Personal Loan Between Friends Contract Template free printable template

Show details

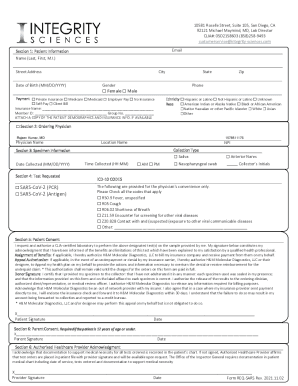

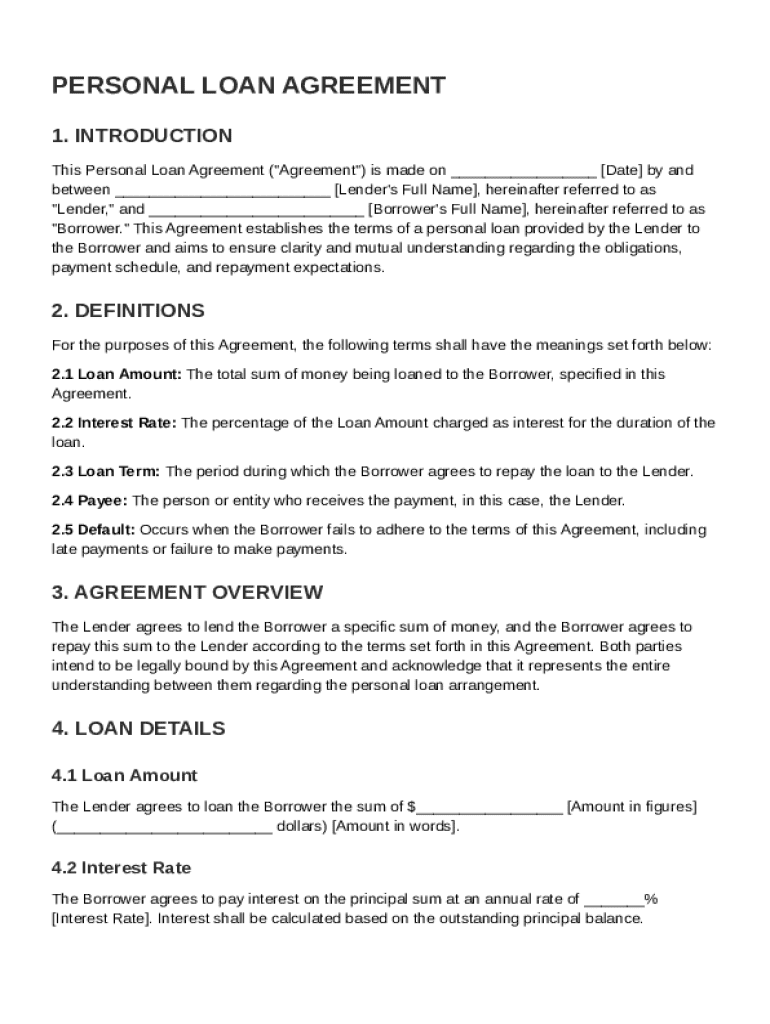

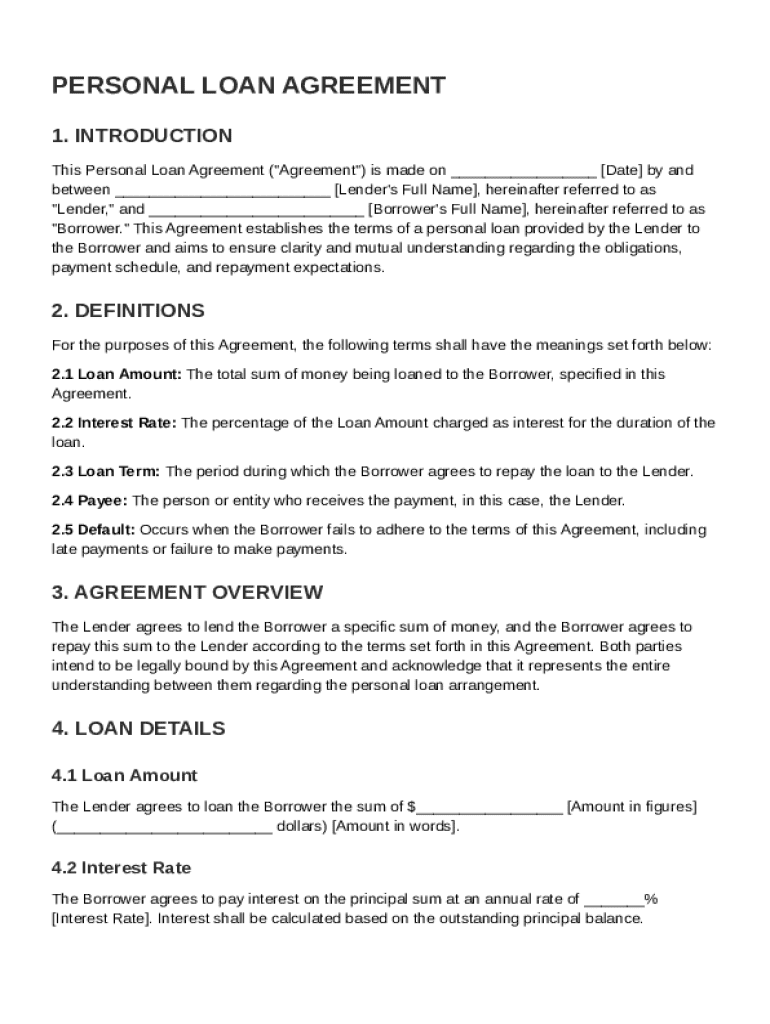

This document outlines the terms and conditions of a personal loan between a lender and a borrower, detailing the loan amount, interest rate, repayment terms, and conditions for default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Personal Loan Between Friends Contract Template

A Personal Loan Between Friends Contract Template is a written agreement outlining the terms and conditions of a loan provided by one friend to another.

pdfFiller scores top ratings on review platforms

Learning as I go.

