Payment Contract Template free printable template

Show details

This Payment Contract defines the terms and conditions governing the payment obligations between the parties pertaining to specific services or goods.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Payment Contract Template

A Payment Contract Template is a formal agreement outlining the terms and conditions of payment between parties involved in a transaction.

pdfFiller scores top ratings on review platforms

Pretty useful but a little bit expensive

So far the app has worked very well. It is very user-friendly and intuitive. Customer feedback has been quick and very helpful

Just beginning to use it. Would like a tutorial of some sort.

Super easy getting contracts over to people with a verified E-signature.

Very simple and easy to use. Only problem I've had is with one document that did not download properly/

Seems easy to do and will help me a lot with my new business

Who needs Payment Contract Template?

Explore how professionals across industries use pdfFiller.

Payment Contract Template Guide on pdfFiller

Filling out a Payment Contract Template form is crucial for ensuring clear agreements between parties. This guide outlines the essential elements, structured payment terms, and best practices to help you create an effective payment contract.

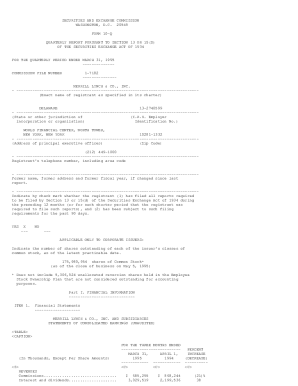

What is a payment contract?

A payment contract is a legally binding agreement that outlines the payment terms and conditions between a borrower and a lender. Understanding its components ensures both parties are clear on their obligations and protects their interests in financial transactions.

-

A payment contract specifies the amount owed, payment schedule, and consequences of default, making it vital for debt management.

-

It reduces misunderstandings between parties, clarifies responsibilities, and enhances accountability in financial agreements.

-

Failure to comply with the terms of a payment contract can lead to legal disputes, making adherence necessary.

What are the essential elements of a payment contract?

-

Include full names and addresses of both parties involved to avoid any confusion.

-

Clearly state the total payment due along with any breakdowns, such as taxes or additional fees.

-

Establish specific due dates for payments to provide clarity on when payments must be made.

-

Explain the conditions under which the borrower defaults and any acceleration clauses that may apply.

How to structure payment terms?

Structuring payment terms in a contract ensures transparency about when payments are expected and the associated methods.

-

Define if payments will be made in a single lump sum or in installments to suit the borrower's financial situation.

-

Specify accepted payment methods, including bank transfer, credit cards, or checks for convenience.

-

Detail penalties and interest rates that may apply for late payments to encourage timely compliance.

How to fill out the payment contract template?

Utilizing pdfFiller’s template allows you to efficiently complete a Payment Contract Template form online.

-

Follow the template fields sequentially, ensuring all required information is included for an enforceable contract.

-

Be cautious of incomplete fields or unclear terms, as they can lead to misunderstandings later on.

-

Leverage pdfFiller’s electronic signature and editing tools to finalize the contract efficiently.

How to manage your payment contract?

Effective management of your Payment Contract is essential to ensure all obligations are met.

-

Utilize pdfFiller’s cloud features for secure storage and organization of your important documents.

-

Implement a system to monitor payment deadlines and progress to prevent late fees.

-

Foster teamwork by sharing contracts with relevant stakeholders to ensure everyone is informed.

What legal considerations should you keep in mind?

Legal considerations are paramount when drafting a payment contract to ensure enforceability.

-

Be aware of any local laws in [region] that may affect the terms and conditions of your agreement.

-

Follow guidelines to ensure that the contract meets all regulatory requirements to avoid legal issues.

-

Understand potential areas of conflict and strategies to address them before they escalate.

What are the advantages of using pdfFiller for payment contracts?

pdfFiller provides several benefits for managing payment contracts effectively.

-

Edit and manage contracts easily within a centralized platform to save time.

-

Communicate effortlessly with stakeholders to finalize agreements and make necessary changes.

-

Utilizing pdfFiller can be more affordable than traditional document management options, saving you money.

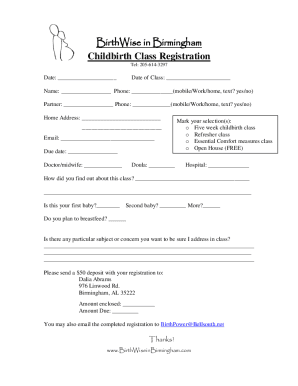

How to fill out the Payment Contract Template

-

1.Begin by downloading the Payment Contract Template from pdfFiller.

-

2.Open the template in pdfFiller to access the editing tools.

-

3.Fill in the names and contact details of all parties involved at the top of the document.

-

4.Specify the total payment amount and the payment schedule, including due dates.

-

5.Include details of the services or products being paid for, ensuring clarity and completeness.

-

6.If applicable, add any late payment penalties or interest terms.

-

7.Review the terms and conditions section to ensure it meets your agreement; modify if necessary.

-

8.Sign the document digitally or print it for physical signatures from all parties.

-

9.Save the completed document and share it with all involved parties for their records.

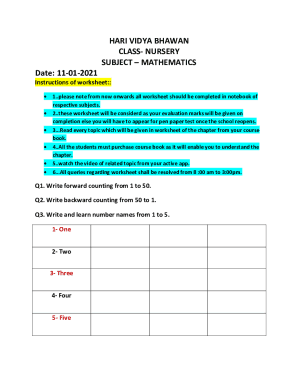

How to write a contract agreement for payment?

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

How to write a payment plan template?

What to Include (7) Date: The date the agreement is being completed should be clearly listed at the top of the document. Parties Involved: The names and addresses of the lender and borrower. Amount: The balance ($) the lender owes to the creditor. Reason for Loan: Why the lender owes money to the creditor.

What is an example of a payment clause in a contract?

As an example, the following wording is often used: the general contractor shall pay the subcontractor within 10 days, on the next day following receipt of progress payment from the owner []; 10 days after payment []; payment shall be made 10 days after the [Client]'s payment.

What is a simple payment terms agreement?

A payment terms clause in your Terms and Conditions agreement is where you disclose details such as how your business will process transactions electronically, what forms of payment you accept and what happens if the buyer cancels a transaction.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.