Promissory Note Contract Template free printable template

Show details

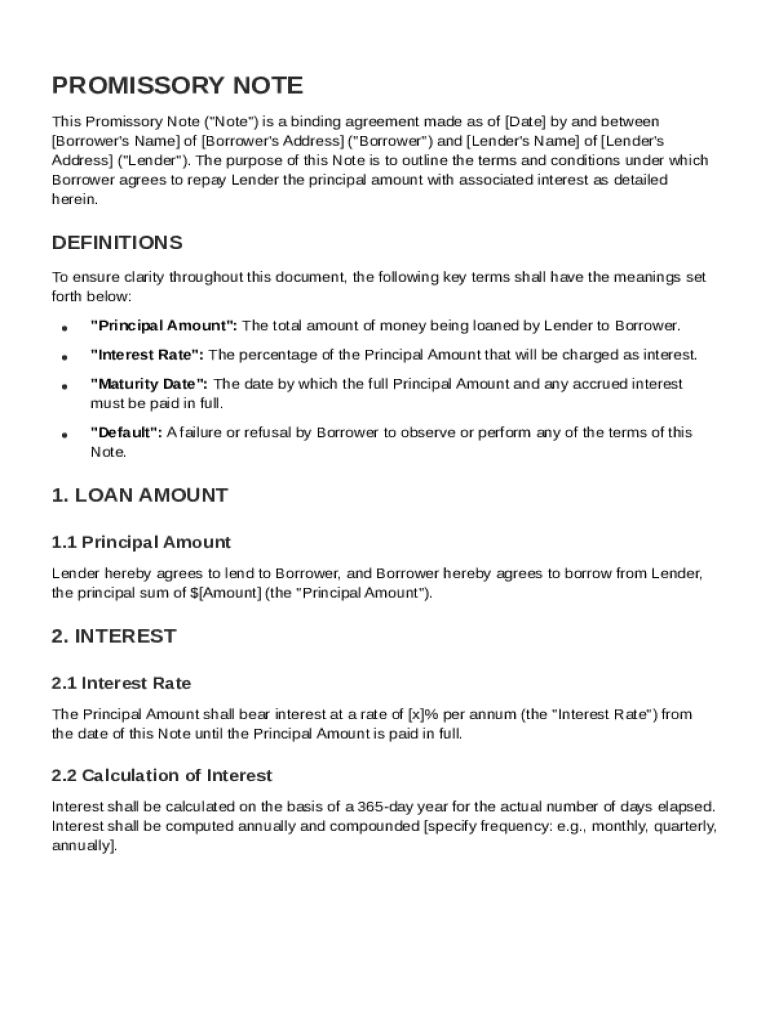

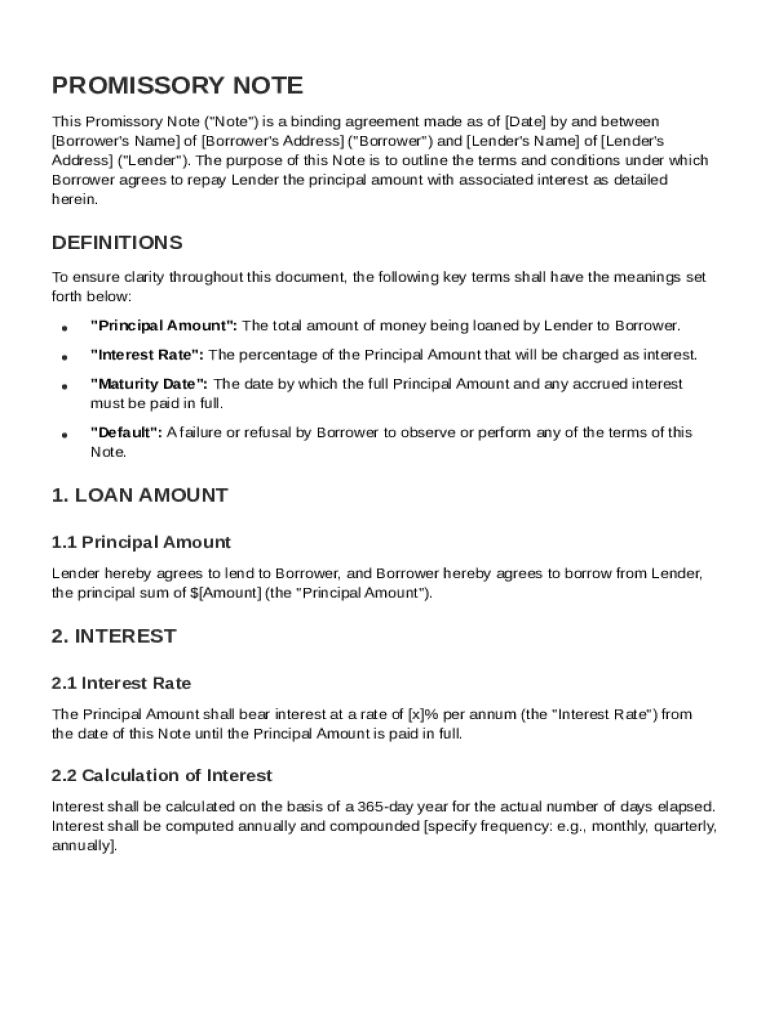

This document is a binding agreement outlining the terms and conditions under which the Borrower agrees to repay the Lender a principal amount with interest.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Promissory Note Contract Template

A Promissory Note Contract Template is a legal document in which one party agrees to pay a specific amount of money to another party under agreed terms.

pdfFiller scores top ratings on review platforms

Great!

oo

very very good

very easy

EXCELLENT

dsdsdsdsdsdsdsd

Who needs Promissory Note Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Using the Promissory Note Contract Template on pdfFiller

How to fill out a Promissory Note Contract Template form

Filling out a Promissory Note Contract Template form involves a systematic approach to ensure all necessary elements are accurately captured. Users should clearly enter borrower and lender information, define the loan terms, and ensure all sections are complete to create a legally enforceable document.

