Repayment Contract Template free printable template

Show details

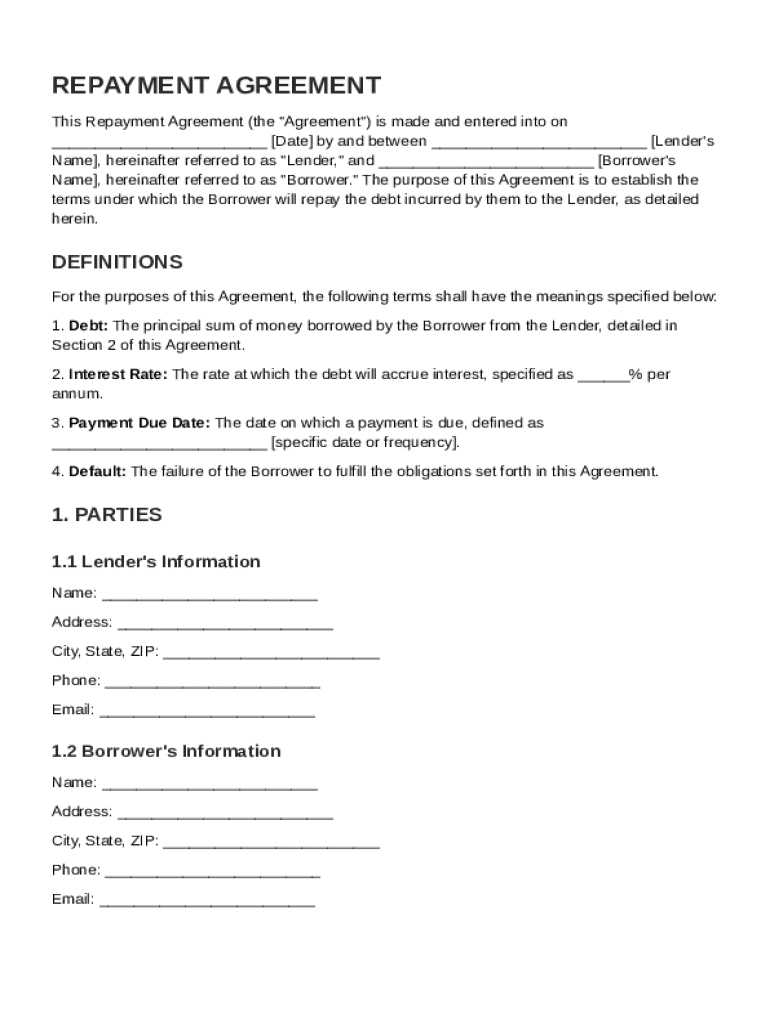

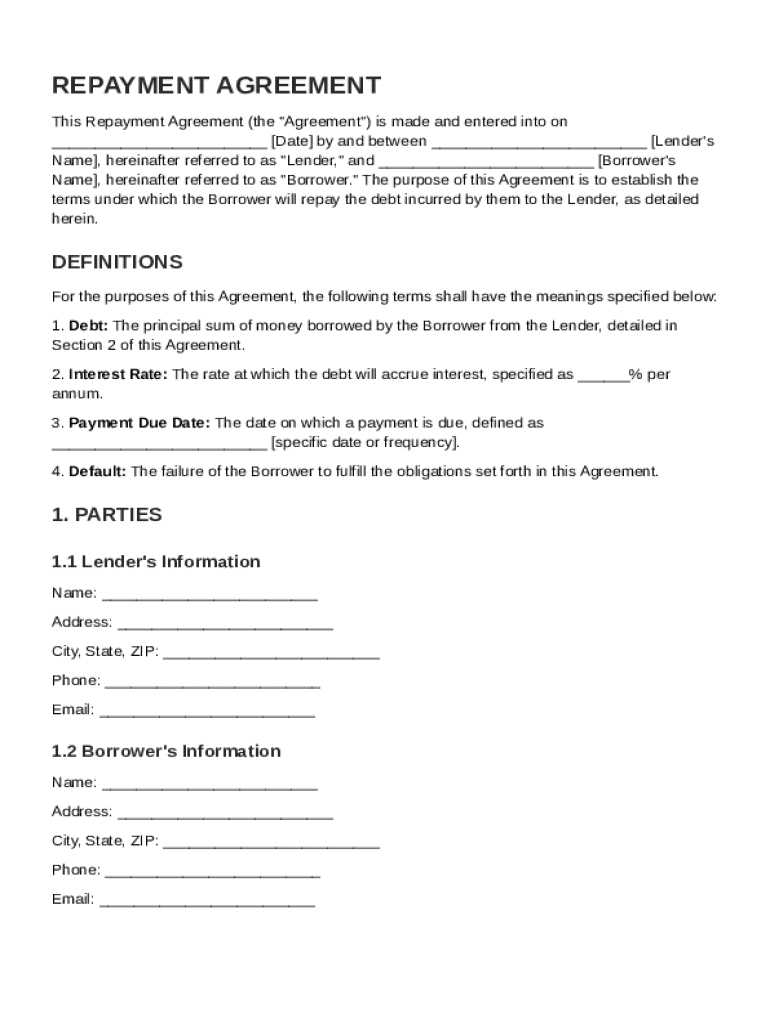

This document establishes the terms under which a borrower agrees to repay a debt to a lender, including definitions, loan amount, repayment terms, interest rate, default terms, and other legal provisions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Repayment Contract Template

