Repayment Of Money Contract Template free printable template

Show details

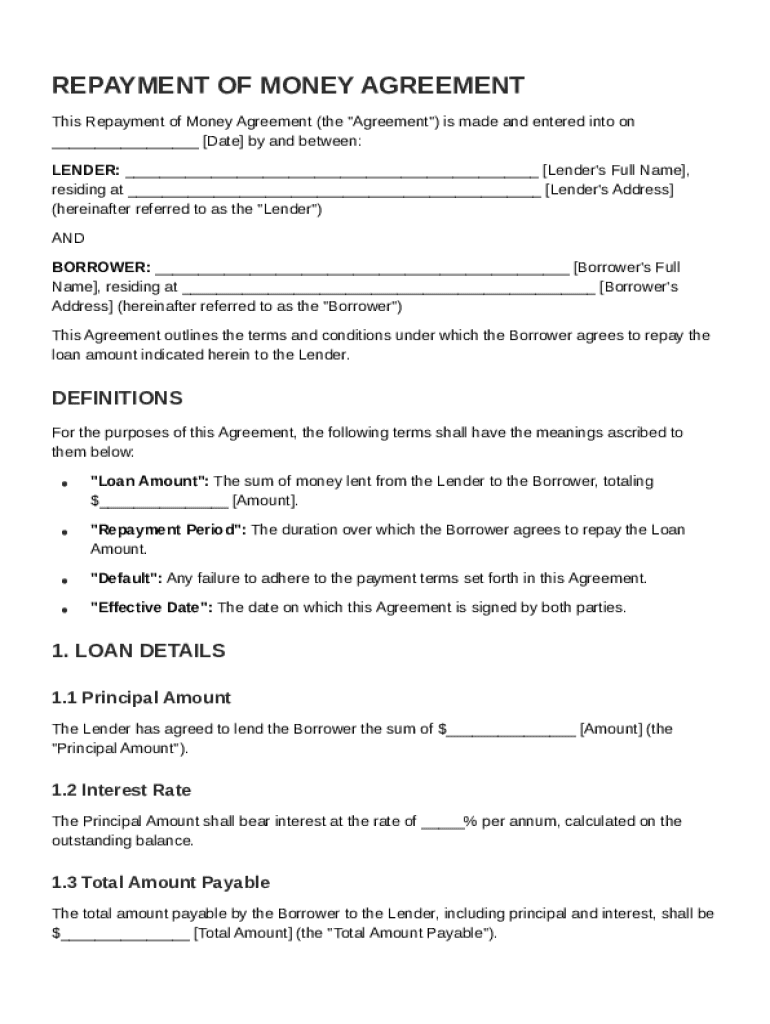

This document outlines the terms and conditions under which a borrower agrees to repay a loan to a lender, including definitions, loan details, repayment terms, responsibilities of parties, default

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

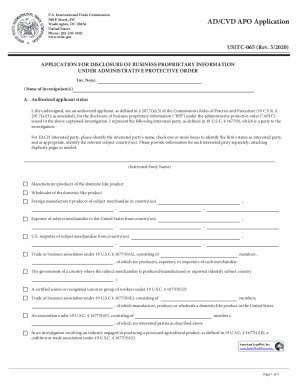

What is Repayment Of Money Contract Template

A Repayment Of Money Contract Template is a legal document outlining the terms for the repayment of borrowed money.

pdfFiller scores top ratings on review platforms

Easy

Easy, quick and exactly what I needed!

Easy and Superb!

I love how easy pdfFiller is to use. Also, the results are amazing! I uploaded a signature that looked great from my computer but I couldn't get the page colour right. PdfFiller fixed the colour so that the background of the upload and the entire document were identical. I didn't need to try fixing it myself!

Easy to navigate around.

Very easy to use and understand

was good for what I needed

this was good for what I needed,

i highly recommend this online Editing…

i highly recommend this online Editing platform, it has the best editing tools and cheap.

Customer support was ? . Had a problem with my Visa card but An agent called"Alex" was helpful , he solved my issue in a kind and professional way, thumbs up

satisfie

Easy and convenient. Huge help in my staffing business

Who needs Repayment Of Money Contract Template?

Explore how professionals across industries use pdfFiller.

Repayment Of Money Contract Template on pdfFiller Landing Page

How to fill out a repayment of money contract template form

To fill out a repayment of money contract template form, start by clearly defining the parties involved, including the lender and the borrower. Next, specify the loan amount, interest rate, and repayment period, ensuring to include specific terms such as payment frequency and late fee structures. Utilizing tools from pdfFiller can simplify editing and signing.

