Owner Financ Mortgage Seller Financ Contract free printable template

Show details

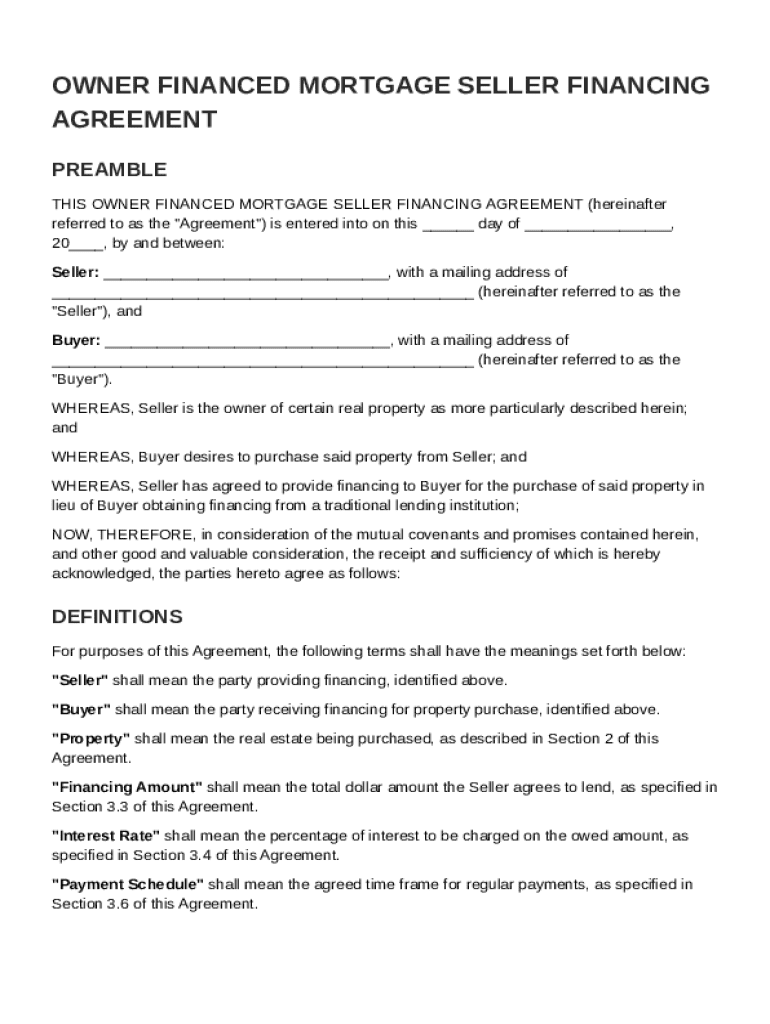

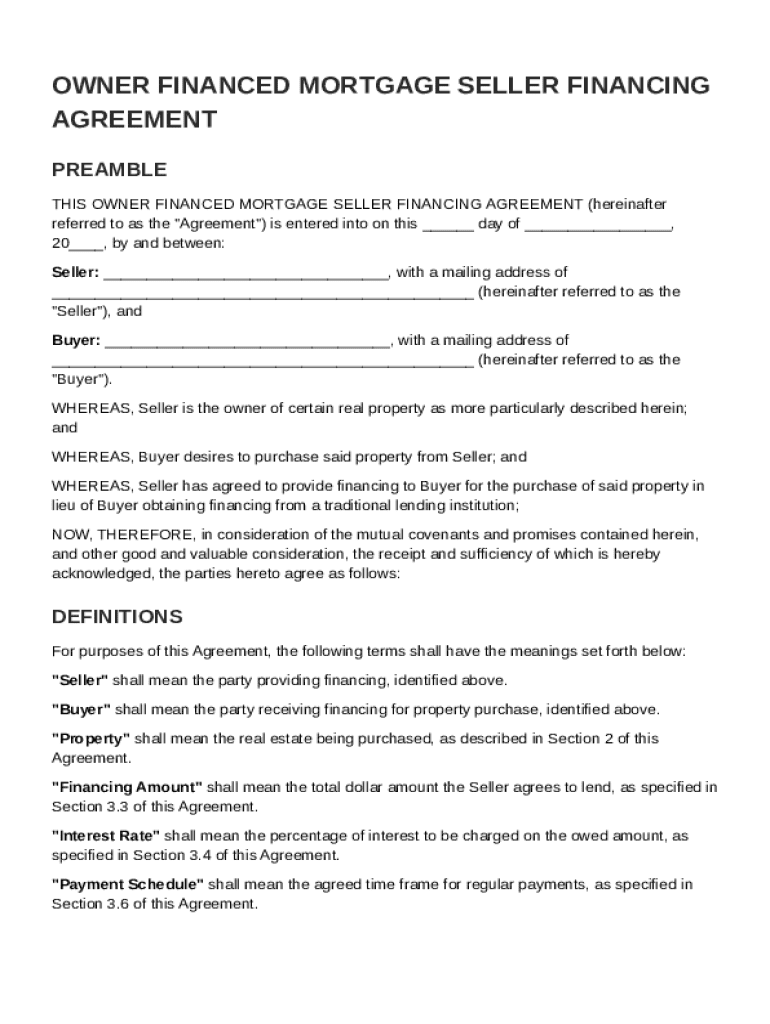

This document is a binding agreement between a seller and a buyer for the sale of real property, where the seller provides financing directly to the buyer.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Owner Financ Mortgage Seller Financ Contract

An Owner Finance Mortgage Seller Finance Contract is a legal document that facilitates the sale of a property where the seller provides financing to the buyer.

pdfFiller scores top ratings on review platforms

It works great.

