Promissory Contract Template free printable template

Show details

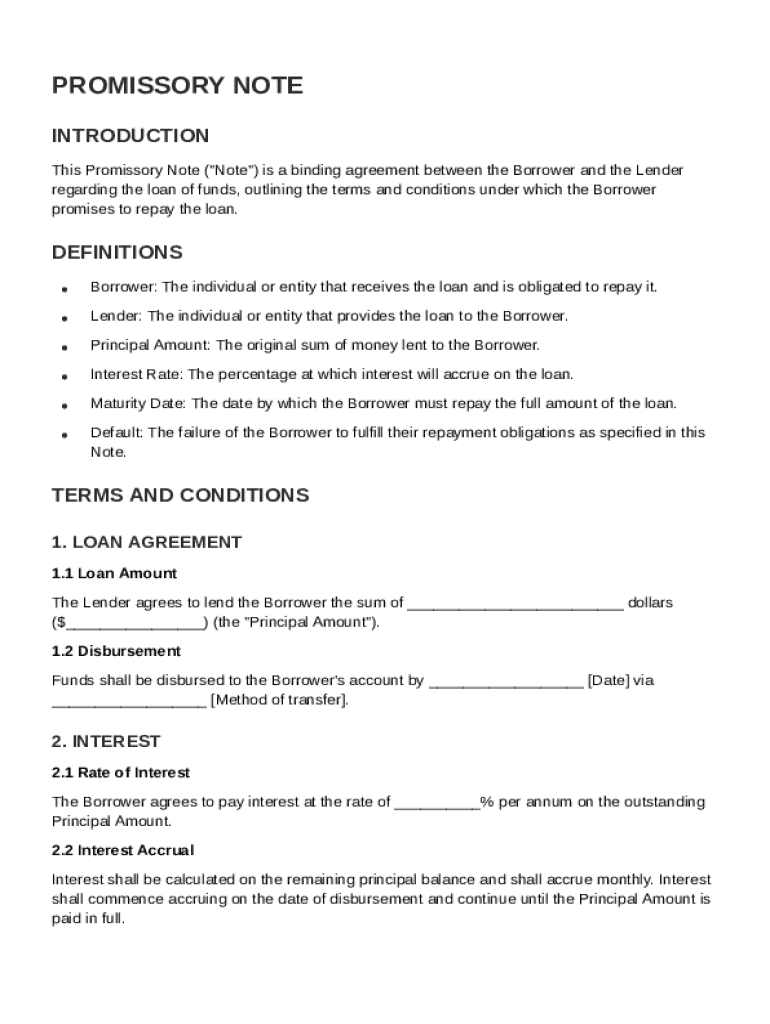

This document serves as a binding agreement outlining the terms and conditions under which a Borrower agrees to repay a loan provided by a Lender.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

pdfFiller scores top ratings on review platforms

Very useful website. Has helped in the processing of many of our business documents.

I am having problems finding documents in the library. Please let me know if there is an easier way. Thank you

Only used once but had good experience with it

It needs better way for positioning pictures at document while also visualizing it

There are sometimes problems with the # of characters and making corrections. Otherwise I prefer it to filling out things by hand.

I really like PDFfiller and it really easy to use. My only suggestion would be that you offer some way to delete or erase Fillable Names etc. that are saved if we choose. (i.e. Wrong spellings or no longer needed information.)

Comprehensive Guide to Promissory Contract Template on pdfFiller

What is a promissory note?

A Promissory Note is a financial document in which one party—the borrower—makes an unconditional promise to pay a specified sum to another party—the lender—at a predetermined future date. Understanding this definition is crucial as it establishes the legal framework of the agreement, ensuring that all involved parties are aware of their rights and responsibilities.

-

The two main parties are the borrower, who receives the loan, and the lender, who provides the funds. Each party has specific obligations under the note.

-

Promissory notes serve as legal evidence to facilitate trust in financial transactions, detailing loan conditions and repayment terms.

