Private Loan Contract Template free printable template

Show details

This document outlines the terms and conditions of a loan between a lender and a borrower, including details on loan amount, interest rates, repayment terms, and obligations.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

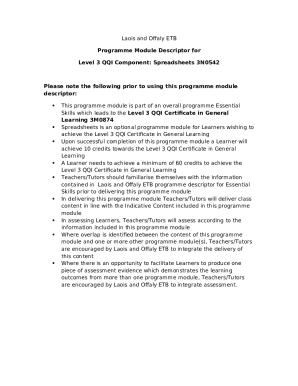

What is Private Loan Contract Template

A Private Loan Contract Template is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower.

pdfFiller scores top ratings on review platforms

pretty good, wish I knew more about the tools however I get lots done with my current knowledge

super easy love it

Great

Awesome

GOOD

So far so good

So far so good, i personally like the documents you created are saved on the main screen and I can use it without having to look up instructions.

Who needs Private Loan Contract Template?

Explore how professionals across industries use pdfFiller.

Private loan contract template guide

Creating a Private Loan Contract Template form is essential for formalizing personal loans, whether between friends, family, or organizations. This guide will help you understand the components and legal considerations required, and how to customize your agreement using tools like pdfFiller.

What is a private loan agreement?

A Private Loan Agreement is a legally binding document that outlines the terms and conditions of a loan between a lender and a borrower. It serves to protect both parties by clearly delineating responsibilities and expectations. Having this contract in writing is crucial as it reduces the risk of misunderstandings and provides a legal foundation for enforcing the terms.

-

The document serves to formalize the terms of a loan, providing clarity and legal backing.

-

Typically consists of the lender (who provides the funds) and the borrower (who receives the funds).

-

A written agreement minimizes disputes and clarifies responsibilities, making it easier to resolve issues if they arise.

What are the essential components of a private loan agreement?

An effective private loan agreement includes several vital components to ensure clarity and enforcement. These elements outline not only the amount and terms of the loan but also the expectations surrounding repayment and consequences of default.

-

Clearly specify the sum being loaned to avoid disputes over repayment. An honest conversation upfront can clarify expectations.

-

Define how interest is calculated and applied, as this significantly affects the total repayment amount.

-

Set a concrete timeline for loan repayment to help manage expectations and financial planning.

-

Outline the consequences of missed payments to protect the lender and encourage timely repayment.

-

Detail any security that may be required to back the loan, providing reassurance to the lender.

How can you break down a loan agreement?

Dissecting a private loan contract reveals the intricacies of financial arrangements. It helps both parties understand their commitments and can aid in more effective financial planning.

-

Consider providing examples and case studies that illustrate different loan amounts and circumstances.

-

Clarify the mechanisms of how funds are transferred from lender to borrower for transparency.

-

Explain various methods such as monthly, quarterly, or yearly breakdowns to help borrowers understand their obligations.

-

Craft an installment plan that considers both parties' financial situations while ensuring the loan is repaid on time.

What are the legal considerations and compliance aspects?

Navigating the legal landscape of private loans is vital to prevent future disputes and complications. Understanding local laws can save both parties from unexpected challenges.

-

Research specific to your region can clarify what is permissible regarding interest rates and loan documentation.

-

Identify common mistakes, such as informal verbal agreements, which can lead to complications later.

-

Referrals to legal professionals or resources can provide guidance tailored to your needs and situation.

How to create your private loan agreement using pdfFiller?

Creating a Private Loan Contract Template form using pdfFiller is straightforward. The platform provides customizable templates to streamline the process.

-

pdfFiller allows you to tailor your document to fit your unique situation, ensuring all necessary terms are included.

-

Easily add electronic signatures to your document for quick, secure signing by both parties.

-

Keep your agreements safe and accessible in the cloud, reducing the risk of loss or damage to physical documents.

How can you edit or modify your loan agreement?

Flexibility in loan agreements is crucial as financial situations can change. Being able to edit documents easily helps maintain a good relationship between borrower and lender.

-

The platform provides intuitive tools to help you make adjustments to existing agreements effortlessly.

-

Learn how to make changes as needed while ensuring both parties are informed.

-

Share documents securely with relevant parties for feedback or input before finalizing updates.

What are real-life scenarios for private loan agreements?

Real-life applications of private loan agreements vary widely, showcasing their utility in diverse circumstances. From personal loans to business dealings, having a formalized agreement is beneficial.

-

A clear agreement can prevent misunderstandings in personal lending situations.

-

Documenting loans within a business context solidifies trust and accountability.

-

In scenarios where collateral is needed, a well-defined agreement ensures clarity on responsibilities.

What are the next steps after creating your loan agreement?

Creating the loan agreement is merely the first step. Effective implementation involves ongoing communication and management to ensure everything proceeds smoothly.

-

Establishing clear expectations for repayments can foster a positive lending experience.

-

Regularly checking in on the repayment status can help resolve any emerging issues promptly.

-

Be open to revising the agreement if either party's situation changes, ensuring the agreement remains fair.

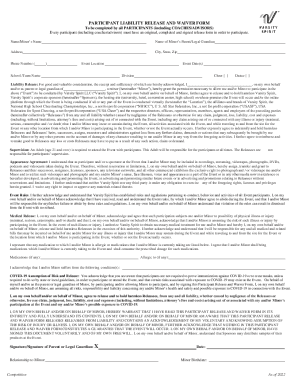

How to fill out the Private Loan Contract Template

-

1.Open the Private Loan Contract Template on pdfFiller.

-

2.Begin by entering the date of the agreement at the top of the document.

-

3.Fill in the lender's full name and contact information in the designated fields.

-

4.Next, input the borrower's full name and address accurately.

-

5.Specify the loan amount clearly in the appropriate section.

-

6.Outline the interest rate and any applicable fees associated with the loan.

-

7.Set the repayment terms, including due dates and payment frequency.

-

8.Include any collateral or security details if applicable.

-

9.Review all entered information for accuracy before proceeding.

-

10.Finally, have both parties sign the document and date it to finalize the agreement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.