Personal Loan Between Family Contract Template free printable template

Show details

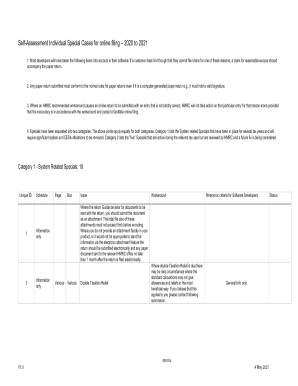

This document outlines the terms and conditions for a personal loan between family members, detailing the loan amount, interest rate, repayment terms, and remedies for default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Personal Loan Between Family Contract Template

A Personal Loan Between Family Contract Template is a legal document that formalizes a loan agreement between family members, outlining terms and conditions.

pdfFiller scores top ratings on review platforms

So far it has been great!! Easy to use, final products looks very clean & professional

This is one of the most simply programs to learn.

Too easy to get into FONT setup and not get out and return to font specified in document. I only wanted to get the lowest priced version, not discontinue.

I found this program very user friendly. I am grateful for being able to do my tax forms and get all the information I need on this site. I would highly recommend it to anyone trying to make since of tax forms.

PDFFiller is a great tool . I would like to learn how to navigate through the site. Thanks.

It was a life saver! I have a fractured right wrist & this made my job a lot easier.

Who needs Personal Loan Between Family Contract Template?

Explore how professionals across industries use pdfFiller.

How to create a personal loan between family members contract

What are personal loans between family members?

A personal loan between family members can be defined as a financial agreement where one family member lends money to another. This arrangement can often be more flexible than traditional bank loans, offering lower interest rates and more personalized repayment terms. Understanding this type of agreement is crucial for ensuring that relationships are maintained and financial transactions are documented appropriately.

Why choose family loans over traditional options?

-

Family loans often come with more flexible repayment terms, tailored to the borrower’s financial situation.

-

Interest rates are typically lower than those offered by financial institutions, reducing overall loan expenses.

-

Borrowers may feel more comfortable discussing financial hardships with family members compared to banks.

Why is a written agreement necessary?

Having a written agreement when lending or borrowing money within family is essential to avoid misunderstandings and conflicts. This document serves as a formal record that outlines the terms agreed upon by both parties, creating a level of accountability and trust. A well-defined family loan agreement can help maintain positive relationships, ensuring both lender and borrower are aware of their rights and responsibilities.

What are the key components of a personal loan agreement?

-

This section should state the purpose of the loan and basic details about the involved parties.

-

Clearly define terms such as Lender, Borrower, Loan Amount, Interest Rate, Repayment Period, and Default to avoid confusion.

-

Ensure every term is explicitly defined to facilitate transparency throughout the loan duration.

How to fill out the lender and borrower details?

Accurately completing the Lender and Borrower sections of the agreement is fundamental. Each party’s legal name, address, and contact information should be included to ensure both parties can be easily reached. This helps to establish clear accountability and ensures legal acknowledgment should any disputes arise.

What factors are involved in calculating the loan amount and setting the interest rate?

-

Determine how much money is being borrowed. Make sure this amount is reasonable and agreed upon by both parties.

-

Choose an interest rate that reflects current market rates but also considers familial circumstances, potentially offering lower rates than banks.

-

Define clear repayment terms, including the frequency of payments (monthly, bi-weekly) and payment methods accepted.

