Payroll Contract Template free printable template

Show details

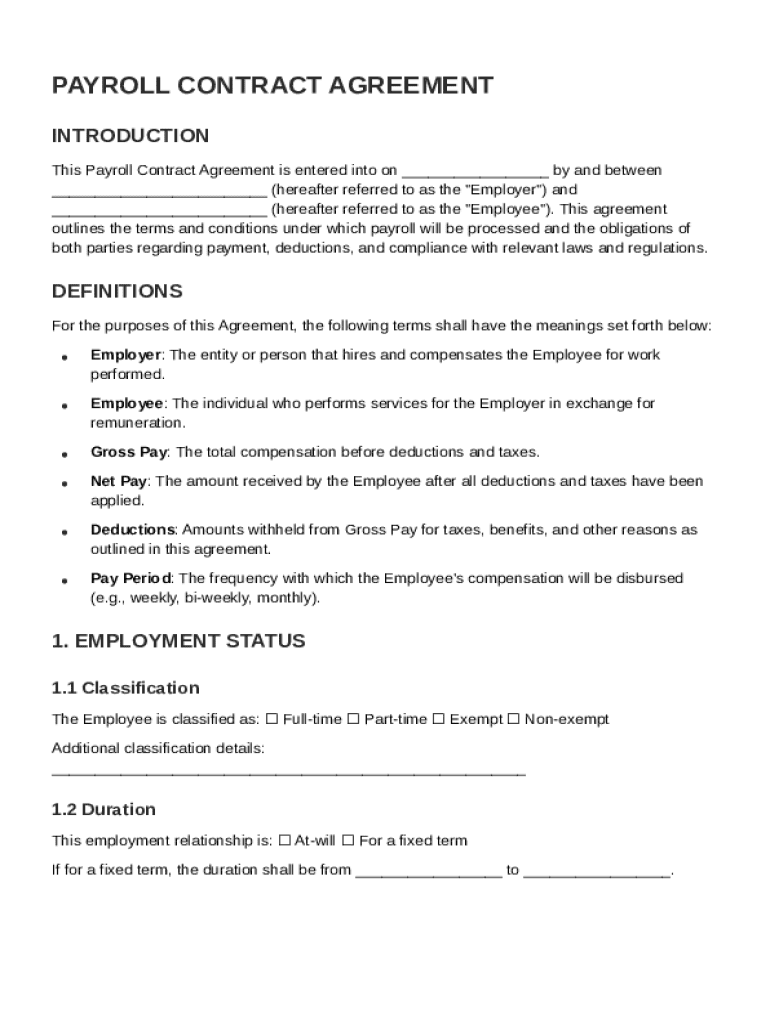

This document outlines the terms and conditions for payroll processing between the Employer and Employee, including definitions of key terms, employment status, compensation details, deductions, compliance

We are not affiliated with any brand or entity on this form

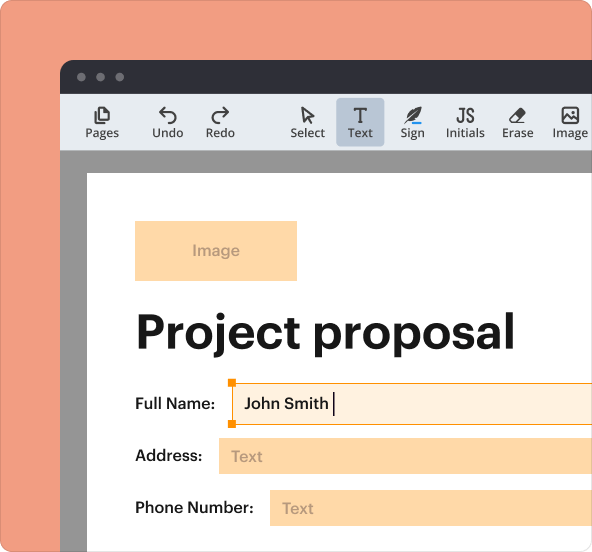

Why pdfFiller is the best tool for managing contracts

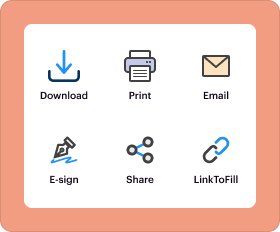

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Payroll Contract Template

A Payroll Contract Template is a standardized document used to outline the terms of employment and payment between an employer and an employee.

pdfFiller scores top ratings on review platforms

very happy good softwaer

Easy to mange and understand

Could be worse!

Cheap, handy, available on all my devices. Billing department works very fast and efficient.

Glitches and crashes while I am doing offline editing.

What do you think about this review?

So far I am satisfied.

very smart

Only thing I don't like is that the boxes don't expand if I have more to write in them other than that its great

Who needs Payroll Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Payroll Contract Template Guide

When creating a Payroll Contract Template form, it’s crucial to understand its components. This guide provides an informative overview along with practical tools offered by pdfFiller to streamline your document creation.

What is a payroll contract?

