Promise To Pay Contract Template free printable template

Show details

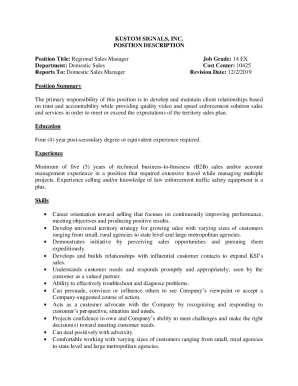

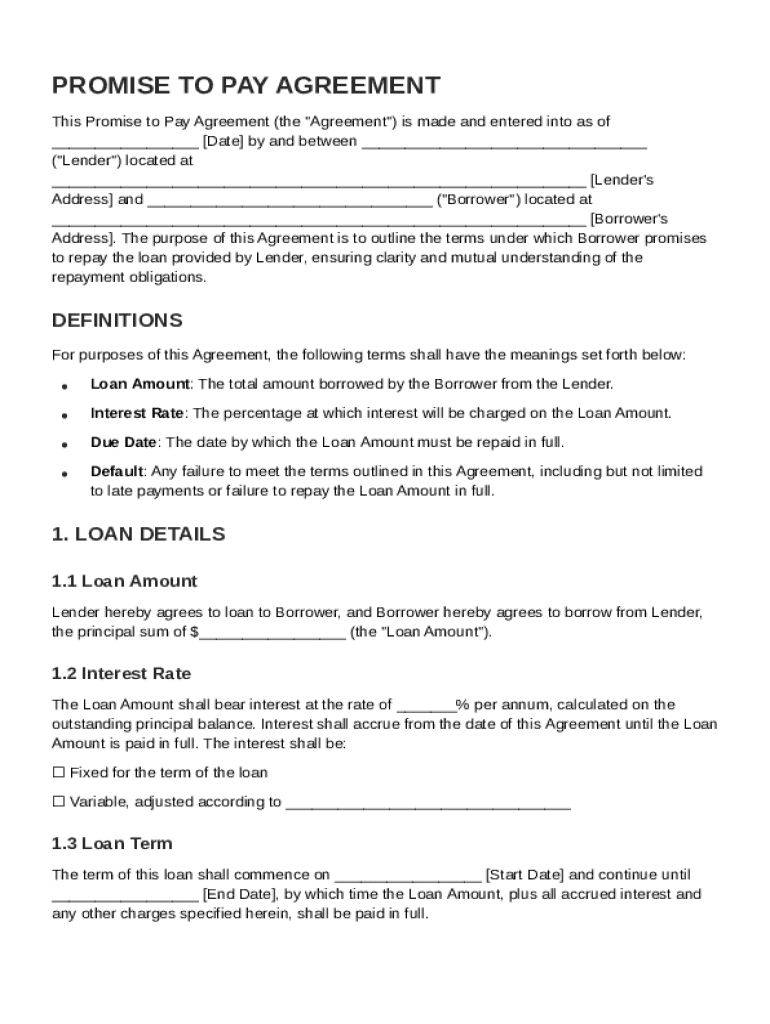

This document outlines the terms under which a borrower promises to repay a loan provided by a lender, detailing loan details, repayment terms, default conditions, and governing law.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Promise To Pay Contract Template

A Promise To Pay Contract Template is a legal document outlining the agreement between a debtor and a creditor regarding the repayment of a debt.

pdfFiller scores top ratings on review platforms

It's New, but good still getting used to it

LIKED THE ABILITY TO SAVE AND PRINT BUT IT TOOK SEVERAL TRIAL AND ERROR EXPERIENCES TO FIGURE OUT THE PROCESS. SOMEONE WITH VERY LITTLE COMPUTER EXPERIENCE WOULD FIND THIS FRUSTRATING

This product is great, It has come in clutch on more than one occasion

I like PDFiller, very useful. I do not understand how to use all of the features available.

i needed a lease form. I hated to spend $20 for one form, but it helped me get the job done with a professional look.