Great product

great

Very satisfied, excellent customer service and a very helpful pdf editor for university students like myself.

GREAT PROGRAM, SAVES TIME

very easy to use

Who needs Owner Financ Mortgage Seller Financ Contract?

Explore how professionals across industries use pdfFiller.

Owner Financing Mortgage Seller Financing Contract Guide

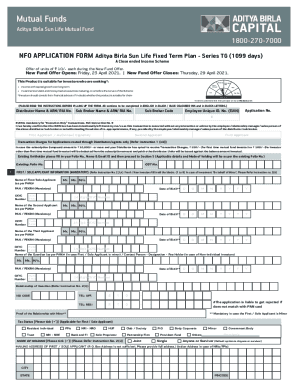

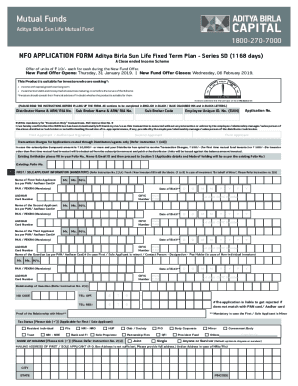

How to fill out an owner financing mortgage seller financing contract form

Filling out an owner financing mortgage seller financing contract form involves clearly stating the agreement terms between the buyer and seller. It's essential to complete each section accurately to ensure the legality and clarity of the contract. Utilize interactive tools for easy edits and e-signatures, and confirm that all financial terms are well-defined.

Understanding owner financing agreements

Owner financing agreements are crucial for real estate transactions, where the seller acts as the lender for the buyer's property purchase. This arrangement allows buyers who might not qualify for traditional loans to secure funding while enabling sellers to close deals more quickly.

-

Owner financing agreements enable property sales without involving banks, ensuring that transactions are quicker and often more flexible.

-

Buyers can avoid lengthy bank processes and negotiate terms directly with the seller, which may include lower down payments.

-

Sellers can attract a larger pool of buyers and potentially command higher sale prices given the flexibility of financing offered.

-

Owner financing is often used in slower markets, for properties that do not qualify for traditional financing, or where buyers have unique financial situations.

Key components of the seller financing agreement

A comprehensive seller financing agreement must include clear details to protect both the buyer and seller. By identifying specific elements, both parties can establish mutual understanding and commitment.

-

The preamble sets the stage by summarizing the intent and terms of the financing agreement precisely.

-

Clearly identify the seller and buyer to avoid any confusion regarding the responsibilities and rights of each party.

-

Detail the address and characteristics of the property being financed, ensuring clarity on what is included in the sale.

-

Specify the total loan amount, breaking down any down payments, monthly payments, and total cost of the loan over time.

-

Clearly outline the interest rate applicable to the loan, including whether it is fixed or variable along with any fees.

-

Define the timeline and frequency of payments, which is crucial for both parties to manage expectations and planning.

Filling out the owner financing agreement

Completing an owner financing agreement accurately is essential to ensure that the intentions of both parties are captured thoroughly. Using a tool like pdfFiller can make this process more seamless.

-

Follow detailed guides to fill out each section correctly, ensuring that all required information is covered.

-

Double-check entered information against related documentation to prevent errors that could invalidate the contract.

-

Make the most of interactive features to edit documents easily and obtain signatures without hassle.

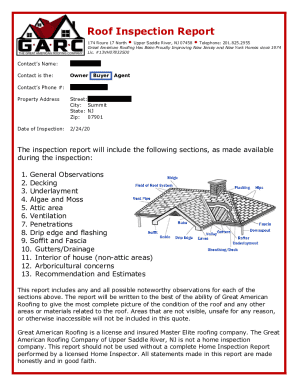

Managing the financing process

After the owner financing agreement is executed, managing the financing process is vital for a successful transaction. Clear communication and proper tracking of payments foster a positive relationship between the seller and buyer.

-

Establish a loan servicing plan that details how payments are collected and processed to keep both parties informed.

-

Leveraging payment management tools can simplify tracking and maintaining records for future reference.

-

Utilize templates and legal resources to ensure compliance and foster ongoing management efficiency.

Legal considerations and disclaimers

Legal adherence is a critical aspect of owner financing agreements. Understanding the local laws governing these transactions can protect parties from potential disputes.

-

Check local regulations in [region] to ensure the agreement meets all necessary legal requirements for validity.

-

Take time to understand compliance notes to avoid pitfalls that could arise from misunderstandings of the agreement.

-

Be aware of common legal pitfalls that could invalidate the agreement or lead to disputes later on.

Related templates and tools

Finding the right forms and tools is essential for effectively managing real estate transactions. Leveraging pdfFiller can enhance the document handling experience.

-

Explore related templates available on the pdfFiller platform that can help simplify document creation.

-

Utilize interactive tools to streamline document management, making the process easier for both buyers and sellers.

-

Access links to further resources for in-depth information on owner financing agreements and associated legalities.

How to fill out the Owner Financ Mortgage Seller Financ Contract

-

1.Open the Owner Finance Mortgage Seller Finance Contract template in pdfFiller.

-

2.Begin by filling in the seller's full name and contact information at the top of the document.

-

3.Next, enter the buyer's full name and contact information in the designated section.

-

4.Specify the property details, including the address and legal description.

-

5.In the financing section, input the total sale price, down payment amount, loan term, and interest rate.

-

6.Fill in the payment schedule, including payment frequency and due dates.

-

7.Include any additional terms or conditions specific to the agreement in the designated area.

-

8.Review all entered information for accuracy before saving the document.

-

9.Once completed, use the e-signature feature if signatures are required.

-

10.Lastly, download or share the completed contract as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.