Private Party Auto Loan Contract Template free printable template

Show details

This document outlines the terms and conditions of an auto loan between a private lender and borrower for the purchase of a vehicle.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

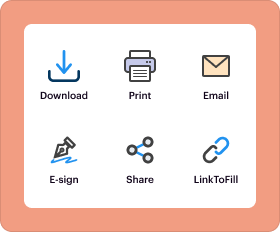

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Private Party Auto Loan Contract Template

A Private Party Auto Loan Contract Template is a legal document that outlines the terms of a loan agreement between a private seller and buyer for the purchase of a vehicle.

pdfFiller scores top ratings on review platforms

Easy

Very easy to use

Excellent product but I have no reason…

Excellent product but I have no reason to continue my membership.

Thank you.

great at editing

great at editing

It is great and easy to use

It is great and easy to use

it works great

it works great

A great alternative to paying adobe…

A great alternative to paying adobe hundreds a year in subscription fees,

Who needs Private Party Auto Loan Contract Template?

Explore how professionals across industries use pdfFiller.

Private Party Auto Loan Contract Template Overview

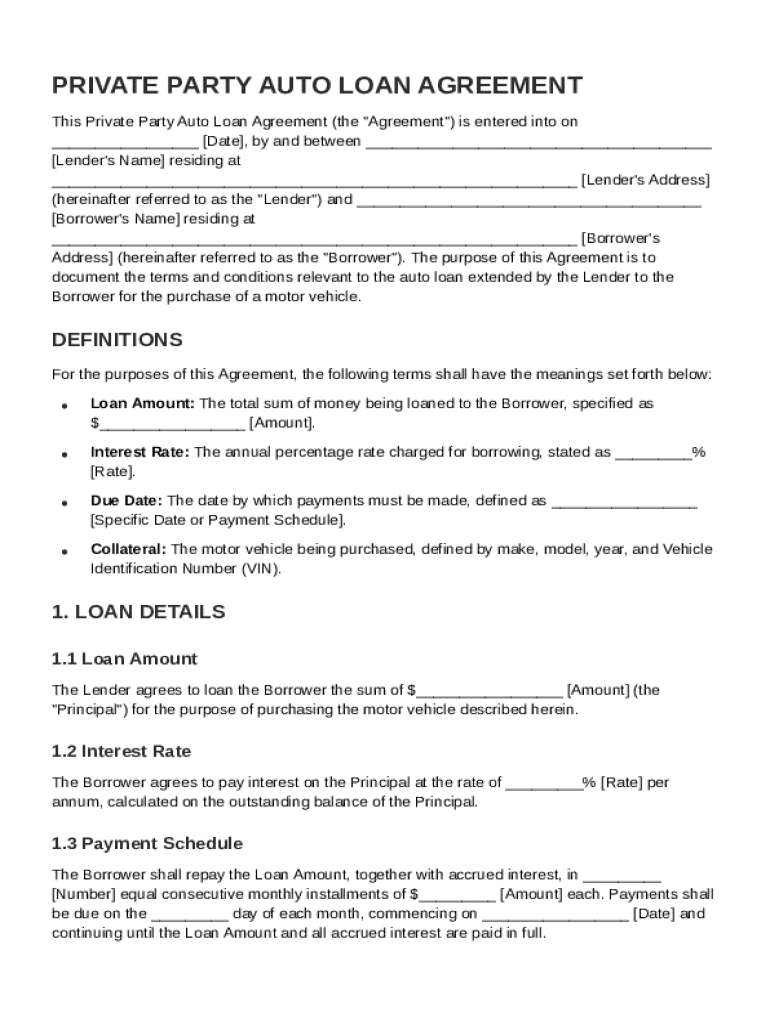

What is a Private Party Auto Loan Agreement?

A Private Party Auto Loan Agreement is a contract between two parties for the borrowing and lending of money for a motor vehicle purchase. This document outlines important terms and conditions governing the loan, ensuring both the lender and borrower understand their obligations. It plays a crucial role in protecting the rights of both parties involved.

The importance of this agreement is underscored by its ability to prevent disputes and misunderstandings by clearly outlining payment terms and legal obligations.

How can pdfFiller simplify document management?

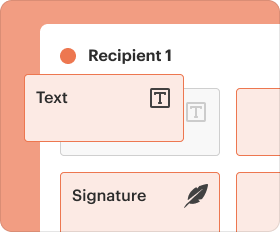

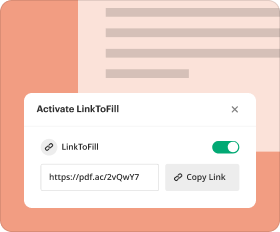

pdfFiller offers a user-friendly platform for creating, editing, and managing PDF documents, including the Private Party Auto Loan Contract Template form. Key features include easy form filling, e-signatures, and cloud storage, making it a comprehensive solution for individuals and teams seeking efficient document management.

-

Users can access a library of templates for various financial agreements, ensuring compliance with legal standards.

-

The platform allows for easy collaboration between parties, enabling them to review and revise documents in real-time.

-

Documents are stored in the cloud, ensuring they are protected and accessible from anywhere.

What does the typical auto loan agreement structure look like?

An auto loan agreement typically includes essential information from both the lender and borrower. Identifying both parties is crucial in solidifying the contract's legality.

-

This includes the name, contact information, and any business identification numbers of the lender.

-

Similarly, accurate details of the borrower must be provided, including their contact information.