It has saved my life when I've been unable to access a printer and needed to sign something!

Who needs Promise To Pay Contract Template?

Explore how professionals across industries use pdfFiller.

Promise To Pay Contract Template Guide

How to fill out a promise to pay contract form

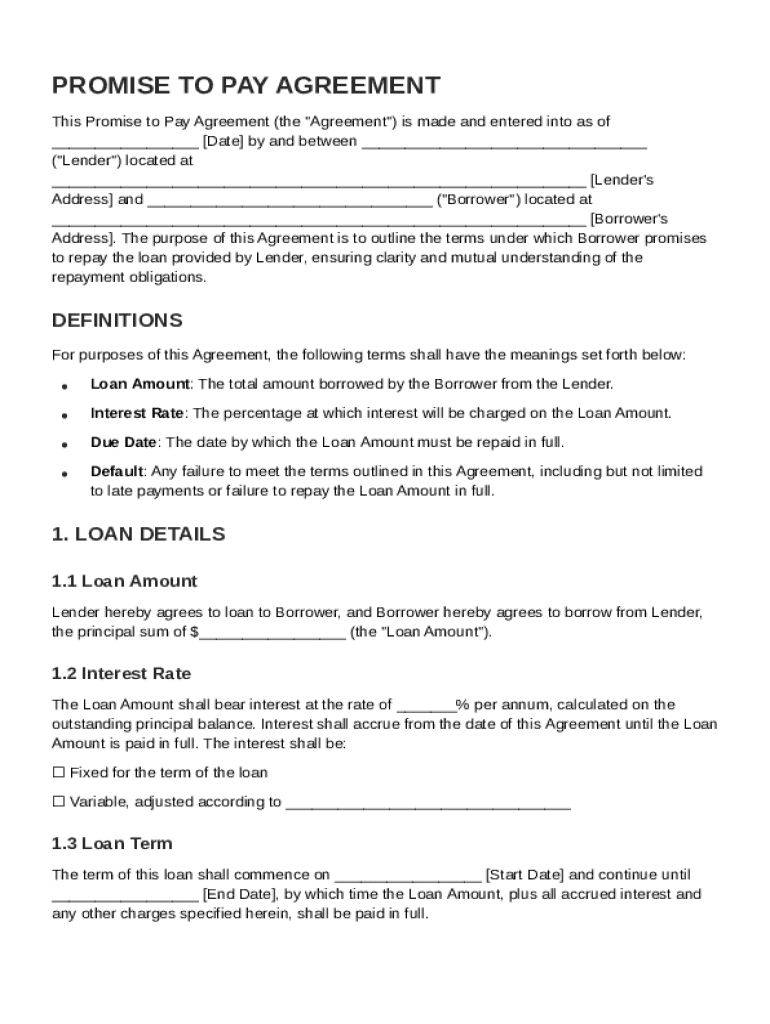

Filling out a Promise To Pay Contract Template form involves detailing the loan amount, setting clear repayment terms, and outlining the responsibilities of both the lender and the borrower. Start by entering basic information like the parties involved, the loan amount, and the interest rate. Finally, ensure the due dates and penalties for default are adequately recorded.

Understanding the Promise To Pay Agreement

A Promise To Pay Agreement effectively establishes the terms for loan repayment. This contract typically involves two parties: the lender, who provides the funds, and the borrower, who agrees to repay the loan on specified terms. The primary purpose of this agreement is to clarify the repayment structure to avoid any future disputes.

What are the key components of the agreement?

Key components of a Promise To Pay Agreement include the loan amount, interest rate, due date, and conditions for default. These elements help ensure both parties understand their commitments and the penalties for not adhering to the agreement.

-

This includes the total borrowed funds and any additional costs associated.

-

It's essential to outline whether the rate is fixed or variable and its impact on overall repayment.

-

Defining a clear timeline for repayment is crucial to avoid late fees.

