Last updated on Feb 17, 2026

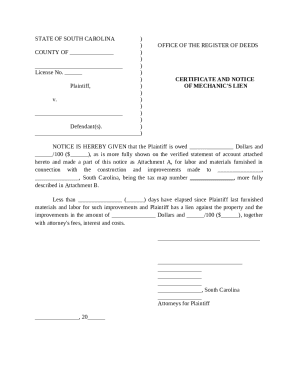

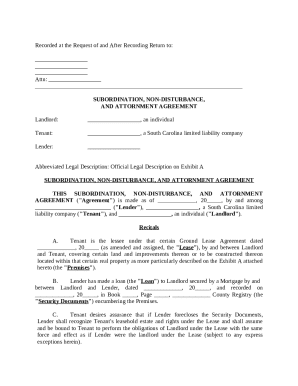

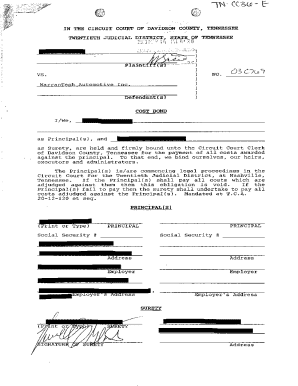

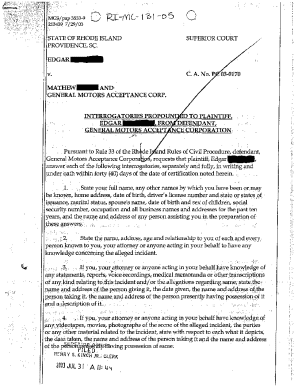

Intermediary Contract Template free printable template

Show details

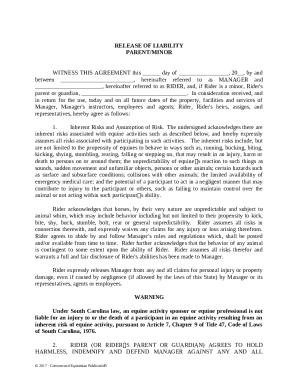

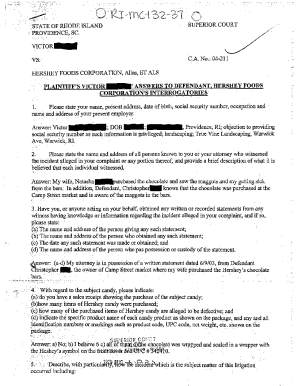

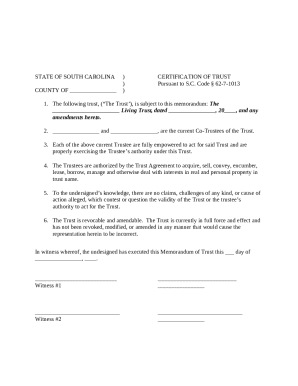

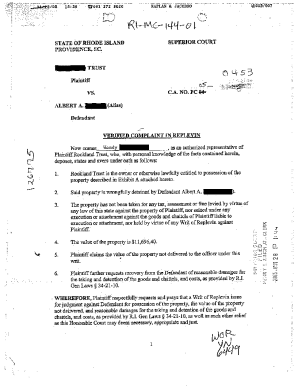

This document is an agreement between a Principal and an Intermediary that outlines their roles, responsibilities, and terms of service, as well as compensation, confidentiality, and dispute resolution

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Intermediary Contract Template

The Intermediary Contract Template is a legal document used to outline the responsibilities and obligations of an intermediary involved in a transaction between parties.

pdfFiller scores top ratings on review platforms

Wish there was a less expensive option for people who only need this once or twice a year.

Whenever I have needed to use PDF filler to find documents of I can always count on PDF filler. I love it.

muy buena aplicación, muy intuitiva y fácil de usa

It is a very helpful tool. I only wish I could send multiple documents at once and indicate one document as the cover sheet.

This form filler has been incredibly beneficial in aiding me to efficiently complete a number of form related tasks....I would unequivocally recommend this software to all college student!!!

I love this app and will use often. It does have some little issues when modifying text, but I can work with it.

Who needs Intermediary Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Intermediary Contract Template on pdfFiller

Filling out an Intermediary Contract Template form requires attention to detail and understanding of the key elements involved in such agreements. An Intermediary Contract serves as a vital document in business relations, outlining roles, responsibilities, and terms of service.

What is an intermediary contract?

