Money Loan Contract Template free printable template

Show details

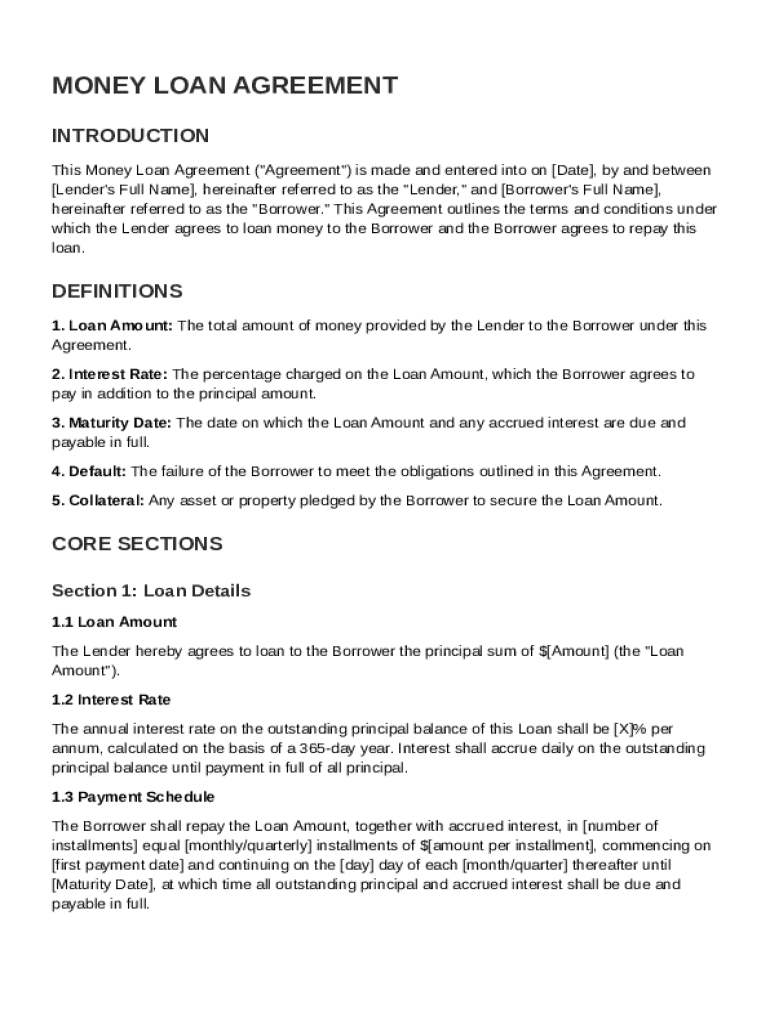

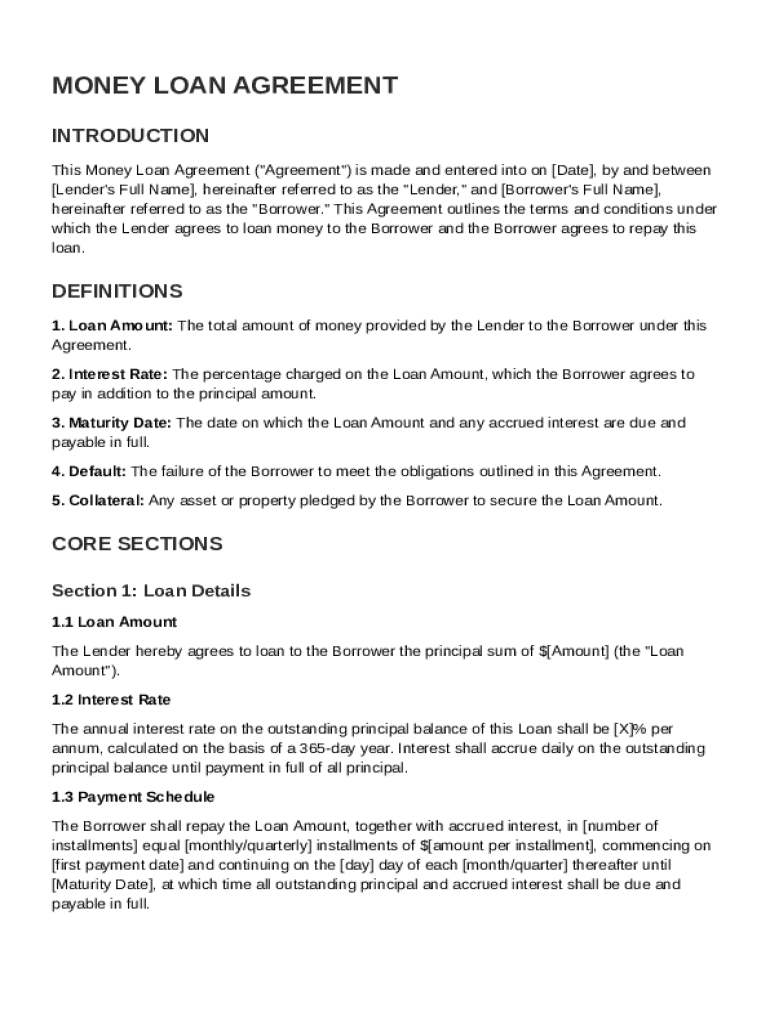

This document outlines the terms and conditions under which a lender agrees to loan money to a borrower, including definitions of key terms, loan details, repayment terms, default provisions, and

