Pay Back Money Contract Template free printable template

Show details

This document is a legal agreement between a lender and a borrower that outlines the terms of a loan, including repayment schedule, interest rates, and consequences for default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Pay Back Money Contract Template

A Pay Back Money Contract Template is a legal document outlining the terms under which one party agrees to repay money borrowed from another party.

pdfFiller scores top ratings on review platforms

easy to use and keeps all doc in the dashboard for future usage.

Excellent. Does everything and reasonable price. Use if for work and business!

Thanks to PDFfiller and all my documents are sign

Karl was very helpful and he resolved my query very quickly

I hated to pay for this ... I hate paying for anything ... but you guys got me .... it is well well weworth it!!!!!!!!!!!!!

honestly its sooooooo helpful for its price point

Who needs Pay Back Money Contract Template?

Explore how professionals across industries use pdfFiller.

Pay Back Money Contract Template on pdfFiller

In this guide, we detail how to effectively utilize a Pay Back Money Contract Template form. This document is essential for both lenders and borrowers, ensuring clarity in financial arrangements.

What is a Pay Back Money Agreement?

A Pay Back Money Agreement is a written commitment between a lender and a borrower outlining the terms under which money is borrowed and repaid. This agreement is crucial in establishing trust and formalizing a financial transaction. It is particularly important in circumstances like personal loans, business funding, or family loans.

-

It clearly defines the roles of the lender and borrower, along with the specifics of the loan.

-

These agreements serve to protect both parties in the event of disputes and clarify expectations.

-

Common scenarios include funding for education, starting a business, or covering unexpected expenses.

What are the key components of a Pay Back Money Agreement?

Key components of a Pay Back Money Agreement ensure all terms are explicitly stated to avoid misunderstandings. The agreement typically identifies the parties involved, outlines financial specifics, and defines important terms.

-

The agreement must identify precisely who the lender and borrower are.

-

Definitions of terms like 'principal amount' and 'interest rate' must be clear.

-

Details including the loan amount, interest rate, and repayment schedule need to be clearly defined.

How to craft a Pay Back Money Agreement?

Creating a Pay Back Money Agreement involves filling out crucial fields accurately. Understanding how to specify the loan amount and repayment terms is vital for legal enforceability.

-

Begin by entering the names and contact information of both parties.

-

Be specific about the loan amount and the intended use to avoid ambiguity.

-

Include specifics on interest rates and the repayment schedule, making it as clear as possible.

What common mistakes to avoid when creating payment agreements?

Mistakes in a Pay Back Money Agreement can lead to disputes and legal challenges. Recognizing common errors can help ensure the document is both effective and enforceable.

-

Neglecting to define crucial terms can lead to misinterpretations.

-

Failing to specify how and when payments will be made can create ambiguity.

-

Ignoring local laws can result in an unenforceable agreement.

How to utilize pdfFiller for your payment agreement needs?

pdfFiller offers a robust platform for creating, editing, and managing contracts, including the Pay Back Money Contract Template form. Its features allow for easy access and collaboration across teams.

-

From templates to customization, pdfFiller equips users with everything they need for seamless document creation.

-

You can easily add electronic signatures, making completing contracts faster and more efficient.

-

The platform simplifies managing documents from any device, ensuring accessibility at all times.

What are the implications of default in a Pay Back Money Agreement?

Understanding default is crucial for borrowers and lenders alike. A default occurs when the borrower fails to meet the repayment terms set in the agreement, leading to serious financial consequences.

-

Default happens when a borrower misses payment deadlines repeatedly.

-

Lenders may pursue legal action, while borrowers might face increased debt due to penalties.

-

Clear communication and regular monitoring of payments can help prevent default.

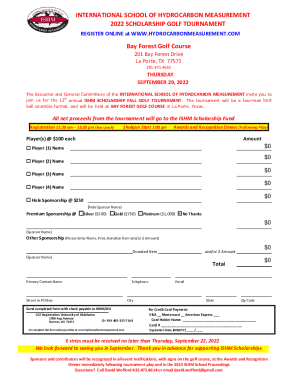

How to fill out the Pay Back Money Contract Template

-

1.Open the Pay Back Money Contract Template in pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the names and contact details of the lender and borrower in the designated fields.

-

4.Specify the amount of money being borrowed in the 'Loan Amount' section.

-

5.Outline the repayment terms, including the repayment schedule, interest rate, and any late fees, in the appropriate sections.

-

6.Include any additional agreements or terms that both parties have agreed to.

-

7.Review the document for accuracy and completeness, ensuring all necessary information is included.

-

8.Once all details are filled out, save your changes.

-

9.Print the document for signatures, or use electronic signature tools if available in pdfFiller.

-

10.Both parties should sign and date the contract to make it legally binding.

How to write an agreement to pay back money?

Key elements of a repayment agreement Parties involved. Clearly define the lender and borrower, including their contact information. Loan amount and interest. Specify the principal amount and any interest to be charged. Repayment schedule. Late fees: Outline any penalties for late payments. Default terms. Governing law.

Can I make a contract for someone to pay me back?

Verbal contracts are completely legal. So, you just have to be prepared to explain what the terms of the contract/agreement were. Any evidence that you have showing the transfer of the funds would be good too, like a canceled check, etc.

What is the agreement for returning money?

The 'Return of money' clause establishes the obligation for one party to refund payments or deposits to the other party under specified circumstances. Typically, this clause outlines the conditions under which money must be returned, such as contract cancellation, failure to deliver goods or services, or overpayment.

How to write a payment plan agreement?

Clearly Define the Terms: Clearly state the amount of the debt, the repayment schedule, and any interest or fees involved. This ensures that both parties are aware of their obligations. Include Late Payment Consequences: Specify the consequences of late or missed payments, such as additional fees or penalties.

How to write a contract to pay back money?

The essential components include: Title: Clearly label the document as a “Promise to Pay” or “Promissory Note.” Date: Include the date of the agreement. Parties Involved: Specify the names and addresses of both the lender and borrower. Principal Amount: Clearly state the amount of money being borrowed.

Can I make a contract for someone to pay me back?

Verbal contracts are completely legal. So, you just have to be prepared to explain what the terms of the contract/agreement were. Any evidence that you have showing the transfer of the funds would be good too, like a canceled check, etc.

How do you write a contract agreement for payment?

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

How to write a contract agreement for borrowing money?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.