An intermediary contract is a legal agreement between two parties, the Principal and the Intermediary, outlining the terms under which the Intermediary will provide services to the Principal. The purpose of intermediary agreements is to formalize roles and expectations in business transactions, which mitigate risks and clarify responsibilities.

Why are intermediary agreements important?

Intermediary agreements are crucial as they ensure clear communication and protection for both parties involved. They help in preventing misunderstandings, setting defined expectations for performance, and managing accountability.

Key parties involved in the contract

-

The party that seeks the service, usually responsible for providing resources and information.

-

The party that facilitates services or transactions between the Principal and a third party.

What are the core components of an intermediary agreement?

-

Key definitions clarify roles, services provided, and terms such as Confidential Information and Compensation.

-

Specifics on what services are expected, including timelines and deliverables.

-

Clarity on payment terms helps avoid disputes and misunderstandings.

How to fill out the intermediary contract template?

Filling out this template involves a step-by-step approach that guides you through the necessary sections while ensuring completeness. Make sure to focus on key details like Start Date and End Date, which are crucial for defining the contract's duration.

-

Include the names, addresses, and roles of the Principal and the Intermediary.

-

Specify what services the Intermediary will provide, as well as any expectations.

-

Be precise about how and when the Principal will compensate the Intermediary.

What are the responsibilities of each party?

-

This includes demonstrating skill, adhering to compliance standards, and providing regular reporting.

-

The Principal must provide the necessary information and materials to facilitate the Intermediary's work.

-

Maintaining transparency and cooperation helps build trust between both parties.

What compensation structures are common?

Negotiating fair compensation is vital to ensure that both parties are satisfied. Payment structures can vary; however, some common examples include flat fees, retainer agreements, and commission-based payments.

-

Best for defined and temporary projects, ensuring both parties know the exact payment upfront.

-

Used for ongoing work, providing steady income to the Intermediary while offering the Principal assurance that the services are readily available.

-

Effective for sales-related roles, incentivizing the Intermediary based on performance.

What legal considerations should you keep in mind?

-

Adhering to relevant laws prevents legal issues, particularly concerning licensing and industry standards.

-

When sharing Confidential Information, ensure that all parties understand their rights and obligations.

-

Understanding the consequences of breaking the contract, such as financial penalties or loss of services, is crucial.

How can pdfFiller help manage your intermediary agreements?

pdfFiller provides tools that can simplify contract management for users. With functionalities such as eSignatures and collaborative editing features, pdfFiller allows multiple parties to participate in the editing process seamlessly.

-

Allows for quick and secure finalization of contracts without the need for physical signatures.

-

Involve all necessary parties during the editing process for better accuracy and compliance.

-

Store and manage signed agreements conveniently, ensuring easy access from anywhere.

What additional resources are available?

-

Explore related templates available on pdfFiller for various intermediary roles.

-

Access resources that provide further insights into managing intermediary agreements effectively.

-

Further reading on industry standards helps in maintaining quality and compliance.

How to fill out the Intermediary Contract Template

-

1.Download the Intermediary Contract Template from the provided source.

-

2.Open the template in pdfFiller for editing.

-

3.Begin by entering the date at the top of the document.

-

4.Fill in the names and addresses of all parties involved in the contract.

-

5.Specify the scope of services the intermediary will provide clearly.

-

6.Outline the payment terms, including amounts and deadlines.

-

7.Indicate the duration of the agreement and any termination clauses.

-

8.Review the document for completeness, ensuring all sections are filled.

-

9.Save the completed contract and consider sending it for review to legal counsel.

-

10.Once finalized, have all parties sign the document electronically if possible.

What is an intermediary contract?

A type or contract, whereby a person or company acts as a sales intermediary on behalf of the exporting company (principal), introducing its products to potential buyers in the external market, in exchange for a commission based on the value of the business deals arranged and paid to the principal.

How to write a basic contract template?

On this page Drafting a contract. Provide details of the parties. Describe services or results. Set out payment details. Assign intellectual property rights. Explain how to treat confidential information. Identify who is liable – indemnity. Provide insurance obligations.

What is an intermediary agreement in insurance?

Definition: agreement entered into between a microinsurer and an intermediary outlining the terms under which the intermediary will render services as intermediary in respect of the microinsurer's policies. Intermediary agreements may be concluded with the following. types of intermediaries: ➢ Representatives.

What is the best format for a contract?

To make your contracts easier to read and understand, it's important that the terms follow a logical order. Generally, contracts follow a standard format, such as: introduction, definitions, scope of services, obligations, payment terms, termination, and then your other legal provisions.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.