Payment Plan Car Installment Payment Contract free printable template

Show details

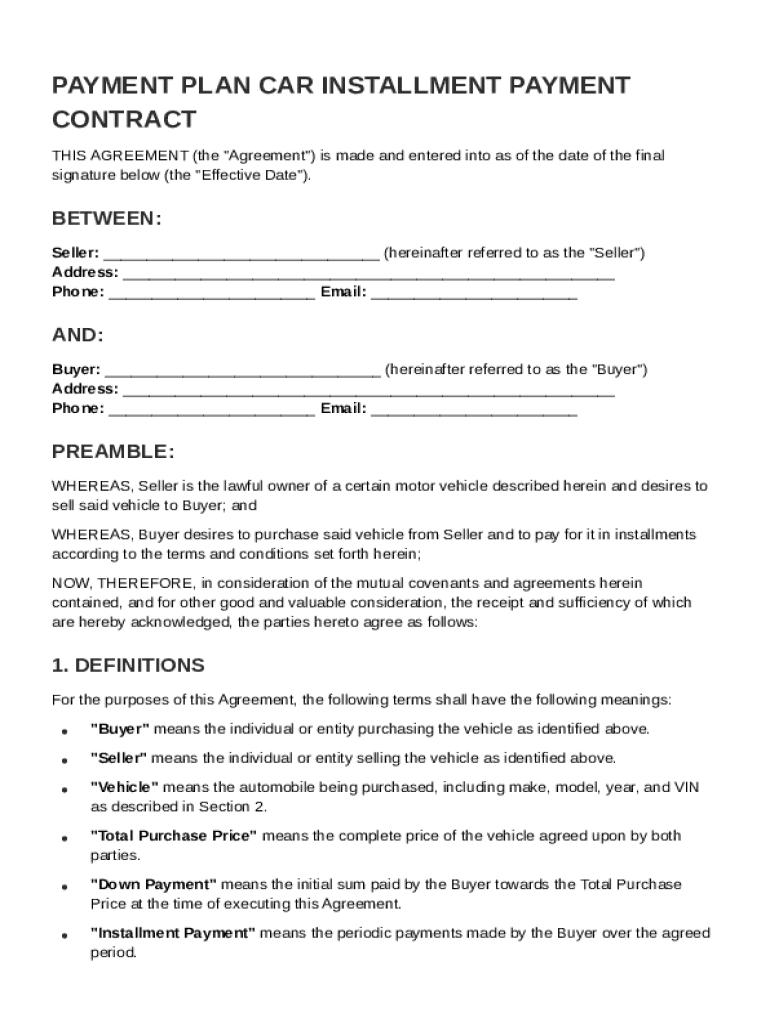

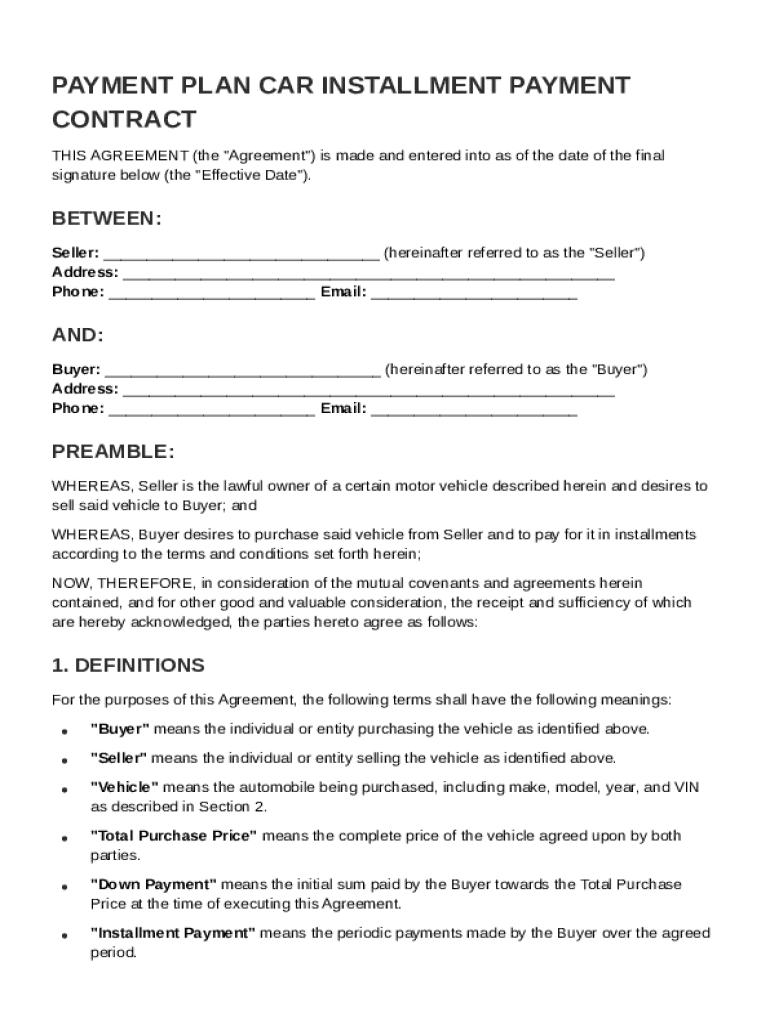

This document is a contractual agreement between the Seller and Buyer for the purchase of a vehicle through installment payments, detailing terms, conditions, payment schedule, and responsibilities

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Payment Plan Car Installment Payment Contract

A Payment Plan Car Installment Payment Contract is a legal agreement detailing the terms under which a buyer will make installment payments for a vehicle purchase.

pdfFiller scores top ratings on review platforms

I desperately want to combine all of my accounts into one. Help

PDFfiller is professional and reliable! Thank you for your service!

Great app - easy to use for E signatures:)

This is an awesome app. Saves on a printing paper. I really enjoy it.

It is good but the date format should be adjustable. Example: mm-dd-yyyy.

fast, easy to use and i love the ability to crete a templete

Who needs Payment Plan Car Installment Payment Contract?

Explore how professionals across industries use pdfFiller.

Payment Plan Car Installment Payment Contract Guide

What is a payment plan car installment payment contract?

A payment plan car installment payment contract is a legal document that outlines the terms of financing a vehicle purchase. It serves to protect both the buyer and the lender by clearly stating the payment schedule, interest rates, and consequences of default. This agreement is crucial for individuals who prefer to pay for their vehicle over time instead of upfront.

