Owner Financed Land Contract Template free printable template

Show details

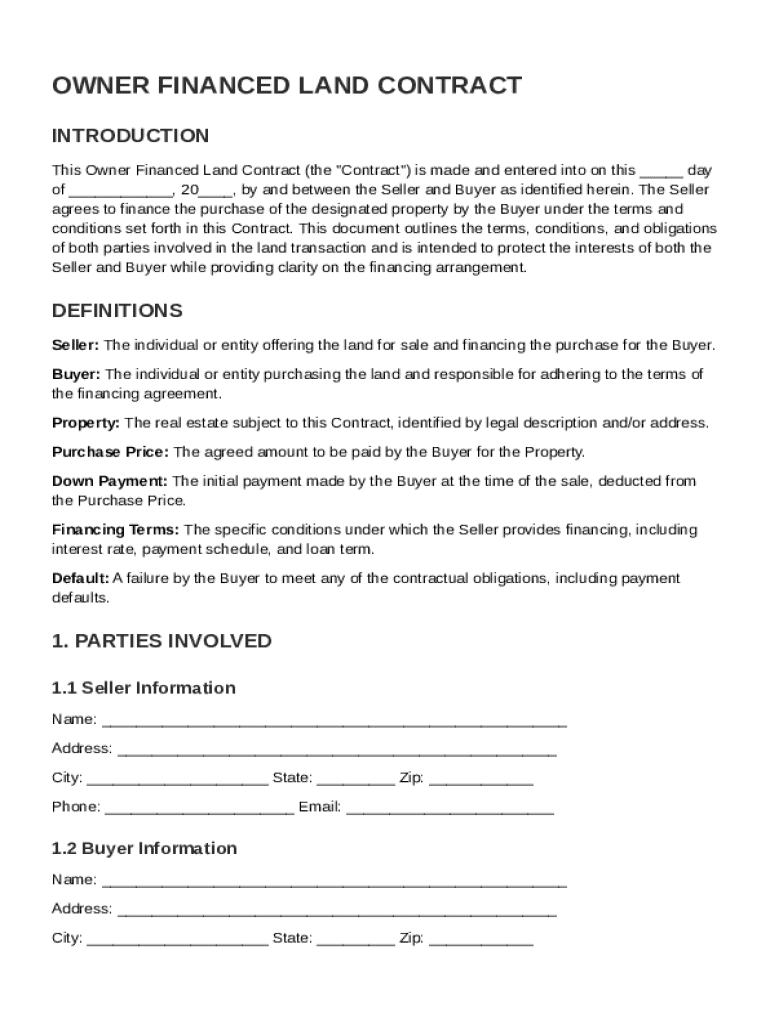

This document outlines the terms, conditions, and obligations of both parties involved in a land transaction where the seller finances the purchase for the buyer, including responsibilities, purchase

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Owner Financed Land Contract Template

An Owner Financed Land Contract Template is a legal document that outlines the terms under which a seller finances the purchase of land to a buyer, allowing the buyer to make payments directly to the seller instead of a bank.

pdfFiller scores top ratings on review platforms

Such an intuitive tool! Wonderful and really a time-saver!

Super easy to find/upload document. Love the multiple choices to utilize the completed document.

pdf filler has allowed me to easily upload and edit pdf documents...as the technology improves it will be a standard use software for most users.

Where has PDFfiller been my whole life?!?! LOVE IT!

outstanding,

wish i could save the document

Has been good but, several forms I've searched for have not been found

Who needs Owner Financed Land Contract Template?

Explore how professionals across industries use pdfFiller.

Owner Financed Land Contract Guide

Owner Financed Land Contract Template forms provide a vital means of facilitating real estate transactions without traditional financing. These agreements allow sellers to extend financing directly to buyers, often easing the purchasing process.

What are owner financing contracts?

Owner financing contracts are agreements where the seller of a property provides loan financing directly to the buyer. These are particularly valuable for buyers who may not qualify for traditional loans from financial institutions. Unlike conventional financing, the owner financing process often requires less documentation and can close faster.

-

Owner financing allows buyers to purchase property directly from sellers without involving banks, making it accessible for those who might face financial hurdles.

-

While traditional financing relies on strict bank lending criteria, owner financing is more flexible, with terms negotiable between the two parties.

-

Advantages include easier access to financing and faster closing times, while disadvantages may involve higher interest rates and less legal protection.

What are the key elements of an owner financed land contract?

-

The seller acts as the lender, receiving monthly payments from the buyer, who becomes the property owner with the obligation of payment.

-

Terms like 'down payment' and 'default' need to be clearly defined to avoid misunderstandings and establish clear obligations.

-

Financing terms, including interest rate, payment schedule, and loan duration, should be clearly articulated to ensure both parties are on the same page regarding payment expectations.

How to draft an owner financed land contract

-

Include details such as buyer and seller information, property description, purchase price, down payment, and financing terms.

-

Incorporate essential legal clauses to protect both parties, including default clauses and maintenance responsibilities.

-

Ensure all personal information is accurate and complete to prevent legal complications.

What are the property description requirements?

-

A precise legal description is crucial. This can usually be found on the property deed or local tax records.

-

Include relevant parcel numbers and clear address details to avoid confusion over the property being sold.

-

Ensure that all aspects of the contract comply with local real estate laws to uphold its validity.

What are the terms of sale in owner financed contracts?

-

Clearly stipulate the total purchase price of the property payable in agreed-upon installments.

-

Typically, a down payment is required upfront; knowing how to calculate this is crucial for both buyer and seller.

-

Set interest rates and terms of the loan, which can be fixed or adjustable, to suit the needs of both parties.

How to sign and finalize the contract?

-

Both parties must sign the contract to make it legally binding. This includes the seller and the buyer.

-

pdfFiller simplifies the eSigning process, allowing users to sign securely and manage documents efficiently.

-

Once signed, both parties should store the contract securely for easy access in the future.

How to manage owner financed land contracts?

-

It's essential to keep track of payments made to avoid disputes and ensure loan servicing is properly managed.

-

In case of default, both parties should refer to the terms in the contract to resolve the issue or seek legal assistance.

-

Both seller and buyer should maintain clear communication to foster trust and resolve potential issues swiftly.

What additional considerations and resources are available?

-

Explore templates for various documents related to owner financing that can assist in drafting agreements.

-

Access links to professional resources, literature, and articles to further educate users about owner financing.

-

Refer to legal publications that cover owner financing and its implications to stay informed.

How to fill out the Owner Financed Land Contract Template

-

1.Start by downloading the Owner Financed Land Contract Template from pdfFiller.

-

2.Open the template in pdfFiller and review the sections provided.

-

3.Begin with the 'Seller' section, entering the name and address of the seller(s).

-

4.Next, fill in the 'Buyer' section with the name and address of the buyer(s).

-

5.In the 'Property Description' section, clearly describe the property including the address and legal description if applicable.

-

6.Specify the total purchase price of the property in the designated field.

-

7.Outline the down payment amount and the payment schedule in the appropriate sections, detailing interest rates and monthly payment amounts.

-

8.Include the section regarding the length of the contract and the terms related to default or late payments.

-

9.Review all entries for accuracy and completeness, and make any necessary adjustments.

-

10.Once the document is completed, save it and consider having both parties sign it in the presence of a notary public for added legality.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.