Private Lend Contract Template free printable template

Show details

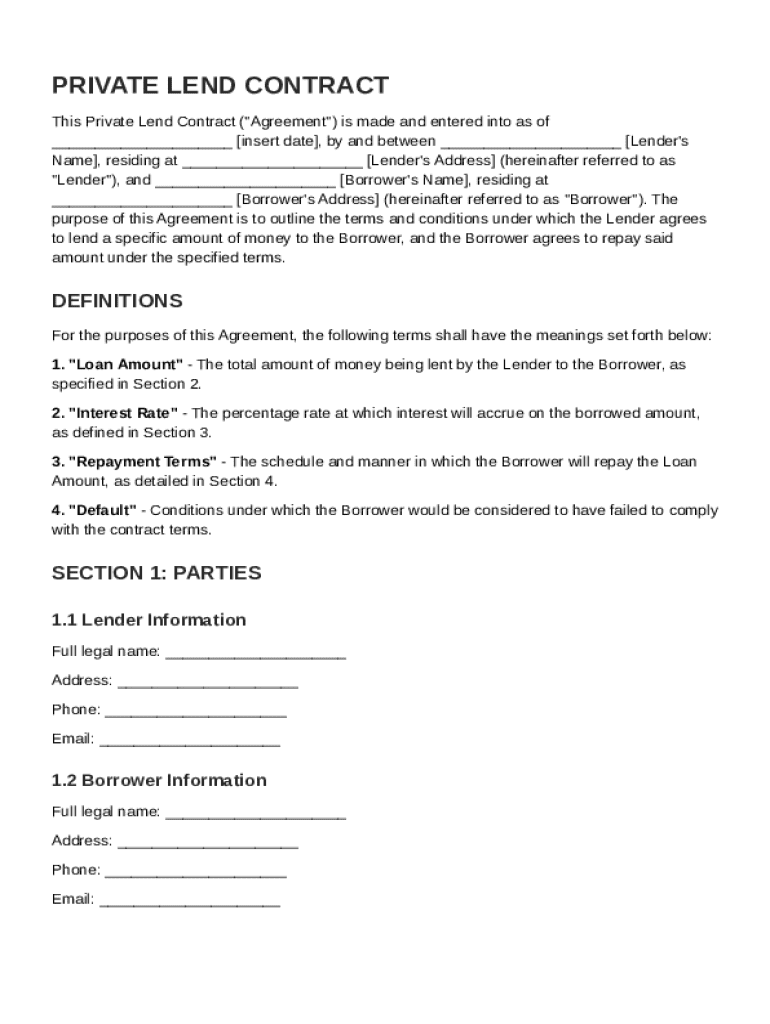

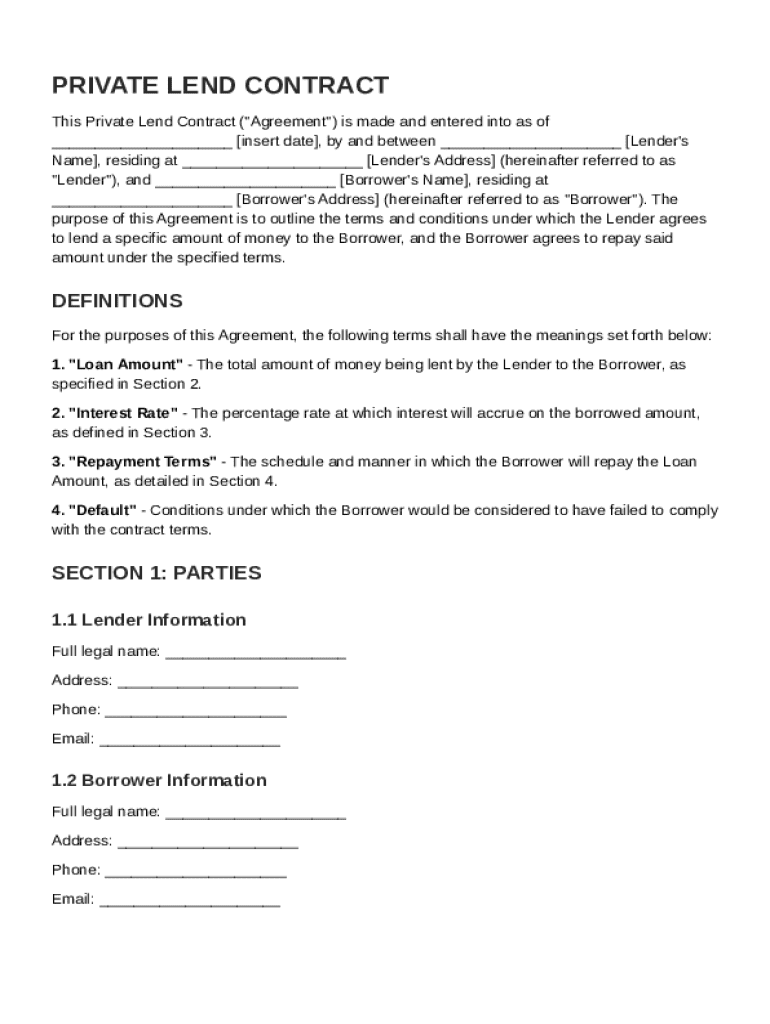

This document outlines the terms and conditions for a private lending arrangement between a lender and a borrower, detailing loan amount, interest rate, repayment terms, and default provisions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

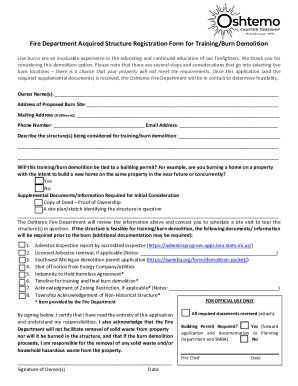

What is Private Lend Contract Template

A Private Lend Contract Template is a legal document that outlines the terms and conditions under which a loan is made between private parties.

pdfFiller scores top ratings on review platforms

I could not expand the fill-in area when there isn't enough space.

Millions od forms, but sometimes difficult to find.

Easy to use and excellent customer service.

PDFfiller was intuitively simple to use in creating an important document. I had difficulty erasing some text I accidentally superimposed onto my document and the recipient who ultimately got the PDF I created could not open it. Also disappointing was the fact that I didn't realize I had to pay a tidy subscription price until after I completed my document and tried to send it off (and save it). That all led to an initially horrible review.

