Seller Financ Business Contract Template free printable template

Show details

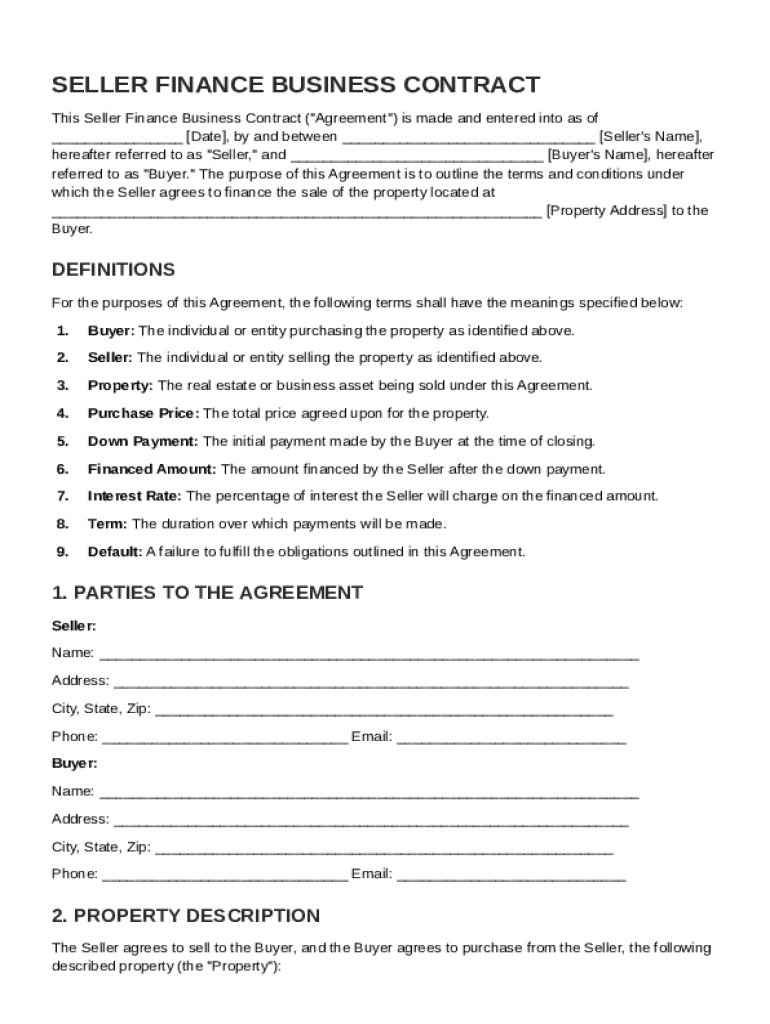

This agreement outlines the terms and conditions under which the Seller agrees to finance the sale of property to the Buyer, including definitions, purchase price, financing terms, and remedies in

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

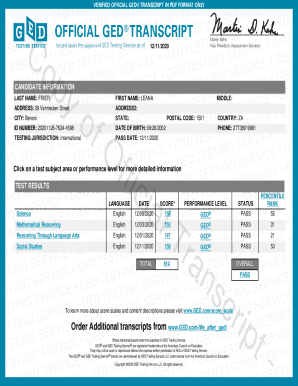

What is Seller Financ Business Contract Template

A Seller Financing Business Contract Template is a legal document used to outline the terms and conditions under which the seller of a business offers financing to the buyer.

pdfFiller scores top ratings on review platforms

Still need to understand what tool do what

Very good at letting me sign snd send documents on the go

It' s quick and easy!

great service

Great!!!

Works very well!

Who needs Seller Financ Business Contract Template?

Explore how professionals across industries use pdfFiller.

Seller finance business contract guide

What is seller financing?

Seller financing is a transaction where the seller of a property provides financing to the buyer, allowing them to purchase without a conventional mortgage. This approach simplifies the purchase process and can attract buyers who might otherwise be unable to secure traditional financing. An effective business contract is essential in defining the terms and protecting the interests of both parties.

-

Seller financing occurs when the seller acts as the lender to finance the buyer's purchase, often involving easier qualification processes.

