Personal Loan Repayment Contract Template free printable template

Show details

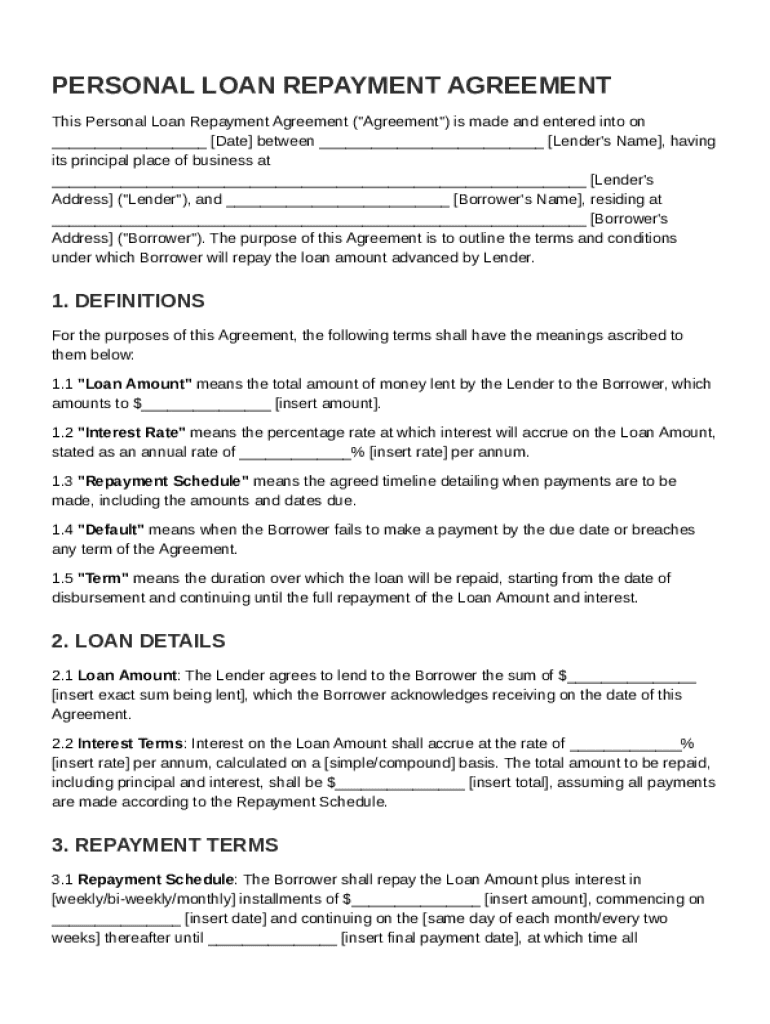

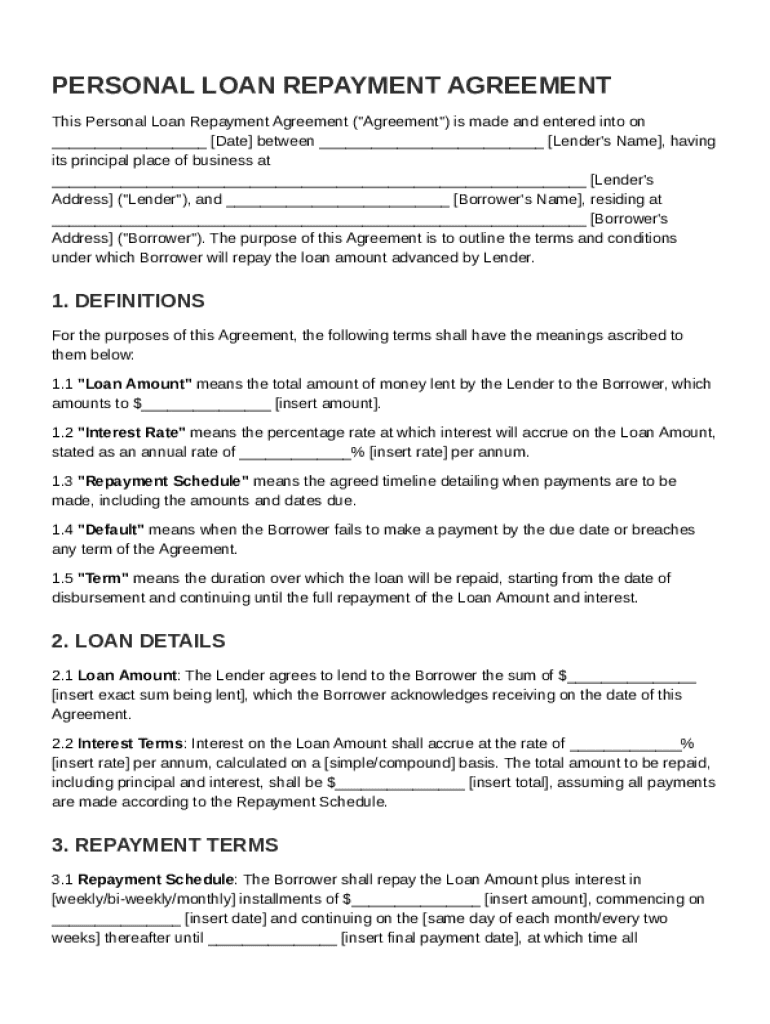

This document outlines the terms and conditions under which a borrower agrees to repay a loan amount advanced by a lender. It includes definitions, loan details, repayment terms, provisions for late

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Personal Loan Repayment Contract Template

A Personal Loan Repayment Contract Template is a formal document outlining the terms and conditions under which a borrower agrees to repay a personal loan to a lender.

pdfFiller scores top ratings on review platforms

Easy to use with a comprehensive set of features for viewing, creating, and editing PDF’s.

