Payment Term Contract Template free printable template

Show details

This document establishes the framework for payment terms between two parties, outlining their rights, responsibilities, and obligations regarding payment practices.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Payment Term Contract Template

A Payment Term Contract Template is a structured document that outlines the payment conditions agreed upon by parties involved in a transaction.

pdfFiller scores top ratings on review platforms

It's good but some forms they are not available for filling because not able to rotate from the vertical position to the horizontal.

After some changes, the next printout showed "Watermark"...nt sure why.

Needed an easy way to convert online forms into fillable ones. PDFfiller is perfect for that. No more filling out applications by hand.

Great value and easy to use with readily available support tools

I love it. It makes my documents so easy to complete

I was looking for a NC simple property purchase agreement

Who needs Payment Term Contract Template?

Explore how professionals across industries use pdfFiller.

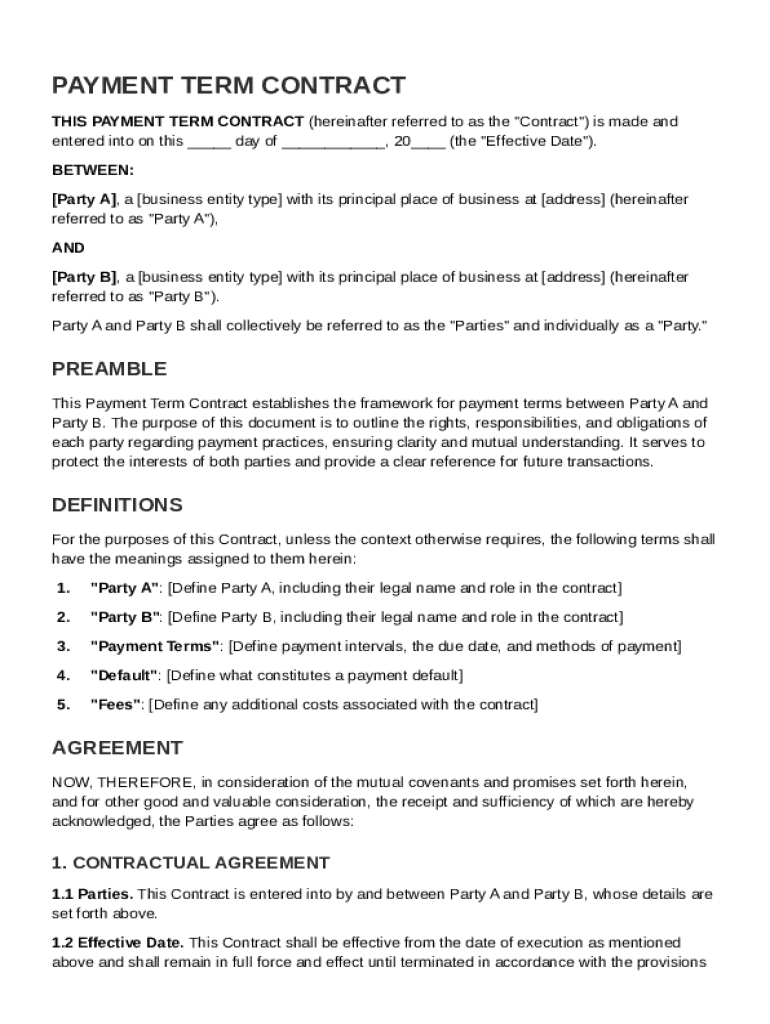

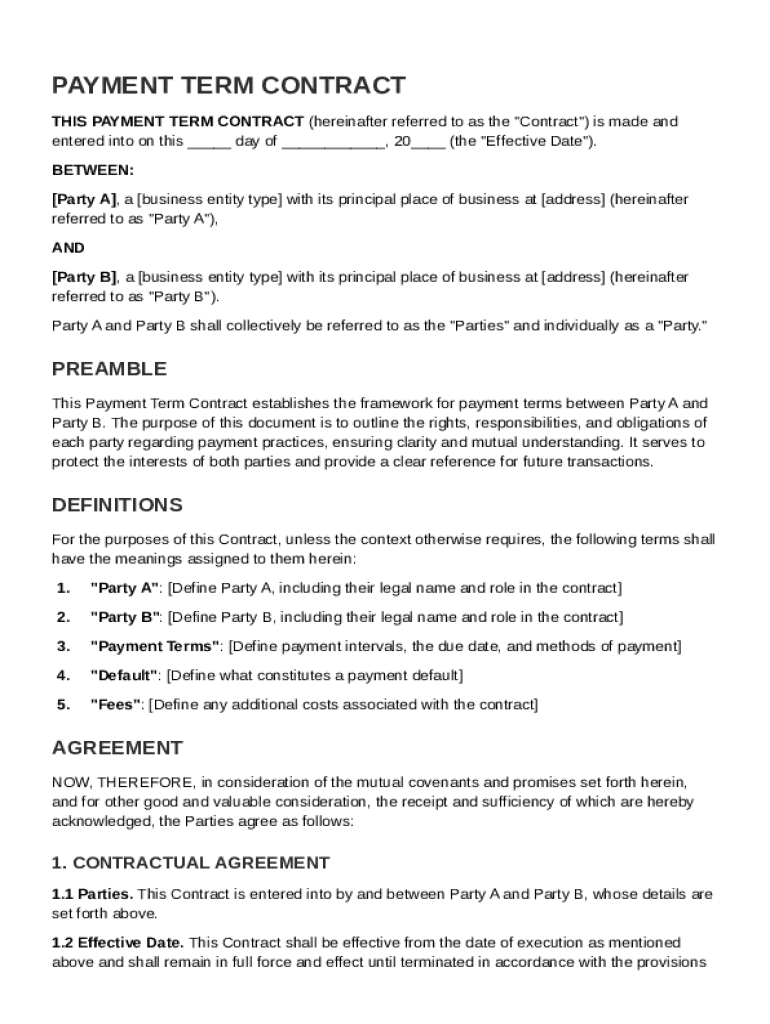

Comprehensive Guide to the Payment Term Contract Template Form

Filling out a Payment Term Contract Template form requires thorough understanding to ensure accurate detailing of payment procedures, obligations, and rights of both parties involved.

What is a Payment Term Contract?

A Payment Term Contract is crucial in formalizing the financial agreements between two parties, outlining how and when payments should be made. This type of contract is essential for fostering transparency in financial transactions, ensuring both parties are clear on the terms and conditions governing their agreement.

-

Defines payment obligations and timelines, preventing any legal disputes and ensuring smooth business operations.

-

Usually includes payment amounts, schedules, parties involved, due dates, and fees for defaults, all aimed at reducing potential conflicts.

-

Creates a structured environment, assisting both parties to keep track of financial commitments, enhancing overall business transparency.

How to determine the parties involved?

Clearly defining the parties involved in a Payment Term Contract—Party A (the payer) and Party B (the payee)—is essential for legal enforceability. Correctly identifying these parties helps clarify their roles and responsibilities, limiting the risk of misunderstandings.

-

Each party should be distinctly identified, along with their legal capacities, to avoid ambiguity in accountability.

-

Incorrect identification can lead to undermined enforcement opportunities in case of disputes over obligations or payments.

-

Failure to accurately define parties can result in legal complications, which can destabilize business relationships and lead to disputes.

What makes payment terms effective?

Crafting effective payment terms is vital for ensuring both parties adhere to their financial responsibilities. This involves explicitly stating payment intervals, due dates, and acceptable payment methods to streamline the transaction process.

-

Establishing intervals such as monthly or quarterly ensures a regular schedule, promoting better financial planning.

-

By specifying dates and methods, it minimizes confusion and enhances compliance with the agreed terms.

-

Including terms for late fees or service charges incentivizes on-time payments, reducing the risk of defaults.

