Owner Financed Auto Contract Template free printable template

Show details

This document outlines the terms and conditions of an ownerfinanced vehicle sale agreement between the Seller and Buyer, detailing responsibilities, financing terms, and rights associated with the

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Owner Financed Auto Contract Template

An Owner Financed Auto Contract Template is a legal document used to outline the terms and conditions under which a buyer can purchase a vehicle through seller financing.

pdfFiller scores top ratings on review platforms

great

It helped, but I had limited internet so it kept crashing.

it is very easy to use

works perfect

has been very easy to navigate

learning more about how it can enhance my work and make it better in everyway

Who needs Owner Financed Auto Contract Template?

Explore how professionals across industries use pdfFiller.

Owner Financed Auto Contract Template Guide

This guide provides a comprehensive overview of the Owner Financed Auto Contract Template form, aimed at helping both buyers and sellers understand their rights and responsibilities. A well-structured contract ensures a smooth transaction and protects the interests of all parties involved.

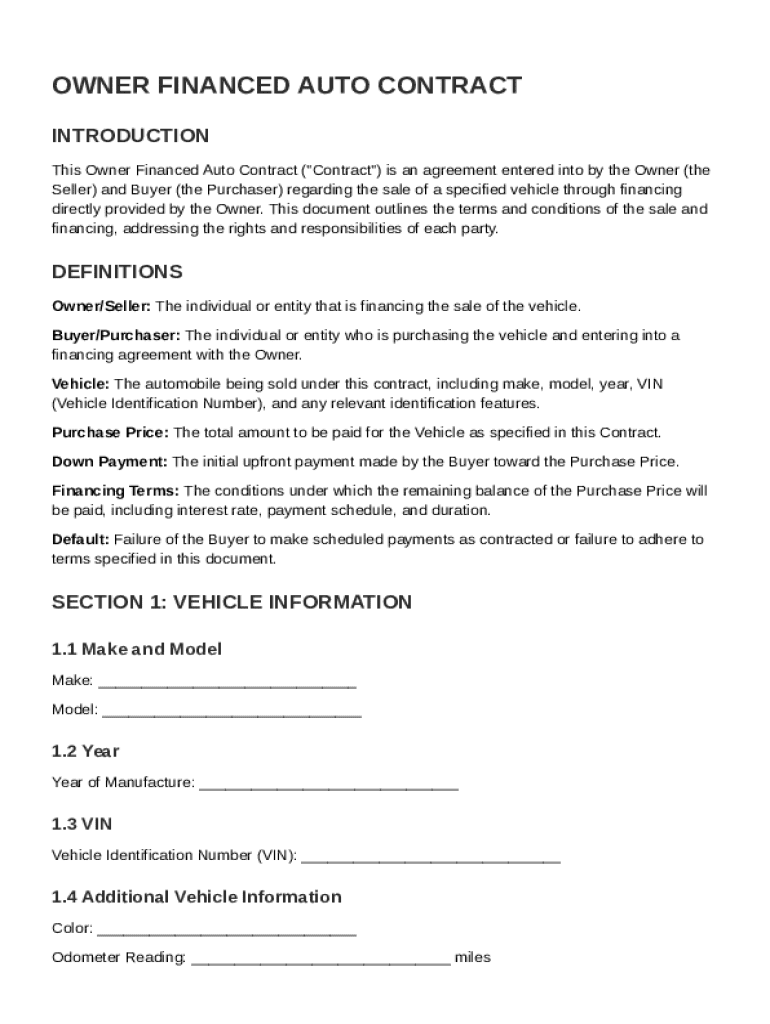

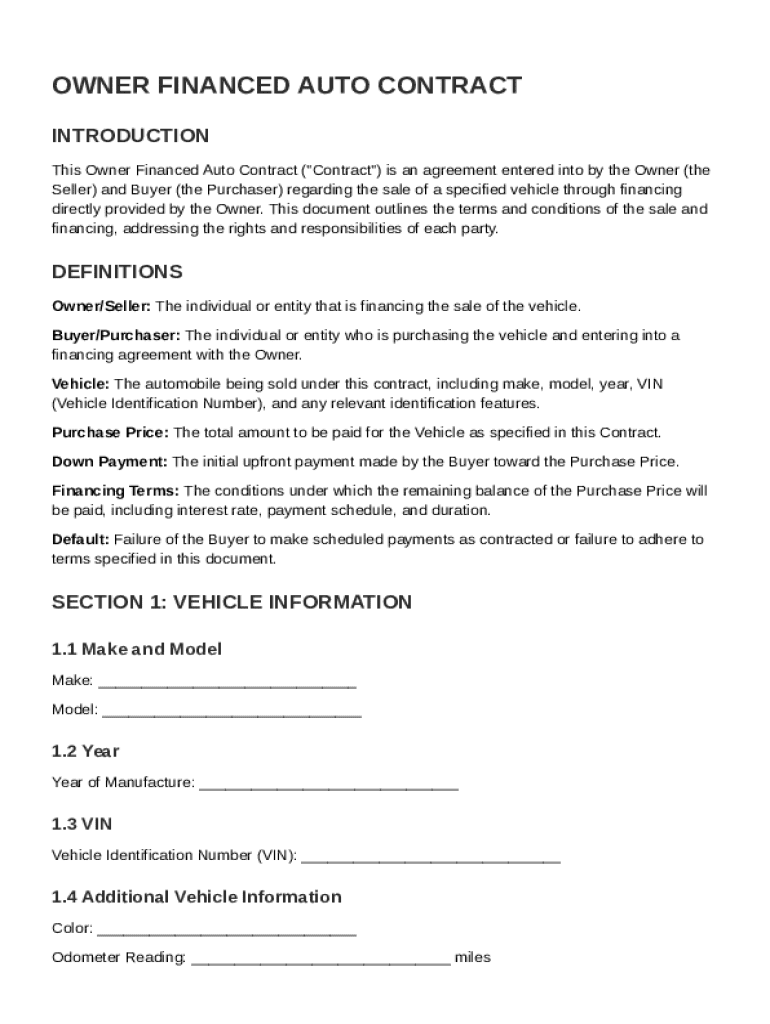

What is an owner financed auto contract?

An Owner Financed Auto Contract is a legally binding agreement that allows the seller to finance the vehicle purchase, bypassing traditional lending institutions. This type of contract is crucial as it outlines the terms of sale, payment obligations, and legal protections for both the owner (seller) and the buyer (purchaser).