A payroll contract is a legally binding document that outlines the terms of employment related to compensation and benefits. It ensures both employers and employees understand their rights and obligations regarding payroll processes.

-

Payroll contracts establish clear expectations which can help prevent disputes over earnings and benefits.

-

Key elements include salaries, work hours, and benefits specific to the employee’s role.

-

Employers must adhere to regional employment laws to ensure compliance during payroll processing.

Which components are essential in a payroll contract?

Understanding the structure of a payroll contract is crucial for both parties involved. It clarifies expectations and can safeguard against misunderstandings.

-

Clearly defining who is considered the employee and employer helps avoid ambiguities.

-

Gross pay reflects total earnings before deductions, while net pay is what an employee takes home after deductions.

-

Deductions for taxes, benefits, and garnishments must be fully explained alongside the pay schedule.

What are employment status classifications?

Employment classifications dictate how employees are managed, paid, and provided benefits within a company.

-

Employment can be classified as full-time, part-time, exempt, or non-exempt, impacting eligibility for benefits.

-

At-will employment allows termination without cause, while fixed-term contracts offer stability for a specified duration.

-

Classifications affect how payroll is processed, influencing tax obligations and benefit eligibility.

How are compensation structures determined?

Compensation structures are essential for clarity in employee payment. They dictate how salaries or wages are calculated and paid.

-

Employers should be transparent about how salaries are set based on role responsibilities and marketplace standards.

-

Deciding between weekly, bi-weekly, semi-monthly, or monthly payment schedules impacts employee cash flow.

-

Employers can offer various payment methods, such as direct deposit or checks, enhancing convenience for employees.

How are payroll deductions understood?

Understanding payroll deductions is crucial for both parties, ensuring transparency in how paychecks are calculated.

-

Mandatory deductions include federal, state, Social Security, and Medicare taxes that must be withheld from employee pay.

-

Voluntary deductions can include health insurance premiums, retirement contributions, and flexible spending account contributions.

-

Court-ordered garnishments require employers to withhold a portion of an employee’s paycheck as directed by a legal authority.

How do you create a payroll contract template?

Creating a Payroll Contract Template form can be simplified by using interactive tools, such as those offered by pdfFiller.

-

A structured approach to filling out the payroll contract can help avoid common errors.

-

Utilizing tools on pdfFiller can streamline document creation, making it easy to input information and generate the contract.

-

Customizing your payroll contract template ensures that it meets the specific needs of your organization.

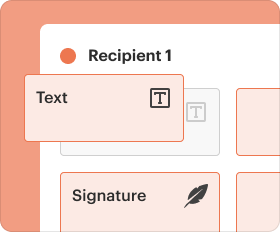

How to edit and sign your payroll contract online?

Utilizing pdfFiller's features can significantly enhance the editing and signing process of payroll contracts.

-

pdfFiller provides advanced editing tools that allow users to modify contract details easily.

-

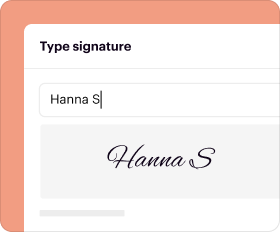

The eSigning process is legally binding, ensuring that payroll contracts hold the same validity as traditional signatures.

-

Involving stakeholders during contract creation fosters clarity and agreement on terms before finalization.

How to manage your payroll contracts?

Effective management of payroll contracts is essential for compliance and accessibility.

-

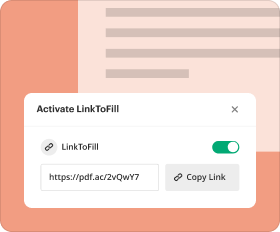

pdfFiller offers cloud storage, ensuring that contracts are easily accessible anytime, anywhere.

-

Regularly updating contracts keeps terms relevant and compliant with current laws and regulations.

-

Establishing a schedule for contract reviews can help maintain compliance and address any changes in policy.

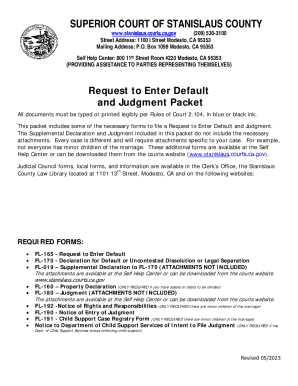

How to fill out the Payroll Contract Template

-

1.Open the Payroll Contract Template on pdfFiller.

-

2.Review the introductory section to understand the purpose of the document.

-

3.Fill in the employee's full name and contact information in the designated fields.

-

4.Enter the company's name, address, and contact information in the appropriate areas.

-

5.Specify the employment position and a brief job description to ensure clarity.

-

6.Detail the compensation type (e.g., hourly, salary) and payment frequency (e.g., monthly, bi-weekly).

-

7.Include any additional benefits or bonuses the employee may receive.

-

8.Make sure to note the start date of employment and any probationary period, if applicable.

-

9.Gather both the employer's and employee's signatures by using pdfFiller's signing feature.

-

10.Review all entered information for accuracy before saving and downloading the completed contract.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.