What should know about defaults and fees?

Understanding payment defaults is crucial when drafting a Payment Term Contract. A default occurs when a party fails to make payments as agreed. Clearly outlining the penalties and additional fees associated with such defaults can serve as deterrents and protect the interests of both parties.

-

Explicitly define what constitutes a default within your contract, illustrating the timeframe for missed payments.

-

Incorporating potential fees related to payment delays can encourage prompt payments and help cover potential losses.

-

Utilize strategies such as payment reminders and flexible terms to reduce the likelihood of defaults.

What are the key considerations when executing the contract?

The effective date of a Payment Term Contract is a pivotal component that marks when the parties are bound by the agreement. Ensuring both parties review the agreement thoroughly can clear up any ambiguities and align expectations.

-

The effective date triggers the contract’s obligations and rights, making it vital for clarity in both parties' responsibilities.

-

Engaging in collaborative discussions helps uncover misinterpretations, ensuring all parties grasp the contract terms.

-

pdfFiller's platform simplifies editing and collaboration on contracts, facilitating smooth executions and eSignatures.

How to leverage pdfFiller for document management?

Utilizing pdfFiller can greatly enhance the management of your Payment Term Contract Template form. The platform enables users to create, edit, and securely eSign documents seamlessly, improving overall efficiency.

-

Users can easily create and modify payment contracts using intuitive tools tailored for user experience.

-

Integrate multiple users in the drafting process, facilitating feedback and revisions in real-time.

-

Cloud-based access allows users to manage contracts on-the-go, ensuring flexibility in document management.

How do payment agreement templates compare?

A comparative analysis of payment agreement templates, particularly those offered by pdfFiller, showcases several unique features enhancing usability and compliance. Understanding these differences can aid in selecting the best template for your needs.

-

Evaluating pdfFiller templates against others can highlight superior customization capabilities suited to user requirements.

-

pdfFiller offers user-friendly navigation, guidance tools, and support that facilitate easier contract drafting.

-

Templates from pdfFiller simplify the process by providing fillable forms and immediate support for any queries.

How to fill out the Payment Term Contract Template

-

1.Open the Payment Term Contract Template in pdfFiller.

-

2.Review the template to understand the required sections, including parties' information, payment amounts, due dates, and terms.

-

3.Begin by filling in the names and addresses of both parties involved in the contract.

-

4.Clearly specify the payment amounts and the currency in which the payments will be made.

-

5.Enter the payment schedule, detailing when payments are due and any late fees applicable.

-

6.Include any additional terms or conditions that are relevant to the payment process, such as discounts for early payments.

-

7.Review all filled-in information for accuracy and completeness.

-

8.Utilize the tools in pdfFiller to sign the document electronically or prepare it for printing.

-

9.Save the completed contract and share it with all relevant parties for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.