Investor Contract Template free printable template

Show details

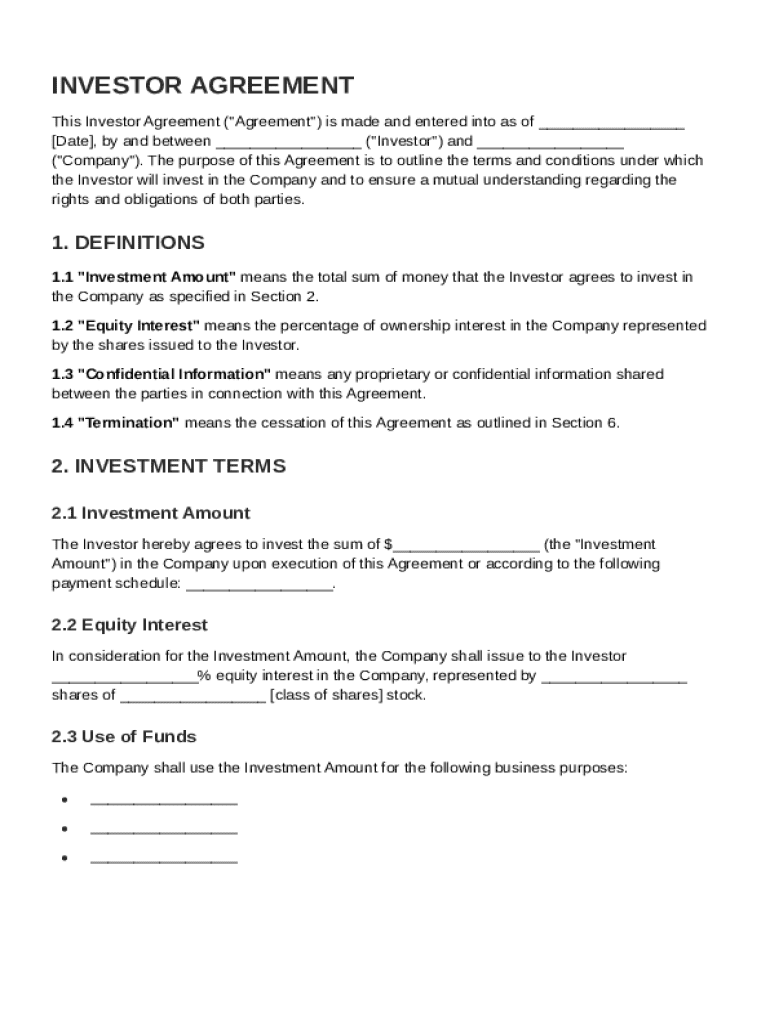

This document outlines the terms and conditions for an investor\'s investment in a company, detailing the rights and obligations of both parties, as well as confidentiality, representations, termination,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Investor Contract Template

An Investor Contract Template is a legal document outlining the terms and conditions of an investment agreement between a financier and a business.

pdfFiller scores top ratings on review platforms

I have just started using the service, but so far, so good.

Has worked very well even if I don't use it often

monthly should be month to month not auto extending and 5.99.

Excellent Service. But way too expensive.

Needs a title for the documents that you can change before exporting

Buying a house. Husband in Prague. You are a life saver. Made filling out standard forms for buying a house and getting signatures attached a real breeze.

Who needs Investor Contract Template?

Explore how professionals across industries use pdfFiller.

