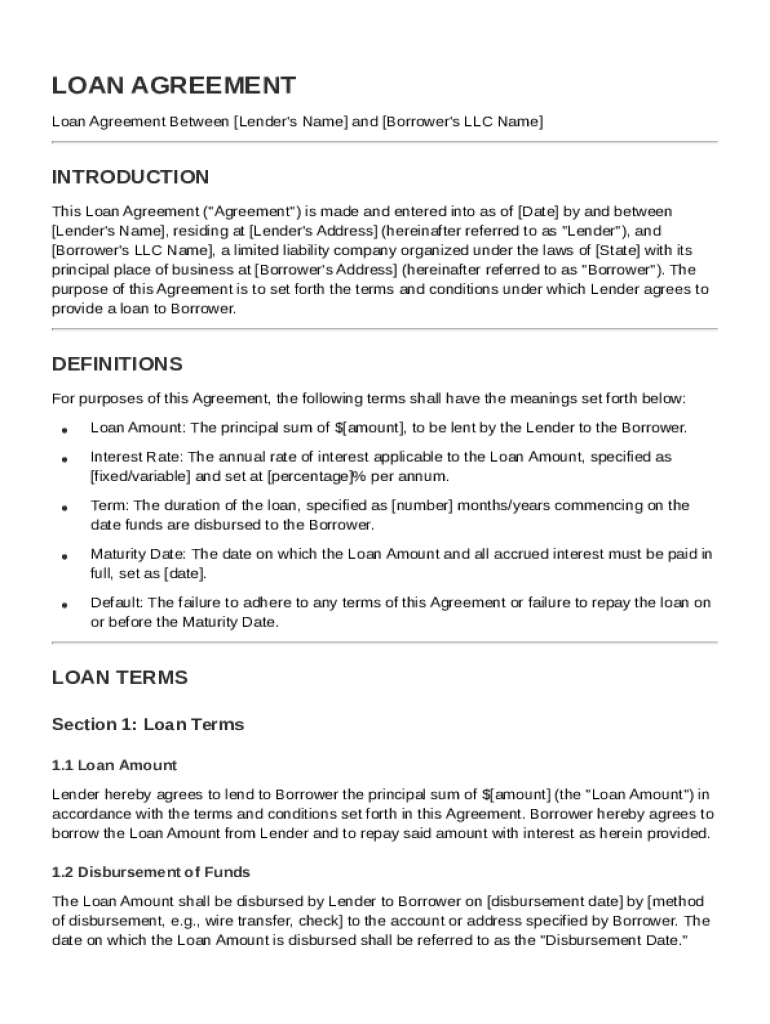

Llc Loan Contract Template free printable template

Show details

This document outlines the terms and conditions of a loan agreement between the lender and the borrower, detailing the loan amount, interest rate, repayment schedule, and other important provisions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

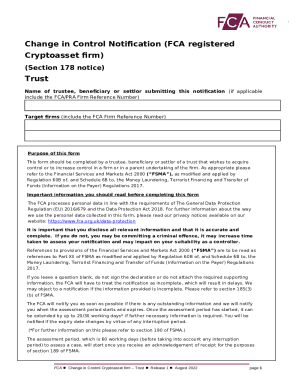

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Llc Loan Contract Template

An Llc Loan Contract Template is a formal document outlining the terms and conditions under which a loan is provided to a Limited Liability Company (LLC).

pdfFiller scores top ratings on review platforms

PDFFiller has allowed me to complete processes that I would have otherwise been unable to do. The service is somewhat easy to use and has quite a large range of features that have been a huge benefit for me.

As a Realtor I am constantly having to merge PDF files, or fill in forms, or add notes to contracts, or rotate pages from horizontal to vertical. My hand writing is not very legible, but PDFfiller makes all of my docs look professional.

I am not a computer person but your format is user friendly.

It is a pricey service if you only need it once but well worth the money if it is something you can use all the time.

Customer support is excellent. However the product offering with regards to price is great but not excellent to my expectation

It s working good if you use the web platform

Who needs Llc Loan Contract Template?

Explore how professionals across industries use pdfFiller.

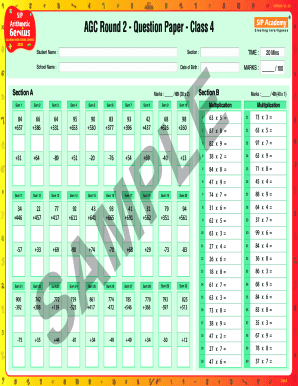

loan contract template guide

How to fill out an loan contract template form

Filling out an LLC loan contract template form involves understanding the key terms including loan amount, interest rate, and loan term. Properly identify both the lender and borrower, and accurately specify loan details. To ensure compliance, consider any regional regulations that may apply.

Understanding key terminology

-

The total sum the lender will provide, crucial for determining repayment obligations.

-

The cost of borrowing, which can be fixed or variable, affecting total amount paid over time.

-

The duration of the loan, including payment start dates and length, impacting repayment schedule.

-

The final date by which the loan must be fully repaid, marking the end of loan obligations.

-

Failure to meet repayment terms, which can lead to penalties or legal repercussions.

