Personal Car Loan Contract Template free printable template

Show details

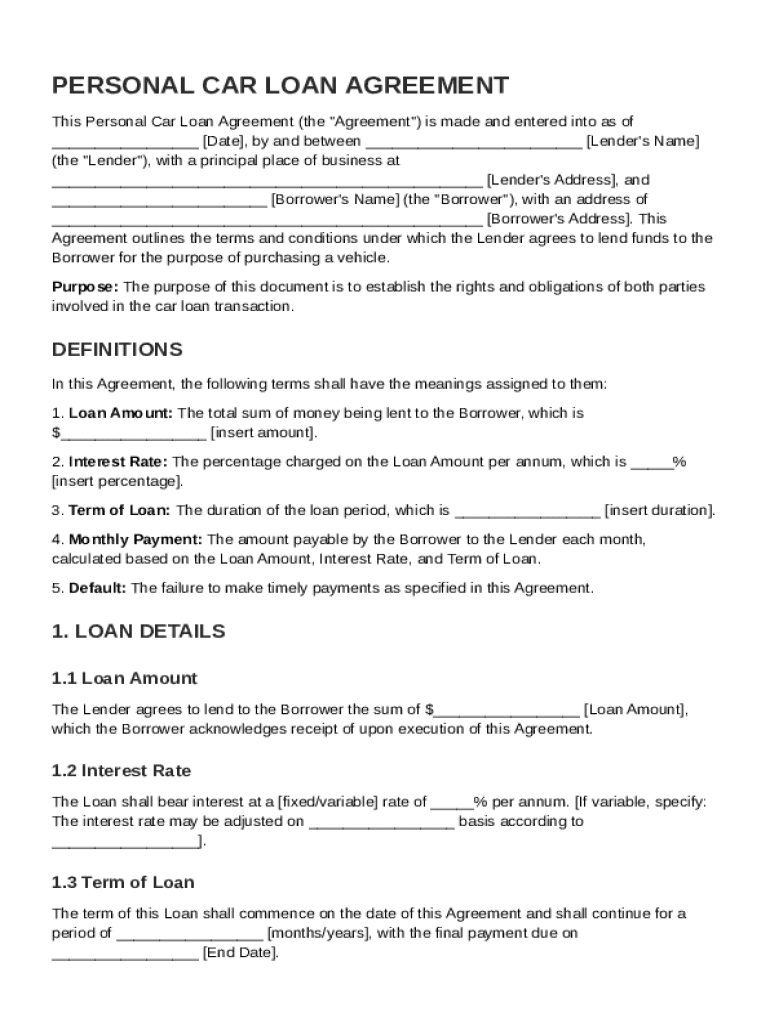

This document outlines the terms and conditions of a loan agreement between a lender and a borrower for the purchase of a vehicle.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Personal Car Loan Contract Template

A Personal Car Loan Contract Template is a legal document outlining the terms and conditions of a loan provided to an individual for purchasing a vehicle.

pdfFiller scores top ratings on review platforms

I haven't used the service enough to give any opinion, except to say that I am presently satisfied with my experience.

Just started filling out my first forms--beats he heck out of using a typewriter and retyping!!!

This is an awesome site to have if you have any type of paperwork whether your a tenant Landlord or just need help with any issues that require legal paperwork.

Finally...something which works to eliminate the tedious task of form completion. Thank you.

I' am elated with the use of your service it is easy fast and simple

Easy to use. Came in handy to assist my Daughter with her court issues.

Who needs Personal Car Loan Contract Template?

Explore how professionals across industries use pdfFiller.

Complete Guide to the Personal Car Loan Contract Template on pdfFiller

If you're looking to secure funding for a vehicle, understanding how to fill out a Personal Car Loan Contract Template is crucial. This guide will take you through each step, providing you with everything from the structure of the agreement to crucial editing tools offered by pdfFiller.

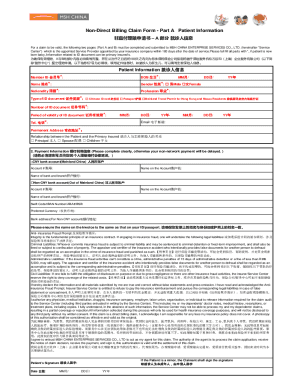

What is a personal car loan agreement?