Investor Contract Template Guide

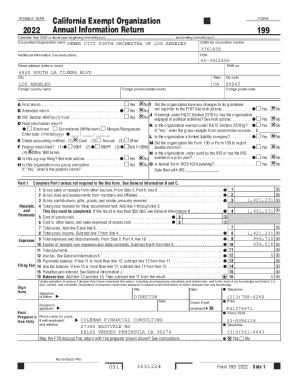

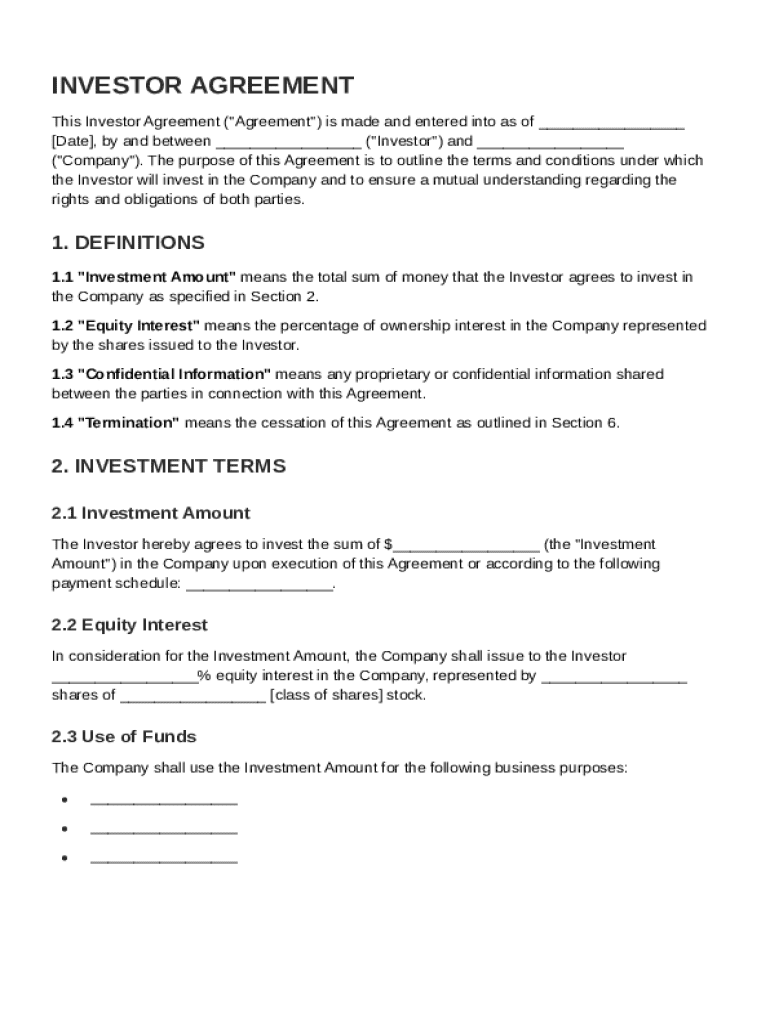

What is an investor agreement?

An investor agreement is a legal document that defines the terms and conditions between an investor and a company. This contract outlines expectations, responsibilities, and the implications for both parties involved. Clarity in these terms is crucial for avoiding misunderstandings and ensuring that both the investor and the company are on the same page regarding their roles.

What are the key components of an investor agreement?

A well-crafted investor agreement includes several key components that are essential for outlining the relationship between the investor and the company. Understanding these components helps both parties to navigate their rights and obligations successfully.

-

The total amount of money that the investor commits to the company, which must include a detailed payment schedule.

-

Represents the ownership stake the investor obtains, which is usually expressed through shares in the company.

-

Specifies how the company intends to use the investment, ensuring transparency in fund allocation.

What rights and obligations does the investor have?

Investors possess specific rights that are proportionate to their equity interest. Understanding these rights is crucial for ensuring that the investor can influence business decisions effectively.

-

Investors often have voting rights tied to their equity interest, allowing them to participate in significant business decisions.

-

Investors should have access to the company's financial records, providing transparency about the company's operations.

-

Some investors may be entitled to seats on the company's board, giving them a direct voice in corporate governance.

On the other hand, the company has its own set of obligations to uphold, including financial reporting requirements and compliance with relevant regulations. These obligations ensure the protection of the investor's interests within the agreement.

Why is confidentiality important in investor contracts?

Confidentiality clauses safeguard sensitive business information from being disclosed to unauthorized parties. Protecting proprietary information not only helps maintain competitive advantage but also fosters trust between the investor and the company.

-

Confidential information typically includes trade secrets, business strategies, and any non-public financial data.

-

Confidentiality is crucial in maintaining the integrity of business operations and investor relations.

-

Common confidential information includes product designs, pricing strategies, and customer lists.

What are the implications of non-competition clauses?

Non-competition clauses are essential in preventing investors from engaging in competing businesses during or after their investment tenure. These clauses protect the company’s proprietary processes and strategies from being compromised.

-

Investors are typically required to refrain from investing in similar companies.

-

Both parties must understand the restrictions imposed by these clauses to mitigate any conflicts of interest.

-

When drafting non-competition terms, it’s important to balance protection with the investor's ability to participate in relevant markets.

How can an investor agreement be terminated?

Termination conditions should be explicitly stated in the investor agreement to avoid future disputes. Certain events may prompt a termination, such as breach of contract or completion of the investment purpose.

-

Known conditions such as bankruptcies or failures to meet designated funding milestones can lead to contract termination.

-

Upon termination, both parties must satisfy specified contractual obligations to ensure clarity and comply with legal standards.

-

It's critical for investors to understand how termination affects their rights and potential equity in the company.

How do you navigate the signing process effectively?

Utilizing tools like pdfFiller can streamline the process of filling out and signing documents. This platform enables users to edit PDFs, eSign forms, and manage documentation efficiently from any location.

-

The platform allows easy collaboration and ensures all parties can access documents securely.

-

Follow a step-by-step guide to complete the Investor Agreement accurately and promptly.

-

Maintain organized records post-signing to ensure all parties can refer back to the agreement when necessary.

How to fill out the Investor Contract Template

-

1.Open the Investor Contract Template on pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the names and contact information of both the investor and the business owner.

-

4.Specify the investment amount and the type of investment being made.

-

5.Outline the terms of the investment, including equity shares or interest rates.

-

6.Include any conditions related to the investment, such as milestones or deliverables.

-

7.If necessary, add any provisions for confidentiality or non-disclosure agreements.

-

8.Review the contract for completeness, ensuring all parties' responsibilities are detailed.

-

9.Once finalized, save the document and either print it for signatures or share it electronically for digital signing.

How do you write an investor contract?

What to include in an investor agreement. A well-executed agreement should include the basics, such as names and addresses, the amount and purpose of the investment, and each party's signatures. In addition, when drafting an investor agreement, the Kumar Law Firm said to be concise and not leave room for ambiguity.

How to make an investment document?

Key elements of an investment agreement #1 Introduction and background information. #2 Investment terms and conditions. #3 Rights and obligations of the parties. #4 Investment amount and payment terms. #5 Governance and decision-making processes. #6 Reporting and accountability requirements. #7 Termination and exit provisions.

What is the agreement between business owner and investor?

Investment contracts are legal agreements between an investor and a company that protects the investor's financial investment in the company. These contracts also provide guidance as to how the company shall provide the investor with a return on their investment.

What is an investor agreement?

An investment agreement is a contract in which an investor or investors agree to invest in a company by subscribing for shares in it an agreed price per share.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.