But, I have to say that my experience with PDFfiller and Elie, the rep I dealt with, revised my entire experience. Not only did Elie help resolve the problems in a very timely fashion, I received a refund! PDFfiller seems dedicated to provide the user an efficient product and the customer service is the best I've seen with any internet-based business. Elie is a great ambassador for the business and she really follows through with her promises! I never expected that. They are also going to revise some aspects of the user interface to ensure proper notice of expense and conditions of subscription. I will certainly use PDFfiller in the future!

So far, so good. Just starting, but I like it so far.

Day one using has been great! The only thing is you can't just bold what you want, you have to bold the whole line.

Who needs Private Lend Contract Template?

Explore how professionals across industries use pdfFiller.

Private Lend Contract Template Guide on pdfFiller

How to fill out a Private Lend Contract Template form

Filling out a Private Lend Contract Template requires careful attention to detail. Start by clearly identifying the lender and borrower, outlining the loan amount and interest rate, and specifying repayment terms. Use pdfFiller's interactive tools to input details effectively while ensuring compliance with legal standards.

Understanding the essentials of a Private Lend Contract

A Private Lend Contract is crucial for both personal and business financing. This agreement formalizes the loan arrangement, ensuring both parties are clear on their obligations.

-

The contract governs the terms under which money is borrowed and lent, providing legal protections to both parties.

