Monthly Car Payment Contract Template free printable template

Show details

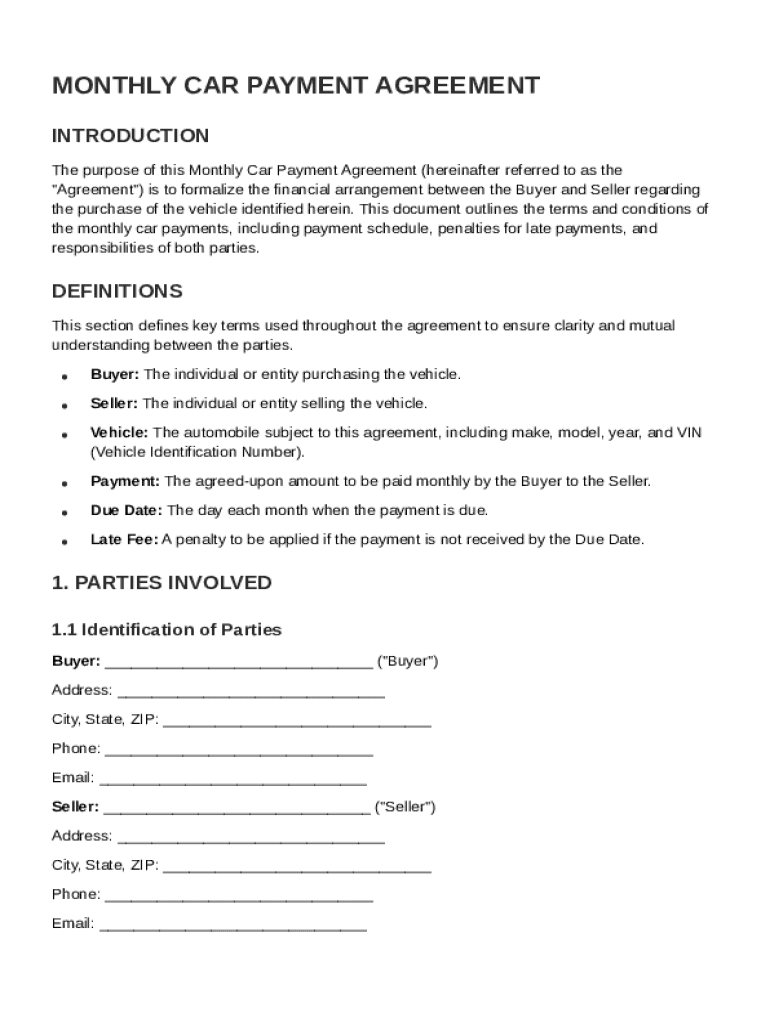

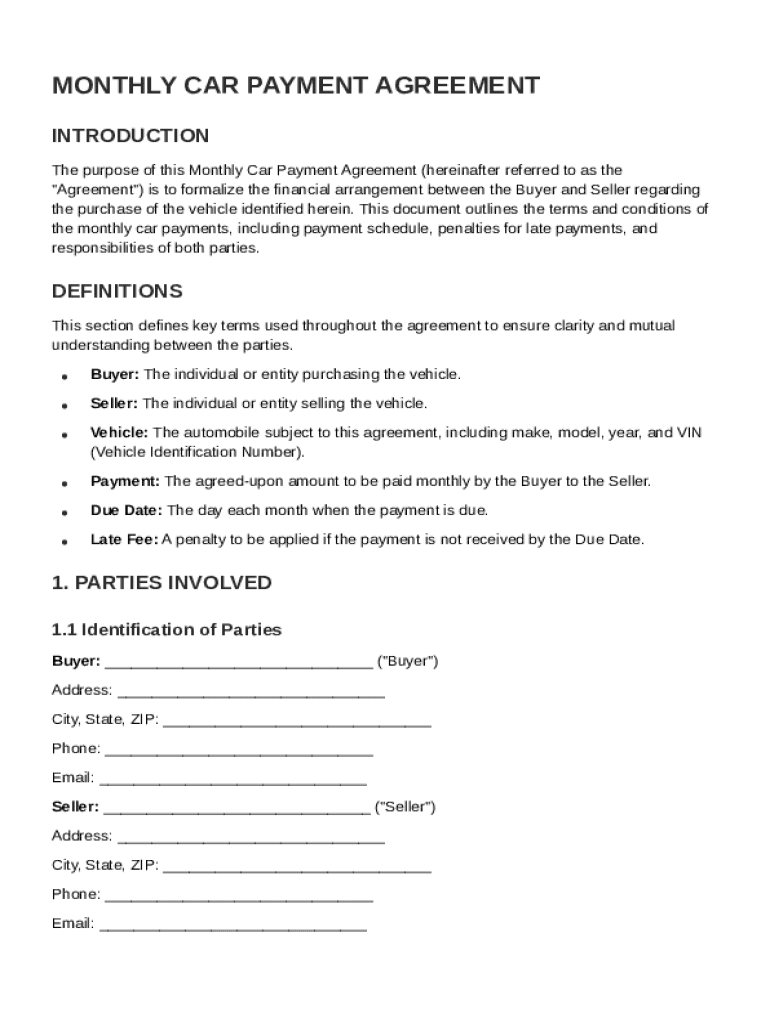

The document outlines the terms and conditions of a financial arrangement between a buyer and seller for the purchase of a vehicle, covering payment terms, responsibilities, and penalties for late

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

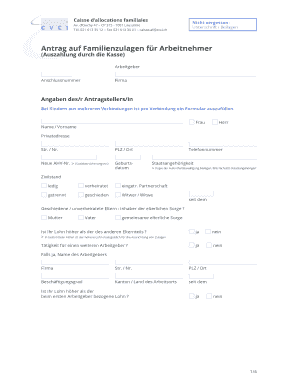

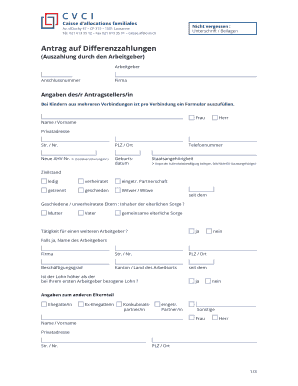

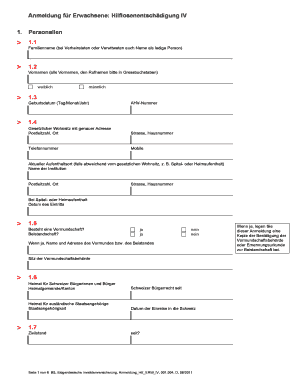

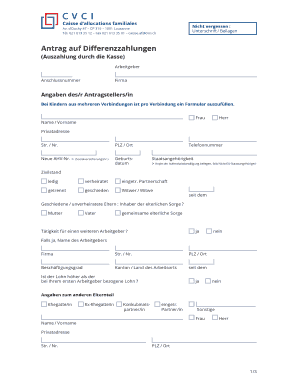

What is Monthly Car Payment Contract Template

A Monthly Car Payment Contract Template is a standardized document that outlines the payment terms for financing a vehicle purchase over a specified time period.

pdfFiller scores top ratings on review platforms

Great software. Only thing is that i wish the email could be modified to where i can get paperwork sent directly to it. The automated one we're given is way to complicated to remember so copy and paste it is. Other than that this is amazing software.

Very nice to have options for correction of PDFs.

PDFiller has made my business run smoother. Thank you for the easy to fill experience! My favorite feature has to be the Chrome add on extension.

I do like the ease of use as this is the first time I have used a PDF application. I have just started using Adobe and unfortunately I think I like that better. Not positive yet.

Easy to use. Works well for what we need at this time

The PDFfiller has greatly improved on my efficiency's.

Who needs Monthly Car Payment Contract Template?

Explore how professionals across industries use pdfFiller.

Monthly Car Payment Contract Template on pdfFiller Landing Page

How do you understand monthly car payment agreements?

A Monthly Car Payment Agreement is a formal document outlining the terms of the financial arrangement between a buyer and a seller regarding the payment for a vehicle. It is crucial for both parties to have this agreement in place to clarify expectations and protect their interests. This document typically covers the payment schedule, responsibilities, and other vital details about the transaction.

-

Definition of a Monthly Car Payment Agreement: A legally binding document detailing the terms under which the buyer agrees to pay for the vehicle over time.

-

Importance of having a formal agreement: It creates a clear understanding and can prevent disputes between the buyer and seller.

-

Overview of what the document will cover: Payment amounts, schedules, responsibilities of both parties, and vehicle information.

What are key terms defined in the agreement?

Understanding the key terms in a Monthly Car Payment Contract is essential for both parties. These terms define the roles, responsibilities, and expectations throughout the payment period.

