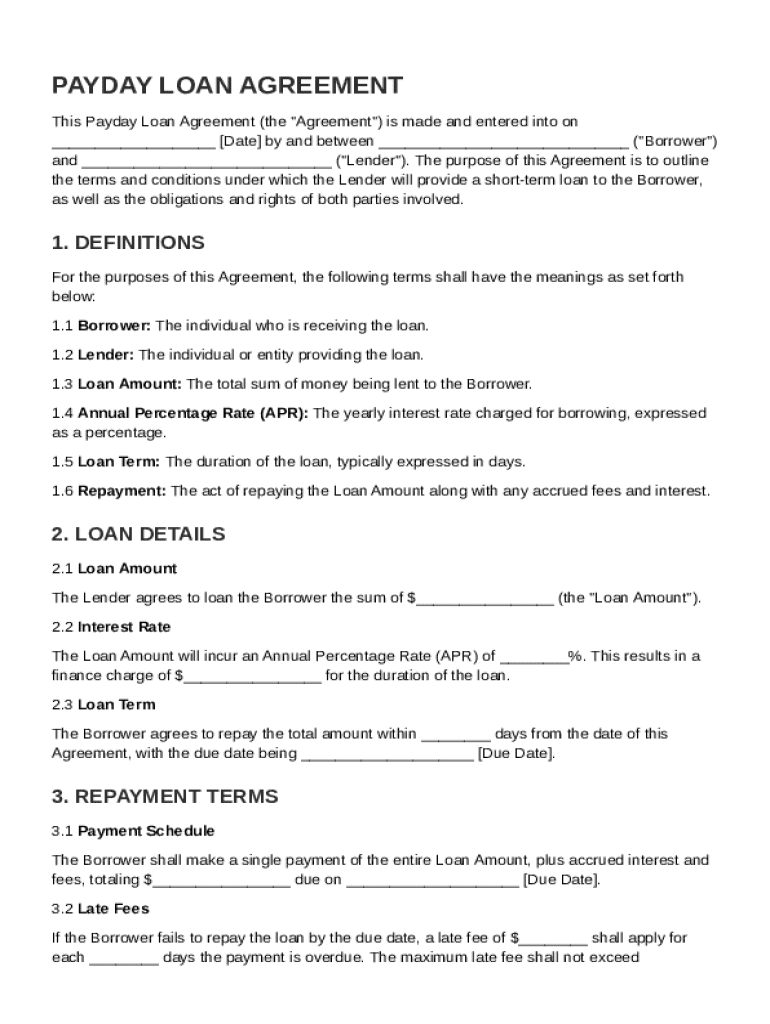

Payday Loan Contract Template free printable template

Show details

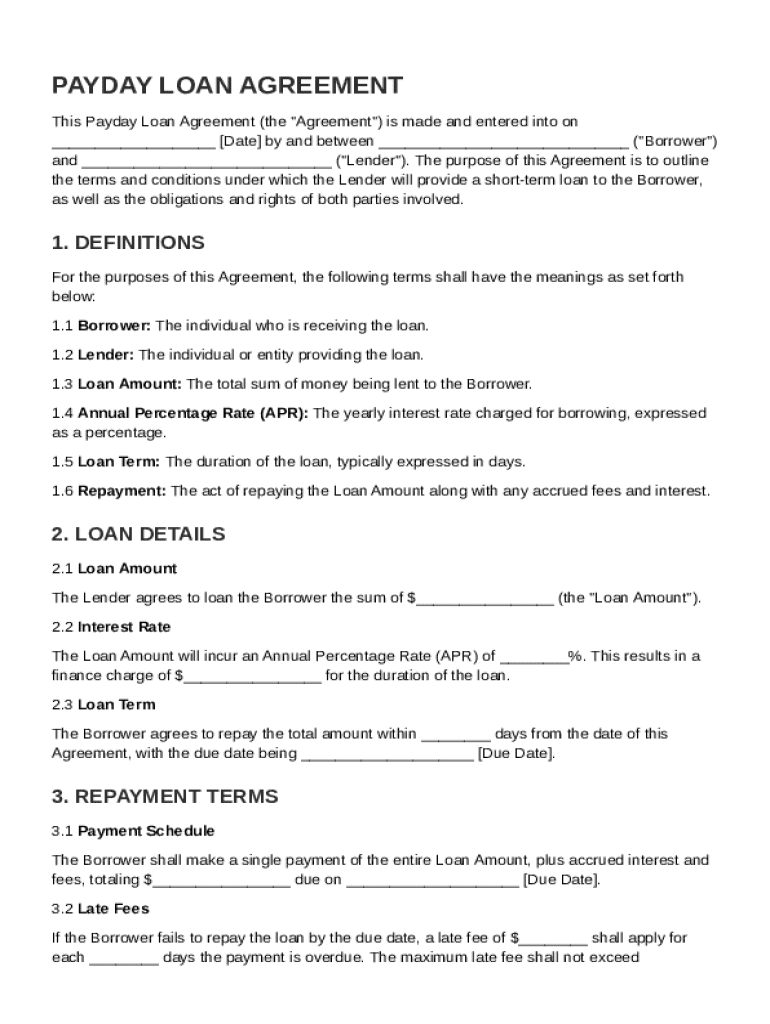

This document outlines the terms and conditions of a payday loan agreement between a borrower and a lender, detailing the loan amount, interest rates, repayment terms, and borrower and lender obligations.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Payday Loan Contract Template

A Payday Loan Contract Template is a legally binding agreement that outlines the terms and conditions of a payday loan between a lender and a borrower.

pdfFiller scores top ratings on review platforms

The discovery has truly changed my life. I am not kidding you!! For a technophobe it is awesome

It's the easiest PDF alteration software I've ever used. Highly recommend it to anyone!

Very easy to use. Top notch and professional. I will definitely use again.

Amazing the easiest product I have ever used!

easy to use. Gives a bit of a professional look to on the fly estimates.

It has been very easy to use I will continue with it

Who needs Payday Loan Contract Template?

Explore how professionals across industries use pdfFiller.

How to fill out a payday loan contract template form

Understanding payday loan agreements

A payday loan agreement is a short-term financial agreement between a borrower and a lender, usually involving a small amount of money lent until the borrower’s next paycheck. Key components of these agreements include the principal amount, interest rate, repayment terms, and specific borrower obligations. Understanding these agreements is vital before signing, as they can have significant financial implications.

Essential definitions in payday loan agreements

-

The individual who receives the loan and is responsible for repayment.

-

The entity providing the loan, which should be legally qualified to lend money.

-

This is the total sum of money being lent, which is typically a small amount.

-

This is the yearly interest rate expressed as a percentage that indicates the cost of borrowing.

-

This defines the length of time the borrower has to repay the loan.

-

This refers to the process of paying back the borrowed amount along with any interest.

How to break down loan terms

-

Understanding how your total loan amount is calculated helps in managing expectations.

-

