Owner Financed Business Contract Template free printable template

Show details

This document outlines the terms and conditions under which the Seller finances the purchase of a business by the Buyer, protecting both parties\' rights and clarifying their responsibilities.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Owner Financed Business Contract Template

An Owner Financed Business Contract Template is a legal document outlining the terms under which a seller finances the purchase of a business by the buyer.

pdfFiller scores top ratings on review platforms

I need some more education on how to complete my forms.

learned about it at work and now use it myself for documentation for progress notes. paid version is much better than the free version

Except that I am still getting used to this, I did not see any issue whatsoever in my limited time in using this app.

PDF Filler should have a facility to copy form details from one to another without the markings

ONCE I FIGURED OUT HOW TO SAFE AND PRINT, I WAS VERY SATISFIED.

it was simple and super easy..... Just wish i didn't have to do the legal work myself. Sure saved money by not having to hire an attorney.

Who needs Owner Financed Business Contract Template?

Explore how professionals across industries use pdfFiller.

Owner Financed Business Contract Template Guide

This guide provides a comprehensive view of the Owner Financed Business Contract Template form, designed to help both sellers and buyers navigate the intricacies of owner financing agreements.

An owner financing contract is a unique tool in real estate and business transactions, allowing buyers and sellers to bypass traditional financing hurdles. This guide will explain the essential components of creating and managing such agreements.

What are owner financing contracts?

Owner financing contracts essentially allow the seller to finance the sale of their property directly to the buyer. This means the buyer can make payments over time, often with terms more favorable than traditional lenders.

-

An owner financing contract serves as a legal document outlining the sale terms where the seller finances the purchase for the buyer.

-

The main parties are the seller, who owns the property and finances the sale, and the buyer, who is purchasing the property.

-

It is essential for both parties to understand their rights and responsibilities as defined in the contract to avoid future disputes.

What are the details of financing terms?

Understanding the critical terms within the owner financing contract ensures both parties are aligned on financial expectations. These terms lay the groundwork for a smooth transition of ownership.

-

The total monetary amount, agreed upon by both parties, that the buyer agrees to pay for the property.

-

Buyers often make an initial payment up front to demonstrate commitment and reduce the total financed amount.

-

Includes interest rates and specific repayment schedules, detailing how the buyer will pay back the financed amount.

-

The contract should clearly specify what happens if the buyer fails to make payments, including potential foreclosure on the property.

What information is essential from seller and buyer?

Accurate information is crucial in crafting a legal owner financing contract that is compliant and enforceable. Both parties must provide specific details to ensure clarity.

-

Includes the seller's name, address, and business details to identify the property owner clearly.

-

Similar to the seller, buyers must provide name, address, and business details to establish their identity and commitment.

-

Inaccurate or incomplete data can lead to legal issues and complications in enforcing the contract.

How to create a comprehensive business description?

A detailed business description in the owner financing contract provides clarity and establishes clear expectations between the parties.

-

Include the business name, address, and type to provide context about what is being sold.

-

Define what tangible and intangible assets are part of the sale, such as inventory and intellectual property.

-

Describe the business structure, operational status, and any pertinent details to inform the buyer about what they are acquiring.

What are the intricacies of purchase price and payment terms?

Setting the purchase price is often one of the most critical aspects of the contract. Both parties must agree to the terms, ensuring fairness and transparency.

-

Discuss how the total price will be determined and if adjustments may occur during the contract.

-

Provide guidance on what a typical down payment might be and when it should be made.

-

Detail how repayment will occur, including due dates to minimize confusion.

How do you sign and execute the agreement?

Signing the owner financing agreement is the final step that binds the contract. Ensuring all parties understand the signing process can prevent issues later.

-

Both the seller and buyer must sign the agreement for it to be legally binding and enforceable.

-

Discuss the best practices for when and where the signing will take place to ensure all necessary parties are present.

-

Consider digital solutions like pdfFiller for seamless signing, allowing for easy management and security of documents.

How can technology help manage owner financing contracts?

Using technology can simplify the management of owner financing contracts significantly. Effective tools can streamline editing, signing, and tracking changes.

-

Tools like pdfFiller simplify modifying documents and keeping them organized, allowing for quick access.

-

Maintain different versions of the contract, ensuring that all parties are aware of the latest terms and conditions.

-

Enable team collaboration on document oversight, making it easier to manage approvals and changes in real-time.

Why is compliance essential in owner financing contracts?

Legal compliance is crucial in all contracts, especially in owner financing agreements, to avoid unpleasant legal consequences that could affect either party.

-

Ensure the agreement meets local and state laws. This can vary by location and can affect the terms of the contract.

-

Detailing terms legally requires knowledge to avoid loopholes that could be exploited.

-

Failure to comply with laws may lead to contract invalidation and financial losses.

What are the final thoughts on utilizing the template?

In conclusion, utilizing the Owner Financed Business Contract Template form can guide both sellers and buyers through the complexities of finance. A well-structured agreement safeguards both parties' interests.

Encourage proper usage of the template while emphasizing how pdfFiller enables effortless document processing, making the task manageable and secure.

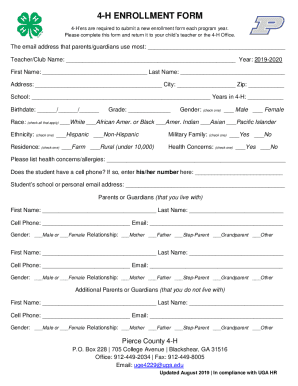

How to fill out the Owner Financed Business Contract Template

-

1.Open the Owner Financed Business Contract Template on pdfFiller.

-

2.Review the document to understand the required information sections.

-

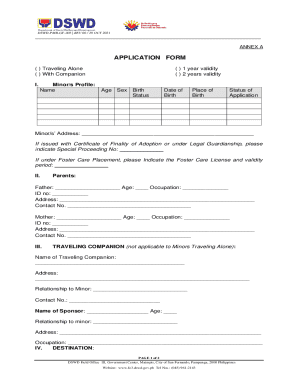

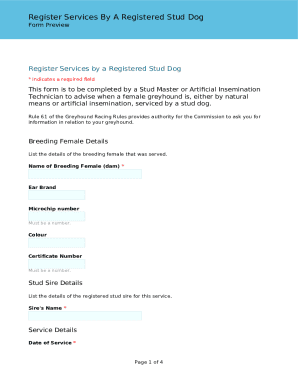

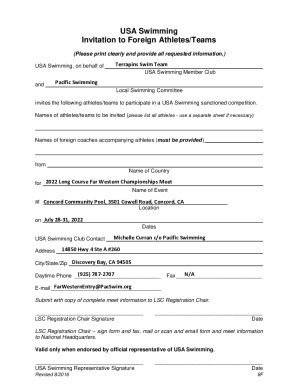

3.Begin by filling in the names and contact details of both the buyer and seller in the designated fields.

-

4.Specify the business details including name, address, and description in the appropriate sections.

-

5.Enter the purchase price agreed upon by both parties.

-

6.Outline the financing terms, including interest rate, payment schedule, and total payment duration.

-

7.Include any additional terms or conditions that relate to the business sale.

-

8.Review all entered information for accuracy and completeness.

-

9.Sign the contract electronically, ensuring both buyer and seller also sign.

-

10.Download or save the completed document for your records and provide copies to all parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.