What are the core elements of a promissory note?

The core elements of a Promissory Note define the financial agreement's framework and are essential for its validity. Each of these elements influences the transaction and must be understood clearly.

-

The principal amount refers to the initial sum borrowed, which guides future interest calculations and repayment schedules.

-

This is the cost of the loan expressed as a percentage of the principal. Factors like market conditions and borrower creditworthiness influence its determination.

-

The maturity date is the specific deadline by which the borrower must repay the loan. Understanding this deadline is crucial for both parties.

-

Default occurs when one party fails to adhere to the terms set in the note, potentially leading to legal issues for the borrower.

How do you create a promissory note template?

Creating a Promissory Note Template can streamline the loan process, making it easier to customize the document for specific needs. Using a platform like pdfFiller allows users to efficiently tailor templates for various purposes.

-

Select a template that fits your needs from pdfFiller’s extensive library; options differ based on the type of loan or agreement.

-

Fill in critical information such as borrower and lender details, loan amounts, and specific terms. Accurate details ensure legal compliance.

-

Utilize eSignatures and collaboration features to address parties' needs effectively, facilitating a smoother signing and approval process.

What should you include in the terms and conditions?

Terms and conditions are crucial components of a Promissory Note, dictating how the loan will be managed and repaid. This section can significantly impact the loan experience for both borrower and lender.

-

Clearly outline loan amounts, repayment intervals, and interest terms to prevent misunderstandings.

-

Explain how and when the lender will provide the funds to the borrower, including any associated fees.

-

Clarify whether interest is calculated monthly or yearly, which will affect the overall amount due.

How do you design a repayment structure?

An effective repayment structure can ensure timely loan repayment. Crafting this structure will help both parties avoid future complications associated with delayed payments.

-

Design a clear schedule outlining when payments are due and the amounts, making it easier for the borrower to comply.

-

Consider policies that allow borrowers to pay off loans early without penalties, offering financial flexibility.

-

Clearly explain what happens if the borrower defaults on repayments, including potential legal actions and credit implications.

What are the default and remedies?

Understanding default and its remedies is vital for both lenders and borrowers. Should a default occur, parties must know their options.

-

Define events that constitute default, such as missed payments or breach of loan terms, to safeguard lender interests.

-

Explore various methods lenders can utilize to rectify situations of default, providing clear paths to resolution.

-

Discuss the legal actions a lender can take in response to default, noting the potential consequences for borrowers.

Why use pdfFiller for your promissory note needs?

Utilizing a platform like pdfFiller for your Promissory Note needs offers various advantages. These features empower users to manage documentation more efficiently.

-

Creating and managing documents through a cloud platform ensures accessibility from any location while enhancing collaboration.

-

pdfFiller's features include eSigning and document editing, enabling smoother workflows related to promissory notes.

-

The intuitive interface allows users at any level to navigate the features easily, while real-time collaboration capabilities enhance teamwork.

How to write a promissory agreement?

But what exactly do you need to write a promissory note? Include their full legal names, addresses, and contact numbers — include any co-signers if applicable. The terms of this note should specify the amount borrowed, repayment terms (including interest rate, if applicable), and the due date or schedule of payments.

Does Microsoft Word have a promissory note template?

Begin by locating a suitable promissory note template. You can find templates within Word's template library or download them from reputable online sources. Look for templates that adhere to legal standards and include essential sections such as identification of parties, loan amount, payment terms, and interest rates.

What is a promissory note example?

A simple promissory note might be for a lump sum repayment on a certain date. For example, let's say you lend your friend $1,000 and he agrees to repay you by December 1st. The full amount is due on that date, and there is no payment schedule involved.

Is a promissory note a formal contract?

It is a formal contract between parties that contains a promise to pay a certain amount of money on demand at a specified time, or over a period of time in future. A promissory note usually covers smaller loans.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.