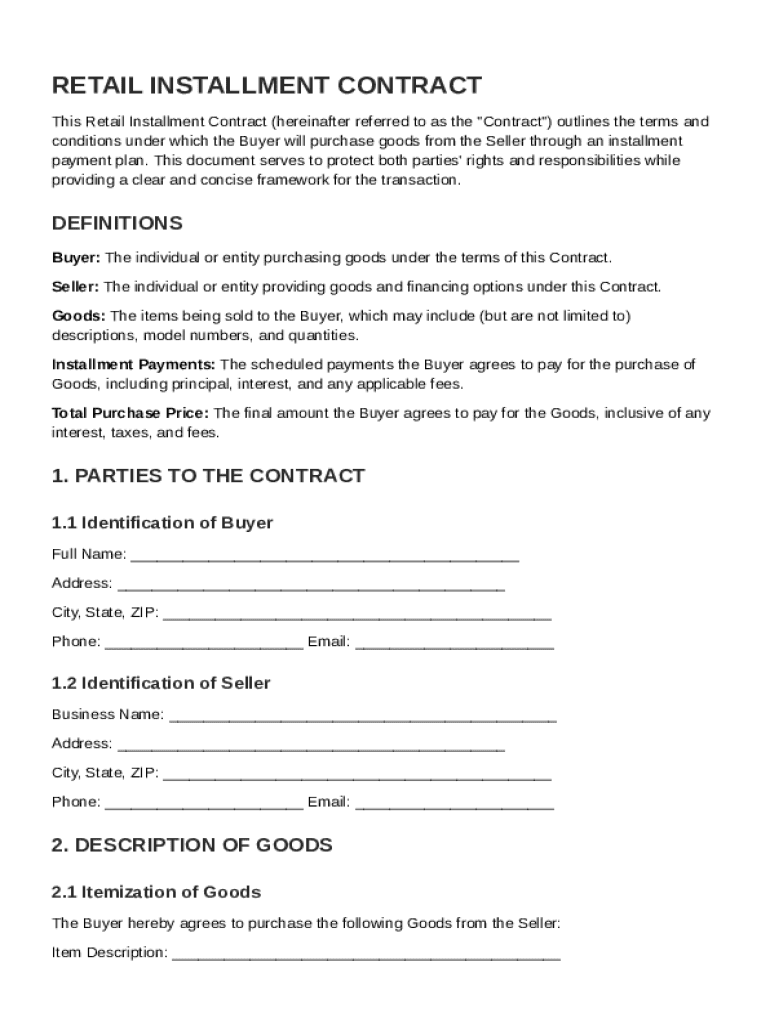

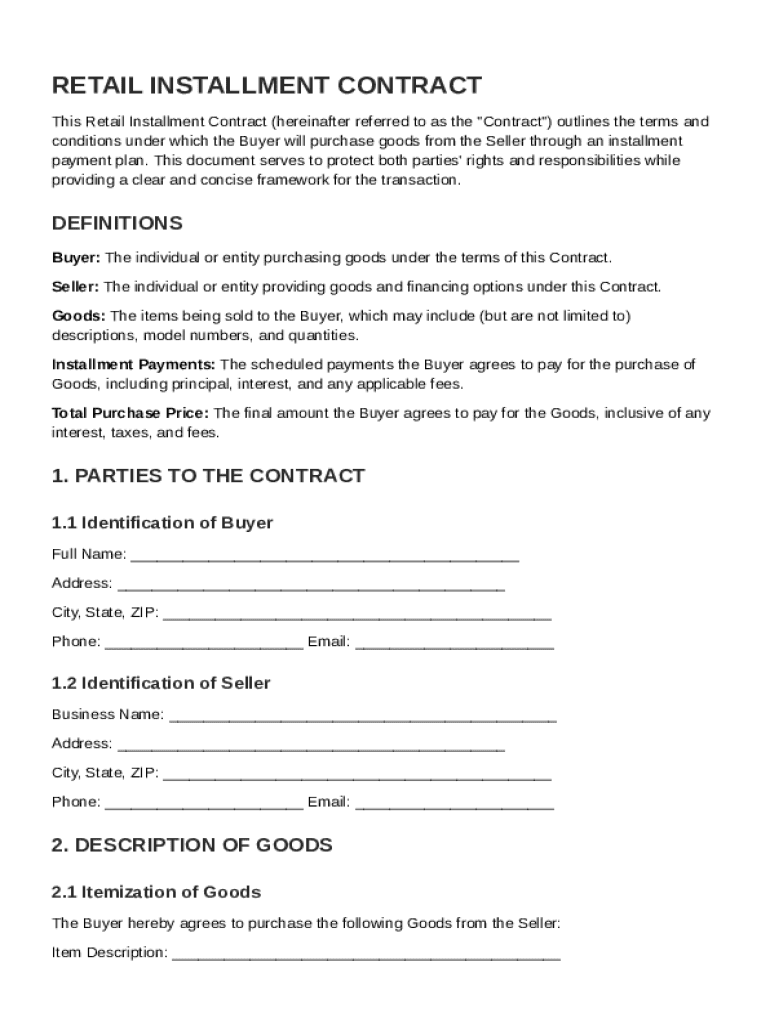

Retail Installment Contract Template free printable template

Show details

This document outlines the terms and conditions of a retail installment purchase agreement between a buyer and seller, detailing rights, responsibilities, payment terms, and related provisions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