A Repayment Contract Template is a legal document outlining the terms under which one party agrees to repay borrowed funds to another party.

pdfFiller scores top ratings on review platforms

Great Program!!! Couldn't do my work without it. Your support staff is the best. Thank you for creating such easy to use program.

works great some skipping on typing but great

I hate when I fill a pdf, then have to log in, and mistype my password, so by the time I've logged in I've lost ALL my work. Otherwise, it works flawlessly

so helpful to me because of my disability

the free version is such a great resource!

overall exp.was good except#3 where C,and D, kept interchanging

Who needs Repayment Contract Template?

Explore how professionals across industries use pdfFiller.

Repayment Contract Template Guide

In this guide, we will explore the essential elements of a repayment contract template form, focusing on how to effectively use it for your borrowing needs. Understanding each component can help ensure clarity between lenders and borrowers.

What are repayment agreements?

A repayment agreement is a formal contract between a borrower and lender detailing the terms under which the borrowed money will be repaid. These contracts are vital for protecting both parties' interests and can prevent misunderstandings or disputes.

-

Clearly defines the obligations of both the lender and the borrower, stating how and when repayment will occur.

-

Establishing a repayment contract solidifies trust and outlines expectations, which fosters a healthier borrower-lender relationship.

-

Failure to adhere to the terms can lead to legal repercussions and damaged credit ratings for the borrower.

What are the key components of a repayment agreement?

Each repayment agreement should contain specific components that provide clarity and enforceability. Understanding these elements can greatly enhance the effectiveness of your contract.

-

The principal amount borrowed must be clearly identified to avoid any confusion regarding the terms.

-

Detail whether the rate is fixed or variable, as this will significantly affect the total repayment amount.

-

Establishing a consistent due date ensures punctuality in payments, helping both parties manage expectations.

-

Defining what constitutes a default and the consequences will help protect the lender's interests.

How to fill out a repayment contract template?

Filling out a repayment agreement involves providing specific information correctly and accurately to avoid disputes. Utilizing platforms like pdfFiller makes this process seamless.

-

Complete all required fields to ensure the lender can be easily contacted if necessary.

-

Include accurate data about the borrower, as documentation is crucial for enforcing the contract.

-

Clearly state the total borrowed amount, ensuring that both parties agree on this figure.

-

Disclose any extra charges upfront to maintain transparency.

How to define repayment terms?

Defining repayment terms is critical to ensure both parties understand their obligations. This includes determining the payment amount, schedule, and methods.

-

Clearly calculate the amount to be paid at regular intervals, agreed upon by both parties.

-

Choosing an appropriate schedule helps ensure manageable payments for the borrower, whether they are weekly, monthly, or quarterly.

-

Exploring various payment methods such as bank transfers or checks can make it convenient for the borrower.

What should you consider about interest rates?

The interest rate is a pivotal part of any repayment agreement as it impacts the overall cost of borrowing. Understanding the differences can lead to better agreements.

-

A fixed rate remains constant over the loan term, while a variable rate can fluctuate, affecting the total repayment amount.

-

Researching current market rates can help both parties agree on a fair and manageable interest rate.

-

Successful agreements include clear disclosure of the interest rates to prevent misunderstandings.

How to utilize pdfFiller for your repayment agreement?

pdfFiller streamlines the process of creating and managing repayment documentation through its user-friendly platform, enhancing both efficiency and security.

-

Easily upload your repayment template onto pdfFiller and edit it as needed to fit your unique circumstances.

-

Use pdfFiller to apply digital signatures, making it easy and secure to finalize the contract.

-

Share and collaborate with other involved parties seamlessly, ensuring everyone is on the same page.

How to compare payment agreement templates?

Exploring various payment agreement templates helps you to identify the best fit for your needs. Comparing features can guide you to a more effective template.

-

Analyzing various templates for their unique configurations can help you choose one that meets your needs best.

-

Assessing the pros of different templates can highlight which features are most beneficial.

-

Reading reviews and testimonials can provide insight into real-world usage of these templates.

How to fill out the Repayment Contract Template

-

1.Download the Repayment Contract Template from pdfFiller.

-

2.Open the template in the pdfFiller application.

-

3.Begin by filling in the 'Borrower' section with the name and address of the person who will be repaying the loan.

-

4.Next, fill in the 'Lender' section with the name and address of the individual or organization providing the funds.

-

5.Specify the loan amount in the provided section, along with the interest rate if applicable.

-

6.Outline the repayment schedule, including due dates and installment amounts in the designated areas.

-

7.Include any additional terms or conditions that both parties agree upon in the 'Terms' section.

-

8.Double-check all the information for accuracy before finalizing the document.

-

9.Save the filled-out contract and share it for signatures or print it for physical signing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.