Lien Contract Template free printable template

Show details

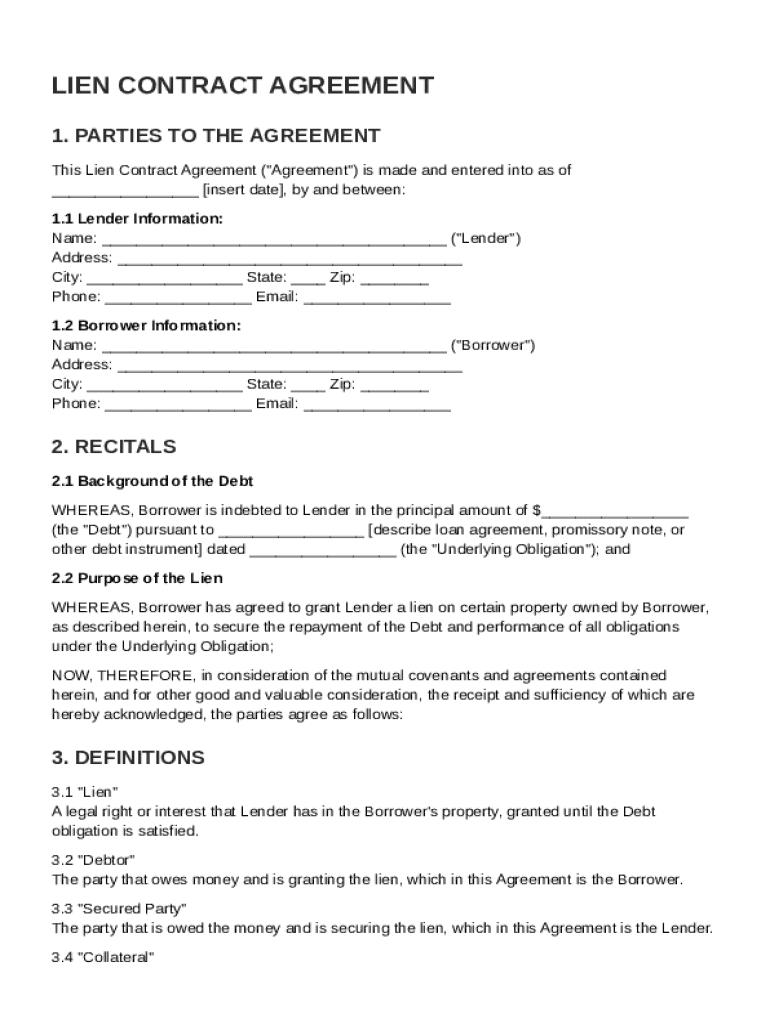

This document serves as a legal agreement between a lender and a borrower, establishing a lien on certain property to secure the repayment of a debt.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Lien Contract Template

A Lien Contract Template is a legal document used to secure a creditor's interest in a debtor's property until the obligation is satisfied.

pdfFiller scores top ratings on review platforms

best ever

best ever easy to use no complications

great service

it works excellent

easy to use. i wish i could multiselect fields to make editable

easy to use

Convenient

Who needs Lien Contract Template?

Explore how professionals across industries use pdfFiller.

Your Guide to Lien Contract Template Forms

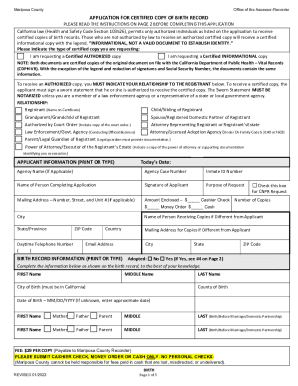

How to fill out a Lien Contract Template form

Filling out a Lien Contract Template form involves understanding your roles as either lender or borrower, outlining key terms regarding the loan and collateral, and adhering to local legal requirements.

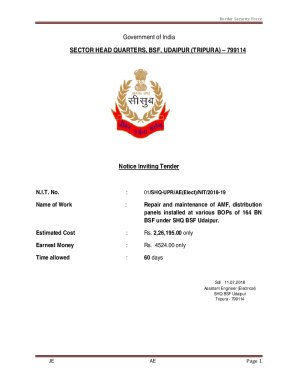

What is a lien contract agreement?