-

An effective contract clarifies the financing arrangement, including payment terms and consequences for default, thus safeguarding both parties.

-

Buyers may benefit from lower down payments and flexible terms, while sellers can attract more potential buyers and potentially earn a higher interest rate.

What are the key elements in a seller finance business contract?

A well-structured seller finance business contract includes critical information that protects both the seller and the buyer. Understanding the necessary components ensures clarity and reduces the chances of disputes later.

-

Typically, the significant parties are the seller, who retains the title until the buyer fulfills their payment obligations, and the buyer, who receives ownership rights upon completing payments.

-

The contract must include a detailed description of the property being financed, including its legal address and any covenants that may apply.

-

It is essential to specify the total purchase price, down payment, and the amount that is being financed for a clear understanding of financial liability.

-

Detailing the interest rate is crucial as it impacts the total cost of acquisition and influences monthly payment amounts.

How do fill out the seller finance business contract template?

Filling out the seller finance business contract template requires careful attention to detail. Correctly completing all relevant sections ensures that all legal obligations are met, and parties are clearly informed of their rights and responsibilities.

-

Both parties must provide their full names, addresses, and contact information to establish identity clearly.

-

Including the proper legal description of the property—size, features, and any existing liens—helps in avoiding future conflicts.

-

Details like the down payment, total price, and financing amount should be outlined clearly to avoid ambiguity.

-

Specify the principal amount, interest rates, repayment schedule, and any penalties for late payment or default.

What legal considerations should you keep in mind?

Navigating legal considerations in seller financing agreements is vital for both parties. Consulting legal resources or a professional ensures that all aspects are compliant with local laws and adheres to best practices.

-

Parties must ensure that the financing agreement complies with local, state, and federal laws, potentially varying across regions.

-

Having a lawyer review the contract helps identify potential legal pitfalls and ensures clarity in language to prevent misunderstandings.

-

Including explicit clauses regarding defaults, including penalties and remedy procedures, is crucial to protect the interest of all parties.

How can pdfFiller assist in managing seller financing agreements?

Utilizing pdfFiller for managing seller financing agreements streamlines the process of document editing, signing, and storing. pdfFiller’s features provide an easy and efficient way to collaborate on these important agreements.

-

pdfFiller allows all parties—buyers, sellers, and their agents—to collaborate in real-time, reducing the turnaround time on changes or document finalization.

-

The platform's cloud-based features enable users to track document history, view revisions, and recover previous versions if necessary.

-

With pdfFiller, users can eSign documents securely, ensuring a legally binding agreement without the need for in-person meetings.

What resources are available for seller financing?

Accessing credible resources and tools for seller financing can greatly enhance both buyers’ and sellers’ understanding and execution of agreements. Numerous templates, guides, and advice articles can be beneficial.

-

There are various templates available specific to seller financing that can cater to different transaction needs.

-

Resources like articles, forums, and videos can provide insight into best practices for structuring seller financing deals.

-

Addressing common questions helps clarify the nuances of seller financing agreements, making them more accessible.

What disclaimers and notices should be aware of?

It is important to recognize limitations regarding the use of a seller finance business contract template. Understanding these limitations and seeking personalized legal advice can help mitigate risks.

-

We advise potential users that templates might not cover unique nuances of every transaction and customization may be necessary.

-

Engaging a lawyer familiar with seller financing can help navigate complicated aspects that standard templates cannot address.

-

It is crucial to have a plan for addressing potential conflicts, potentially leveraging mediation, arbitration, or legal recourse.

How to fill out the Seller Financ Business Contract Template

-

1.Download the Seller Financing Business Contract Template from pdfFiller.

-

2.Open the template in the pdfFiller application.

-

3.Fill in the seller's name and contact information at the top of the document.

-

4.Enter the buyer's name and contact details in the appropriate section.

-

5.Specify the purchase price of the business in the designated field.

-

6.Detail the financing terms, including the interest rate, repayment schedule, and any down payment required.

-

7.Include any contingencies or conditions that must be met for the sale to proceed.

-

8.Review the document for accuracy and completeness.

-

9.Sign the contract electronically or print it for physical signatures.

-

10.Save the completed document in your pdfFiller account for future reference.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.