Legal For Borrow Money Contract Template free printable template

Show details

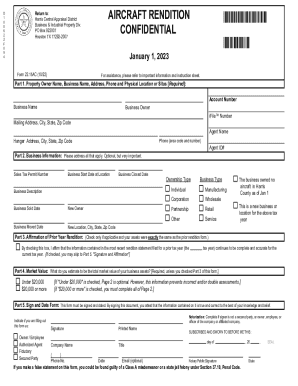

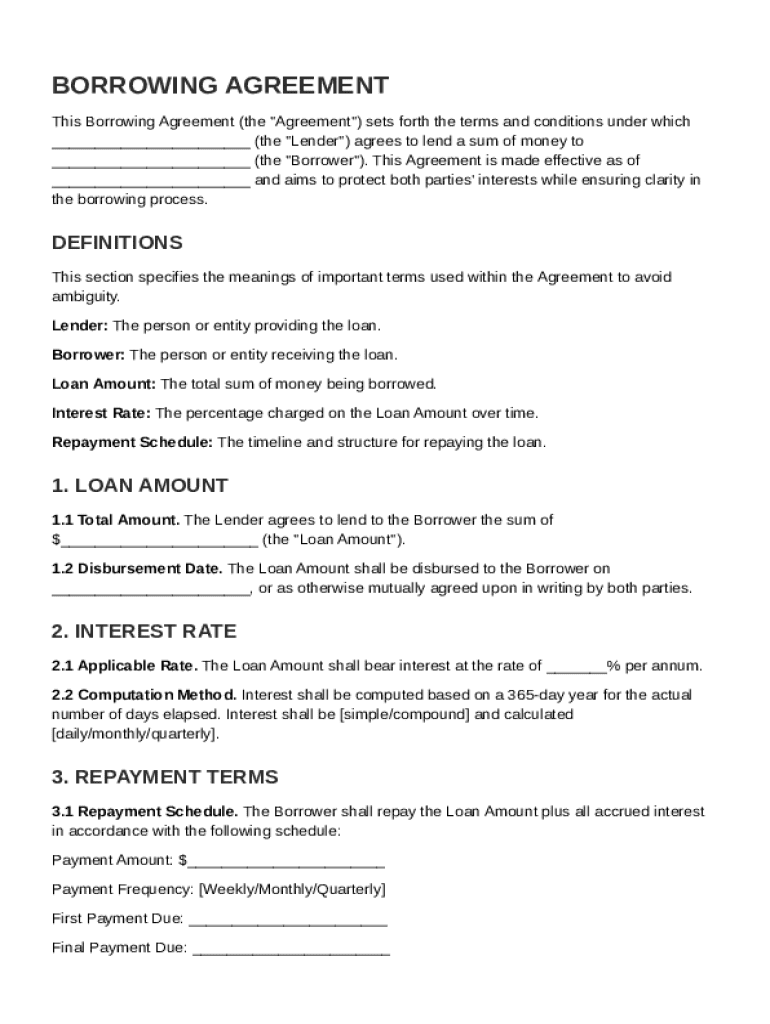

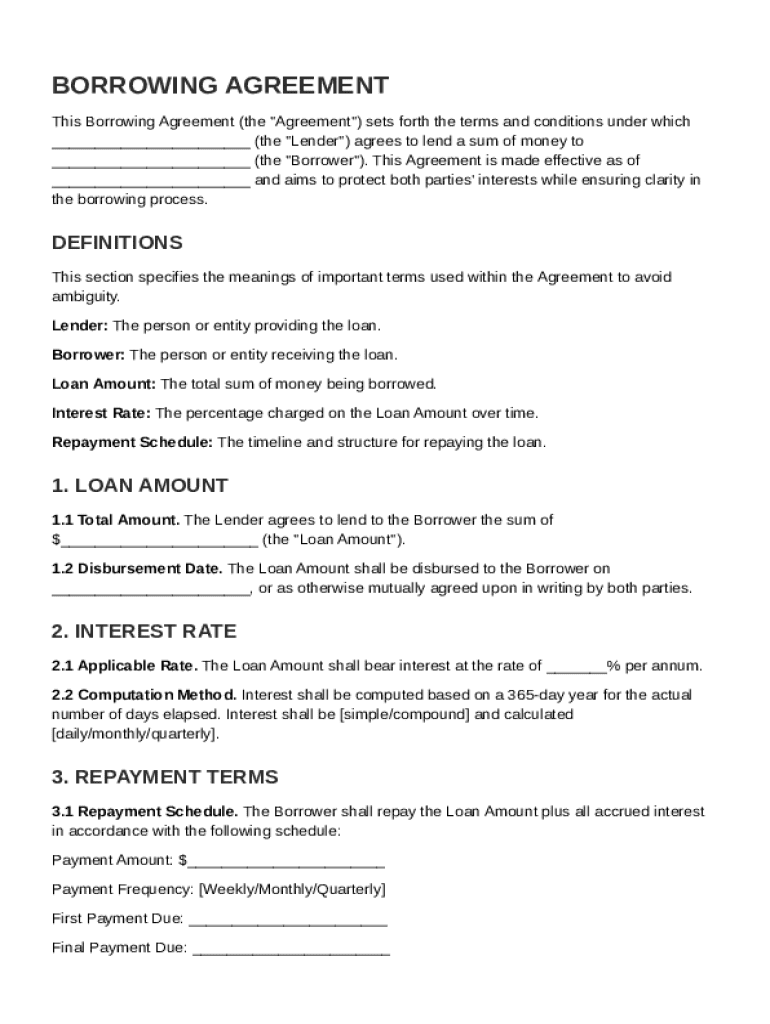

This document outlines the terms and conditions under which a lender agrees to loan money to a borrower, including definitions, loan amount, interest rate, repayment terms, use of funds, representations,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Legal For Borrow Money Contract Template

A Legal For Borrow Money Contract Template is a formal document outlining the terms and conditions of a loan agreement between a lender and a borrower.

pdfFiller scores top ratings on review platforms

So far all worked really well, the only thing that could be still improved is to have the possibility to change the font size, when filling in a document

Easy to use. Wish the auto fill from the 1120s worked for 2018

i like it i would recommend this to someone else..

I've had some problems with the application but overall it meets my business needs.

Easy to use and very useful in today's business world

This is a great tool (and I design systems similar to this). However, I'm just not sure I will use it enough in order to justify the annual price.

Who needs Legal For Borrow Money Contract Template?