Understanding the Promissory Note: Key Concepts

A Promissory Note is a written promise to pay a specified sum of money to someone under agreed-upon terms. Its purpose is to outline the financial obligation between a borrower and a lender, ensuring clarity in the terms of repayment.

-

The total sum of money borrowed that needs to be repaid.

-

The percentage of the principal charged as interest for borrowing.

-

The date by which the borrowed amount must be paid back in full.

-

Legal consequences if the borrower fails to repay as agreed.

Recognizing these key concepts is essential for properly using the Promissory Note Contract Template form and ensuring it's a legally binding agreement.

What are the essential elements of a Promissory Note?

A comprehensive Promissory Note includes specific essential elements that protect both parties involved. Each component directly influences the document’s legality and clarity.

-

Names and contact information for both parties should be clearly defined.

-

The total amount being borrowed plays a critical role in outlining responsibilities.

-

Specifying the interest rate helps avoid any ambiguity regarding cost.

-

These clarify repayment schedules, including frequency and due dates.

-

Omitting critical elements can lead to unintended consequences, including unenforceability.

How do you complete the template step-by-step?

Completing a Promissory Note template is streamlined with pdfFiller’s interactive tools. To ensure accuracy and compliance, follow these step-by-step instructions.

-

Download or open the Promissory Note Contract Template on pdfFiller.

-

Enter the full legal name of the person or entity borrowing the funds.

-

Clearly indicate the total sum being borrowed.

-

Outline when payments are due to ensure clarity for both parties involved.

-

Double-check all entered information for completeness and correctness.

In what ways can you edit and customize your Promissory Note?

pdfFiller’s PDF editing tools allow users to personalize their Promissory Note templates effectively. Customizing the document ensures that it reflects the specific needs of the agreement.

-

Participants may wish to include additional terms or conditions specific to their agreement.

-

Simplifying the document by eliminating sections that are not pertinent to the transaction can enhance clarity.

-

Engage legal advice or input from other stakeholders before finalizing to avoid misunderstandings.

What is the process for signing and managing your Promissory Note?

Signing a Promissory Note has been streamlined through pdfFiller’s eSigning capabilities. Understanding the importance of digital signatures ensures that agreements are secure and legally binding.

-

Start the signing process directly within the pdfFiller platform to expedite execution.

-

Utilizing verified e-signatures enhances the security of the contract.

-

Managing signed documents with cloud storage ensures easy access and organization.

What are common mistakes to avoid when using Promissory Notes?

When dealing with Promissory Notes, awareness of frequent errors can mitigate potential pitfalls. Understanding what mistakes to avoid ensures that the documents are both effective and enforceable.

-

Leaving fields blank can lead to misunderstandings about obligations.

-

Errors in data entry can invalidate the entire agreement or lead to disputes.

-

Failing to adhere to local laws can result in an unenforceable note.

What are the legal considerations for Promissory Notes?

Legal requirements for Promissory Notes vary significantly by region. Understanding these regional laws is crucial to creating an enforceable document.

-

Different jurisdictions may impose varied requirements that must be adhered to.

-

Consult legal professionals when drafting or enforcing the note to ensure compliance and avoid pitfalls.

When should you compare Promissory Notes to other loan documents?

Different types of lending agreements can serve various purposes, and knowing when to use a Promissory Note is essential. This understanding can impact financial arrangements significantly.

-

Loan agreements are typically more comprehensive, while Promissory Notes are simpler and focus primarily on repayment.

-

Secured notes offer collateral against the loan, providing more security to lenders compared to unsecured versions.

-

Selecting the appropriate agreement depends on the specific needs of the lending situation.

How to fill out the Promissory Note Contract Template

-

1.Download the Promissory Note Contract Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by entering the full legal names of both the borrower and the lender at the top of the document.

-

4.Fill in the principal amount being borrowed in the designated section, ensuring it is clear and correct.

-

5.Specify the interest rate in the appropriate field, which can be fixed or variable depending on the agreement.

-

6.Indicate the repayment terms, including the start date, frequency of payments, and due date for the final payment.

-

7.If applicable, outline any collateral that secures the loan in the appropriate section to protect the lender's interest.

-

8.Include any late fees or penalties for missed payments to ensure clarity on consequences of non-payment.

-

9.Once all fields are filled, review the document for accuracy and completeness before saving.

-

10.Finally, print or share the completed Promissory Note with both parties for signatures, ensuring that a copy is retained for records.

How do I write a simple promissory note?

What to include in a promissory note Amount of money borrowed (principal amount) Amount to be repaid (principal and interest) When and how often payments will be made (payment schedule, or “due dates”) Interest rate and repayment specifics. Time frame and maturity date (date the loan will be fully repaid)

Does Microsoft Word have a promissory note template?

Begin by locating a suitable promissory note template. You can find templates within Word's template library or download them from reputable online sources. Look for templates that adhere to legal standards and include essential sections such as identification of parties, loan amount, payment terms, and interest rates.

Is a promissory note a formal contract?

It is a formal contract between parties that contains a promise to pay a certain amount of money on demand at a specified time, or over a period of time in future. A promissory note usually covers smaller loans.

How to write a promise to pay contract?

How do I write a Promise to Pay? Title: Clearly label the document as a “Promise to Pay” or “Promissory Note.” Date: Include the date of the agreement. Parties Involved: Specify the names and addresses of both the lender and borrower. Principal Amount: Clearly state the amount of money being borrowed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.