Very good support and appreciate the…

Very good support and appreciate the demonstration too, Thank you.

I was a little difficult to select and…

I was a little difficult to select and move around the program to start

Amazing platform

Amazing platform, so easy to use

the software was efficient

penis

penis penis penis penis

Who needs Personal Loan Between Friends Contract Template?

Explore how professionals across industries use pdfFiller.

Personal Loan Between Friends Contract Template form

Navigating finances with friends can be tricky but rewarding, particularly through a personal loan between friends contract template form. This document not only facilitates the borrowing process but also sets clear expectations, ensuring the friendship remains intact.

What is a personal loan between friends?

A personal loan between friends is an informal agreement where one friend lends money to another, typically outside the traditional banking system. This arrangement can offer flexible terms that cater to both parties, fostering a sense of trust and direct communication.

-

This arrangement often comes with lower or no interest rates, flexible repayment terms, and a more relaxed approval process compared to banks.

-

However, such loans can lead to strained relationships if not managed properly, including issues related to repayment and expectations.

-

Unlike standard bank loans, personal loans between friends usually lack formal credit checks or documented interest rates.

What are the essential components of a personal loan agreement?

-

Clearly state the total loan amount to avoid misunderstandings later.

-

Specify whether interest will be charged and how to calculate it, ensuring transparency.

-

Outline the duration for repayment, as well as any implications of early repayment or late fees.

-

Specify what constitutes default on the agreement and the actions that may follow.

How do you create your personal loan agreement?

-

Fill in the lender's and borrower's personal details, ensuring all information is accurate.

-

Specify key loan details such as amount, interest rates, and repayment terms.

-

Agree on payment methods and schedules to ensure clarity on when repayments are due.

-

Include any mutually agreed-upon terms to accommodate particular needs.

Where can you find a personal loan agreement template?

Accessing templates online can simplify the process of creating a personal loan agreement. A reliable source is pdfFiller, which offers customizable templates suitable for this purpose.

-

pdfFiller provides a user-friendly platform to find templates, easily edit, and store them securely.

-

You can personalize online templates to fit your specific requirements and the nature of your loan.

-

Comparing various templates helps you find one that aligns best with your agreement's complexity.

How do you manage and edit your personal loan document?

-

Utilize pdfFiller's tools to revise the loan agreement efficiently.

-

Ensure to eSign the agreement legally, making it binding for both parties.

-

Engage any third parties if necessary by sharing and collaborating on the document.

What are the legal considerations for personal loans?

-

Understand that your agreement is legally binding, providing rights to both lender and borrower.

-

Identify where disputes will be addressed, which is essential for resolving issues should they arise.

-

Ensure your agreement complies with local laws governing personal loans, which vary by region.

What are examples of personal loan agreements?

-

Review sample agreements to understand commonly accepted terms and structures.

-

Explore examples of how personal loans between friends worked out in different situations.

-

Study success and challenges faced by others to guide your own loan arrangement.

In summary, drafting a personal loan between friends contract template form can provide clarity and structure, preventing misunderstandings down the line. By following the outlined steps and utilizing resources like pdfFiller, you ensure that both parties have a fair and clear agreement.

How to fill out the Personal Loan Between Friends Contract Template

-

1.Start by downloading the Personal Loan Between Friends Contract Template from pdfFiller.

-

2.Open the template in pdfFiller's editor to begin customizing it.

-

3.Enter the full names and contact information of both the lender and borrower at the top of the document.

-

4.Specify the loan amount in clear terms, ensuring both parties understand the figure.

-

5.Outline the interest rate, if applicable, indicating whether it’s zero or a fixed percentage.

-

6.Define the loan repayment schedule, detailing the amount and frequency of payments.

-

7.Include any late fees or penalties for missed payments to clarify expectations.

-

8.State the purpose of the loan, if pertinent, to reinforce the agreement's context.

-

9.Ensure both parties read through the entire document for understanding and accuracy.

-

10.Finally, both the lender and borrower should sign and date the contract to make it legally binding.

How do I write a personal loan agreement between friends?

Comments Section The amount loaned When and how you expect payment What happens if he does not pay (and when it happens) What the loan is for (generally) Signed and dated by both of you, with copies for both of you

How do I document a loan to a friend?

If you are issuing a loan to a family member or friend, here are several steps you should take to document them: Draft a Promissory Note. Document the Payment Schedule. File and Record Keeping. Understand the Annual Gift Tax Exclusion. Update Your Estate Planning Documents.

Can I make a personal loan to a friend?

According to Publication 550, one can make a personal loan to a friend or family member and not have to charge interest if the loan is $10k or less…

Can a friend give me a personal loan?

To regulate personal loans from friends and relatives, the government has made certain rules and regulations, and also implemented various restrictions. They are as follows: The first restriction is one cannot accept a loan exceeding a limit of Rs 20000 in cash or by bearer cheque.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.