Payment Plan Installment Payment Contract Template free printable template

Show details

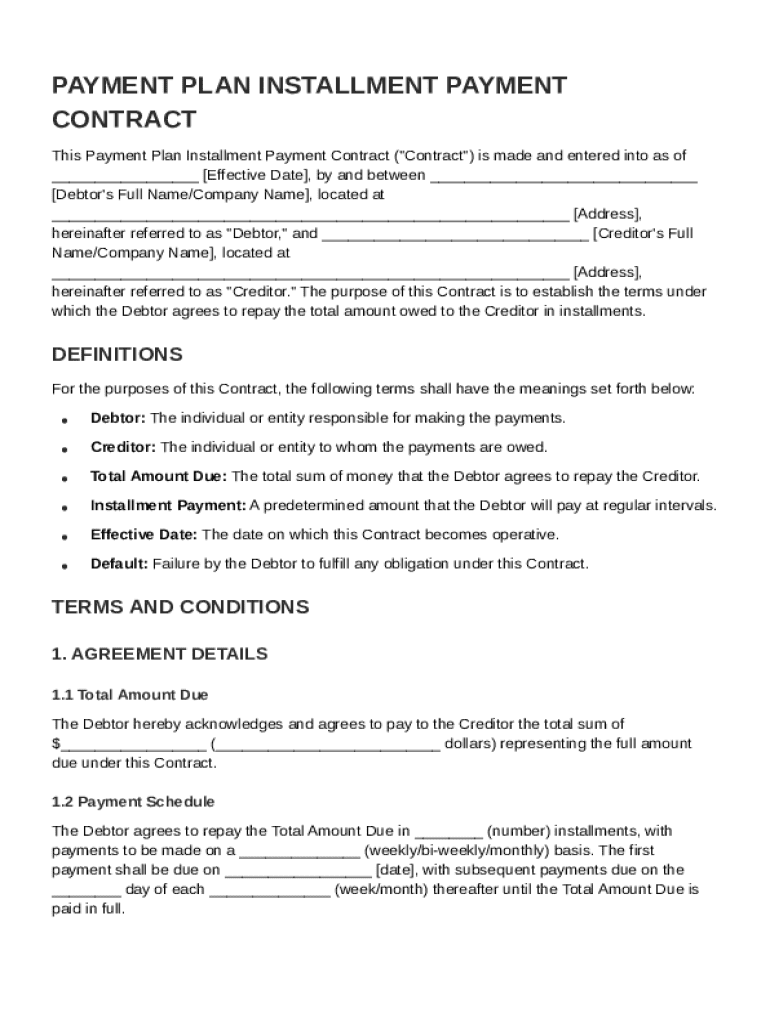

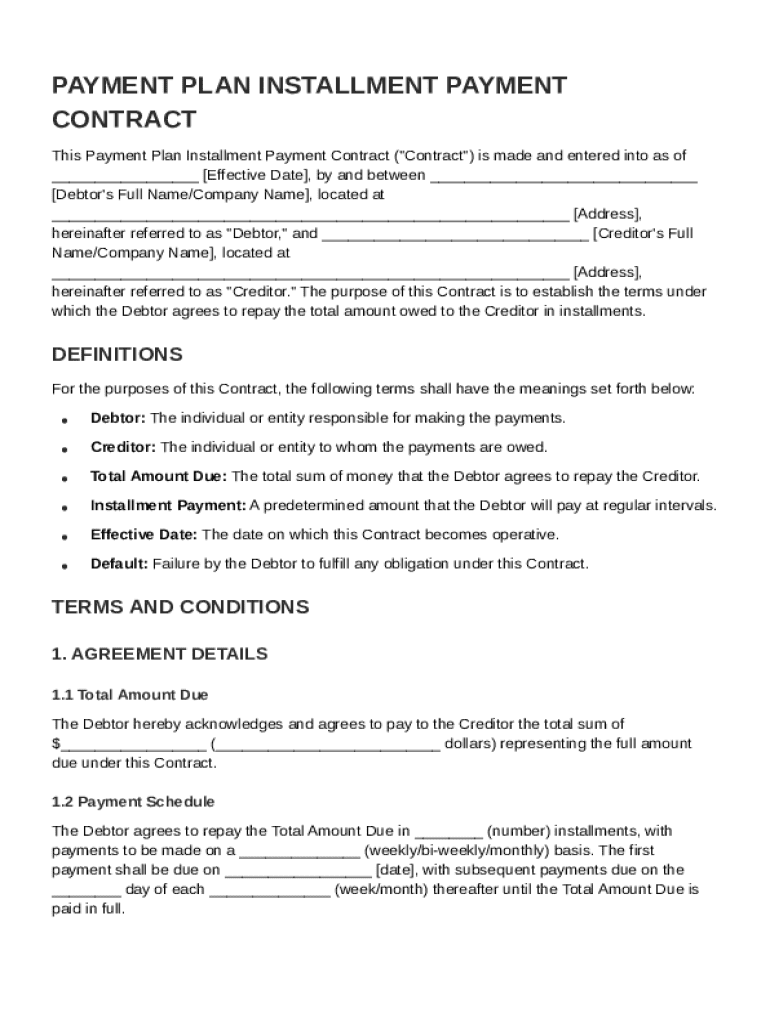

This document is a contract between a debtor and creditor outlining the terms for installment payments for a debt.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Payment Plan Installment Payment Contract Template

A Payment Plan Installment Payment Contract Template is a legal document that outlines the terms and conditions of a payment plan between a debtor and a creditor.

pdfFiller scores top ratings on review platforms

I found PDFfiller easy to use but I would like to learn more>

Awesome!! if i could erase letters without distorting the background that would be awesome. i would give 5 stars for that. Otherwise if i could 4.75 I WOULD!!!

