Person To Person Loan Contract Template free printable template

Show details

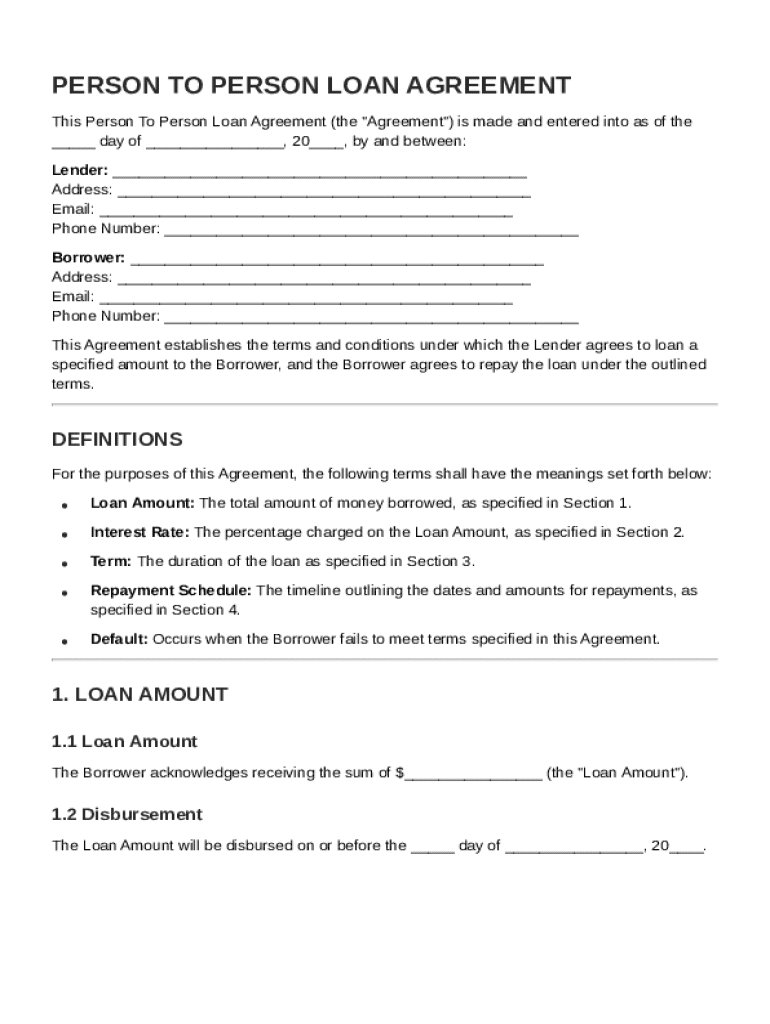

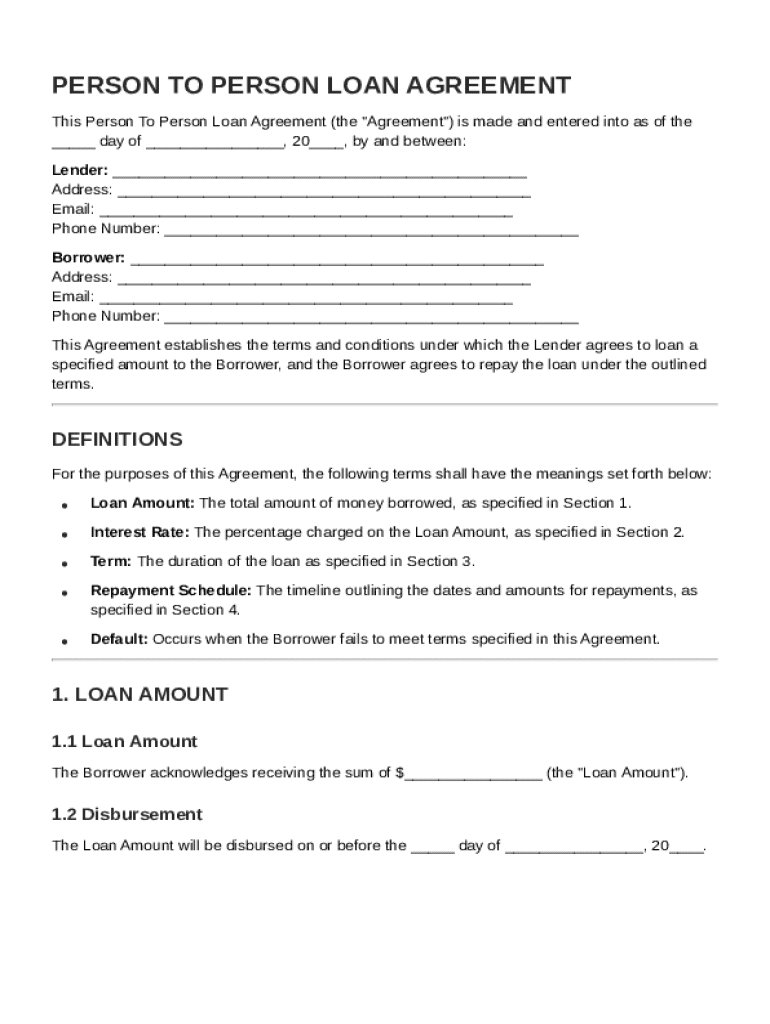

This document outlines the terms and conditions of a loan agreement between a lender and a borrower, detailing the loan amount, interest rate, repayment schedule, and remedies in case of default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Person To Person Loan Contract Template

A Person To Person Loan Contract Template is a legal document outlining the terms and conditions of a loan agreement between two individuals.

pdfFiller scores top ratings on review platforms

Still learning how to use and what forms are available.

Just found your site yesterday, and already I'm finding many potential uses. Thank You!