Explore how professionals across industries use pdfFiller.

Legal For Borrow Money Contract Template Guide

How to fill out a legal for borrow money contract template form

Filling out a legal for borrow money contract template form involves clearly defining the essential terms such as the parties involved, the loan amount, interest rate, and repayment schedule. Make sure to provide accurate details and review the document carefully before finalizing.

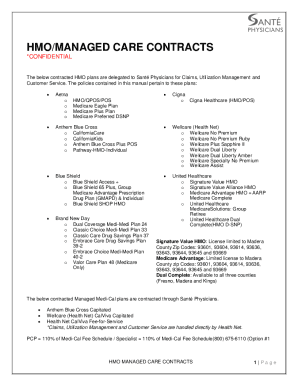

Understanding loan agreements

Loan agreements are crucial for formalizing financial transactions, ensuring both parties are aware of their obligations. These contracts can vary widely in type, including personal, business, secured, and unsecured loans.

-

A loan agreement is a legally binding document outlining the terms of a loan.

-

They protect both lender and borrower, outlining rights, obligations, and interests.

-

There are personal, business, secured (backed by collateral), and unsecured loans (not backed by collateral).

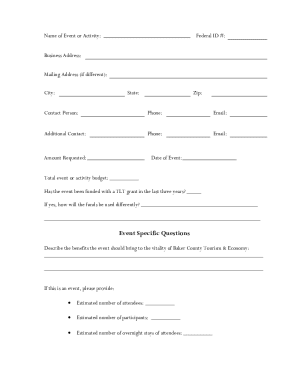

Key components of a borrowing agreement

A borrowing agreement must include several key terms that define the transaction. These terms help prevent misunderstandings and set clear expectations.