High interest rates can significantly increase your repayment amount; be aware of its implications.

-

The length of your loan can impact your ability to repay; shorter terms mean higher payments.

-

Adhering to your repayment schedule is crucial to avoid extra fees and penalties.

What are repayment strategies for borrowers?

-

Establishing a clear payment schedule can help ensure timely repayment.

-

Be aware of how late payments can incur additional charges, further increasing the total cost.

-

Various payment methods are available; choose one that fits your financial habits.

Understanding the borrower's obligations in payday loan agreements

-

Loan proceeds should be used as stated in the agreement; misusing can have legal consequences.

-

Misuse of funds can lead to penalties and damaging your credit score.

-

Transparency with your lender can help manage changes in your financial situation.

How to use video tutorials for completing payday loan contracts

-

Video tutorials can provide necessary guidance on using pdfFiller to fill out forms accurately.

-

Learn how to modify text and details within forms for accuracy.

-

Digital signatures are important; video guides can help in understanding their significance.

-

Use collaborative features to work alongside lenders or financial advisors.

User guides for payday loan management

-

Strategies for managing your loan post-signing, ensuring timely payments.

-

Employ pdfFiller for document management and secure storage of your agreements.

-

Create an effective repayment strategy to maintain financial health.

How to fill out the Payday Loan Contract Template

-

1.Download the Payday Loan Contract Template from pdfFiller.

-

2.Open the document in the pdfFiller editor.

-

3.Begin by filling in the borrower's personal information, including name, address, and contact details.

-

4.Next, input the lender's information, specifying the name and business details of the lending party.

-

5.Clearly state the loan amount being borrowed and the agreed-upon interest rate.

-

6.Specify the repayment terms, including the loan duration and any applicable fees.

-

7.Include a section for signatures, ensuring both parties agree to the terms.

-

8.Review the completed contract for accuracy and completeness before saving or printing.

-

9.Finally, share the signed copy with all parties involved for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.