Very easy to edit and add a few things, well worth the cost.

Great templates, easy to use. Worth the value

IRS changed the 1099 misc form

IRS changed the 1099 misc form, so I had to find an alternative access to the 1099 misc form that showed non employee compensation. The 1099 NEC form was the form I needed. A new bokkeeper will handlethis from now on. Thank you

EXCELLENT

good

Who needs Personal Loan Repayment Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to personal loan repayment contract template

What is a personal loan repayment agreement?

A personal loan repayment agreement is a formal contract between a lender and a borrower that outlines the terms of a loan, detailing how and when payments are to be made. Having a well-structured contract is essential as it serves to protect the interests of both parties, ensuring clarity and accountability.

Why is having a contract for loan repayments important?

A repayment contract provides legal protection and clarifies the responsibilities of both the lender and borrower. It minimizes misunderstandings regarding payment schedules, interest rates, and terms in case of disputes.

The role of lender and borrower in the agreement

The lender is responsible for providing the loan and receiving timely payments, while the borrower is obligated to make repayments according to the specified terms. Both parties must adhere to the contract to avoid penalties or legal consequences.

What are the key components of a personal loan repayment agreement?

Essential components of the agreement include the loan amount, interest rate, repayment schedule, and terms regarding default. All these elements must be clearly defined to ensure both parties understand their obligations.

What essential terms and definitions should be included?

-

This is the total sum of money being borrowed, which should be clearly stated.

-

The cost of borrowing, often expressed as a percentage of the loan amount.

-

The timeline for repayments, including due dates and amounts.

How do accurately fill out my personal loan repayment contract?

Filling out a personal loan repayment contract involves accurately stating the lender and borrower information, specifying the loan amount, and outlining the repayment schedule. Attention to detail is crucial in this process to prevent potential disputes later on.

What steps should follow to fill in the contract information?

-

Collect personal information for the lender and borrower, including names and contact details.

-

Clearly write down the total loan amount and the applicable interest rate.

-

Outline the payment amounts and due dates to ensure clarity and avoid confusion.

How to calculate loan repayment amounts?

Calculating loan repayment amounts involves determining the total interest due along with the principal. Different repayment structures, such as fixed or flexible payments, can lead to varying total repayment obligations.

What methods are used to calculate interest on the loan?

-

Calculated only on the principal amount for a given period.

-

Calculated on the principal and on accumulated interest, leading to a higher total over time.

How can manage my loan agreement with pdfFiller?

pdfFiller allows users to edit, sign, and collaborate on loan documents seamlessly. With its cloud-based platform, you can access your personal loan repayment agreement anywhere and manage it effectively.

What features does pdfFiller offer for loan management?

-

Easily modify any part of the loan repayment agreement using intuitive editing tools.

-

Quickly add electronic signatures to finalize contracts securely.

-

Share documents with team members for collaborative editing and review.

What common mistakes should avoid in loan agreements?

Common pitfalls include failing to specify essential terms such as interest rates or payment dates. Additionally, not keeping accurate records of payments can lead to disputes, and ignoring default clauses can have serious repercussions.

How can ensure compliance with loan agreement legal considerations?

It's crucial to understand the legal regulations surrounding personal loans in your region. Violating terms can lead to financial penalties, and being aware of these consequences can help protect both parties.

What are some examples of personal loan repayment agreements?

Sample templates for different loan amounts can provide insight into how to structure your own agreement. These templates can also vary according to borrower profiles and specific needs.

What next steps should take after creating my loan agreement?

-

Review all details for accuracy before both parties sign.

-

Store loan agreements securely in a digital format using pdfFiller for easy access.

-

Track payments and manage the agreement using tools available on pdfFiller.

How to fill out the Personal Loan Repayment Contract Template

-

1.Open the Personal Loan Repayment Contract Template in pdfFiller.

-

2.Begin by entering the date of the agreement at the top of the document.

-

3.Fill in the full names and addresses of both the lender and borrower in the designated fields.

-

4.Specify the loan amount in both numerical and written form to avoid discrepancies.

-

5.Detail the interest rate, including whether it is fixed or variable, and how it will be calculated.

-

6.Outline repayment terms, including the schedule (monthly, quarterly) and due dates for payments.

-

7.Indicate any late fees or penalties for missed payments in clear language.

-

8.Include a section for additional terms, such as collateral or conditions for early repayment.

-

9.Review the entire document for accuracy and clarity before finalizing.

-

10.Save the completed document and consider printing it for both parties to sign.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.