Investment Loan Contract Template free printable template

Show details

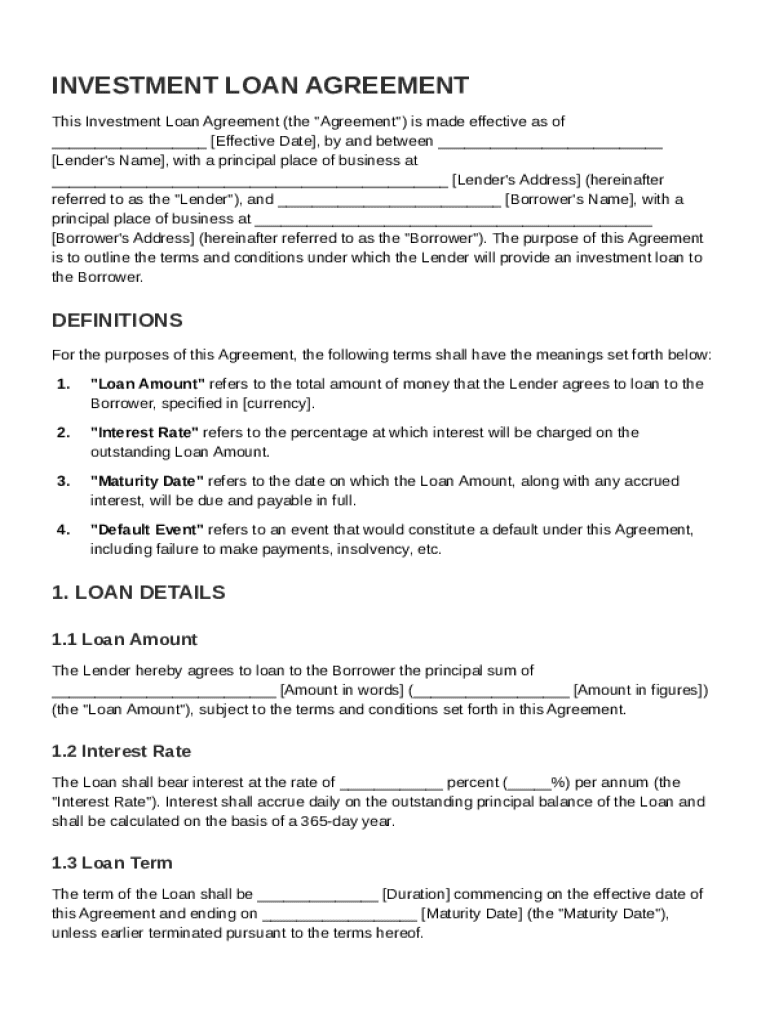

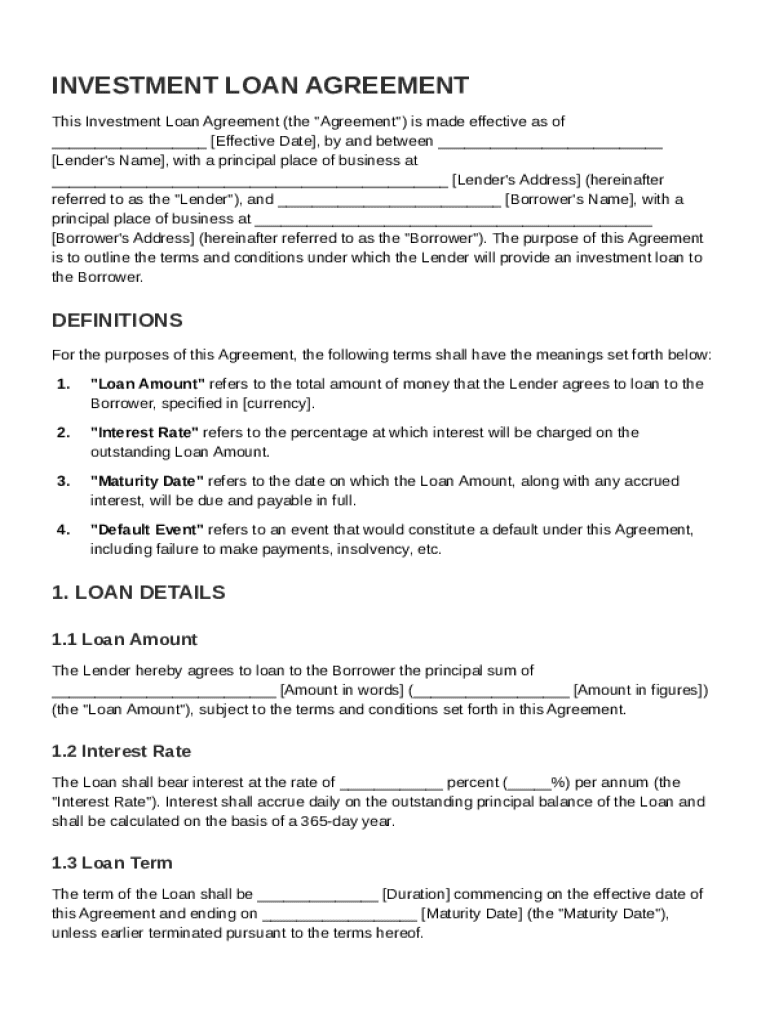

This document outlines the terms and conditions under which an investment loan is provided by a lender to a borrower, including definitions, loan details, repayment terms, use of funds, borrower covenants,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Investment Loan Contract Template

An Investment Loan Contract Template is a legal document outlining the terms and conditions of a loan used for investment purposes.

pdfFiller scores top ratings on review platforms

Awesome! The horrors of using a typewriter are now over!!!!

