Money Loan Between Friends Contract Template free printable template

Show details

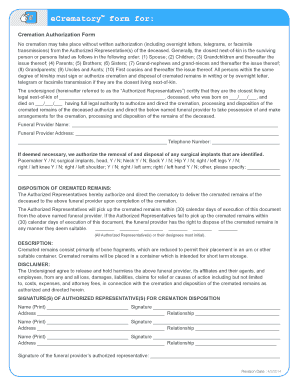

This document outlines the terms and conditions under which a borrower will borrow money from a lender, establishing a binding agreement between friends.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Money Loan Between Friends Contract Template

A Money Loan Between Friends Contract Template is a legal document that outlines the terms and conditions of a loan made between friends, ensuring clarity and protection for both parties.

pdfFiller scores top ratings on review platforms

It has been great! Great Product!

It is so easy to use, and your forms can be saved

ok

SO FAR SO GOOD

MAKES MY BUSINESS SMOOTHER!

Easy to use.

Who needs Money Loan Between Friends Contract Template?

Explore how professionals across industries use pdfFiller.

Money Loan Between Friends Contract Template Guide

When entering into a financial arrangement with a friend, having a Money Loan Between Friends Contract Template form is essential for clarity and protection.

This guide provides you with all the necessary steps and details to create a legally binding agreement that sets clear expectations and responsibilities.

Follow the outlined sections to learn how to fill out the form effectively.

What is a money loan agreement?

