Personal Lend Contract Template free printable template

Show details

This Agreement outlines the terms and conditions under which a lender provides funds to a borrower for personal use, including repayment obligations.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Personal Lend Contract Template

A Personal Lend Contract Template is a legal document that outlines the terms and conditions under which one party lends money to another.

pdfFiller scores top ratings on review platforms

It works very well. I just don't use it enough to justify the monthly charge.

I like it. My PDFs look so much better and are readable.

its difficult sending multiple fax at once.

It has been a real lifesaver for signing contracts remotely and for growing my business!

would be a 5 star if you could line up what you want to replace easie

Works well in completing the necessary forms I need in my business.

Who needs Personal Lend Contract Template?

Explore how professionals across industries use pdfFiller.

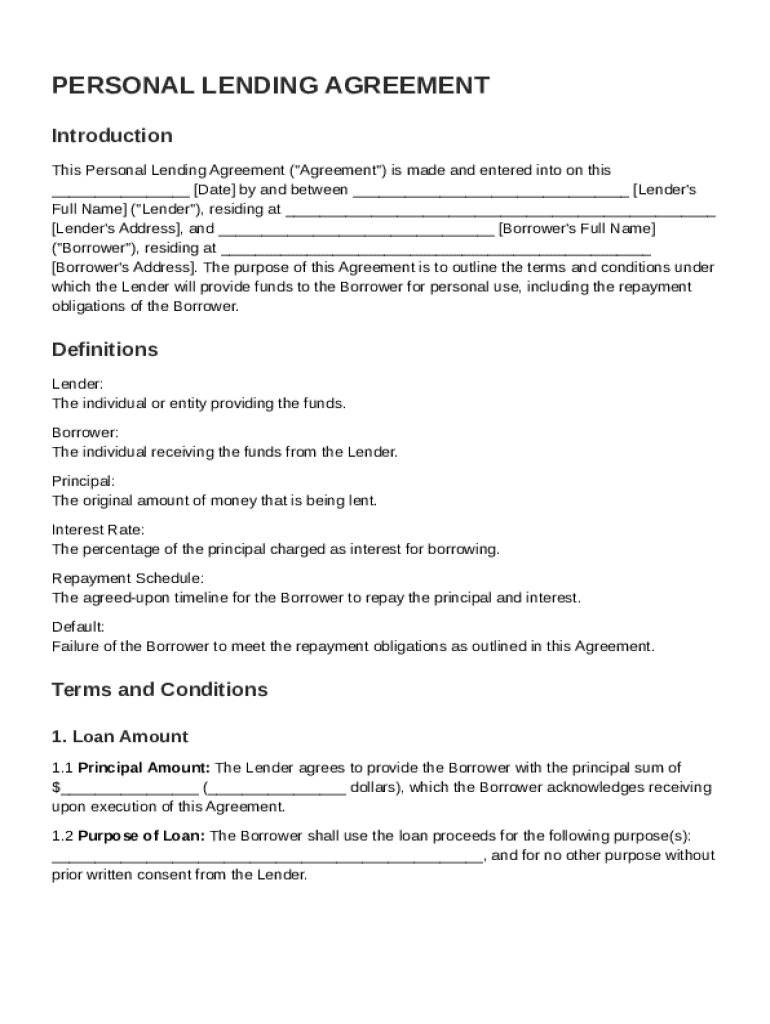

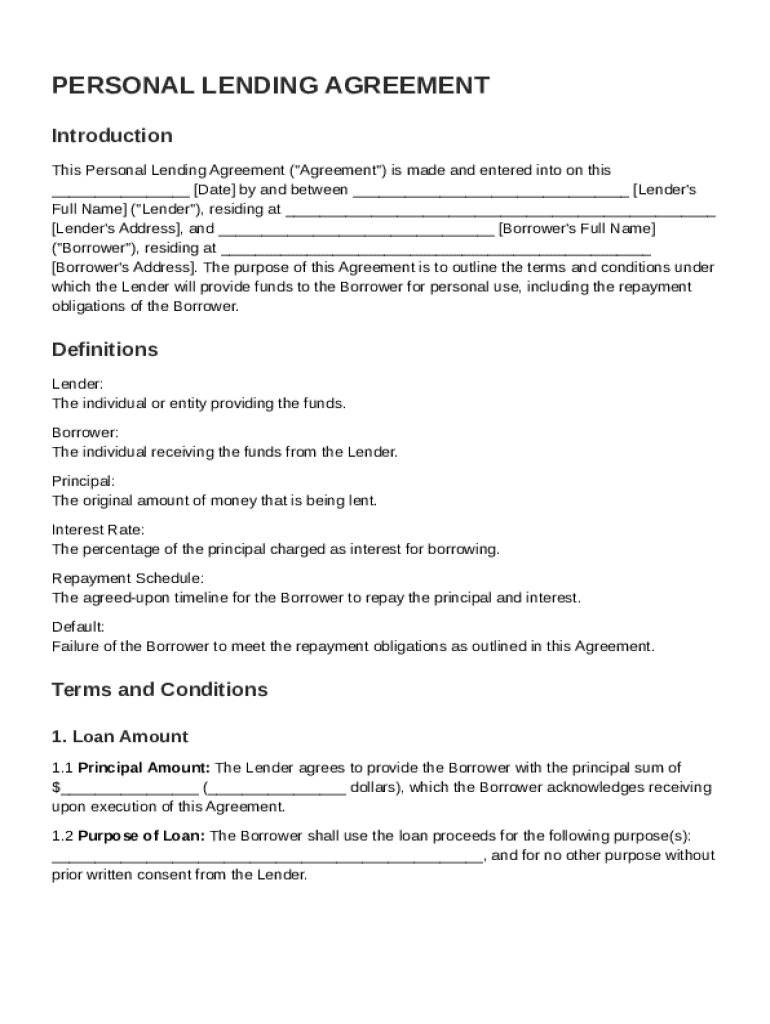

Personal Lending Agreement Form Guide

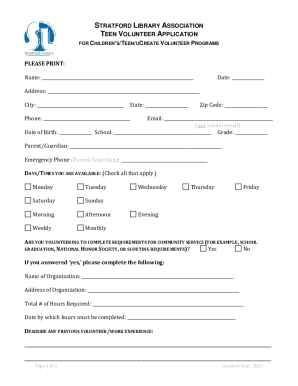

How to fill out a Personal Lend Contract Template form

To fill out a Personal Lending Agreement form, start by accurately entering the date and the names of both the lender and the borrower at the top of the form. Specify the loan amount as well as the purpose for the loan. Clearly outline the interest rate and repayment terms, and ensure both parties sign the agreement.

Understanding personal lending agreements

A personal lending agreement is a legal document that outlines the terms under which a lender provides money to a borrower. These agreements help solidify the understanding of repayment terms, including the loan amount, interest rate, and payment schedule. It is essential for protecting both parties in case of disputes.

-

It's a contract between an individual lender and borrower specifying loan conditions.

-

Personal loans are often used for debt consolidation, medical expenses, or home improvements.

-

Formalizing loans with a written agreement can prevent misunderstandings and protect legal rights.

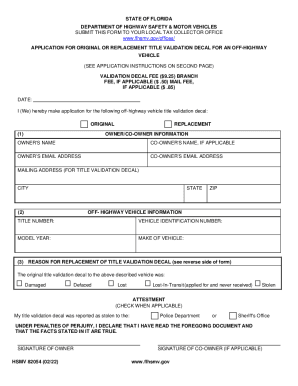

What are the key components of a personal lending agreement?

A well-structured personal lending agreement includes several critical components that need to be addressed clearly. These components ensure that both parties have a mutual understanding of their obligations.

-

Clearly state the full names and contact information of both parties.

-

Specify the total loan amount and detail what the funds will be used for.

-

Define the interest rate and the methods available for payment, including due dates.

What is the detailed structure of the personal lending agreement?

In order to ensure clarity and enforceability, personal lending agreements should be structured logically. This includes the necessary terms and conditions laid out in a straightforward manner.

-