-

The individual or entity purchasing the vehicle is responsible for adhering to the payment terms outlined in the contract.

-

The individual or entity selling the vehicle, who must ensure that all representations of the vehicle are accurate and legal.

-

Details such as make, model, and VIN (Vehicle Identification Number) are crucial for accurately identifying and verifying the vehicle in question.

-

The payment details, including monthly payment amount, the due date for payments, and any late fees applicable in case of a delinquency.

Who are the parties involved in the agreement?

Identifying the parties involved is a critical aspect of the Monthly Car Payment Agreement. Accurate identification helps ensure that both the buyer and seller are legally bound to the terms of the contract.

-

Both parties should be clearly identified using their legal names and any applicable business names to avoid confusion or misrepresentation.

-

Include accurate contact details for both parties, such as phone numbers and email addresses, to facilitate communication.

-

Incorrect identification could lead to unenforceable contracts or disputes, so precision is essential.

What should be included in the comprehensive vehicle information section?

An accurate vehicle information section is essential for the Monthly Car Payment Agreement. This area should provide all relevant details that clearly identify the vehicle being sold.

-

Make, model, year, color, and VIN must be included to ensure the vehicle is accurately identified.

-

A detailed description of the vehicle's current condition should be documented to avoid misunderstandings.

-

Consider including details such as any modifications or aftermarket features that may affect the vehicle's value.

How do you detail the payment terms?

Clearly defined payment terms are a cornerstone of any Monthly Car Payment Agreement. This section specifies how payments will be made and any conditions regarding payment structure.

-

Detail the total purchase price of the vehicle and the amount being financed after accounting for any down payment.

-

Include the amount of the down payment and its importance in reducing the financed amount.

-

Calculate the monthly payment based on the financed amount, interest rates, and duration.

-

Outline the payment schedule, including when the first payment is due and subsequent payment dates.

How should late payments and fees be handled?

It's important to specify how late payments will be handled in the Monthly Car Payment Agreement. This helps set clear expectations and consequences for both parties.

-

Clearly state what constitutes a late payment, such as payments made after the due date.

-

Explain how late fees will be calculated and applied to ensure transparency.

-

Discuss potential options available for both parties in the event of late payments, including grace periods or payment plans.

How can pdfFiller enhance monthly car payment agreements?

Utilizing pdfFiller for Monthly Car Payment Agreements provides numerous advantages. This platform offers tools for editing, eSigning, and collaboration that streamline the process.

-

Customize the agreement using pdfFiller's editing tools to add specific details or alterations as needed.

-

Both parties can easily sign the document online, ensuring a smooth and efficient agreement process.

-

With features designed for team collaboration, negotiation and agreement finalization can occur seamlessly.

How do you ensure compliance and legal validity?

Ensuring compliance with local laws and regulations is paramount when implementing a Monthly Car Payment Agreement. Familiarity with the laws applicable in your region protects both buyer and seller.

-

Identify and adhere to key local laws that affect car payment agreements in your area, ensuring that the agreement is legally binding.

-

Maintain compliance with industry standards relevant to car sales to protect both parties' interests.

-

Document the agreement properly and maintain records that provide proof of the terms set forth in the contract.

What are the final steps in using a Monthly Car Payment Agreement Template?

Once the template has been filled out, the final steps ensure the agreement is accurate and secure. This process is critical for both parties.

-

Carefully review the completed agreement for clarity and to correct any errors before signing.

-

Both parties should sign the agreement to formalize the contract and adhere to the outlined terms.

-

Tips for securely storing the signed agreement using pdfFiller to ensure both parties have access to the document.

How to fill out the Monthly Car Payment Contract Template

-

1.Open the Monthly Car Payment Contract Template on pdfFiller.

-

2.Start by entering the borrower's name and contact details at the top of the document.

-

3.Next, fill in the lender's information, including the name and contact details.

-

4.Specify the total loan amount requested for the car purchase.

-

5.Input the interest rate applicable to the loan, ensuring accuracy for calculations.

-

6.Indicate the length of the loan term in months or years as per agreement.

-

7.Calculate the monthly payment amount based on loan amount, interest rate, and term, and write it in the designated section.

-

8.Include any additional fees or charges related to the loan, such as processing or service fees.

-

9.Review the entire document for accuracy, particularly the financial calculations and personal details.

-

10.Once completed, save the document and share it with all parties involved for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.