What are the advantages of using an installment payment contract for car purchases?

-

Financial Flexibility: Paying in installments allows buyers to spread out the cost of the vehicle over time, making it more affordable.

-

Increased Accessibility: Many people may not have the funds to purchase a vehicle outright, making an installment plan a viable option.

-

Credit Building: Successful repayment of an installment contract can contribute positively to a buyer's credit history.

What are the key components of an installment payment contract?

Key components of an installment payment contract include the total purchase price, down payment amount, interest rate, payment due dates, and the consequences of missed payments. This structure ensures both parties understand their obligations and rights, creating transparency in the transaction.

How do you clarify buyer and seller roles?

Clearly defining the roles of the buyer and seller in the contract ensures accountability and sets expectations. The buyer is the individual financing the vehicle, while the seller, often a dealership, provides ownership transfer. This clarity minimizes disputes and helps streamline the transaction process.

What vehicle information is required in the contract?

-

The Vehicle Identification Number (VIN) uniquely identifies the car and is essential for ownership records.

-

Including the make and model ensures both parties know the specific vehicle being financed.

How is the total purchase price calculated?

The total purchase price calculation includes the vehicle's price plus any taxes, fees, and required add-ons. Transparency in this calculation helps avoid misunderstandings and allows the buyer to plan their payments accurately.