Include the effective date of the agreement and have all involved parties sign to validate it.

-

Clearly indicate what is considered 'principal' and detail any applicable interest rate.

-

Outline the payment schedule, including how often and when payments are expected.

How can you fill out the personal lending agreement?

Filling out the personal lending agreement accurately is crucial to uphold its validity. This process requires attention to detail and a clear understanding of what each section requires.

-

Follow clear instructions for completing each part of the form to avoid errors.

-

Double-check details like names, amounts, and dates to prevent misunderstandings.

-

Take advantage of pdfFiller's tools to easily fill and edit your agreement.

What legal considerations and compliance issues should you be aware of?

Navigating the legal landscape of personal loans requires knowledge of local laws and regulations. Ensuring compliance is essential for the validity and enforcement of the lending agreement.

-

Clarify the repercussions of failing to repay the loan as agreed.

-

Familiarize yourself with the specific lending regulations applicable in your region.

-

Make sure your lending agreement complies with local legal requirements.

How can you manage your personal loan agreement with pdfFiller?

Using pdfFiller’s features facilitates seamless management of your personal lending agreement. From storing documents to ensuring secure e-signatures, pdfFiller provides a range of tools to enhance efficiency and collaboration.

-

Utilize cloud storage options for easy access to your documents from anywhere.

-

Make use of real-time collaboration tools for effective communication between parties.

-

Follow secure processes to eSign your documents, ensuring authenticity.

What are the post-agreement steps and management best practices?

After the agreement is signed, managing the loan effectively is vital for maintaining financial health. This includes tracking payments and being proactive about communication.

-

Keep a record of payments made and outstanding balances for clear financial tracking.

-

Understand the necessary steps to take if repayment becomes an issue.

-

Maintain open lines of communication to address any concerns promptly.

How to fill out the Personal Lend Contract Template

-

1.Download the Personal Lend Contract Template from pdfFiller.

-

2.Open the template using pdfFiller's editing interface.

-

3.Fill in the date of the agreement at the top of the document.

-

4.Enter the full names and addresses of both the lender and the borrower.

-

5.Specify the loan amount clearly.

-

6.Outline the interest rate, if applicable, and any payment deadlines.

-

7.Detail the repayment schedule, including dates and amounts.

-

8.Include any additional terms or conditions relevant to the loan.

-

9.Review all filled information for accuracy and completeness.

-

10.Save the completed contract and consider printing for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.