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Money Loan Contract Template

A Money Loan Contract Template is a legal document outlining the terms and conditions under which a loan is extended from one party to another.

pdfFiller scores top ratings on review platforms

Worked well. Looks like a good program. I was only using it for one foerm, and do not feel I need the program. You charged me for a full year $72.00, when I felt I WASA SUBSCRIBING FOR ONE MONEH. PLEASE REFUND TTHE DIFFERENCE.

Nice, but very expensive month to month!

seems to do exactly what it says i'm not sure about signatures other wise excellent

I felt very mislead, I entered a lot of info onto a form and was only told when I tried to print there was a charge. There was a monthly charge shown but when I selected the monthly option the cost suddenly shot up

Wonderful--Works across platforms, all around outstanding product!! Dr. T.

easy to use great access. unless the internet is down.

Who needs Money Loan Contract Template?

Explore how professionals across industries use pdfFiller.

Money loan contract template guide

TL;DR: How to fill out a money loan contract template

To fill out a Money Loan Contract Template, gather necessary information such as the loan amount, interest rate, and repayment terms. Make sure to include particulars about collateral if applicable. Finally, ensure both lender and borrower sign the document for legal validity.

What is the purpose of a money loan agreement?

A Money Loan Agreement serves as a formal document that outlines the terms of a loan between the lender and borrower. It provides clarity on the expectations for both parties, reducing risks associated with borrowing and lending money.

This agreement is essential as it protects both parties by minimizing misunderstandings regarding repayment expectations and conditions.

-

Clarifies loan terms: The agreement clearly states the loan amount, interest rate, and repayment methods.

-

Offers legal protection: In case of disputes, a signed contract provides a legal recourse for the lender.

What key definitions should you know?

-

The total sum of money being borrowed. It is significant as it defines the financial obligation of the borrower.

-

The percentage of the loan amount charged as interest, typically expressed as an annual percentage rate (APR). It impacts repayments because higher rates lead to higher costs.

-

The date on which the loan must be fully repaid. It marks the end of the loan term and is crucial for both lender and borrower.

-

This occurs when the borrower fails to fulfill their repayment obligations. Understanding default conditions prepares both parties for possible consequences.

-

Assets pledged as security for the loan. Failure to repay the loan may result in the lender seizing these assets.

What essential loan details should be included?

-

Clearly specify the amount being lent. Accuracy here is vital to avoid misunderstandings.

-

Include stipulations for setting and potentially adjusting this rate over time, if applicable.

-

Outline options for repayments, which could be monthly, quarterly, or annually. Define the exact frequency to avoid confusion.

-

Provide clear examples, contrasting monthly vs. quarterly installments, to clarify expectations.

How are repayment terms typically structured?

-

Detail acceptable repayment methods, such as bank transfers or checks, to ensure convenience for both parties.

-

Stress the importance of on-time payments to prevent defaults. This section can outline potential penalties.

-

Explain what late payments mean for the borrower, including potential fees or increased interest rates.

What common pitfalls should you avoid?

-

Always keep signed and dated copies of the agreement for reference. This is crucial for legal protection.

-

Understand and be aware of the obligations regarding collateral since this can impact the borrower's assets.

-

Failing to comply with regulations in your state can lead to penalties. Always be informed of local laws.

How can you utilize interactive tools for managing your loan agreement?

-

Platforms like pdfFiller offer tools to edit loan agreements easily, providing versatility in adjustments.

-

Use electronic signatures for a faster and more efficient way to finalize agreements.

-

Manage your documents from the cloud, ensuring you can access and modify agreements anywhere.

How to customize your loan agreement?

-

Explore templates on pdfFiller to suit various loan scenarios, providing a starting point for customization.

-

Learn how to alter templates to meet specific lending situations. Tailoring terms can be critical for both parties.

-

Consider incorporating additional clauses for special terms and conditions to protect both the lender and borrower.

How to fill out the Money Loan Contract Template

-

1.Download the Money Loan Contract Template from pdfFiller.

-

2.Open the template in pdfFiller's editor.

-

3.Begin by filling in the lender's information, including name and address.

-

4.Next, enter the borrower's details in the designated section.

-

5.Specify the loan amount clearly within the document.

-

6.Outline the interest rate and payment terms, including due dates.

-

7.Add any collateral requirements if applicable.

-

8.Include a section for default terms and penalties.

-

9.Review all entered details for accuracy and completeness.

-

10.Once all fields are filled, save your changes.

-

11.Finally, export or print the completed contract to have both parties sign.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.