Very User Friendly and convenient. Wish there was other nursing cheat sheets available. ( Treatment sheets, Vital assessment sheets, etc) Takes the guess work out of creating your own.

I find it very helpful, but sometimes I can't find the form I have completed and I have to start over when I need to make changes. Or it wont allow me to make changes.

Great app just wish it wasn't so pricey!

Quisiera poder copiar y pegar textos o dibujos para que queden iguales, y poder utilizar todas mis fuentes.

Who needs Payment Plan Installment Payment Contract Template?

Explore how professionals across industries use pdfFiller.

How to create a Payment Plan Installment Payment Contract Template

TL;DR: How to fill out a Payment Plan Installment Payment Contract Template form

To fill out a Payment Plan Installment Payment Contract Template form, start by defining the key terms such as debtor and creditor. Then, clearly draft the payment plan outlining schedules, amounts, and methods while ensuring compliance with local laws. Finally, utilize pdfFiller to customize, sign, and share your document securely.

What are the key terms in your payment plan?

Understanding key terms in your payment plan is essential for both parties to avoid misunderstandings. A debtor is the individual responsible for making payments, whereas the creditor is the entity receiving those payments. The total amount due is plainly stated in the contract to ensure the debtor knows the debt they are obliged to pay.

-

The individual responsible for the repayment of the debt.

-

The entity receiving the installments as payment for the debt.

-

The full debt as outlined within the contract.

-

Regularly scheduled payments made by the debtor to the creditor.

-

The date on which the payment plan becomes officially binding.

-

Consequences and legal implications associated with failing to fulfill payment obligations.

How do you draft the payment plan contract?

Drafting a comprehensive payment plan contract is vital for clarity and legal enforcement. Key components include clear definitions, payment amounts, and terms of default. It's also crucial to adhere to state laws and compliance standards to ensure the contract holds up in court.

-

Include all necessary legal terminology and clear payment instructions.

-

Avoid ambiguity to ensure all parties understand their obligations.

-

Research local laws that may dictate specific contract terms.

-

Use platform tools to create a legally binding PDF template.

What should you know about payment schedules?

A well-structured payment schedule is crucial to maintain cash flow for the creditor while ensuring the debtor has manageable payments. Consider determining the total number of installments based on the debtor's financial capacity and the total amount due. Frequency options can include weekly, bi-weekly, or monthly payments.

-

Decide how many payments will be made to settle the total amount.

-

Choose how often payments will be made (weekly, bi-weekly, or monthly).

-

Establish a start date and clear due dates for each installment.

How do you detail the payment amounts?

Clearly detailing payment amounts prevents confusion and sets expectations for both parties. Begin by calculating the amount due for each installment, ensuring it aligns with the total amount due and payment frequency. Adjustments may be necessary for the last payment, especially if interest is accrued.

-

Break down the total amount into manageable payments.

-

Ensure the last payment reflects any necessary financial adjustments.

-

If applicable, vary the amount based on interest accrual.

What payment methods can you choose?

Selecting secure and convenient payment methods for both parties is crucial. Various options include bank transfers, checks, money orders, and even cash. Each method should be carefully documented to maintain transparency and accountability in transactions.

-

Explore secure payment methods such as bank transfer or check.

-

Choose methods that protect both parties from fraud.

-

Keep accurate records of all payments to ensure transparency.

How do you address default and acceleration clauses?

Establishing clear definitions of default and the resulting consequences safeguards your interests. A default occurs when the debtor fails to make agreed-upon payments. Acceleration clauses enable the creditor to demand the full outstanding balance when certain conditions, such as late payments, are met.

-

Clearly specify what actions constitute a default.

-

List potential consequences and remedies for defaulting.

-

Outline conditions under which the full amount becomes due immediately.

How to access your payment plan form on pdfFiller?

Accessing your Payment Plan Installment Payment Contract Template on pdfFiller offers users powerful tools for customization. Begin with a step-by-step guide to locate and utilize the template. pdfFiller also allows for editing and eSigning, ensuring your completed forms are securely shared with the necessary parties.

-

Follow the intuitive interface to locate the payment plan template quickly.

-

Edit the template to meet your specific needs and circumstances.

-

Utilize electronic signatures and secure sharing options for completed documents.

What are best practices and compliance considerations?

Legal compliance is essential in drafting any contract, including a payment plan. Be aware of local regulations that might impact the specific terms required in your agreement. Adhering to best practices such as clarity, detailed records, and mutual understanding can prevent disputes down the line.

-

Research and adhere to jurisdiction-specific contract requirements.

-

Understand what clauses may be legally mandated in your region.

-

Ensure transparency and comprehensibility to avoid future conflicts.

How to fill out the Payment Plan Installment Payment Contract Template

-

1.Begin by downloading the Payment Plan Installment Payment Contract Template from pdfFiller.

-

2.Open the template in your pdfFiller editor to start filling it out.

-

3.Enter the date of the agreement at the top of the document.

-

4.Fill in the names and contact information of the debtor and creditor in the designated fields.

-

5.Specify the total amount due in the payment amount section.

-

6.Detail the number of installments and due dates for each payment.

-

7.Outline the interest rate, if applicable, in the relevant section.

-

8.Include any late fees or penalties for missed payments in the contract.

-

9.Review the terms for clarity and completeness.

-

10.Once complete, save the document and send it to all parties for signing.

-

11.Ensure both parties receive a copy of the signed contract for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.