-

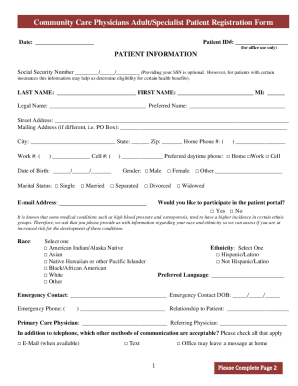

Identification of the parties involved in the loan agreement.

-

The total sum of money borrowed, which must be clearly stated.

-

The percentage charged on the loan amount, defining the cost of borrowing.

-

A clear outline of when payments are to be made, including due dates.

The loan amount: breakdown and structure

Determining the loan amount requires careful consideration of the purpose of the funds. Borrowers should assess their needs and capacity for repayment.

-

Before applying for a loan, calculate how much you truly need and why.

-

Define the timeline for when the funds will be available for use.

Interest rate calculation: a necessary detail

Interest rates can significantly affect the overall cost of a loan. Borrowers should understand how these rates are determined and the type that suits their needs.

-

Fixed rates remain constant, while variable rates fluctuate based on market conditions.

-

Learn the difference between simple and compound interest and how they affect the total payable amount.

Crafting the repayment terms

Establishing clear repayment terms is essential to avoid disputes. Borrowers and lenders should negotiate terms that are fair and manageable.

-

Clearly outline every payment, including amount and due date.

-

Define what happens if payments are missed, including potential penalties.

-

Consider if prepayment is allowed and how that impacts the loan.

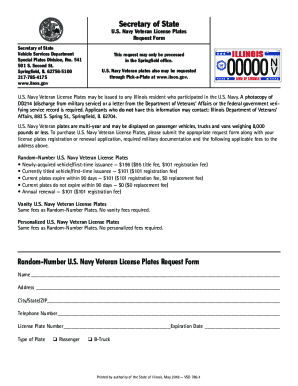

Navigating legal requirements and compliance

Every region has its own legal requirements regarding loan agreements. Ensuring compliance is essential for the validity of the contract.

-

Identify the laws that govern loan agreements in your area.

-

Both lenders and borrowers should be aware of the ongoing legal obligations tied to their agreements.

Editing and personalizing your template with pdfFiller

With pdfFiller, editing a borrowing agreement has never been easier. Users can modify templates, add necessary details, and prepare for signing.

-

Follow the guided process to customize your document effectively.

-

Utilize pdfFiller’s tools to eSign agreements and work collaboratively.

Common mistakes to avoid when drafting loan agreements

When drafting a loan agreement, many pitfalls can arise. It's crucial to be aware of common mistakes to ensure clarity.

-

Make sure all essential terms and details are included in the agreement.

-

Avoid ambiguous terms that could lead to misinterpretations.

-

Consult a legal professional to ensure compliance and protect your interests.

Final review and ensuring safety before signing

A final review is imperative to verify that everything is in order before signing a borrowing agreement. This step can prevent future disputes.

-

Check essential components such as interest rates, payment schedules, and compliance requirements.

-

Seek legal advice, especially if any terms appear unclear or complex.

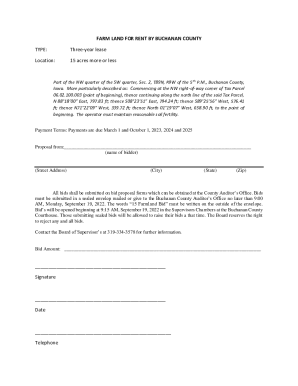

How to fill out the Legal For Borrow Money Contract Template

-

1.Open the Legal For Borrow Money Contract Template on pdfFiller.

-

2.Begin by filling out the date at the top of the document.

-

3.Enter the full name and contact information of the lender in the specified section.

-

4.Next, input the borrower's full name and contact details.

-

5.Specify the principal amount being borrowed in the designated area.

-

6.Indicate the interest rate and payment schedule, detailing how frequently payments are due.

-

7.Include any penalties for late payments or default in the applicable sections.

-

8.Outline the collateral, if any, that secures the loan.

-

9.Review all filled sections for accuracy and completeness.

-

10.Once satisfied, save the document and download it or send it directly from pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.