A lien contract agreement is a legal document that secures a loan by placing a lien on a property or asset. This agreement ensures that the lender has a claim to the collateral should the borrower default on repayment.

Understanding the importance of lien contracts is crucial in real estate and financing, as these agreements protect the lender's interests and provide a clear path for recourse in case of default.

-

This provides the lender with legal rights to the specified asset until the debt is settled.

-

Lien contracts are especially common in real estate, distinguishing between various types of liens.

Who are the key parties involved?

Several key parties play a role in a lien contract agreement: the lender, borrower, secured party, and debtor. Each has specific responsibilities that must be clearly defined in the agreement.

-

The entity that provides the funds for the loan and typically seeks collateral to secure the agreement.

-

The individual or entity receiving the loan, responsible for adhering to the repayment terms outlined in the lien contract.

-

The secured party has a legal claim over the collateral, while the debtor is responsible for fulfilling the terms of the agreement.

How do you fill out the lien contract agreement?

Filling out a lien contract involves several steps to ensure both parties' interests are protected. Essential information needs to be gathered and properly documented.

Essential information for lender and borrower

-

Include the lender's name, address, and contact information to establish their identity in the agreement.

-

Document the borrower's name, address, and contact details to ensure accountability and clarity in contact.

Background of the debt

-

Clearly record the amount the borrower is obliged to pay back.

-

Describe the nature of the debt and any related agreements to provide context.

What are the detailed terms for granting a lien?

The terms of the lien grant specify the type of lien and the collateral tied to the loan. Various types of liens may apply, including mortgage liens and mechanics liens, each with distinct details.

-

Understanding different liens such as mortgage liens, mechanics liens, and security interests helps in determining the appropriate lien type for your agreement.

-

Provide a thorough description of the asset that serves as collateral; this is critical to uphold legal claims.

-

Clarify terms under which the lien secures debt repayment, outlining any interest rates, payment schedules, or conditions.

What are the legal definitions within a lien contract?

Understanding key terms in a lien contract is vital. Each term introduces specific legal implications that can affect the agreement's enforceability.

-

A claim against an asset that can secure a debt.

-

The individual or entity that owes the debt and is subject to the lien.

-

The lender or creditor who has legal rights to the lien on the collateral.

-

The asset pledged by the debtor to secure the loan.

How to properly file a lien contract agreement?

Filing your lien contract agreement is essential for its legal enforceability. Each jurisdiction may have varying requirements, and following the correct procedures is vital.

-

Identify the specific steps required to file a lien in your jurisdiction, including necessary documentation.

-

Familiarize yourself with the compliance specifics for your state to avoid penalties.

-

Utilize tools like pdfFiller to store, manage, and easily access your lien contracts from anywhere.

How to utilize pdfFiller for lien contracts?

pdfFiller empowers you to conveniently edit PDFs and eSign your lien contract forms. Its collaborative features enable team management, making it an excellent tool for both individual and team users.

-

Easily make changes and sign documents digitally, streamlining the overall process.

-

Work together with team members seamlessly, even if they are not in the same location.

-

Access your lien contracts from any location with cloud storage support.

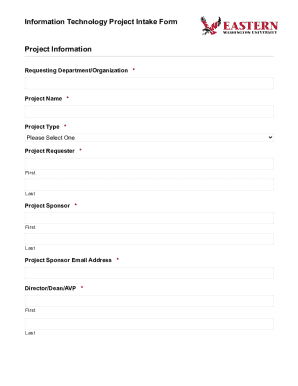

How to fill out the Lien Contract Template

-

1.Open the Lien Contract Template on pdfFiller.

-

2.Review the document to understand its structure and sections.

-

3.Begin by filling in the date at the top of the form.

-

4.Enter the names and addresses of both the lien claimant and the property owner in the appropriate fields.

-

5.Provide a detailed description of the property that is subject to the lien, including its address.

-

6.Fill in the total amount owed, specifying the services or goods that led to the lien.

-

7.If applicable, include any payment due dates or relevant terms in the designated sections.

-

8.Review all information for accuracy and completeness.

-

9.Use the signature fields to add the signatures of both parties and date it accordingly.

-

10.Save and download the completed document, or send it directly for filing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.