Private Mortgage Contract Template free printable template

Show details

This document outlines the terms and conditions of a mortgage loan between a borrower and a lender, including loan amount, interest rate, repayment terms, and obligations of the borrower.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Private Mortgage Contract Template

A Private Mortgage Contract Template is a legal document that outlines the terms of a loan between a private lender and a borrower, including the payment schedule, interest rates, and any collateral involved.

pdfFiller scores top ratings on review platforms

What do you like best?

Ease of use and the editing tools available.

What do you dislike?

It would be great if the system would take me straight to the My Docs page at login.

What problems are you solving with the product? What benefits have you realized?

Great for needed digital signatures on contracts, etc. We also use it to edit maps we use in our business for clarity.

What do you like best?

The ability to edit almost any part of a pdf has saved me on countless hours of retyping a document for one minor change. The interface is very easy as well

What do you dislike?

The only improvement I would like to see is the ability to remove sections (cut) and move others into the opening. I may be a novice and this ability does exist, but if it does not, I personally would find it beneficial

What problems are you solving with the product? What benefits have you realized?

I am able to correct sentances, paragraphs or simply small typos. The ability to adjust those without redoing an entire document is an amazing benefit.

What do you like best?

pdfFiller is so easy to use! I can upload my documents to sign, edit, add or delete information to them.

What do you dislike?

nothing! It has helped me tremendously in my business

What problems are you solving with the product? What benefits have you realized?

I can easily make edits to existing documents. I can add signatures to letters.

What do you like best?

I love the ability to create forms from both pdfs and word documents. But the link to fill feature is my favorite. It allows persons to complete a form by simply sharing a link.

What do you dislike?

The sign now feature needs to be better developed. I need the ability for one person to complete a form and then get it signed by others before being returned to me.

What problems are you solving with the product? What benefits have you realized?

We are able to cut down on printing cost, and have been able to reduce turnover time for gathering information.

What do you like best?

It is so easy to learn how to use the app I am not strong on a computer but this made me look like a pro.

What do you dislike?

Having to answer something I have not found yet everything has worked great

Recommendations to others considering the product:

I would tell anyone looking for an pdfApp this is the best and easiest I have found to use.

What problems are you solving with the product? What benefits have you realized?

Erase and retype over words has been a great help. Its quick and Easy to use.

Used the free trial and forgot to…

Used the free trial and forgot to cancel very quick response and understanding to getting subscription cancelled If I was in the market I'd use pdfFilter

Who needs Private Mortgage Contract Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Private Mortgage Contract Template form: A Comprehensive Guide

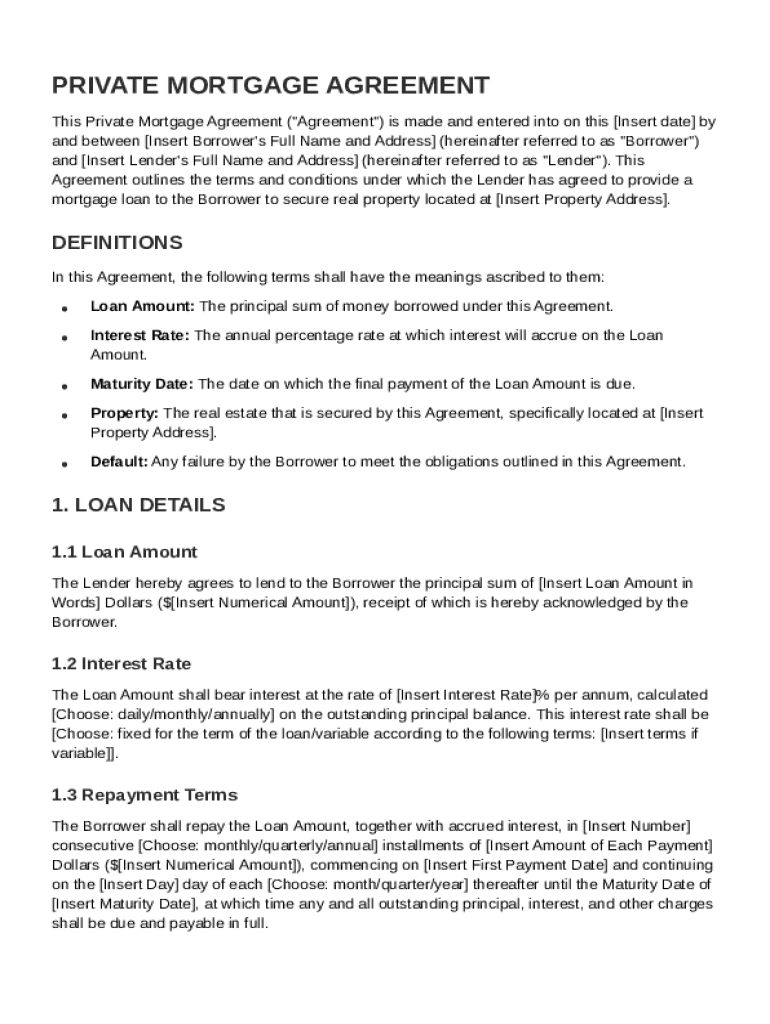

Understanding the Private Mortgage Agreement

Private Mortgage Agreements are tailored contracts that facilitate lending between individuals outside of traditional financial institutions. They are governed by various legal frameworks, which ensure that both parties' rights and obligations are clearly defined. Such agreements become necessary in scenarios where borrowers cannot obtain financing through conventional means.