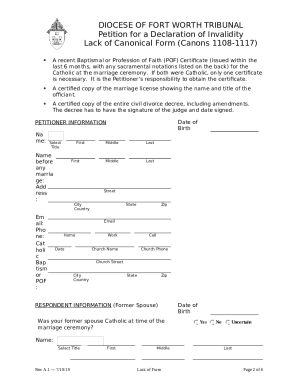

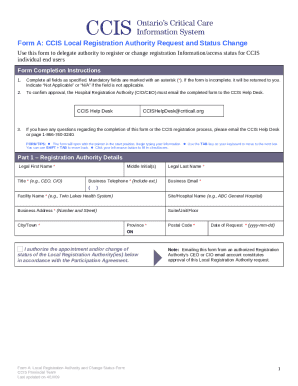

The parties: Identifying lender and borrower

Clearly identifying the lender and borrower is critical for the validity of the LLC loan contract template. Enter specific names and mailing addresses, ensuring that all parties are recognized legally. Distinguish the roles of the lender and borrower to mitigate any misunderstandings about responsibilities.

-

Include full legal names and contact details for the entity lending the funds.

-

Similar requirements as the lender; include the legal name of the borrowing party for clear recognition.

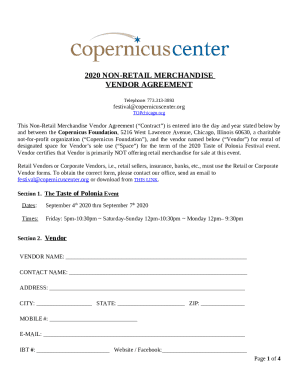

Crafting your loan agreement

Creating your loan agreement involves specific steps to ensure accuracy. Start by filling in essential fields such as loan amount, interest rates, and term. Double-check all entries to avoid future disputes related to the loan contract template.

-

Follow a step-by-step guide to input details securely and accurately.

-

Clearly outline how each term is defined to prevent ambiguity in interpretations.

Setting the terms: Critical loan policies

Establishing robust loan policies is essential for a successful loan agreement. This includes provisions about loan security and co-signers, as well as setting clear conditions under which defaults may occur. Be transparent about prepayment policies to avoid misunderstandings.

-

Specify what collateral, if any, is required to secure the loan.

-

Explain if early repayment is allowed and what fees, if any, apply.

-

Outline the specific circumstances that would constitute default on the loan agreement.

Managing your agreement post-signing

After signing the LLC loan contract template, effectively managing the agreement is crucial. Utilize pdfFiller tools for managing and editing your loan agreement, and leverage e-signature options for streamlined collaboration. Keeping lines of communication open with stakeholders ensures smooth operating procedures.

-

Access a suite of PDF editing tools to modify your agreement as needed.

-

Learn how to use pdfFiller’s eSigning feature to expedite the approval process.

-

Use collaborative platforms for sharing and discussing loan terms post-signing.

Miscellaneous considerations

There may be adjustments required for your LLC loan agreement over time. It is vital to maintain compliance with any regional or industry-specific laws. Establishing best practices for communication between lender and borrower can preserve the integrity of the agreement.

-

Know how and when to make formal adjustments if circumstances change.

-

The importance of adhering to region-specific regulations to avoid legal consequences.

-

Strategies for clear dialogue to prevent misunderstandings during the loan term.

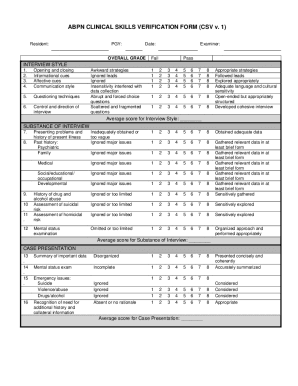

How to fill out the Llc Loan Contract Template

-

1.Open the Llc Loan Contract Template on pdfFiller.

-

2.Begin by filling in the names and addresses of the borrower (LLC) and lender, ensuring accurate contact information.

-

3.Specify the loan amount clearly in the designated field.

-

4.Set the interest rate applicable to the loan as agreed upon by both parties.

-

5.Outline the repayment terms, including the loan duration, payment schedule, and method of payment.

-

6.Include any collateral details if applicable and describe the conditions under which the collateral can be claimed.

-

7.Review the terms of default to understand the repercussions should the LLC fail to meet payment obligations.

-

8.Have both parties sign and date the contract in the spaces provided to make it legally binding.

-

9.Finally, save the completed contract and distribute copies to all parties involved.

How to write a loan contract agreement?

What's in a Personal Loan Agreement? Identifications: The contract will need to list the names of all those involved and their addresses. Dates: There will need to be dates for when the contract goes into effect and any other important dates. Loan amount: This is the principal amount the borrower agrees to take out.

What is the difference between a promissory note and a loan?

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

What is the agreement for returning money?

The 'Return of money' clause establishes the obligation for one party to refund payments or deposits to the other party under specified circumstances. Typically, this clause outlines the conditions under which money must be returned, such as contract cancellation, failure to deliver goods or services, or overpayment.

What is the unsecured loan contract?

An unsecured loan agreement is a legal contract between a lender and a borrower that agrees to fund a loan without requiring collateral.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.