Line Of Credit Contract Template free printable template

Show details

This document outlines the terms and conditions under which a lender extends a line of credit to a borrower, including definitions, repayment terms, fees, and covenants.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Line Of Credit Contract Template

A Line Of Credit Contract Template is a formal agreement outlining the terms and conditions of borrowing against a line of credit.

pdfFiller scores top ratings on review platforms

Great Customer Service

Used the service on a free trial, was a positive experience but I didn't need it after I was done applying for apartments. Forgot to cancel after my trial and was charged for 2 months, contacted customer service on their live chat and was given the full refund within a minute! World class customer service!

EXCELLENT SOFTWARE

Great program.

its a pdf but i cant find delete page…

its a pdf but i cant find delete page option

love u guys u just need better prices!

Support person was prompt

Support person was prompt, courteous and quite knowledgeable. Very helpful.

Who needs Line Of Credit Contract Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Line Of Credit Contract Template on pdfFiller

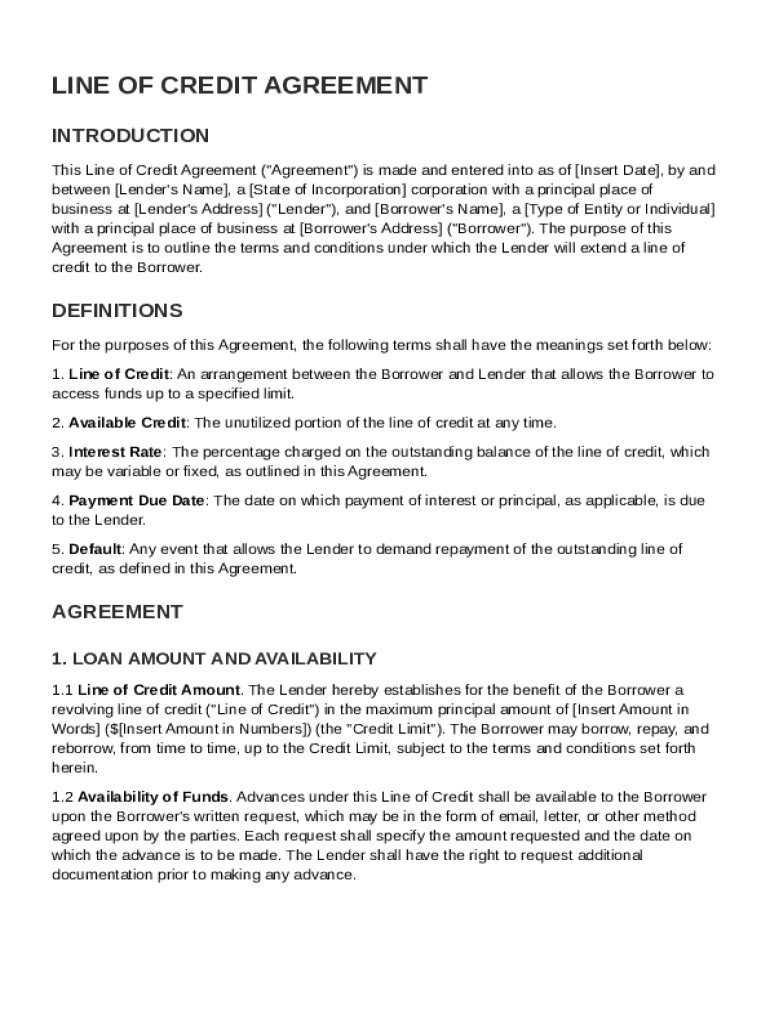

Understanding the Line of Credit Agreement

A Line of Credit Agreement is crucial for both lenders and borrowers as it outlines the terms and conditions governing the credit extended. It allows for flexible borrowing against a preapproved credit limit, making it a vital financial tool for individuals and businesses. The agreement not only protects the rights of both parties but also ensures compliance with relevant legal frameworks.

-

An arrangement that permits the borrower to access funds up to a specified limit, allowing for repeated borrowing and repayment.

-

It protects both the lender and the borrower, outlining the responsibilities and expectations for each party.

-

These can vary by region and include specific compliance notes that guide the formation and execution of these agreements.

What are the core components of the agreement?

Each Line of Credit Agreement includes essential components that define its structure. Understanding these elements is critical for users filling out the contract template.

-

Describes the credit limit and conditions surrounding the borrowing, repayment, and potential reborrowing options.

-

Explains the differences between fixed and variable rates, focusing on how these affect the total cost of borrowed funds.

-

Stresses the importance of making timely payments and outlines possible repercussions for delays.

-

Details various events that could compel immediate repayment of the loan, thus safeguarding the lender's interests.

How to fill out your Line of Credit Contract Template

Filling out your Line of Credit Contract Template using pdfFiller is efficient and user-friendly. Here’s a step-by-step guide to ensure accuracy and completeness.

-

Begin by entering the correct date of the agreement at the top of your template.

-

Accurately input the names and addresses of the lender and borrower to avoid any contractual disputes.

-

Clearly state the total amount available for the line of credit, ensuring it aligns with any previously discussed figures.

How to edit and manage your Line of Credit documents

pdfFiller provides robust tools to edit and manage your Line of Credit Agreements effectively.

-

Users can modify existing agreements quickly, ensuring that all information is up to date.

-

Track changes in documents over time, maintaining a clear history of edits to ensure compliance.

-

Allows multiple users to interact with the document, streamlining the negotiation process.

What is the eSigning process for the Line of Credit Agreement?

Utilizing eSigning through pdfFiller is a convenient method to authorize your Line of Credit Agreement legally.

-

Follow the guided process to insert your electronic signature securely.

-

eSignatures are legally recognized under current regulations, making this process both safe and binding.

-

pdfFiller incorporates advanced security measures to protect vital information throughout the eSigning procedure.

Why is managing compliance and record-keeping important?

Maintaining accurate records is critical for both tax purposes and audits, particularly for financial documents such as a Line of Credit Agreement.

-

Helpful for tracing transactions, ensuring all parties fulfill their obligations under the agreement.

-

The platform includes functions to store and manage documents efficiently.

-

Stay within the bounds of regulations regarding Line of Credit Agreements—this is essential for protecting your interests.

How to troubleshoot common issues with your Line of Credit Agreement?

Addressing common issues encountered when working with a Line of Credit Agreement helps streamline the borrowing process.

-

Recognize typical mistakes that occur during the filling process to prevent complications later.

-

Know the next steps if your application is denied, such as requesting feedback or reconsideration.

-

pdfFiller provides support and resources designed to assist users facing issues during the agreement process.

How to fill out the Line Of Credit Contract Template

-

1.Download the Line Of Credit Contract Template from a reliable source.

-

2.Open the document using pdfFiller or a similar PDF editing tool.

-

3.Begin by filling in your personal details, including your name and contact information, in the designated fields.

-

4.Next, provide the lender's information, including their name and address.

-

5.Specify the total amount of credit being offered and the interest rate associated with it.

-

6.Indicate the repayment terms, including the due date for repayments and any relevant fees.

-

7.Review any clauses related to default, collateral, and liabilities to ensure clarity.

-

8.Sign the document electronically or provide your signature in the designated area.

-

9.Finally, save the filled-out document and consider printing a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.