Pleased with this product. Works as described.

I'm new at this so I am trying to figure it out.

Still learning, but have found it extremely helpful in filling out some legal documents. Will do my best to master this.

The greatest tool I have invested in; better than PDF Converter.

Love it. It's the BEST thing that has happened for my business! PDF Filler has allowed my company to go almost completely paperless. Thanks PDF Filler.

Who needs Investment Loan Contract Template?

Explore how professionals across industries use pdfFiller.

Investment Loan Contract Template Guide

How to fill out an Investment Loan Contract Template form

To efficiently fill out an Investment Loan Contract Template form, carefully review each required section. Gather your financial details, such as your loan amount and terms, before starting. Ensure all parties agree on the terms to avoid misunderstandings. Finally, use reliable tools like pdfFiller for editing and eSigning to streamline the process.

Understanding the Investment Loan Agreement

An Investment Loan Agreement serves as a formal contract between the lender and borrower. It outlines the essential conditions of the investment loan, ensuring both parties have a mutual understanding of their obligations and expectations.

-

This is a legal document that specifies the terms and conditions under which a loan is provided, including the amount, interest rate, and repayment terms.

-

The agreement helps protect both parties by clarifying rights, responsibilities, and processes in case of disputes or defaults.

-

The lender provides the funds, while the borrower commits to repaying the loan under agreed-upon terms.

What are the key components of the Investment Loan Agreement?

Key components provide a roadmap to understanding and managing the loan effectively. These features influence the overall success and understanding of the loan.

-

This specifies how much money is borrowed, impacting the overall financial obligations.

-

The percentage charged over the loan amount, critical in determining how much will be repaid.

-

The end date of the loan term, indicating when full repayment is due.

-

Conditions under which the borrower fails to meet the loan terms, leading to loss or legal actions.

How to analyze loan details?

Understanding the intricate details behind the loan can prevent future complications and ensure informed decision-making.

-

Determining the loan amount should involve careful financial planning to avoid over-borrowing.

-

Interest rates should be compared against market averages to ensure competitiveness.

-

Know typical loan terms in your industry to make informed choices regarding the duration.

Why are repayment terms critical?

Repayment terms govern how and when you will fulfill your financial obligations. Understanding this component can save you from penalties and negative credit reports.

-

A payment schedule clearly outlines due dates and payment amounts, essential for effective financial planning.

-

Defaulting can lead to damaged credit ratings and potential legal action, thus it's crucial to understand the implications.

How do fill out the Investment Loan Agreement Template?

Filling out the Investment Loan Agreement Template accurately is vital to avoid future complications during the loan process. Adhering to best practices can enhance efficiency.

-

Ensure you review each field thoroughly, entering accurate information such as loan amount and interest rates.

-

Neglecting to double-check numbers and failing to include all required signatures often leads to delays.

-

Use tools like pdfFiller to manage your templates effectively and ensure all details are compliant with legal standards.

How can pdfFiller enhance my loan agreement experience?

pdfFiller offers a robust platform for managing documents that can streamline the process of working with loan agreements. Its features address the complexities of document management.

-

The platform supports editing, eSigning, and organizing documents, providing a comprehensive solution for your loan-related needs.

-

Utilize shared folders and track changes, ensuring all involved parties remain informed throughout the loan process.

What compliance and legal considerations should keep in mind?

Compliance with local regulations is crucial when drafting your loan agreement. Not adhering to legal standards can lead to severe implications.

-

Familiarize yourself with applicable laws in your region to ensure your agreement meets all required standards.

-

Different regions may have unique laws impacting loan agreements, so research your locality for specificities.

How to fill out the Investment Loan Contract Template

-

1.Download the Investment Loan Contract Template from pdfFiller.

-

2.Open the document in the pdfFiller editor to start filling out.

-

3.Begin with the borrower's information, including full name and contact details.

-

4.Enter the lender's information in the designated section.

-

5.Specify the loan amount requested and the interest rate agreed upon.

-

6.Fill in the repayment terms, including the duration and payment schedule.

-

7.Detail any collateral being offered as security for the loan.

-

8.Include any fees associated with the loan, such as origination fees or closing costs.

-

9.Review all entries to ensure accuracy and completeness.

-

10.Save the completed document and consider signing it digitally within pdfFiller.

-

11.Share the finalized contract with all parties involved for their signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.