-

These include offer, acceptance, consideration, and intent, which validate the agreement legally.

-

Understanding the obligations and rights of each party, including potential legal consequences of default.

Navigating the Private Lend Contract Template

Using the Private Lend Contract Template simplifies the documentation process. Each section is tailored to outline essential elements clearly.

-

Key components include Parties, Loan Amount, Interest Rate, Repayment Terms, and Default Conditions.

-

Utilize pdfFiller's interactive tools to accurately include required information for both lender and borrower.

-

Ensure all information is entered correctly to meet legal standards and prevent issues down the line.

Detailing the agreement: A breakdown of key sections

Each section of the Private Lend Contract is critical to detail the arrangement effectively.

-

Clearly identify the Lender and Borrower to avoid future disputes. Include accurate contact information.

-

Specify the principal amount along with details on any additional fees that may be applicable.

-

Clarify whether the interest rate is fixed or variable while ensuring the terms are clearly defined.

-

Outline how repayments will be made, including schedule and methods.

-

Define what constitutes a breach of contract and the resulting consequences for the borrower.

Editing and signing your Private Lend Contract virtually

Using pdfFiller's platform, editing your Private Lend Contract is user-friendly and secure.

-

Follow a step-by-step guide to make necessary changes effortlessly.

-

Electronic signatures provide legal validity and are convenient for all parties involved.

-

Allow multiple parties to review and approve the document to streamline the signing process.

Understanding compliance and legal obligations

Adhering to state-specific lending regulations is crucial when drafting a Private Lend Contract.

-

Each state has unique laws governing loans that must be considered before signing.

-

Being aware of these helps in drafting contracts that are less likely to lead to disputes.

-

Leverage built-in features to ensure your documents meet local and state regulations.

Next steps: Post-agreement management

Managing the contract after it is signed is vital for both lending and borrowing parties.

-

Use pdfFiller’s management features for effective tracking of loan repayments.

-

Keep an accurate record of any renegotiations or changes to the original terms.

-

Securely manage and retrieve your contracts with ease through cloud storage solutions.

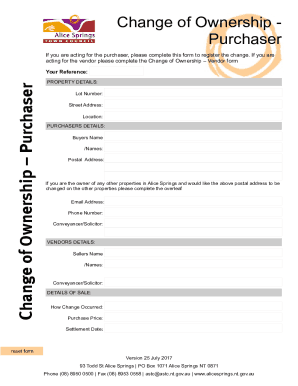

How to fill out the Private Lend Contract Template

-

1.Download the Private Lend Contract Template from pdfFiller.

-

2.Open the document in the editing interface.

-

3.Start by filling in the names and contact information for both the lender and the borrower.

-

4.Specify the loan amount clearly in the designated space.

-

5.Outline the interest rate and any fees associated with the loan in the provided fields.

-

6.Set the repayment terms, including the payment schedule, in the relevant section.

-

7.Include any collateral details if applicable, specifying the assets involved.

-

8.Review the contract for completeness and accuracy, ensuring all parties agree with the terms outlined.

-

9.Save the changes and download the completed contract, or share it directly with involved parties for signatures.

How to write a private loan agreement?

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. Date of the agreement. Interest rate. Repayment terms. Default provisions. Signatures. Choice of law. Severability.

Can I make a contract for a personal loan?

If you borrow or lend money to someone, consider writing a personal loan agreement to protect everyone involved. Even if you're exchanging money between family and friends, a personal loan agreement ensures everyone knows what the expectations of paying back the loan are upfront.

How to make a contract for a private service?

How do I write a Service Agreement? State how long the services are needed. Include the state where the work is taking place. Provide the contractor's and client's information. Describe the service being provided. Outline the compensation. State the agreement's terms. Include any additional clauses.

How do you write a private agreement?

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Describe how the contract will end. Say which laws apply and how disputes will be resolved. Include space for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.