A personal car loan agreement is a legal contract between a lender and a borrower detailing the terms and conditions under which the borrower can finance vehicle purchases. The purpose of this agreement is to protect both parties' rights and obligations. Establishing a written agreement is essential to ensure transparency and reduce potential disputes in case of loan default or repayment issues.

-

Clearly laid-out terms help both parties understand their responsibilities.

-

A written agreement provides legal recourse in case of contract violations.

What are the key components of the personal car loan agreement?

A well-structured personal car loan agreement consists of several key components that define the roles and responsibilities of both the lender and the borrower.

Definitions: Key Terms Explained

-

This is the total amount that the borrower seeks to finance to purchase the vehicle, which will determine repayment terms.

-

It can be fixed or variable, and it significantly impacts the total cost of the loan.

-

This refers to the duration over which the loan is repaid, often ranging from two to five years.

-

The calculated figure that the borrower must pay periodically until the loan is fully repaid.

-

This refers to the failure to make timely payments, which can result in penalties or repossession.

How is the structure of the agreement organized?

-

Includes essential information such as names, addresses, and identification numbers.

-

Specifically outlines the amount of the loan, purpose, and conditions.

-

Describes how and when payments will be made, including provisions for late payments.

How do you fill out the personal loan agreement template?

When filling out the Personal Car Loan Contract Template, take a step-by-step approach to ensure all relevant fields are accurately completed. Start by detailing the borrower and lender information, then proceed to specify the loan amount and terms.

-

Fill in personal details, ensuring names and addresses are accurately recorded.

-

Clearly state the loan amount, interest rate, and repayment terms.

-

Review for any mistakes, as inaccuracies can lead to disputes later.

-

Both parties must sign to validate the agreement.

Common mistakes to avoid during this process include leaving blanks, using incorrect figures, or misunderstanding terms.

How can you edit and manage your loan agreement with pdfFiller?

pdfFiller provides robust tools for editing and managing your personal car loan agreement. With this platform, you can easily modify text, add comments, and make necessary adjustments to the document.

-

It allows you to edit text directly within your document, streamlining the revision process.

-

With pdfFiller, you can sign documents electronically, enhancing convenience.

-

Share your completed agreement securely with involved parties for easy collaboration.

What compliance and legal considerations should you keep in mind?

Navigating the legal landscape concerning personal car loans can be complex. It's essential to understand the local laws regarding personal loans in your region, as they can influence various aspects of the agreement.

-

Familiarize yourself with any local laws affecting personal loans, as these will dictate specific compliance requirements.

-

Make sure your agreement fulfills any legal requirements to avoid issues later.

-

Including liability notices can protect both parties involved in the agreement.

What additional tools and support does pdfFiller offer?

pdfFiller not only provides a comprehensive Personal Car Loan Contract Template but also offers a range of additional templates. Their platform includes guides on related forms and agreements, making it easier for users to manage all their documentation needs in one place.

-

A collection of additional templates for various financing agreements is readily available for users.

-

Thorough guides assist in navigating through different types of forms.

-

Reach out for assistance to clarify any doubts regarding your loan agreement.

How to fill out the Personal Car Loan Contract Template

-

1.Open the Personal Car Loan Contract Template in pdfFiller.

-

2.Review the pre-filled personal information section and ensure accuracy. If it's an initial download, fill in your full name, address, and contact information.

-

3.Locate the loan amount field and input the total amount you wish to borrow for purchasing your car.

-

4.Fill in the interest rate, ensuring it reflects the agreed-upon rate with your lender.

-

5.Specify the loan term, detailing how many months or years you have to repay the loan.

-

6.Complete the vehicle information section by entering the car’s make, model, year, and VIN (Vehicle Identification Number).

-

7.Indicate your payment schedule, including the payment frequency (e.g., weekly, biweekly, monthly).

-

8.Review all fields for completeness and accuracy to avoid future disputes.

-

9.Add any additional clauses or amendments if necessary, confirming they align with both parties' agreements.

-

10.Finally, save your completed document and follow the e-signature instructions to finalize the contract.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.