-

Detailing what happens if the borrower fails to meet the repayment terms.

What are the detailed loan terms and conditions?

Loan terms and conditions should be explicitly defined to avoid misunderstandings. This section typically specifies the exact loan amount, interest rate, duration of the loan, and any additional charges that may apply.

-

Indicate the precise amount borrowed, including currency.

-

Clarifying whether it’s fixed or variable helps in understanding total repayment.

-

Define the start and end date of the loan repayment period.

-

Identify any extra fees like processing charges that may apply.

What are the repayment strategies?

Choosing the right repayment strategy is vital for ensuring timely payments without financial strain. Options vary from lump sum payments to installment plans, and borrowers should consider their cash flow when making decisions.

-

Choose between a single payment or multiple installments based on financial capability.

-

Select whether payments will occur weekly, monthly, or quarterly.

-

Discuss options for renegotiating payment terms if financial circumstances change.

Using pdfFiller to manage your contract

pdfFiller offers distinct advantages for managing your Promise To Pay Agreement, including easy editing, signing, and document storage. With its cloud-based platform, users can collaborate with relevant stakeholders in real time.

-

Learn how to edit the template to suit your needs effectively.

-

Utilize the eSigning feature to handle agreements without needed printing.

-

Engage with other stakeholders effortlessly during the document management process.

-

Keep your documents secure with online storage for easy access.

What are the compliance and legal considerations?

It's essential to ensure compliance with state-specific laws that impact your Promise To Pay Agreement. Understanding legal concepts such as usury fees and maximum allowable interest rates can safeguard against potential legal issues.

-

Research your state's regulations regarding loans and agreements.

-

Recognize the penalties for exceeding maximum interest rates to avoid legal troubles.

-

Be aware of the legal implications of failing to adhere to contractual obligations.

What are some examples of promise to pay agreements?

Understanding various styles of Promise To Pay Agreements can help in crafting your document. From formal templates to informal agreements, knowing the differences can guide you in selecting the right template for your needs.

-

Finding templates specific to your state can ensure compliance with local laws.

-

Decide whether a formal or informal approach is more suitable for your situation.

-

Learn the pitfalls to avoid when crafting your Agreement for better clarity.

How to fill out the Promise To Pay Contract Template

-

1.Open pdfFiller and upload the Promise To Pay Contract Template.

-

2.Begin by entering the names and contact information of both the borrower and the lender at the top of the document.

-

3.Specify the amount of money being borrowed in the designated space.

-

4.Indicate the interest rate, if applicable, and the payment schedule including the due dates for repayments.

-

5.Include any terms and conditions regarding late fees or penalties for non-payment.

-

6.If there are any collateral items involved as security for the loan, clearly describe them in the provided section.

-

7.Make sure to add a clause for dispute resolution methods, if applicable.

-

8.Review the entire document for accuracy and completeness before moving on.

-

9.Once reviewed, use the electronic signature feature to sign the document on behalf of both parties, ensuring all required signatures are included.

-

10.Finally, save the completed document and distribute copies to both the borrower and the lender for their records.

How to write a Promise to pay contract?

How do I write a Promise to Pay? Title: Clearly label the document as a “Promise to Pay” or “Promissory Note.” Date: Include the date of the agreement. Parties Involved: Specify the names and addresses of both the lender and borrower. Principal Amount: Clearly state the amount of money being borrowed.

How to create a Promise to pay?

Create Promise to Pay Search for the customer account to retrieve the outstanding transactions. From the Transaction tab, select the single transaction that is 30 days past due. Click the Promise button. Click Add row icon. Enter the Promise Date.

What is an example of a Promise to pay?

Example of a Promise to Pay Agreement Suppose John borrows $10,000 from his friend, Lisa, to pay for home renovations. They agree that John will pay back the loan over five years, with annual payments at an interest rate of 5%.

How do you write a contract agreement for payment?

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.