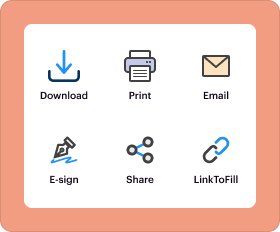

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Retail Installment Contract Template

A Retail Installment Contract Template is a legal document used to outline the terms of a payment plan for consumers purchasing goods or services over time.

pdfFiller scores top ratings on review platforms

Seems pretty easy to use

Seems pretty easy to use. I am still learning how to use it, but works for what i need to do.

it is okay

it is okay I am satisficed. Do not know how to use it yet.

Statement in Support of Claim

Seemed to have excellent, professional service. Highly recommended.

positive; easy to use - performance can be a little better

I am restarting to use pdffiller after 1 year. I would like to learn more about it as I have several ideas to implement fillable forms. Please let me know when I could attend a webinar.

Very good! Very helpful

Who needs Retail Installment Contract Template?

Explore how professionals across industries use pdfFiller.

Retail Installment Contract Template on pdfFiller

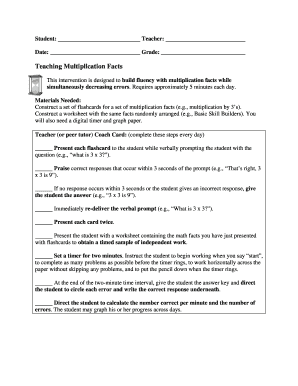

How to fill out a retail installment contract template form

To fill out a Retail Installment Contract Template form, begin by understanding the key parties involved—the buyer and the seller. Next, clearly describe the goods being purchased and their condition. Then, break down the total financial terms, including payment structure and rights and responsibilities of both parties. Finally, utilize pdfFiller’s interactive tools for smooth signing and document management.

What are retail installment contracts?

A Retail Installment Contract is a legally binding agreement between a buyer and a seller for the purchase of goods or services, where the buyer agrees to pay the total purchase price in periodic installments. Such contracts provide clarity on terms and conditions regarding the transaction, protecting the interests of both parties.

-

It specifies the arrangement whereby the buyer receives goods immediately but pays for them over time.

-

Formalizing the terms of an agreement to prevent misunderstandings and legal disputes.

-

Essential elements include buyer and seller details, payment terms, and item descriptions.

Who are the key parties involved?

Understanding who is involved in a Retail Installment Contract is crucial. The two main parties are the buyer, who purchases the product, and the seller, who supplies it. Each party has specific roles and responsibilities outlined in the contract.

-

The individual or entity receiving goods/services and providing payment.

-

The business or individual supplying the goods/services and expecting payment.

-

Buyers must adhere to payment schedules, while sellers must deliver goods as promised.

How to describe the goods in the contract?

Describing the goods accurately in a Retail Installment Contract is crucial. Clear itemization helps avoid disputes later by outlining what the buyer is purchasing. Additionally, detailing the condition and delivery methods ensures both parties have a shared understanding.

-

Each good should be listed with specific descriptions, such as model numbers and serial numbers.

-

Specify whether the goods are new or used and detail delivery methods.

-

Ensure descriptions are legally binding and adhere to regulations.

What are the financial terms and payment structure?

The financial terms indicate how much the buyer owes and how payments should be structured. This includes a breakdown of the total purchase price, which encompasses the principal amount and any interest that may accrue. Establishing clear terms for the down payment, number of installments, and payment frequency is vital.

-

Outline the total cost and any applicable fees or taxes.

-

Include the principal amount to be financed along with the interest rate.

-

Specify down payment amounts, payment frequency, and the total number of payments.

What rights and responsibilities do buyers have?

Buyers have certain rights and obligations under a Retail Installment Contract. Understanding these can protect you from misunderstandings. Notably, buyers have the right to cancel the contract within a specified timeframe, and they must remain diligent in making payments.

-

The ability to cancel without penalty under specific conditions.

-

Buyers are obligated to make payments on time to avoid penalties.

-

Penalties may include fees or negative impacts on credit scores.