Why is down payment important?

A down payment reduces the amount financed and often lowers monthly installments. It also demonstrates the buyer's commitment to the purchase and can result in a better interest rate, which saves money over time.

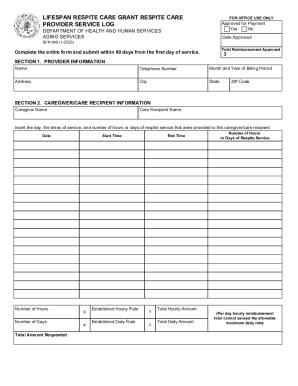

What does the payment schedule entail?

-

It typically details whether payments are made weekly, bi-weekly, or monthly.

-

Specifies how much should be paid at each interval, ensuring clarity in financial responsibility.

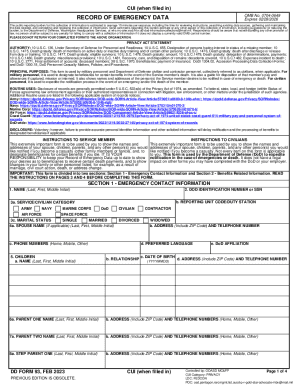

How do you fill out the payment plan form?

Filling out the payment plan car installment payment contract form systematically is crucial. Start by entering the buyer and seller information to establish the parties involved. Next, complete the vehicle section detailing the VIN, make, and model, followed by the financial sections that specify the total purchase price and agreed-down payment. Detail the payment schedule to clarify the expectations of repayment.

What challenges might arise during the process?

-

Buyers and sellers might disagree on the state of the vehicle, impacting the agreement's enforcement.

-

Buyers need to be aware of penalties for delayed payments, and sellers must understand how to handle defaults.

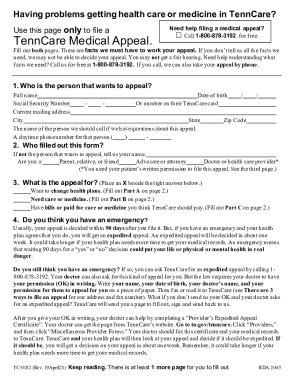

How to ensure legal compliance?

Ensuring legal compliance in your agreement requires understanding state-specific laws concerning car sales, consumer protection regulations, and tax implications. Non-compliance can lead to legal disputes or unfavorable financial consequences, so reviewing local laws is crucial.

How can pdfFiller assist in managing your payment plan documentation?

-

Utilizing pdfFiller allows you to modify your payment plan contract directly within its platform, saving time and effort.

-

The platform enables hassle-free electronic signatures, streamlining the process of finalizing agreements.

-

Engage with buyers and sellers efficiently, ensuring all parties are on the same page.

What should you consider for local compliance?

-

Familiarize yourself with your state's regulations regarding car sales to avoid legal issues.

-

Ensure the contract adheres to local consumer laws to protect buyers from unfair practices.

How to fill out the Payment Plan Car Installment Payment Contract

-

1.Begin by downloading the Payment Plan Car Installment Payment Contract template from pdfFiller.

-

2.Open the document in pdfFiller and familiarize yourself with the sections that require input.

-

3.Fill in the buyer's full name and contact information at the top of the contract.

-

4.Enter the seller's information, including the dealership's name and address.

-

5.Clearly specify the vehicle details: make, model, year, and VIN (Vehicle Identification Number).

-

6.Outline the total cost of the vehicle and the amount of the down payment, if applicable.

-

7.Detail the installment payment amount, frequency (weekly/monthly), and the total number of payments.

-

8.Include information about interest rates and any applicable fees, ensuring transparency.

-

9.Review the terms and conditions section, making any necessary adjustments to suit the agreement.

-

10.Both parties should sign and date the contract to make it legally binding.

-

11.Finally, save and print the document for both the buyer and seller to retain a copy.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.