-

A contract between a borrower and a private lender that sets the terms of a mortgage.

-

Private mortgages are regulated under state law, which varies by region, ensuring enforceability.

-

These agreements are crucial when traditional loan options are not available or are unfavorable.

Key Components of a Private Mortgage Agreement

A well-structured Private Mortgage Agreement covers essential details to safeguard both parties. Understanding terms such as Loan Amount, Interest Rate, and Maturity Date is vital to managing expectations. Furthermore, identifying the property secured by the loan protects the lender's interests, while clearly defined default conditions outline consequences for non-payment.

-

These terms specify how much is borrowed, the rate of interest, and when the loan must be repaid.

-

The specific property being used as collateral must be detailed to avoid disputes.

-

In the event the borrower defaults, the agreement will outline the lender's options, including foreclosure.

Detailed Breakdown of Loan Details

Filling out a Private Mortgage Contract Template correctly is crucial in preventing misunderstandings. Start by determining the loan amount based on your financial needs and capabilities. It's also important to choose an interest rate that suits both the lender’s investment strategy and the borrower’s financial situation.

-

Clearly state the loan amount, ensuring it aligns with discussed terms between lender and borrower.

-

Decide whether the interest will remain constant or fluctuate, based on financial goals.

-

Outline a payment schedule that is realistic for the borrower to adhere to and is acceptable for the lender.

-

Specify when payments will begin and when the loan will fully mature to avoid confusion.

Filling Out the Private Mortgage Contract Template

Utilizing tools like pdfFiller allows users to efficiently complete their Private Mortgage Contract Template. A step-by-step guide, along with editing and signing features, can simplify the process. Ensuring compliance with local regulations while collaboratively managing agreements is crucial for maintaining legality.

-

Follow the provided instructions to accurately fill in all required fields.

-

Leverage pdfFiller’s capabilities to streamline the process of editing and electronically signing documents.

-

Engage multiple stakeholders in the agreement process through collaboration tools.

-

Research state-specific regulations to ensure the agreement complies with applicable laws.

Managing Your Private Mortgage Agreement

Once the Private Mortgage Agreement is established, effective management is essential. Storing documents in an accessible, organized manner such as on pdfFiller enables ease of access. Utilizing electronic signing can hasten execution, and digital tracking of loan repayments facilitates better financial management.

-

Ensure all completed documents are saved in the cloud for easy retrieval.

-

Take advantage of electronic signatures to execute agreements without delays.

-

Monitor repayment schedules and outstanding balances digitally for better clarity.

-

Utilize collaborative features to keep all parties informed and engaged.

Examples and Scenarios

Several real-world scenarios can highlight the importance of a Private Mortgage Agreement. From personal loans for home purchases to financial support for investment properties, these agreements serve various purposes. Understanding these contexts can help potential borrowers assess whether to proceed with such arrangements.

-

Consider instances where traditional lending fails, requiring a personal loan approach.

-

Review stories where individuals achieved financial goals through private lending.

-

Be cautious of vague terms and conditions that could lead to misunderstandings.

Exploring Related Documents and Forms

Understanding related mortgage forms can provide better insight into private lending. Knowing the differences between Private and Public Mortgage Agreements often informs borrowers’ choices. Accessing legal resources may also aid in negotiating terms favorable for both lenders and borrowers.

-

Explore various forms that complement the Private Mortgage Agreement.

-

Assess the strengths and weaknesses of different mortgage types.

-

Seek guidance from legal professionals to ensure best practices in agreements.

How to fill out the Private Mortgage Contract Template

-

1.Start by downloading the Private Mortgage Contract Template from pdfFiller.

-

2.Open the document in the pdfFiller interface and review the sections available.

-

3.Fill in the borrower's name and contact information at the top of the document.

-

4.Enter the lender's details in the designated sections following the borrower's information.

-

5.Specify the loan amount in the 'Loan Amount' field, ensuring it aligns with the agreement between parties.

-

6.Set the interest rate clearly in the 'Interest Rate' section and specify if it’s fixed or variable.

-

7.Outline the repayment terms, including the payment schedule, due dates, and any grace periods if applicable.

-

8.Include sections for collateral description, if any, ensuring to detail what is securing the mortgage.

-

9.Add any additional clauses or terms relevant to the agreement in the empty sections provided in the template.

-

10.Review the filled document for accuracy, making sure all information is correct and complete.

-

11.Once finalized, save the document and consider downloading it in PDF format for distribution.

How to write a private loan agreement?

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. Date of the agreement. Interest rate. Repayment terms. Default provisions. Signatures. Choice of law. Severability.

What is a private mortgage?

A private mortgage is a type of mortgage loan whereby funds can be sourced from another person or business rather than borrowing from a bank or other finance provider. The private lender could be family, friends or others with personal relationships to the borrower.

What are the disadvantages of a private mortgage?

This means you're only paying to borrow the money, not reducing the mortgage amount you owe. Private mortgage fees are often higher than with a traditional mortgage. Private lenders can charge fees for late payments, lapsed insurance, or property upkeep if they take over your property due to unfulfilled mortgage terms.

How to create a simple mortgage?

Firstly, they are created by executing a mortgage deed, which outlines the terms and conditions of the mortgage agreement. Secondly, the mortgagee (lender) has the right to sell the property without the intervention of the court in case of default by the mortgagor (borrower).

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.