Personal Money Loan Contract Template free printable template

Show details

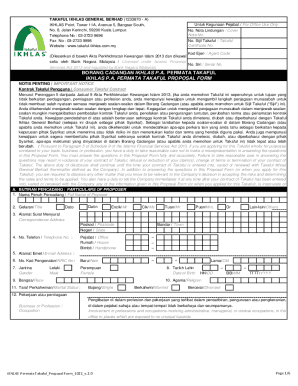

This document is a loan agreement between a lender and a borrower, outlining the terms and conditions of the loan, including repayment terms, interest rates, and parties\' obligations.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

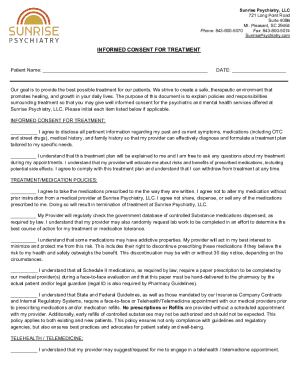

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Personal Money Loan Contract Template

A Personal Money Loan Contract Template is a formal agreement outlining the terms of a loan between an individual lender and borrower.

pdfFiller scores top ratings on review platforms

Mostly good with limited experience. I would recommend.

I love it. I don't have to fill out in writing or typing.

Very helpful. Like that it keeps forms neat and professional. Love the search option.

It's pretty easy to use and I like the options of e-mailing, faxing & printing.

It worked as advertized. When I had a problem, the staff helped me out.

fairly easy to navigate and love the database of available forms

Who needs Personal Money Loan Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Personal Money Loan Contract Template

How to fill out a Personal Money Loan Contract Template form

To fill out a Personal Money Loan Contract Template form, begin by gathering the necessary information from both the lender and the borrower. Clearly specify the loan details such as the amount, interest rate, and repayment term. Make sure to read through all terms and conditions, and then insert the required signatures to finalize the agreement.

What are personal money loan agreements?

Personal money loan agreements are legally binding documents outlining the terms under which one party lends money to another. They specify various details including the loan amount, interest rate, repayment schedule, and any applicable fees. The primary purpose is to provide clarity and legal protection for both the lender and borrower.

-

This agreement serves to outline the loan's terms, protecting both parties in case of disputes.

-

The lender provides the funds, while the borrower receives them and agrees to repay under specified terms.

-

A written contract reduces misunderstandings and provides a legal reference point if disputes arise.

What are the core components of the agreement?

A Personal Money Loan Contract Template includes several vital components that dictate the terms of the loan and the responsibilities of each party involved. Understanding these components helps in evaluating how they affect the overall agreement.

-

This is the total amount of money that the lender provides to the borrower, which is crucial as it determines the entire scope of the agreement.

-

The cost of borrowing expressed as a percentage of the loan amount, influencing the total repayment cost over time.

-

This is the duration over which the loan is to be repaid, impacting the monthly payment amount.

-

Specifies when payments are required, ensuring that both parties understand their obligations.

-

Details any penalties for late payments, which encourages timely repayment and maintains the lender's interests.

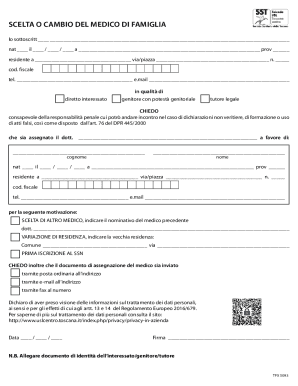

How do you fill out your loan agreement?

Filling out a loan agreement requires meticulous attention to detail to avoid errors and ensure legality. Begin with filling in the necessary information about the lender and borrower, and proceed to specify the loan details.

-

Input each party's full name, contact information, and details about their identities to establish clarity.

-

Clearly state the amount being loaned, the agreed interest rate, and the duration of the loan to ensure both parties have identical expectations.

-

Outline how and when payments will be made, which helps prevent missed payments and ensures both parties are on the same page.

How does PDFfiller assist in creating and managing the agreement?

PDFfiller streamlines the process of creating and managing your loan agreement by providing user-friendly tools for editing and collaboration. Users can upload templates, make necessary edits, and securely sign documents.

-

Users can simply upload their Personal Money Loan Contract Template and modify it as necessary, making for a hassle-free creation process.

-

The platform allows multiple users to sign and collaborate in real-time, ensuring efficient document flow and reducing delays.

-

All documents can be securely stored on PDFfiller, providing easy access and peace of mind regarding data integrity.

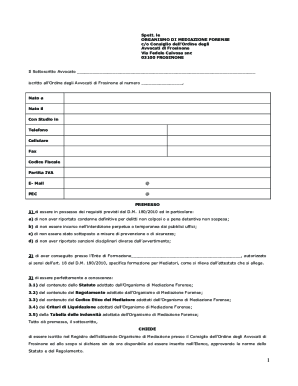

What are the compliance and legal considerations?

Navigating the legal landscape surrounding personal money loans is crucial for both lender and borrower. Compliance with local laws ensures that the agreement is enforceable and protects both parties.

-

Familiarize yourself with state or regional regulations affecting personal loans, as these can vary significantly.

-

Different jurisdictions may have unique requirements, making it essential to consult a legal professional to ensure compliance.

-

To maintain legality, ensure that all terms are clearly outlined and both parties have signed without any coercion.

What common mistakes should be avoided in loan agreements?

Errors in a loan agreement can have serious legal repercussions. Understanding the common mistakes can help you to avoid them and create a robust contract.

-

Ensure all fields are filled out correctly, as omissions can lead to misunderstandings and disputes.

-

Clear communication is vital as misinterpretations may hinder the lender-borrower relationship.

-

Before finalizing the document, review all details carefully, and consider seeking a third-party review for added assurance.

How can you adapt to changes in your agreement?

Life circumstances often change, and adjusting your loan agreement can be necessary to reflect new realities. Understanding how to make legal amendments can save you troubles down the line.

-

Look out for changes in financial status or market conditions that affect the terms of your contract.

-

Utilize PDFfiller's features to easily amend documents, ensuring that previous terms are correctly updated.

-

Bear in mind that alterations to the agreement may necessitate re-signing by both parties to maintain legal integrity.

What are the final thoughts on personal money loan agreements?

The importance of a clear and legally sound Personal Money Loan Contract Template cannot be understated. By prioritizing accuracy and communication, both parties can manage the loan agreement proactively.

-

Clear terms ensure that both parties are on the same page, reducing the likelihood of disputes.

-

Regular reviews and updates of the agreement encourage responsible financial conduct.

-

Stay informed on legal requirements and consider periodic evaluations of your contract.

How to fill out the Personal Money Loan Contract Template

-

1.Download the Personal Money Loan Contract Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Fill in the lender's full name and address at the specified section.

-

4.Enter the borrower's full name and address accurately.

-

5.Specify the loan amount in both numeric and written form.

-

6.Detail the interest rate, if applicable, and payment terms clearly.

-

7.Set the loan term (duration) including start and end dates.

-

8.Outline the repayment schedule (monthly, weekly, etc.).

-

9.Include any collateral or security details, if required.

-

10.Ensure all parties understand the terms and conditions stated in the contract.

-

11.Review the contract for accuracy and completeness before saving.

-

12.Finally, save the document and have both parties sign the contract for validation.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.