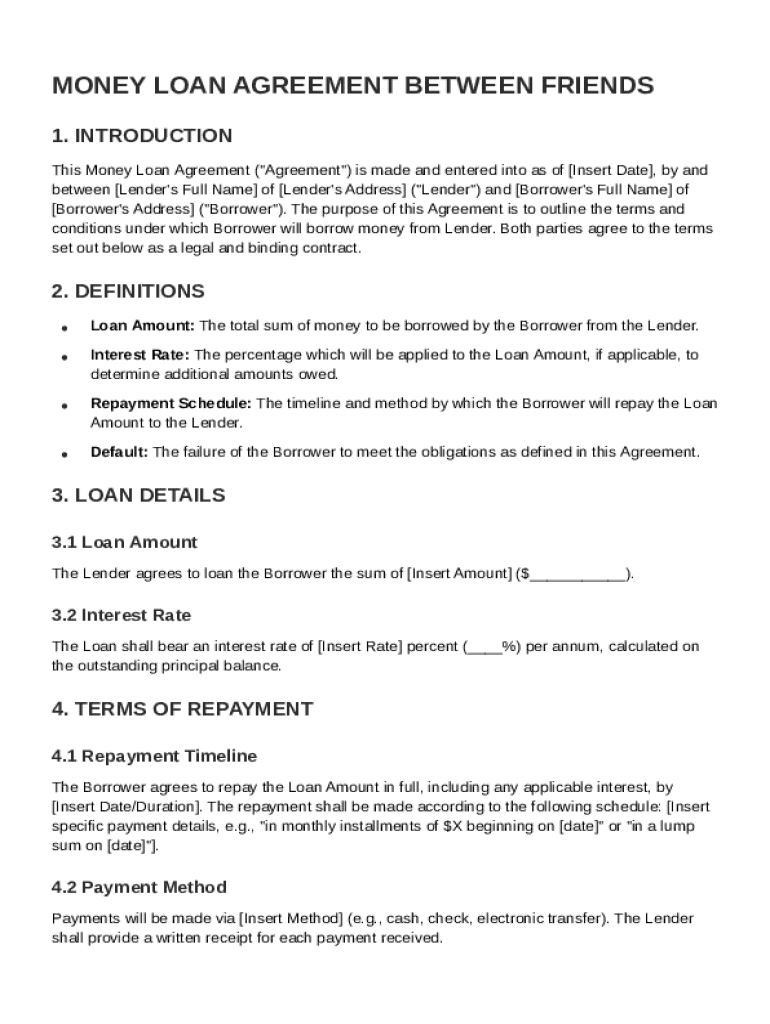

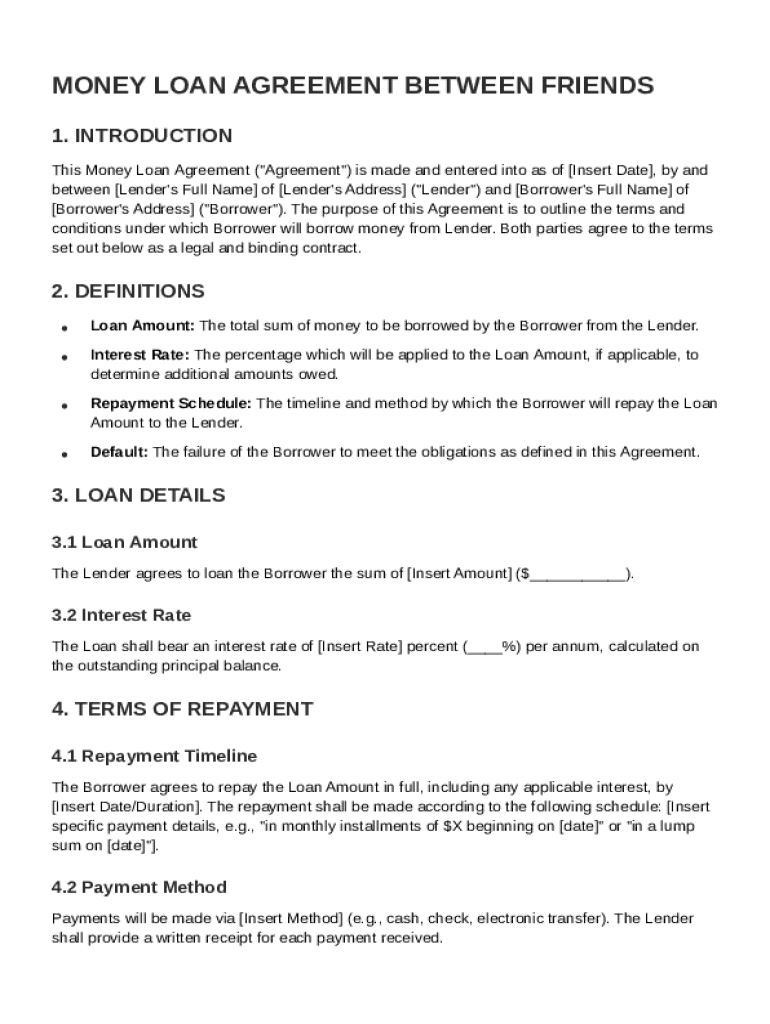

A money loan agreement is a formal document that outlines the terms and conditions of a loan between two parties, typically a borrower and a lender.

Having a written agreement is crucial, even among friends, as it helps to prevent misunderstandings and establishes legal enforceability.

Why is a contractual agreement important?

Contracts serve as a safeguard, providing a clear reference point for both parties. Without this document, disagreements can easily arise regarding the loan terms, leading to potential conflicts.

What makes contracts legally binding?

For a contract to be legally binding, it must include essential elements such as offer, acceptance, and consideration, which essentially means providing something of value in exchange for the loan.

What are the key components of the agreement?

-

Clearly specify the total amount being loaned to avoid any future disputes.

-

Determine an interest rate that both parties agree on, noting any state regulations on maximum allowable rates.

-

Establish a timeline for repayment to keep both parties accountable and clear about expectations.

-

Outline what constitutes a default on the loan and the repercussions, thereby protecting both lender and borrower.

How do you fill out the template?

-

Include full names and addresses to clearly identify each party involved.

-

Decide on an exact figure and specify it in the document to maintain clarity.

-

Ensure both parties understand the agreed interest and include it explicitly.

-

Document clear terms for when payments are due and the total amount to be paid.

-

Specify accepted payment methods and the consequences of failing to make payments on time.

What additional considerations are there?

-

Understand potential tax responsibilities both the lender and borrower may face, as funds might be taxable.

-

Research local regulations regarding money lending to ensure the agreement complies with legal standards.

-

Include a clause on how agreements can be amended should circumstances change.

How can pdfFiller assist with your agreement?

-

With pdfFiller, you can easily edit your PDF Loan Agreement to reflect any changes or updates.

-

Securely sign and manage your document with eSignature features integrated into the platform.

-

Work collaboratively with your friend to negotiate and finalize the terms in real-time.

-

Access and store your documents safely and conveniently from any device.

How do you resolve issues in loan agreements?

-

If disputes arise, communicate openly to address issues directly and amicably.

-

Consulting with a legal expert can provide insight on how to resolve complex issues effectively.

-

Finding a middle ground can often resolve conflicts before they escalate.

What steps are involved in finalizing and executing the agreement?

-

Once terms are agreed upon, review the document carefully before signing.

-

Keep copies of the agreement for both parties' records to avoid confusion in the future.

-

Consider having a witness sign the contract, which can provide additional legal validation if needed.

How to fill out the Money Loan Between Friends Contract Template

-

1.Download the Money Loan Between Friends Contract Template from pdfFiller.

-

2.Open the document and review the default information provided.

-

3.Begin by entering the full names and contact information of both the lender and the borrower at the designated fields.

-

4.Clearly state the loan amount in the specified section, ensuring it's written in both numerical and written form for clarity.

-

5.Fill in the interest rate if applicable, or indicate if the loan is interest-free.

-

6.Define the repayment schedule, specifying how often payments will be made and in what amount.

-

7.Include a start date and end date for the repayment of the loan in the appropriate spaces.

-

8.Insert any specific terms and conditions related to default or late payments as needed.

-

9.Review all entered information for accuracy, then save the completed contract.

-

10.Finally, have both parties sign and date the contract to validate the agreement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.