-

Clarifies the roles of the seller and buyer in the transaction, ensuring both parties understand their obligations.

-

Protects buyers from predatory lending practices and facilitates equitable financing terms.

-

Provides legal recourse in case of disputes regarding payment or ownership.

What are the core components of the contract?

The core components of an owner financed auto contract include definitions of key terms, responsibilities of the owner and buyer, and the legal implications of the contract terms. Understanding these elements can help prevent misunderstandings and legal issues.

-

Key definitions, including terms like 'down payment,' 'interest rate,' and 'payment schedule,' are essential for clarity.

-

Sections outlining the duties of both the owner and buyer ensure that each party knows what is expected.

-

Understanding legal implications can help avoid future disputes and maintain compliance with applicable laws.

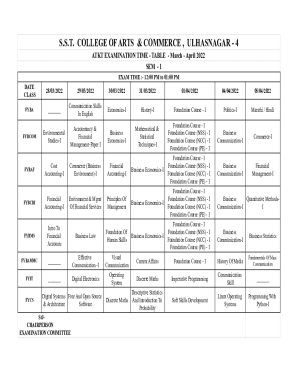

What details should be included in the vehicle information section?

Accurate vehicle information is crucial to the contract because it identifies the property being financed. The Vehicle Information Section should include specifics such as the make, model, year, and Vehicle Identification Number (VIN) to avoid any ambiguity.

-

Make and Model: Identify the vehicle to confirm its reliability and resale value.

-

Year and VIN: These details ensure legal ownership and facilitate future transactions.