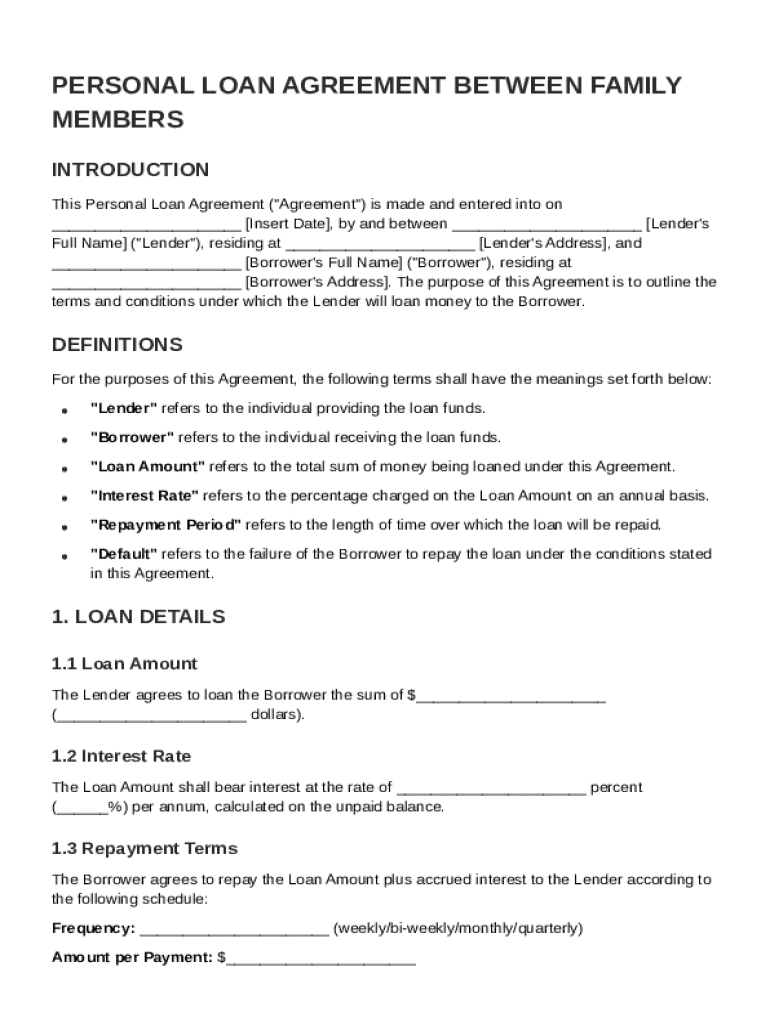

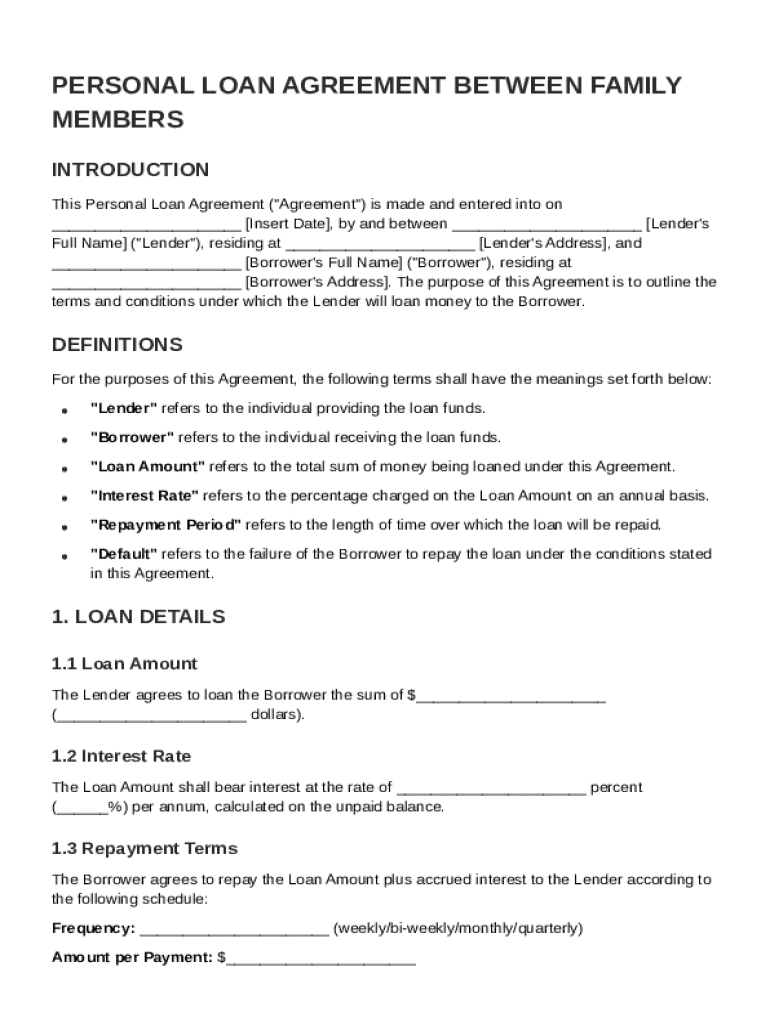

What does a sample personal loan agreement look like?

A sample personal loan agreement provides a clear structure to follow. It includes sections for Loan Amount, Interest Rate, Repayment Schedule, and terms associated with late payments. By reviewing examples of filled-out fields, borrowers can better understand expectations, making it easier to replicate when drafting their own agreement.

Why should you consider a family loan agreement?

Utilizing a family loan agreement can significantly enhance communication and trust between family members involved in the transaction. This formal documentation serves as a protective measure, benefiting both the lender and borrower, resulting in a more professional handling of personal finances. Furthermore, using a template can ease the process, ensuring all necessary elements are included.

What should you know about prepayment and late payment terms?

-

Define the rights for pre-payment without penalties to encourage borrowers to pay off loans early if possible.

-

Clearly state what constitutes a late payment to avoid ambiguity, setting expectations for both parties.

-

Outline available options for addressing late payments, such as grace periods or additional fees, thus reducing potential conflict.

How to manage and maintain your family loan agreement effectively?

Effective management of your family loan agreement is crucial for maintaining good relationships. Regular communication about loan statuses, potential changes, and any issues should be held between the lender and borrower. Additionally, using tools such as pdfFiller can simplify managing your agreement, allowing for easy edits, electronic signing, and collaboration while keeping track of all changes.

Why is making family loans formal important?

Formalizing family loans enhances legitimacy and trust, which is essential for maintaining familial relationships. It’s important that documentation not only safeguards the interests of both parties but also preserves family harmony. Encouraging the use of templates, such as those available on pdfFiller, can further streamline this process, helping maintain clarity and structure in lending.

How to fill out the Personal Loan Between Family Contract Template

-

1.Open the Personal Loan Between Family Contract Template on pdfFiller.

-

2.Begin by entering the names and contact information of both the lender and the borrower at the top of the document.

-

3.Specify the loan amount in the designated field to clearly outline how much is being borrowed.

-

4.Fill in the interest rate, ensuring it complies with any legal requirements for personal loans.

-

5.Set the repayment schedule, including due dates and payment frequency (weekly, monthly, etc.).

-

6.Include any terms regarding late fees or prepayment penalties if applicable.

-

7.Add a section for signatures, ensuring both parties can acknowledge and agree to the terms laid out in the contract.

-

8.Review the completed contract for accuracy and clarity, checking that all necessary fields are filled.

-

9.Finalize the document by printing and signing it in the presence of any witnesses if required.

-

10.Keep a copy for both the lender and borrower for future reference.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.