

Ambiguities can lead to disputes, so it's paramount to have clear and concise terms understood and agreed upon by both parties.

-

Professional legal advice can help review the agreement for compliance and highlight any overlooked provisions.

-

Once signed, managing documents through a cloud-based platform allows for easy access and revision if necessary.

Interactive tools for effective document management

Effective document management enhances the borrowing process. Utilizing interactive tools can improve efficiency and collaboration.

-

pdfFiller’s features, such as e-signatures and collaborative editing, support seamless document management and completion.

-

Being able to collaborate with multiple parties on the same document streamlines the loan approval process, reducing delays.

-

Having access to your documents from anywhere provides significant convenience and security, which are essential for individuals and teams.

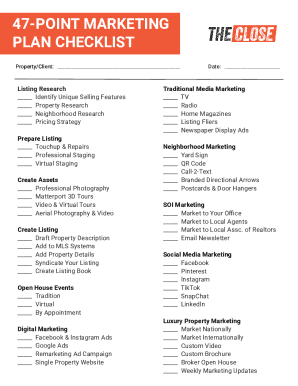

How to fill out the Interest Exemption Contract Template

-

1.Download the Interest Exemption Contract Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by filling in the date at the top of the document.

-

4.Enter the names and contact details of the parties involved in the contract.

-

5.Specify the loan amount and the applicable interest rate.

-

6.Clearly outline the terms of interest exemption, including any conditions or time frames.

-

7.Include any additional clauses relevant to the agreement.

-

8.Review the entire document for accuracy and completeness.

-

9.Sign the contract and have the other party sign as well.

-

10.Save and download the completed contract for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.