-

Using pdfFiller to submit this information simplifies the contract-generation process and enhances accuracy.

How to outline the detailed purchase price?

Outlining the detailed purchase price is essential in any owner-financed transaction. Clarity regarding the total purchase price, down payment, and remaining balance will help set clear expectations and prevent disputes.

-

Total Purchase Price: Clearly define the overall cost of the vehicle, including any applicable taxes or fees.

-

Down Payment: Detail the initial payment required and its immediate impact on the financing agreement.

-

Remaining Balance: Specify the total remaining amount due and outline payment obligations, enabling budgeting and planning.

What are the financing terms explained?

Financing terms are vital as they dictate how the agreement unfolds financially. These terms encompass interest rates, payment schedules, and crucial negotiation tips.

-

Interest Rates: Understand what constitutes a fair rate based on market conditions to avoid overpaying.

-

Payment Schedule: Determine the frequency of payments—monthly, bi-weekly, etc.—to align with your financial capabilities.

-

Negotiation Tips: Be prepared to discuss and negotiate financing terms that are beneficial for both parties.

What is the importance of signatures and legal validation?

Signatures are crucial for enforcing any contract. An owner financed auto contract requires valid signatures from both parties to establish agreement and compliance with the terms set forth.

-

E-Signing: Utilize pdfFiller for electronic signatures, making the process more convenient and legally compliant.

-

Legal Acceptance: Verify that electronic signatures are recognized in your region to ensure full legal impact.

-

Safety and Security: Implement secure methods for signing to protect personal and financial information.

How to manage and edit your contract?

Managing a contract’s details is key to keeping it relevant. pdfFiller offers features that allow users to easily edit and track changes, ensuring all parties are informed.

-

Editing Capability: Easily make updates to the owner financed auto contract if circumstances change.

-

Version Control: Keep track of different versions to prevent confusion about which is the most current.

-

Collaboration: Tools for joint editing allow all parties to contribute, building trust and clarity.

What are compliance and legal considerations?

Staying compliant with local laws around owner financing is critical in avoiding legal repercussions. It is essential to review relevant state-specific laws to understand the implications of the contract.

-

State Laws: Familiarize yourself with regulations surrounding owner financing to ensure compliance.

-

Common Pitfalls: Identify potential issues early, such as unclear terms or payments to prevent disputes.

-

Legal Resources: Seek assistance if needed through local legal services or real estate professionals.

How to troubleshoot common issues?

Problems can arise in any contract, and knowing how to address them can prevent larger disputes. Knowing how to identify and resolve these issues is especially beneficial in owner financed transactions.

-

Dispute Resolution: Understand mechanisms to facilitate negotiation between buyer and seller to resolve issues amicably.

-

Default Protocol: Have a clear plan for handling defaults, including timelines and potential penalties.

-

Using pdfFiller: Utilize the platform's support for documentation and dispute resolution assistance.

In conclusion, the Owner Financed Auto Contract Template form provides a structured way for buyers and sellers to engage in vehicle transactions with clear expectations regarding terms and legal obligations. Utilizing pdfFiller not only simplifies the process but also enhances safety and compliance, making it the ideal solution for effective document management.

How to fill out the Owner Financed Auto Contract Template

-

1.Begin by downloading the Owner Financed Auto Contract Template from pdfFiller.

-

2.Open the template in the pdfFiller editor to start filling in the required fields.

-

3.Enter the date of the agreement at the top of the document.

-

4.Fill in the buyer's full name and contact information in the designated sections.

-

5.Provide details about the vehicle, including make, model, year, VIN, and mileage.

-

6.Specify the total purchase price of the vehicle in the appropriate field.

-

7.Outline the financing terms, including the down payment amount and interest rate.

-

8.Detail the repayment schedule, indicating the number of payments and due dates.

-

9.Include any additional terms or conditions that both parties agree upon.

-

10.Review the completed contract for accuracy and completeness before saving.

-

11.Share the contract with the buyer for their review and signatures.

-

12.Once signed by both parties, ensure each retains a copy of the fully executed contract.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.