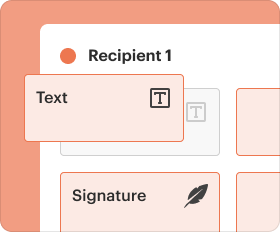

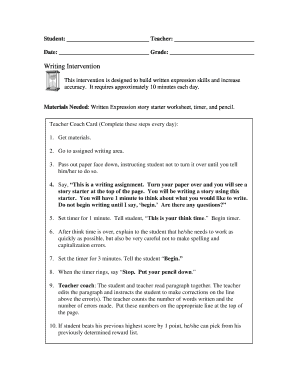

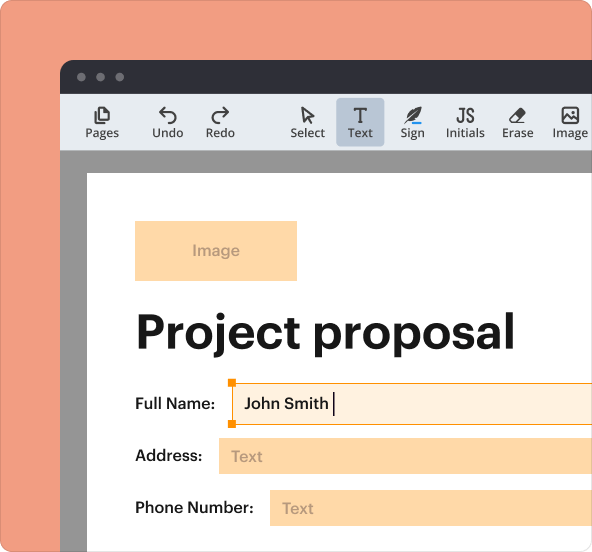

How to use interactive tools on pdfFiller?

Utilizing pdfFiller's interactive tools can simplify the process of managing your Retail Installment Contract. The platform offers features for filling out contracts seamlessly and options for eSigning documents, which enhances convenience. Additionally, pdfFiller enables collaboration and document management.

-

Use pdfFiller’s editing tools to input all necessary information easily.

-

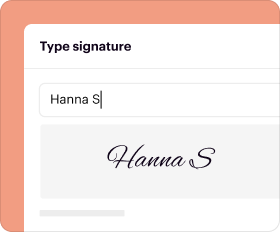

Implement electronic signatures without printing or scanning documents.

-

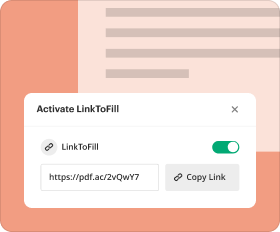

Share documents securely with others for feedback or approval.

What are tips for effective contract management?

Effective management of Retail Installment Contracts is essential for avoiding payment issues and ensuring compliance. Regularly tracking due dates and payments, updating terms as necessary, and using pdfFiller for reminders can streamline this process.

-

Maintain a schedule for payments and due dates to ensure timely submissions.

-

Regularly review and modify terms as trends or agreements change.

-

Use the platform’s reminders and storage for hassle-free document management.

What are compliance and legal considerations?

Compliance with legal standards is necessary to ensure that Retail Installment Contracts are enforceable. This includes understanding specific regulations in your region and making sure all elements of the contract adhere to these laws. pdfFiller aids in maintaining the legal validity and security of your documents.

-

Know the legal framework governing Retail Installment Contracts in your region.

-

Ensures protection for both buyers and sellers against legal issues.

-

Ensure that all documents are stored securely and are accessible for legal verifications.

How to fill out the Retail Installment Contract Template

-

1.Open the Retail Installment Contract Template on pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the buyer's name and address in the designated sections.

-

4.Enter the seller's business name and address next.

-

5.Specify the total purchase price of the goods or services being financed.

-

6.Detail the amount financed and any down payment made by the buyer.

-

7.Outline the interest rate and any finance charges applicable to the contract.

-

8.Indicate the repayment schedule, including the number of installments and due dates.

-

9.Complete any additional terms, such as late fees or prepayment options.

-

10.Review the entire document for accuracy before finalizing.

-

11.Save and print the completed contract for both parties to sign.

What is a retail installment?

Most commonly used in sales of motor vehicles, a retail installment sale is a purchase of personal property where the cost of the good, plus interest, is paid out over a period of time specified in the sales contract.

How to write a sales contract template?

How do I write a Sales Agreement? Specify your location. Provide the buyer's and seller's information. Describe the goods and services. State the price and deposit details (if applicable) Outline payment details. Provide delivery terms. Include liability details. State if there's a warranty on the goods.

What is a retail contract?

A retail agreement is a legal contract between a manufacturer or wholesaler of a product and the retail business that will sell the product to customers. Frequently these agreements are used to set pricing expectations and establish minimum inventory and order amounts.

What is an installment contract?

An installment contract is a single contract that is completed by a series of performances–such as payments, performances of a service, or delivery of goods–rather than being performed all at one time. Installment contracts can provide that installments are to be performed by either one or both parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.