Understanding the repayment of money agreement

A repayment agreement is a legally binding contract detailing how a borrower will repay the loan to the lender. This is crucial for protecting both parties' rights and outlining payment expectations. Common scenarios for using repayment agreements include personal loans, business loans, and situations involving multiple payments.

-

A written contract that specifies the terms of repaying borrowed money, including the amount, interest, and repayment schedule.

-

It provides legal protection and clear terms, reducing the likelihood of disputes between the lender and borrower.

-

Typically used in personal loans, business loans, and informal loans between friends or family.

What are the key elements of a repayment agreement?

A repayment agreement must include essential components for clarity and legality. Identifying the lender and borrower reduces ambiguity. Details like the loan amount, principal, and repayment period must be unambiguous, outlining how long the borrower has to repay the sum borrowed.

-

Clearly state who the lender and borrower are, including their contact details.

-

Specify how much money is being lent and the principal amount that must be repaid.

-

Define how long the borrower has to repay the loan and how this is structured.

-

Outline what constitutes a default and its implications, including consequences.

-

The effective date marks when the agreement starts, which is important for payment schedules.

How do loan details affect repayment?

Loan details like the principal amount and interest rate dictate overall repayment costs. It's essential to understand how these figures translate into the total amount payable. Interest rates can significantly adjust monthly payments and the total sum repaid.

-

This is the initial amount borrowed and does not include interest.

-

The rate at which interest accumulates will affect the total money owed.

-

This total is the sum of what the borrower must repay, including interest.

-

Knowledge of how to calculate percentages is vital for understanding interest and total repayment amounts.

What are the best practices for structuring repayment terms?

Effective repayment terms help avoid defaults and ensure liquidity for lenders. Clearly defining payment frequencies and terms promotes transparency and mutual satisfaction. Consideration of the borrower's cash flow can lead to a more agreeable repayment schedule.

-

Design a schedule that aligns with the borrower's financial capabilities.

-

Decide on weekly, bi-weekly, or monthly payments based on what works best for the borrower.

-

This should reflect the total loan amount divided by the number of payments.

-

Clearly state when the payments begin and the final payment is due.

What payment methods can be used for repayment?

Various payment methods can facilitate repayment, each with its own processes and obligations. Choosing the right method can ease the burden on the borrower while ensuring timely payments for the lender.

-

Establishing automatic bank transfers can ensure timely payments.

-

Using checks requires understanding the procedure for issuance and deposit.

-

Consider digital payment apps and cryptocurrencies for flexibility.

How to effectively address late payments?

Late payments can lead to serious implications, both for the lender and borrower. Understanding late fees, charges, and potential default scenarios is crucial for both parties to navigate potential financial pitfalls.

-

Missed payments can damage credit scores and incur fees.

-

Be aware of how much additional cost late payments will incur.

-

Borrowers should communicate with lenders immediately if they foresee problems in making a payment.

How to edit and manage your repayment agreement on pdfFiller?

Utilizing pdfFiller tools simplifies the editing and management of your repayment agreement. With features like eSigning and collaborative capabilities, you can ensure your document remains up-to-date and accessible.

-

Take advantage of various editing tools to personalize your agreement.

-

Easily sign documents electronically to make transactions seamless.

-

Work with multiple parties efficiently within the document platform.

-

Access your documents from anywhere, improving workflow and collaboration.

How to fill out the Repayment Of Money Contract Template

-

1.Open the Repayment Of Money Contract Template on pdfFiller.

-

2.Begin by entering the date when the agreement is made in the designated field.

-

3.Fill in the names and addresses of both the lender and borrower in the respective sections.

-

4.Specify the loan amount clearly in the appropriate field.

-

5.Detail the repayment terms, including the interest rate and payment schedule.

-

6.Indicate any late fees or penalties for missed payments.

-

7.Include a clause about the consequences of defaulting on the loan.

-

8.Sign the document and have the other party sign where indicated.

-

9.Download or save the completed contract for both parties' records.

How to write a contract to pay back money?

The essential components include: Title: Clearly label the document as a “Promise to Pay” or “Promissory Note.” Date: Include the date of the agreement. Parties Involved: Specify the names and addresses of both the lender and borrower. Principal Amount: Clearly state the amount of money being borrowed.

How do you write a contract agreement for payment?

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

Can I make a contract for someone to pay me back?

Verbal contracts are completely legal. So, you just have to be prepared to explain what the terms of the contract/agreement were. Any evidence that you have showing the transfer of the funds would be good too, like a canceled check, etc.

What is the agreement for returning money?

The 'Return of money' clause establishes the obligation for one party to refund payments or deposits to the other party under specified circumstances. Typically, this clause outlines the conditions under which money must be returned, such as contract cancellation, failure to deliver goods or services, or overpayment.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.