With the exception of the scam you have going to get people to sign up for your service... (i.e., On a holiday I came into my office to get work done quickly so I could then spend time with my family. I was soo pleased with your service as it let me upload a document and seamlessly edit it for 2 hours and the peace of mind that everything was working properly as your program continually provided feedback saying that 'all changes have been saved'. Then when I finally finished, after triple checking my work and feeling thrilled that I could go celebrate the holiday and be with my family, I selected the big bright button that says, Done!. And only THEN, after 2 hours of work, did you tell me, there is an error and I need to sign up for your program. You should be ashamed of yourselves. I was so excited to tell other people about your program and how well it works. After being scammed, ripped off in terms of money and precious time, I won't be telling anyone about your service. If you prefer to keep me as a happy customer, perhaps you will find a way to make up for this inconvenience (e.g., give me a discounted membership, upgrade my membership, some other kind gesture?) and correct this misunderstanding that you are covertly enticing people to use your program with an inconsiderate scam. I'd love if you followed up with me about this survey. Thank you. Sarah

Very user friendly. Great assistant to office and document signatures from a far\!

Could improve with advanced copy pasting features like copying 1 or multiple fields and allowing to paste them in other pages docs etc

The service works well and is very convenient, however I was disappointed by the way I was able to complete an entire form but was not advised it was not free until the form was completed after spending a couple hours working on it. Since this is a pay service, the consumer should be advised immediately upon accessing any forms on an internet search. In order to preserve my work, I had no choice but to subscribe. Perhaps you should market a new service that charges by the document. I would have gladly paid for that up front. The service itself works very well.

Who needs Person To Person Loan Contract Template?

Explore how professionals across industries use pdfFiller.

Your Complete Guide to the Person To Person Loan Contract Template

Understanding how to fill out a Person To Person Loan Contract Template form correctly is key for both lenders and borrowers. This guide provides step-by-step instructions and insights on the essential components of these agreements.

What is a person-to-person loan agreement?

A person-to-person loan agreement is a legal contract between an individual lender and borrower, facilitating a direct loan without traditional financial institutions. These agreements can often offer more favorable terms than the market due to the personalized nature of the arrangement.

-

Person-to-person loans, also known as peer-to-peer loans, allow the lender and borrower to bypass banks, which can lead to lower rates and flexible terms.

-

The agreement is a legally binding document that outlines the responsibilities and rights of both parties.

What to include in a person-to-person loan contract?

The essentials of a Person To Person Loan Contract include clear identification of both parties—lender and borrower. This ensures that both sides understand who is involved in the transaction.

-

Both lender and borrower should provide their full names and any relevant identification numbers to confirm their identities.

-

Comprehensive contact information for both parties, including addresses, emails, and phone numbers, is crucial for communication.

-

The date the agreement is established should be explicitly stated to avoid any confusion regarding the loan start time.

How to define the financial terms of the loan?

Defining the financial terms is critical in a Person To Person Loan Contract. This section details significant aspects such as the total loan amount, interest rate, and the duration of the loan.

-

This is the total sum borrowed, and understanding its significance helps both parties gauge repayment expectations.

-

Whether using simple or compound interest, the method of calculation must be clearly stated to ensure transparency.

-

This specifies the duration over which the loan is to be repaid, enabling both parties to manage their finances accordingly.

How to create a clear repayment schedule?

A well-defined repayment schedule outlines how and when payments are to be made. This avoids misunderstandings and provides a roadmap for loan management.

-

Clearly stating payment amounts, due dates, and the frequency helps both parties adhere to the agreement.

-

It is important to communicate the consequences of failing to meet payment obligations upfront.

-

Discussing prepayment terms allows borrowers to save on interest if they choose to pay off the loan early.

How to fill out the person-to-person loan contract?

Filling out the Person To Person Loan Contract Template form correctly is crucial for legal compliance and clarity. pdfFiller provides a comprehensive set of tools and instructions for users.

-

Each section of the template should be filled in with specific information pertaining to the loan and the parties involved.

-

Utilizing pdfFiller tools helps in creating an accurate and legally compliant document.

-

Make sure that all terms are clear and unambiguous to protect both parties.

How to manage your loan agreement effectively?

Managing loan agreements efficiently is key for maintaining good relationships and ensuring timely payments. pdfFiller allows users to collaborate and manage documents seamlessly.

-

The platform allows both parties to make changes to the document in real-time, ensuring everyone is on the same page.

-

Users can track changes and manage different document versions to avoid confusion.

-

Using electronic signatures provides a secure method for finalizing transactions without physical meetings.

Why choose pdfFiller for loan agreement templates?

pdfFiller stands as a leading document management solution, providing users with a vast library of forms and templates, including customizable person-to-person loan templates. It streamlines the process from document creation to eSigning, making it ideal for any individual or team.

-

Why pdfFiller templates often outperform competitors in terms of ease of use and customization.

-

Ensuring compliance with regional laws demonstrates the reliability of using an established platform.

-

The cloud-based platform allows access from anywhere, making it easier for teams to collaborate.

How to fill out the Person To Person Loan Contract Template

-

1.Download the Person To Person Loan Contract Template as a PDF from a reliable source.

-

2.Open the PDF in pdfFiller to access the editing tools.

-

3.Begin by entering the full names of the lender and the borrower at the top of the document.

-

4.Fill in the loan amount, the interest rate, and the loan duration in the designated fields.

-

5.Specify the repayment schedule, detailing how often payments will be made and due dates.

-

6.Include any additional terms that both parties agree on, such as late fees or prepayment options.

-

7.Review the filled information for accuracy and completeness before finalizing the document.

-

8.Once satisfied, save the completed contract, and print copies for both the lender and borrower to sign.

-

9.Both parties should sign the contract and date it to make it legally binding.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.