-

Defining loan amount, interest rate, due date, and collateral ensures all parties have a clear understanding of the financial obligations.

What are the critical components of a loan agreement?

A well-drafted loan agreement incorporates several critical components that define the lender-borrower relationship.

-

It's important to specify the principal amount being borrowed to avoid confusion during repayment.

-

Understanding how the interest rate is calculated can significantly impact the total payment over time.

-

A detailed overview of payment schedules should be included, guiding the borrower on when and how to make payments.

How are detailed loan terms explained?

Clarifying loan terms is essential for both parties to understand potential financial commitments.

-

Defining the repayment timeframe is crucial for planning and budgeting purposes.

-

Borrowers should be informed about any penalties or benefits associated with early repayment of the loan.

-

Understanding the penalties for late payments helps borrowers stay compliant with the terms of the agreement.

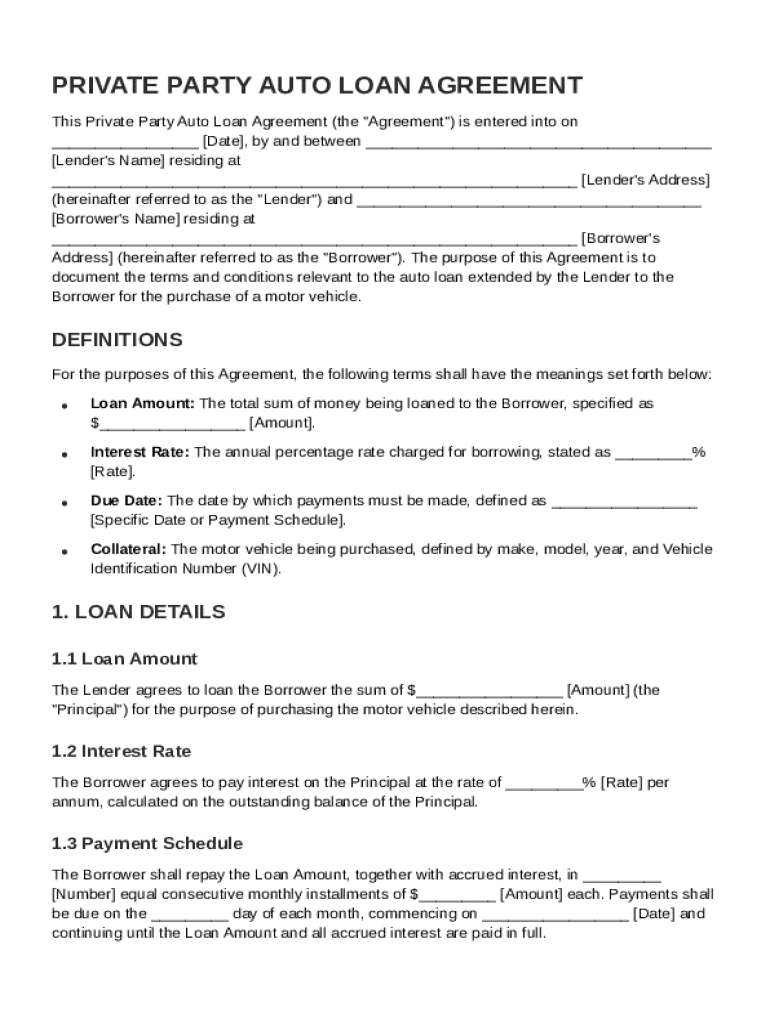

How do you fill out your Private Party Auto Loan Agreement?

Filling out your Private Party Auto Loan Agreement form can be seamless with pdfFiller’s interactive tools. A step-by-step guide will assist you in ensuring all necessary information is completed accurately.

-

Start by inputting lender and borrower information at the top of the form.

-

Clearly specify the loan amount, interest rate, and repayment schedule in designated sections.

-

Discuss and outline any additional terms or conditions that may apply, ensuring mutual agreement.

How can pdfFiller help with document management?

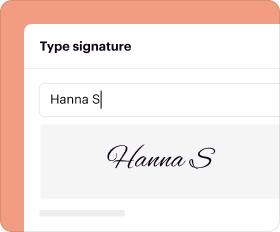

By leveraging pdfFiller’s capabilities, you can efficiently eSign agreements, collaborate with other parties, and manage all documents in a secure, cloud-based environment. This comprehensive management system allows users to focus on their financial agreements without the hassle of significant paperwork overhead.

What related forms should you explore?

Understanding other finance-related templates can be beneficial when finalizing a Private Party Auto Loan Agreement. Depending on your circumstances, additional documents may enhance the agreement.

-

This document can confirm the transfer of ownership of the motor vehicle.

-

If you ever need to change terms, this form allows for legal modifications to the original contract.

-

This outlines clear payment timelines and amounts due to prevent missed payments.

How to fill out the Private Party Auto Loan Contract Template

-

1.Start by downloading the Private Party Auto Loan Contract Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Enter the names and addresses of both the seller and buyer in the designated fields.

-

4.Fill in the vehicle details, including make, model, year, and VIN (Vehicle Identification Number).

-

5.Specify the loan amount, interest rate, repayment schedule, and any additional fees or charges.

-

6.Include the loan term and payment due dates, ensuring clarity on when payments are expected.

-

7.Review and ensure all information is accurate and complete.

-

8.Add signatures for both the seller and buyer to finalize the agreement.

-

9.Save the completed document and consider printing copies for both parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.